5 Best Accounting Software for Tour Operators

When you are operating a tour operator business, it is important that you have proper control over all areas of your organization. Managing the tour in a proper way is primarily important for any tour operator.

Apart from that, accounting is also important which helps to understand finances and help the organization grow.

Bringing efficiency in accounting for travel agents can help them to grow their business to the next level with better profits. Many travel agents are now understanding the importance of accounting for achieving growth. Using accounting software has helped to improve finances and operating efficiency.

There are several accounting software for travel agencies that are used by different travel agents. Different types of accounting approaches are now used by experts to bring efficiency. If you are looking for any relevant software then it must handle tourism accounting properly.

What are the different types of accounting software for travel agencies?

There are several accounting software that can be used by tour operators that can handle most accounting activities.

Here are 5 important software which can do accounting for travel agents:

1. Quickbooks

- Quickbooks is a nice accounting software for tour operators which can do most of the accounting activities. This software can be easily integrated and operated easily to do accounting activities. Quickbooks makes it easier for travel agents to manage their cash flow properly, cash flow management, and other activities. This software has speedup the accounting activities considerably.

2. Xero

- Xero is one of the easy-to-use software that can handle tourism accounting better. This software has all the important features which can handle all the accounting activities in tourism. Its automated invoice handling has fastened the accounting for the travel agency.

3. Odoo

- Odoo has simplified the accounting for most industries and it is very easy to use for travel agencies. It allows the automation of most of the accounting activities for tour operators. Its support for multi-currency transactions makes it easier to do easier transactions from other countries. Odoo has improved the cash receivables through quicker payments.

4. Netsuite

- Netsuite is one of the wonderful cloud accounting software that has improved the access to real-time access. It has the ability to get customized reports whenever needed, making it easier for the owners to understand the progress of the business.

5. Zoho

- Zoho is one such wonderful accounting software for travel agents which can handle most accounting activities. It is easy to operate where most accounting tasks can be automated which improves accounting quality.

Key Features Tour Operators Should Check

Tour firms need tools that keep daily tasks smooth. Each tool must cut steps, save time, and keep cash data neat.

1. Trip Cost Track

- Each tour costs a fixed amount linked to one set plan.

- Clear profit shows fast for each booked tour.

- Cost mix-ups drop when tags track each spend.

- A clear sheet helps with clean Tourism Accounting since all tour costs stay in one place.

2. Auto Invoice System

- Bills print quickly with help from accounting software for travel agencies that stores all tour data in one space.

- Staff save hours once slow manual tasks are reduced.

- All bills stay safe within one clean space.

- Cash comes in fast when bills reach clients on time.

3. Real-Time Cash View

- Live cash shows trends that guide quick daily moves and help with basic accounting for travel agents.

- Issues appear fast when numbers shift through tours.

- Quick plans form once live facts guide team steps.

- Teams act with more ease since cash gaps show early.

4. Easy Bank Match

- Bank lines sync fast in tools built for Tourism Accounting so teams can fix gaps right away.

- Wrong sums drop when tools flag mismatched entries.

- Teams close books fast with clean matched data.

- Fast match work keeps cash flow clear for each day.

5. Role-Based Access

- Staff view tasks based on fixed role rights.

- Data stays safe in accounting software for travel agencies since role rules block wrong access.

- Work flow moves smooth with clear team limits.

- Team trust grows since each staff sees only what they need.

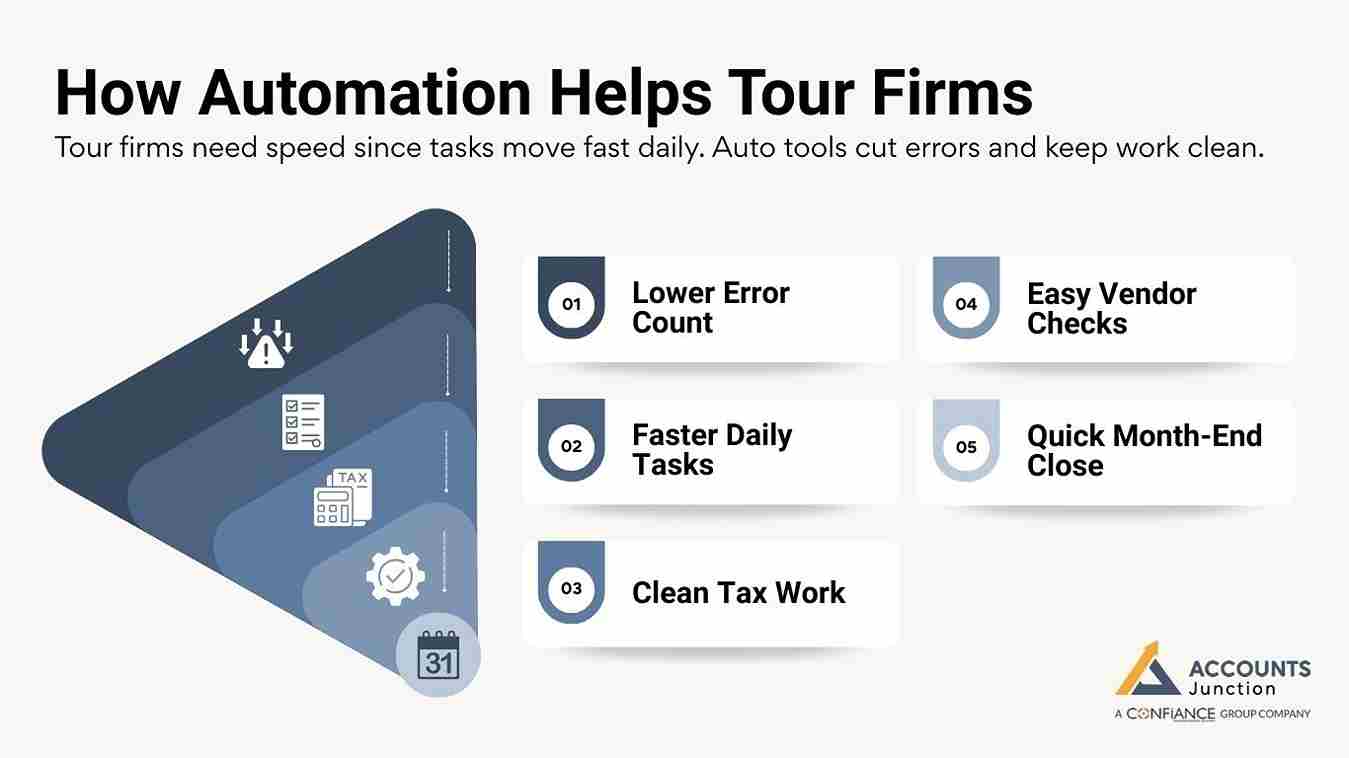

How Automation Helps Tour Firms

Tour firms need speed since tasks move fast daily. Auto tools cut errors and keep work clean.

1. Lower Error Count

- Auto posts catch wrong dates before they spread.

- Sums stay neat, which helps in Tourism Accounting, where each line must stay clear and true.

- Staff face fewer slips when tasks run automatically.

- Clean logs lead to calm days with fewer cash shocks.

2. Faster Daily Tasks

- Auto tools slash long hours spent on repeats.

- Teams close day work quickly with clean logs, which makes accounting for travel agents far smoother.

- Time saved helps staff focus on tour plans.

- Firms move quickly in peak months since less time goes to grunt work.

3. Clean Tax Work

- Auto tax sums update with each new post.

- GST lines stay right with built-in rule sets.

- Tax files print smoothly in accounting software for travel agencies since all GST lines stay tagged.

- Teams stay stress-free when tax checks run on their own.

4. Easy Vendor Checks

- Vendor dues show fast when the lists auto-update.

- Staff track paid sums with logs tied to tourism accounting rules for each vendor.

- Late bills drop since alerts reach staff quickly.

- Strong vendor bonds form when pay lines stay on time.

5. Quick Month-End Close

- Month books close fast with fewer pending lines.

- Numbers line up clean, which helps teams meet month-end needs in accounting for travel agents.

- Teams relax since long delays stay low.

- Leaders get clear monthly facts early for key calls.

Why Multi-Currency Matters for Travel Firms

Tour firms deal with world clients and global vendors. Live rate tools keep sums fair and clear.

1. Clear Rate Updates

- Rate shifts show live in tools built for Tourism Accounting so cross-coin sums stay fair.

- Gains or loss track clean when rules apply.

- Teams act fast since rate trends appear clear.

- No tour loses out due to slow or wrong rate notes.

2. Easy Cross-Border Deals

- Staff pay vendors quickly in their home coin.

- Bills stay right even when coin rates swing.

- One tool tracks all deals and fits well with accounting software for travel agencies that deal with global trips.

- Global work turns smoothly when all coins stay in one place.

3. Clean Audit Trail

- Each rate log stays saved with date stamps.

- Audits move smoothly with clearly linked coin data.

- Errors drop since all sums match stored logs.

- Teams pass audits fast since each rate step is visible.

4. Correct Tour Margins

- Tour margins stay true when coin rates update.

- Profit stays clear even in high-rate swings.

- Firms price tours right with live coin facts.

- Price talks get easy since all sums stay fair.

5. Safe Global Records

- Data stays safe inside one secure cloud base.

- Staff reach files quickly when trips span nations.

- Records stay neat even with wide world work.

- Teams work with ease since files load fast in all zones.

Cloud-Based Tools for Tour Accounting

Cloud tools keep files safe and easy to reach. They cut costs and raise team speed.

1. Work From Anywhere

- Staff view data while on tours or trips.

- Owners check cash even from remote areas.

- Work keeps smooth without a fixed desk.

- Field teams stay sharp since data loads right on the go.

2. Safe Daily Backups

- Files are backed up daily with built-in cloud rules.

- Data loss drops since no device risks remain.

- Old logs load quickly when teams need them.

- Firms avoid panic since all files stay safe in cloud storage.

3. Easy Team Access

- Teams log in with set role-based rights.

- Work stays smooth since updates sync fast.

- Wrong edits drop with strong access limits.

- Large teams stay in sync since all see the same live facts.

4. Live Dashboards

- Dashboards show fast trends for each tour.

- Teams read profits quickly with neat, clear charts.

- Plans improve since live data guides choices.

- Firms act quickly when charts show a dip or rise.

5. Less System Costs

- Firms skip the high costs linked with local setups.

- Cloud plans run light with fixed low fees.

- Updates stay free without user-side work.

- Money saved can shift to staff, gear, or tour growth.

If you find it difficult to use any tourism accounting software, then you can outsource this work to an expert agency. Accounts Junction provides outsourced accounting for travel agents. They have several premium accounting software for travel agencies with experienced staff operating on them. Accounts Junction is a well-known accounting agency across the globe.

FAQs

1. What makes tour cost tracking useful for a tour firm?

- Clear cost lines help teams spot wrong sums fast. True tour gain shows in one clean view.

2. How can auto-bill tools speed work in a tour firm?

- Bills are printed in short steps and reach clients fast. Cash moves in a smooth flow with fewer slips.

3. Why do tour firms need strong cash flow tools?

- Live cash trends show each shift in real time. Quick action stops loss in peak rush days.

4. How can wrong bank lines be found with ease?

- Bank feeds sync with stored logs on one screen. Fast match flags wrong sums at once.

5. What role does staff access play in safe tour work?

- Role rules keep key data safe from wrong edits. Clear rights help each user stay in scope.

6. Why do tour firms shift to auto rules for daily tasks?

- Auto posts cut long work and keep clean logs. More hours stay free for core tour work.

7. What gains come from fast tax sum checks?

- Tax lines update with each new post. Tax files form with clean proof for each step.

8. How do vendor due alerts help a tour firm?

- Due alerts show due sums in quick view. Strong bonds form when all dues are paid on time.

9. Why is a short month-end close key for tour firms?

- Short close keeps stress low for each team. Clear summaries guide leaders with fresh facts.

10. How do Live Coin tools help with global tours?

- Coin shifts show on one screen with a time stamp. Clean coin logs help form fair tour prices.

11. Why do multi-land deals need clear rate logs?

- Linked rate logs keep each deal fair. Cross-land sums stay true in each record.

12. Why do tour firms need clear audit steps for each post?

- Linked logs show each move with time marks. Smooth audits form when proof stays in one place.

13. Why use cloud tools for tour numbers?

- Cloud access helps staff work from any place. Safe store rules guard all data in real time.

14. How do daily cloud backups help tour teams?

- Backups hold old logs for fast checks. Lost files drop to near zero with safe sync.

15. Why are cloud charts good for tour heads?

- Live charts show tour gain or dip fast. Smart calls form with clear trend lines.

16. How can cloud plans cut tech costs for tour firms?

- No need for large gear or big setup work. Light fees help shift more funds to core tasks.

17. What skills help an expert team run tour books?

- Deep cash flow skill and clean log skill help most. Strong tool skill keeps each post in right place.

18. How can a tour firm pick the right finance tool?

- Check ease, speed, link range, and safe store rules. Pick the tool that fits team load and tour size.

19. Why do some tour firms seek pro book support?

- Pro teams fix gaps that slow daily work. Tour plans run smoothly once cash logs stay clear.

20. How can a firm gain from expert support in Tourism Accounting?

- Expert help brings clean logs and fast reports. Strain drops when trained staff handle all sums for accounting for travel agents and other accounting software for travel agencies.