7 Reasons Why Accountants Need to Move to the Cloud

Accounting has changed a lot in recent years. Many accountants are moving from traditional software to cloud-based systems. The cloud makes work easier, faster, and more flexible. It allows accountants to access files anywhere, collaborate with clients in real time, and reduce the need for heavy IT setups. This shift is not just about technology. Let’s see why accountants move to cloud to improve workflow and save time. It helps accountants save time, cut costs, and improve accuracy.

From handling taxes to preparing reports, cloud tools make daily tasks simpler. In this blog, we’ll explore seven reasons why accountants are moving to the cloud and why it might be the right choice for your firm too.

What is Cloud Accounting Software?

Cloud accounting software is a key reason why accountants move to cloud. It allows planning and controlling business finances online. It allows users to perform bookkeeping, payroll functions, invoicing, and financial reporting, and these functions can be securely performed over a web-based platform.

The best feature that can favor a user to opt for the cloud accounting software is accessibility. This accessibility explains part of why accountants move to cloud in their daily work. The data are all in the cloud, so the user can log in anywhere and perform the necessary work, irrespective of being on his or her own device. The software updates all the activities automatically in real time and reduces manual operations through the automation system. It also makes collaboration easier between teams or with clients.

For example, instead of waiting for files to be emailed back and forth, an accountant can log into the cloud system and instantly view the latest financial transactions, update records, or generate reports and save time or avoid errors. This shows clearly why accountants move to cloud for faster and safer financial handling.

Why Are Businesses Adopting Cloud Accounting Solutions?

Businesses are increasingly adopting cloud accounting solutions for several reasons. The cloud-based software offers flexibility, affordability, and increased collaboration among team members.

- Flexibility: Cloud accounting allows businesses to access financial data anywhere, anytime, from anywhere.

- Cost-Efficiency: A cloud accounting environment saves on the costs of setting up expensive infrastructure and maintaining IT. This is why accountants move to cloud instead of investing in heavy software setups.

- Enhanced Collaboration: Up to date, many members can access and work on the same data at the same time, because of cooperation. Enhanced collaboration pushes accountants to move to cloud to work efficiently in teams.

- No Need for On-Premise Servers: Businesses can avoid investing in expensive on-premise servers. This helps eliminate the need for ongoing maintenance.

- Simplified IT: Adopting a cloud solution simplifies IT management for the company, allowing them to concentrate on their main business.

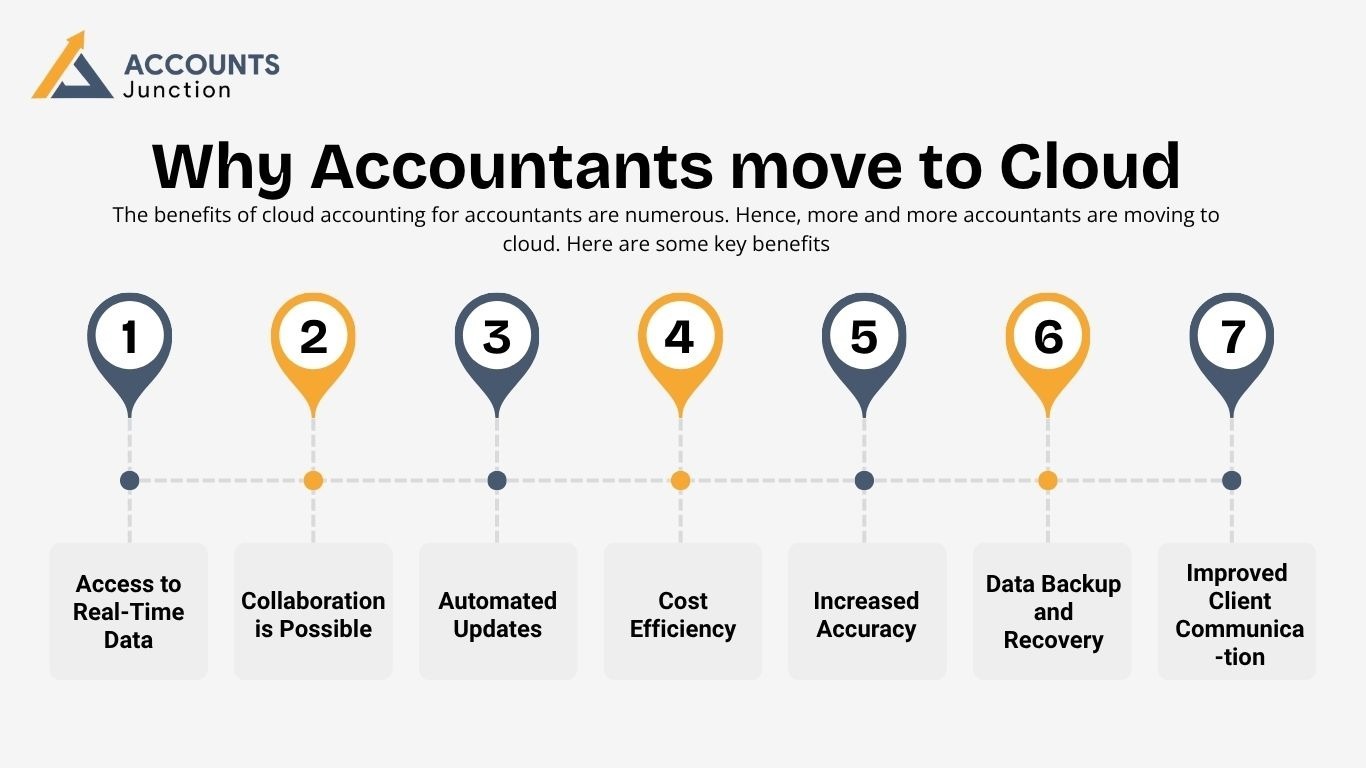

Why Accountants move to Cloud

The benefits of cloud accounting for accountants are numerous. Hence, more and more accountants are moving to cloud. Here are some key benefits:

- Access to Real-Time Data: Accountants can access up-to-date financial data from any location. This improves decision-making speed and effectiveness in their services.

- Collaboration is Possible: Multiple accountants or team members can work on the same financial information with great interaction, teamwork, and through far more productive results. Such collaboration capabilities encourage accountants to move to cloud for teamwork and efficiency.

- Automated Updates: Cloud accounting software is automatically updated. Thus, accountants do not have to worry about the features or necessary security improvements.

- Cost Efficiency: Most cloud accounting services are based on subscription plans, meaning low initial investments and far less IT maintenance normally taken for traditional software.

- Increased Accuracy: Automated processes largely cut down human errors, thus producing accurate records of financial exchanges as well as reports.

- Data Backup and Recovery: Cloud accounting offers automated backups. This helps to save vital financial data from getting lost via a system crash or disaster occurring.

- Improved Client Communication: Accountants might send their clients reports, invoices, and financial documents all to real simple, enhancing as well as easing their delivery service to the client.

How Does Cloud Accounting Software Improve Efficiency?

- Automating Manual Activities: Automated data entry, transaction classification, and report generation. Valuable time is saved, yet the possibility of any human error is minimized. Automation is a top reason why accountants move to cloud to save time and reduce mistakes.

- Strategic activity focus: Accountants can spend more time on activities that matter instead of repetitive manual tasks.

- Seamless Integration with Business Tools: Able to seamlessly integrate with other business software, thus enhancing workflow efficiency.

- User-Friendly Interface: Software that has an intuitive interface will manage the client accounts of accountants with minimal training efforts.

- Faster Adaptation: The software is so easily matched by accountants that it can work better by saving on productive time learning the system..

- Error Reduction: The software works by automating mundane procedures that eliminate human error, thereby leading to more accurate financial data.

How Secure Is Cloud Accounting?

While security remains the principal concern for firms contemplating a shift to cloud accounting systems, nevertheless, cloud accounting providers will protect your financial data through strong security measures. These include:

- Data Encryption: Any data residing in the cloud will be encrypted, preventing unauthorized access and ensuring the confidentiality of sensitive financial information.

- Multi-Factor Authentication (MFA): Often, MFA can be found within cloud accounting software. This will enforce other steps for verification for user access to that system, thus providing an extra fine defense against unauthorized logins.

- Regular Backups: Cloud providers carry out data backups regularly so that data loss is restricted. Besides, this works towards the business continuity in case of system failure or any disruption.

- Compliance with Industry Standards: Leading providers comply with various stringent laws such as the GDPR and the Financial Services Act. This is essentially to ensure that the user's data will be used fairly.

- Firewall Protection: Firewall protection is a constant feature with cloud accounting, otherwise, access will be gained via unauthorized aggression.

- Data Redundancy: Cloud service providers maintain multiple copies of financial data in varied geographical locations so that if one data is lost due to hardware failure, it is protected by other copies.

- Secure User Access Control: The cloud accounting solution implements user access control that permits businesses to assign different roles and permissions with access to certain financial data by authorized individuals only.

- Rea-Time Monitoring: This could mean palpably the monitoring tools employed by the providers to find anything suspicious. Hence, security breaches are detected and acted on timely manner.

- End-to-End Security: Security is built into these cloud accounting systems to provide protection of data as it is being transmitted. Thus, it would be safe once it leaves the user's device and rests in the cloud.

Cloud accounting offers a range of benefits, including flexibility, cost-efficiency, enhanced collaboration, and improved security, making it an essential tool for modern businesses. Cloud accounting aids accountants' efficiency and accuracy. It gives the choice of accessing financial data in real-time with automation and smooth integration with other applications.

Cloud accounting has robust security measures, including data encryption and multi-factor authentication, to ensure that sensitive financial data remains protected. Reading this you might have become familiar with why accountants move to cloud. If you or your business want to shift to the cloud, we can help with the latest cloud-based solutions. At Accounts Junction, we offer complete cloud accounting and bookkeeping services for businesses. Our services can improve your accounting practice or business significantly. Contact us now and make the shift to the cloud.

FAQs

1. What is cloud accounting?

- Cloud accounting can be defined as a kind of accounting system that uses online software for the efficient management of financial tasks. It gives access to financial data from any corner of the world with the presence of the internet.

2. What are the benefits of cloud accounting?

- Advantages include instant access to current information, increased collaboration, reduced costs associated and automatic update of information.

3. How does cloud accounting improve efficiency?

- Manually automated processes and integration with other tools contribute to efficiency improvements in cloud accounting by reducing human error.

4. Is cloud accounting secure?

- Yes. There are features like encryption of data, multi-factor authentication, and even routine backup which are essentially used in ensuring the security of cloud accounting.

5. Why should businesses move to cloud accounting?

- Cloud accounting is the solution for every organization, be it large or small, cost-effective, and scalable, and it allows access to financial data through the internet, which ultimately goes up in improving efficiency levels.

6. Why are accountants switching to the cloud these days?

- Honestly, it just makes life easier. You can open files from anywhere and don’t need clunky servers.

7. Can I work on client accounts from home?

- Yes, you just log in. Everything updates automatically, so no waiting around.

8. Does it really save time?

- It does. Things like invoices, reports, and payroll don’t eat up your whole day anymore.

9. Is my data safe up there in the cloud?

- Yes. It’s all encrypted and locked down. Only the people you allow can see it.

10. Do I still need to double-check numbers?

- A little. It’s smart, but I always glance over things to be sure.

11. Can the team work on the same file at the same time?

- Yes, that’s the best part. No more emailing files back and forth for updates.

12. Will this cost a lot more than old software?

- Not really. Usually, a monthly plan is cheaper than buying the old bulky software and keeping it running.

13. Does it make tax season easier?

- Big time. Everything’s tracked, so you don’t have to dig through receipts or spreadsheets.

14. Can I connect it to other tools I use?

- Yes, you can link payroll, bank accounts, even client trackers, all in one place.

15. Is switching from my old software hard?

- Not too bad. Most cloud services walk you through moving your old data step by step.

16. Can I check accounts on my phone?

- Absolutely. You’re not tied to the office anymore, which is a huge help.

17. Does it make sharing info with clients easier?

Yes, instead of sending emails back and forth, you can just give them access or send reports instantly.

18. Will it help me notice mistakes faster?

- Yes, it flags errors right away, so you can fix them before they turn into problems.

19. Is cloud accounting only for big firms?

- No, even small offices benefit a lot. It’s cheap, simple, and you can grow with it.

20. How does it actually make work easier day to day?

- It takes care of boring, repetitive stuff so you can spend more time on the parts that really matter.