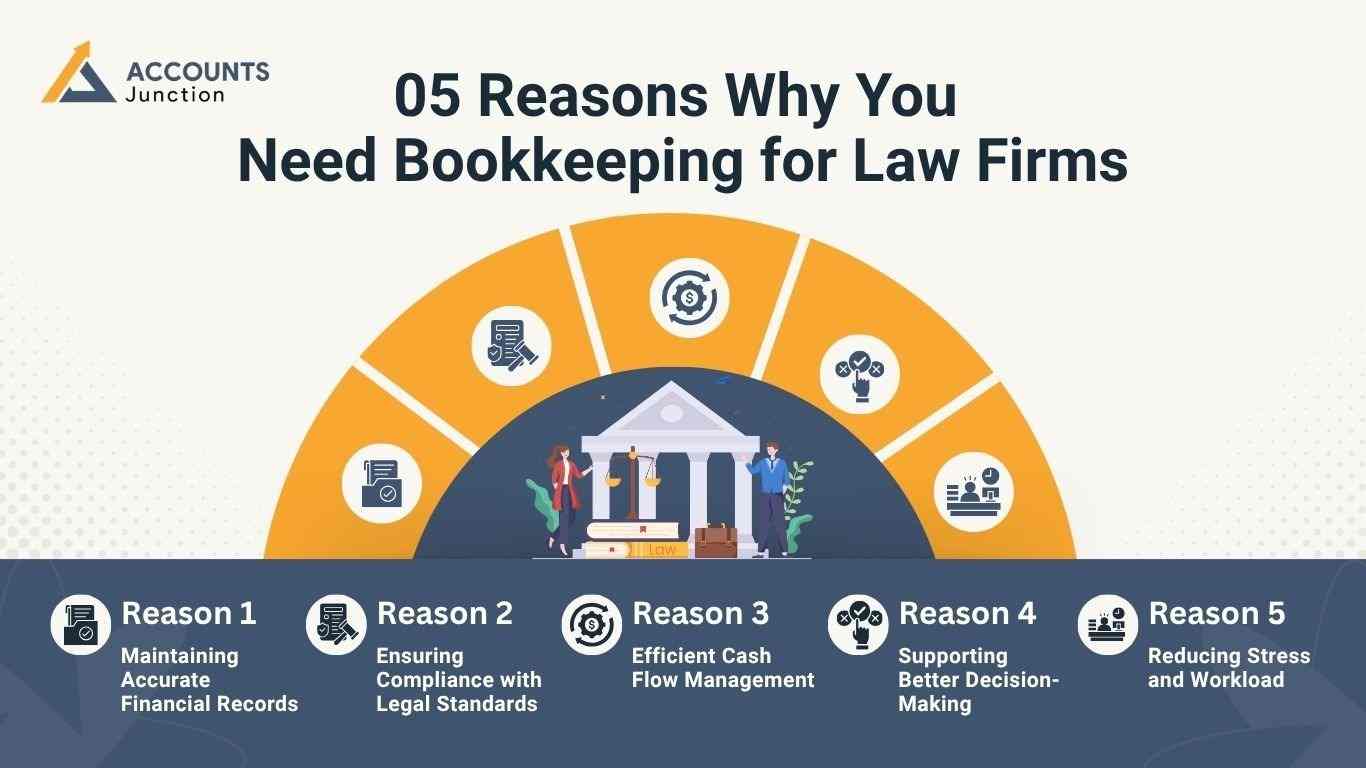

05 Reasons Why You Need a Bookkeeping for Law Firms.

Running a law firm may need more than legal skills. Proper money management may often determine the success of the firm. Bookkeeping may let law firms track client payments, invoices, and other costs. In this blog, we explain why Bookkeeping for Law firms may be vital for smooth work and growth.

Bookkeeping for law firms may not seem very important at first. However, law firms handle many clients, retainers, and work costs at the same time. Without bookkeeping, mistakes may build up and financial records may become unclear.

Bookkeeping may help track pay, billable hours, and client trust accounts. Firms may follow rules while keeping records clear and correct. Using software or hiring experts may make accounting tasks much easier.

Clear financial records may allow lawyers to focus more on cases than on office work. Proper bookkeeping may prevent client disputes and reduce stress during audits.

Reason 1: Maintaining Accurate Financial Records

Good financial records may be key in bookkeeping for Law firms of all sizes.

- Law firms may handle hundreds of money moves each month.

- Without proper Bookkeeping for Law Firms, client pay may go untracked.

- Billing mistakes may rise if records are not kept.

- Accounts may be easier to check with bookkeeping for Law firms.

Accurate records may also help plan budgets and future costs. Law firms may avoid fines for missing or wrong records.

Example Scenario:

A small law firm may get payments from many clients every week. Without bookkeeping, tracking which client paid which invoice may be difficult. Proper bookkeeping may avoid confusion and ensure accurate records.

Reason 2: Ensuring Compliance with Legal Standards

Following rules and accounting laws may be complex for law firms.

- Law firms may manage client trust accounts with strict rules.

- Poor bookkeeping for Law firms may break trust account laws.

- Proper records may provide proof during audits.

- Clear bookkeeping may protect firms from money disputes.

Example Scenario:

A law firm may handle settlements for multiple clients. Without clear records, proving correct fund use may be hard. Bookkeeping may ensure proper documentation and rule compliance.

The following rules may build client trust and help avoid fines or a bad reputation.

Reason 3: Efficient Cash Flow Management

Managing cash flow may be key to smooth firm operations.

- Bookkeeping for Law firms may track money coming in and going out.

- Careful monitoring may prevent late payments or missed bills.

- Records may show times of low or high cash.

- Tracking costs may help reduce unnecessary spending.

Example Scenario:

A mid-sized firm may spend much on office rent and salaries. Without cash tracking, low-income months may create shortages. Bookkeeping may help plan money needs and prevent issues.

Good cash flow may keep operations smooth and help plan for the future.

Reason 4: Supporting Better Decision-Making

Clear records may guide important firm decisions.

- Bookkeeping for Law firms may show which services bring in the most income.

- Tracking costs may show where to spend less.

- Bookkeeping for Law firms' records may guide hiring or resource allocation decisions.

- Firms may plan growth or new services with more confidence.

Example Scenario:

A firm may plan to start a new service. Bookkeeping may show if the current income can cover new staff. Accurate records may help make smart choices.

Bookkeeping may also show trends in money over time. This may guide better planning and smoother operations.

Reason 5: Reducing Stress and Workload

Lawyers often face heavy work due to managing cases.

- Bookkeeping for Law firms may cut office work for lawyers.

- Hiring experts may let lawyers focus on legal tasks.

- Fewer mistakes may reduce stress in audits or reviews.

- Organized records may help firms run smoothly every day.

Example Scenario:

An attorney may spend hours tracking client pay manually. Outsourcing or proper bookkeeping may save time and improve focus. Less administrative work may improve client service and satisfaction.

How Bookkeeping for Law Firms May Work

Bookkeeping for Law firms may follow several methods based on firm size.

Using Accounting Software

- Software may enter data and generate reports automatically.

- Cloud-based systems may allow secure access from anywhere.

- Automation may cut errors and save time for the firm.

Example Scenario:

A firm using cloud software may generate monthly profit reports quickly. Staff may focus on clients instead of manual calculations.

Outsourcing Bookkeeping Services

- Firms may hire experts to manage all bookkeeping tasks.

- Outsourced staff may handle trust accounts and compliance reports.

- Lawyers may focus on cases while experts track finances.

Example Scenario:

A mid-sized firm may hire certified bookkeeping experts. This may save time and ensure rules are followed for client funds.

In-House Bookkeeping

- Some firms may prefer a full-time staff member for bookkeeping.

- In-house staff may know firm-specific needs better.

- Staff may work with lawyers to solve accounting questions quickly.

Example Scenario:

A law firm may hire one bookkeeper to manage daily money tasks. This may keep records correct and reports ready for decision-making.

Key Benefits of Bookkeeping for Law Firms

Proper Bookkeeping for Law firms may give several advantages:

- Clear Records: Clients and partners may see correct finances.

- Fewer Errors: Billing and costs may be tracked correctly.

- Follow Rules: Firms may meet trust and tax requirements.

- Save Time: Lawyers may focus more on cases, less on money.

- Better Planning: Financial information may guide growth and spending decisions.

These benefits may help law firms stay stable and grow.

Common Challenges Law Firms May Face Without Bookkeeping

Not keeping records may cause several issues:

- Client payment disputes may increase.

- Fines for rule violations may occur.

- Cash problems may affect daily work.

- Untracked costs may grow and reduce profits.

- Audits may become stressful and hard.

Proper bookkeeping may prevent these problems and reduce stress.

Tips to Implement Bookkeeping for Law Firms

- Pick software or services that fit the firm's needs.

- Keep client trust accounts correct at all times.

- Reconcile bank statements regularly to avoid mistakes.

- Track all invoices, retainers, and client payments.

- Review financial reports often to make better choices.

- Document all costs clearly and sort them properly.

- Train staff on bookkeeping steps to improve efficiency.

Following these Bookkeeping for Law firms tips may make financial management easier.

Advanced Bookkeeping Practices for Law Firms

Law firms may use advanced bookkeeping to improve results:

- Regular Audit Prep: Check records often to avoid mistakes.

- Automated Alerts: Software may warn about unpaid bills or deadlines.

- Custom Reports: Firms may make reports for each team or case.

- Client Segmentation: Track each client separately for clarity.

- Data Safety: Encrypted systems may keep financial info safe.

These steps may improve accuracy and smooth operations.

Case Example: Small Law Firm

A small firm with three lawyers may struggle with client retainers. Manual bookkeeping may cause missed payments and wrong records. After proper bookkeeping or outsourcing, the firm may:

- Track each client's payment correctly

- Reduce mistakes and rule out risks.

- Save lawyer time for case work.

- Make smart hiring or growth decisions.

Even small firms may see major benefits from good bookkeeping.

Effective Bookkeeping for Law Firms may be vital for smooth operations. Accurate records may reduce mistakes, rule issues, and stress. Firms may gain clear insight into cash, client payments, and overall money health. Certified experts may manage all areas efficiently. Partner with us for accurate finance handling and professional service. At Accounts Junction, we provide comprehensive bookkeeping services for law firms of all sizes. Our certified experts may manage client accounts, trust funds, and financial reporting efficiently. With tailored solutions, law firms may focus on operations while we maintain financial accuracy.

Partner with us to ensure precise financial management and professional handling.

FAQ's

1. What is bookkeeping for law firms?

- It may involve recording financial transactions specific to legal practices.

2. Why do law firms need specialized bookkeeping?

- General bookkeeping may not handle trust accounts and client retainers accurately.

3. Can bookkeeping for law firms prevent billing errors?

- Yes, it may track client invoices and payments precisely.

4. How may bookkeeping help manage client trust accounts?

- It may record deposits, withdrawals, and balances clearly for compliance.

5. Does bookkeeping assist with law firm tax compliance?

- Yes, organized records may simplify tax filings and reporting.

6. Can law firms outsource their bookkeeping?

- Outsourcing may let experts manage financial records efficiently and securely.

7. How does bookkeeping improve law firm cash flow?

- It may track receivables and payables, avoiding financial shortages.

8. Is bookkeeping necessary for small law firms?

- Even small practices may benefit from accurate financial tracking and transparency.

9. Can bookkeeping help law firms track billable hours?

- Yes, it may integrate client billing with attorney time tracking.

10. How may bookkeeping support law firm audits?

- Proper records may make audits smoother and reduce compliance risks.

11. What reports may bookkeeping generate for law firms?

- Profit, loss, trust account, and client billing statements may be included.

12. Can bookkeeping highlight unprofitable services in a law firm?

- Yes, financial data may reveal revenue gaps or cost-heavy practices.

13. How may bookkeeping reduce financial stress for lawyers?

- Organized records may free lawyers from administrative errors and delays.

14. Does bookkeeping help with client billing transparency?

- Yes, accurate invoicing may improve client trust and satisfaction.

15. Can software manage bookkeeping for law firms?

- Yes, legal-specific software may automate accounts and track transactions.

16. How often should law firms reconcile financial records?

- Monthly or transaction-based reconciliation may avoid errors and misstatements.

17. Can bookkeeping detect late client payments?

- Yes, tracking accounts receivable may highlight overdue invoices promptly.

18. How does bookkeeping aid law firm financial planning?

- It may provide insights into expenses, profits, and future investments.

19. Are certified professionals recommended for law firm bookkeeping?

- Yes, experts may ensure accuracy, compliance, and proper trust account handling.

20. Can bookkeeping improve law firm profitability?

- Yes, accurate records may reduce errors, control costs, and enhance revenue.