The Essential Tax Form for Contractors: What Business Owners Must File

The tax form for contractors is seen by many business owners as a key tool for smooth year-end work. Some owners view this form as a simple report, while others see it as a core part of their records. In many cases, the contractor tax form is used to track pay, note costs, and list each job. Many firms feel calmer when this form is clear and clean. At times, the tax form for contractors 1099 may guide the way income paths are linked to work units through the year.

Some owners use this form to help build trust with each contractor they bring on. When the work is done and the books close, a clear record may help each side stay on the same page. Since each job has its own steps, each owner may seek a form that keeps things neat and fair.

Importance of the Tax Form for Contractors

Some firms note that the tax form for contractors sets a base for strong records. Since the contractor's work shifts with each job, the form may keep the path straight. Some see the tax form for contractors 1099, as a sign of clean and honest work.

At times, the right form may also help owners plan for the next season. When owners look back at pay and tasks, they may find gaps or trends. The contractor tax form might guide the link between pay and tasks in ways that help firms shape new plans.

Owners may also feel that the right form helps show care for rules. Clear steps may bring fewer doubts when tax time comes. With the contractor tax form, some owners feel more at ease since the pay they give is tracked with care.

How the Tax Form for Contractors Strengthens Record-Keeping

-

A Base for Clean Pay Notes

Many firms use the contractor tax form to mark pay lines through the year. Since these forms record each job, the notes may help the books stay neat.

-

A Link Between Pay and Work

Some owners treat the tax form for contractors 1099, as a link between tasks and pay. Each line may show how much each job earned.

-

A Guide for Year-End Steps

The contractor tax form may give owners a guide for year-end tasks. When the books close, the form can help track each name, task, and pay.

-

A Tool for Fair Terms

Some firms feel that this form also helps set fair terms with each contractor. A clear form may help each side trust that the pay is noted correctly.

Key Sections of the Tax Form for Contractor Owners to Review

-

Pay Notes

The contractor tax form may list all payments for work done. Many owners review these lines to check if the pay is right.

-

Task Notes

This form may show the tasks a contractor worked on. When owners match tasks with pay, they can see how the year has moved.

-

Work Date Notes

The Contractor tax form also shows when tasks took place. This helps owners plan future work and see how busy each month was.

-

Name and Info Notes

Some owners look at this part first to make sure the contractor's name and info match their books.

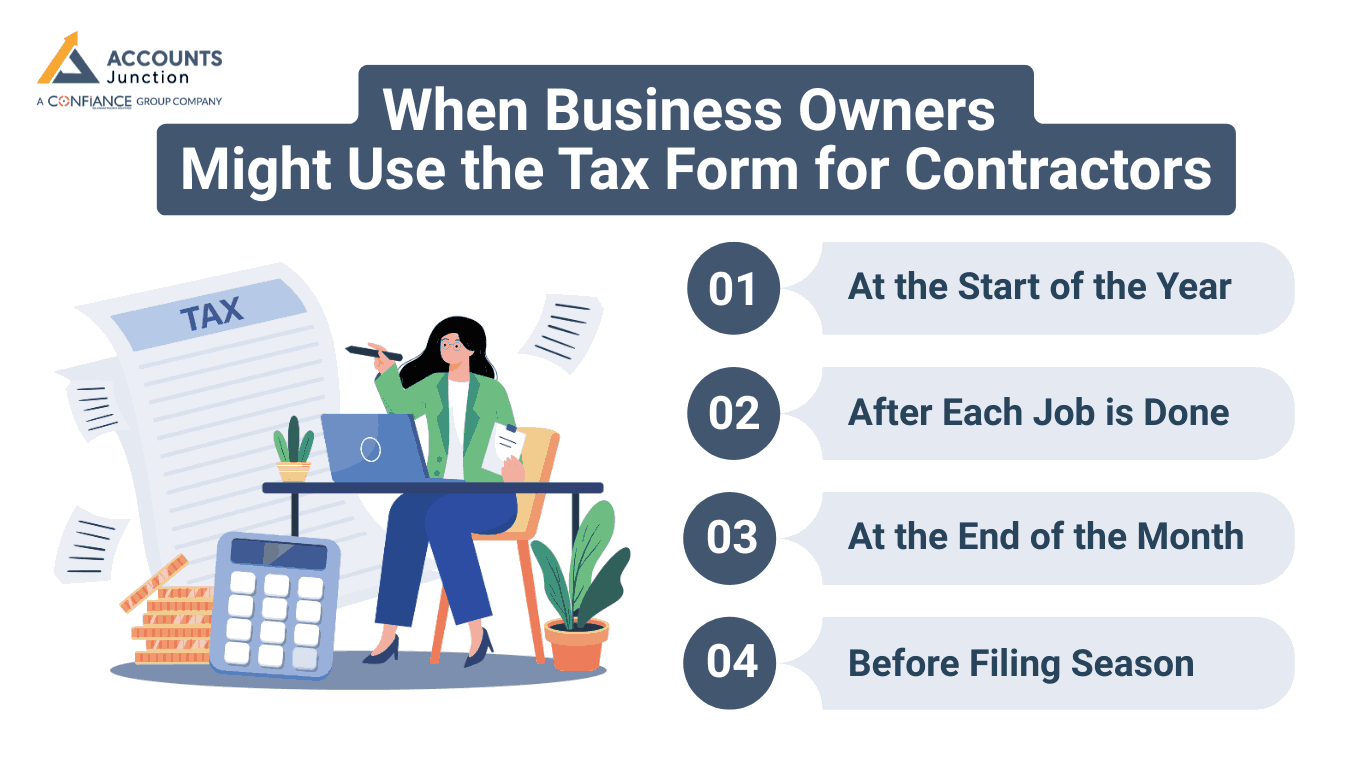

When Business Owners Might Use the Tax Form for Contractors

-

At the Start of the Year

Some firms start the year by setting up files for the contractor tax form. This may help them track work from the first task.

-

After Each Job is Done

Many owners place pay notes after each job. They might update the tax form for contractors 1099 to keep year-end tasks light and easy.

-

At the End of the Month

Some firms pick the end of each month to review pay. This step may help catch small slips early.

-

Before Filing Season

This is the most common time firms check the contractor tax form. They may fix notes or add lines to clean up the form.

Why Owners Share the Tax Form for Contractors with All Hired Workers

1. Builds Trust Through Clear Payment Records

Many owners use the contractor tax form to show detailed pay information.

When contractors see each payment clearly listed, they feel more confident about their work terms.

2. Reduces Disputes and Misunderstandings

Firms find that sharing the form helps prevent small disagreements or claims.

Clear records of tasks and payments keep both owners and contractors aligned.

3. Saves Time on Future Discussions

Strong documentation can reduce lengthy conversations later.

When all payments and tasks are noted, both sides can reference the form for clarity.

How the Tax Form for Contractors Helps With Work Plans

-

Shows Past Work Loads

Owners may use the tax form for contractors to see how full each season was. This may help them plan staff and tasks for the next year.

-

Tracks Funds Used

The form may help show how much each contractor earned. With this, owners may plan pay plans for the next year.

-

Shows Busy Zones in Workflow

The tax form for contractors 1099, may also show busy or slow zones. Owners may use this to shape new project paths.

Why Owners Consider the Tax Form for Contractors 1099 Essential

Many firms talk about how the tax form for contractors 1099 keeps money notes neat. Since the form lists all pay made in the year, many owners rely on it to check if pay lines are right.

The form may also help cut time spent on year-end tasks. When the lines are built throughout the year, the last steps may move more smoothly.

Owners may also feel safer when they use a clear form. They know the year is tracked well, and each job has its place.

Common Points Owners Review on the Tax Form for Contractors

-

Names That Match Their Books

A small name slip may cause long work. Owners often check this part first.

-

Pay Lines that Match the Books

If the pay line looks off, owners may look through notes. The contractor tax form helps them match each pay to each job.

-

Date Lines for Work Done

Some firms check date lines to see when tasks took place. This keeps the record path clean.

-

Task Description

Owners may add more detail here so the form stays clear for year-end use.

Challenges Owners May Face When Using the Contractor Tax Form

-

Missing Notes

Some owners may skip small notes during busy days. This can lead to gaps when they review the tax form for contractors 1099 at year end.

-

Wrong Pay Numbers

If owners rush, they may enter the wrong pay numbers. This may cause stress later.

-

Task Mix Ups

Some tasks may share a name or look close. Without clean records, this may lead to mix-ups.

-

Date Conflicts

At times, notes may show wrong dates. Owners may need to check old call logs or job notes.

Ways Owners Try to Keep the Tax Form for Contractors Clean

-

Regular Reviews

Many firms check the tax form each month. This helps keep gaps small.

-

Clear Work Logs

Owners may ask contractors to keep simple logs. When logs match the tax form for contractors 1099, the record stays neat.

-

Simple Terms for Tasks

Some firms give short task names so the form stays easy to read.

-

Safe Storage of Records

Owners may store their records in safe files to avoid loss.

How Accounting Services Can Support the Tax Form for Contractors

Many owners try to handle these forms alone, but some choose outside help to ease the load. Firms like ours do not make tools or guide people on how to use tax forms. Instead, our team provides full accounting and bookkeeping services.

When owners partner with us, they gain a service that may help keep their books in order and their pay notes clean. We do not claim to fix tax issues for them, but we help maintain clear records that support the work they do with the contractor tax form

Some owners find peace when a team handles the record path for them. They may feel freer to focus on work while our team keeps their books safe.

Steps Owners Should Take While Filing the Tax Form for Contractors

-

Make a List of All Contractors

Owners may start by listing all contractors who worked for them.

-

Check Pay Lines

Next, they may check pay lines for clean notes.

-

Match Tasks to Dates

Some owners match tasks to dates to keep records aligned.

-

Add Each Contractor Line to the contractor tax form

This helps keep each line tied to the right worker.

-

Make a Final Review

Before sending the form, many owners give it a last check to catch small marks.

Following Points Should Owners Keep in Mind Before They File

-

Forms Must Be Clean

Some owners try to keep each line easy to read.

-

Old Records May Help

If there is doubt, they may look at old logs or notes.

-

Tasks Must Match Work Done

When tasks match real work, the contractor tax form looks clearer.

-

Pay Must Be Right

A small slip in pay can change several lines.

How Strong Records Improve the Accuracy of the Tax Form for Contractors 1099

Since the year moves fast, strong notes help owners build a clean form. Good records make the contractor tax form more useful.

When owners keep logs neat, they may avoid stress at year's end. With each record in place, owners may trust that their work path stays clear.

Some firms share that they learned more about their workflow once they kept strong logs. They also saw how tasks grew through the year.

How Owners Use the Tax Form for Contractors to Plan Ahead

1. Plan Clear Budgets

Owners use the contractor tax form to plan clear budgets. It helps them see income trends and plan smart for each new year.

2. Track Tasks That Earn More Money

Some owners use these forms to track which tasks earned more money. This step helps them choose the work that brings strong value.

3. Review Work Flow by Month

Many owners check which months had the most work using the form. This helps them plan cash flow and set goals for slow months.

4. Guide Staff and Workload Plans

A few firms use the tax form for contractors to guide staff plans. They may bring more people on board when busy times appear.

5. Shape New Service Offers

The form may show which tasks clients value the most. This helps owners build new offers that meet real client needs.

The contractor tax form is an important tool for owners to keep records clear and simple. Using the tax form for contractors 1099 helps track pay, match tasks to income, and keep books accurate all year. Keeping records correct reduces mistakes, makes year-end filing easier, and shows clear information to both owners and contractors. Businesses that follow this form may find tax time faster and less stressful.

At Accounts Junction, we offer full accounting and bookkeeping services to keep records right and in order. By working with us, owners get support to maintain clean statements, handle contractor payments, and manage forms like the contractor tax form. This allows owners to focus on business growth while we keep all records accurate, complete, and ready for filing. Partner with us to keep your contractor records clear and accurate.

FAQs

1. What is a tax form for contractors?

- It is a form used to report payments made to independent contractors. Businesses must file it to track contractor income accurately.

2. Who must receive a tax form for contractors 1099?

- Any contractor paid over six hundred dollars in a year may require this form. It ensures IRS reporting is correct.

3. When should businesses file the tax form for contractors 1099?

- The form is usually filed by January thirty first of the following year. Early preparation avoids late penalties.

4. What information is required on a contractor tax form?

- It includes the contractor's name, address, tax ID, and total payments. Accurate details prevent IRS issues.

5. How does the contractor tax form help business owners?

- It tracks contractor payments and supports year-end tax filing. The form keeps financial records organized and clear.

6. What are the penalties for not filing a tax form for contractors 1099?

- Late or missing forms can trigger fines from the IRS. Timely filing avoids unnecessary legal and financial issues.