Why Offshoring Accounting Is a Smart Move for Growing Firms

As businesses grow, so do their responsibilities. One of the most demanding areas is accounting. Balancing books, staying updated with tax laws, and managing payroll can take time away from core activities. For many growing firms, offshoring accounting provides a clear answer.

Offshoring accounting means sending accounting tasks to professionals in other countries. It is not a shortcut. It is a planned move to improve output and reduce costs without hurting quality. This service is now widely used by both small and mid-sized companies who need better control without building large in-house teams.

Understanding Offshoring in Accounting

Offshoring accounting is the process of moving accounting services to a provider outside your country. These providers may handle bookkeeping, payroll, tax filing, or even offer full-time staff. The idea is simple. Use trained staff in countries where the cost of labor is low, but the quality of service is still high.

India, the Philippines, and parts of Eastern Europe are popular for accounting offshoring. They have skilled staff who speak English, work in similar time zones, and understand global accounting standards. Firms in the United States, United Kingdom, Canada, and Australia often use these services.

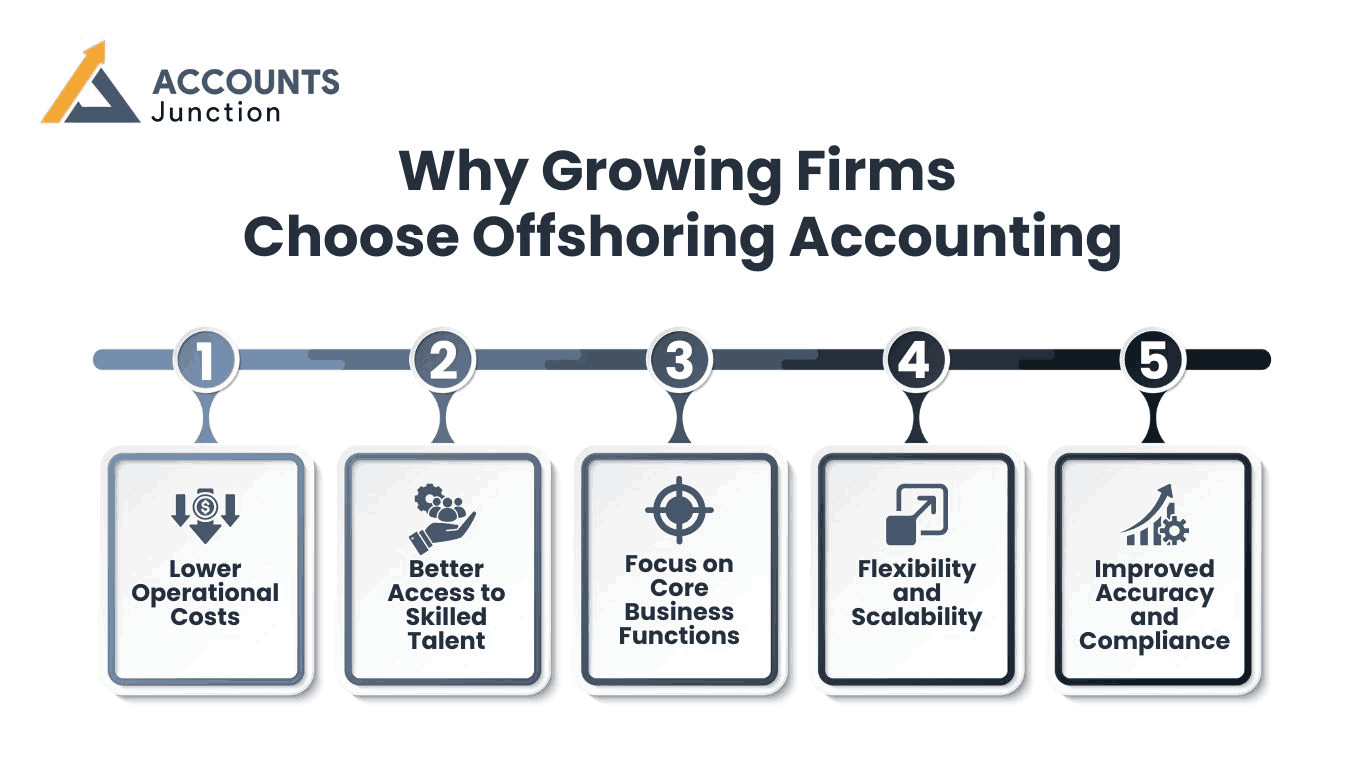

Why Growing Firms Choose Offshoring Accounting

1. Lower Operational Costs

Running a full accounting team in-house can be expensive. Salaries, software, training, and office space all add up. Offshoring accounting can cut these costs by up to 60 percent. This is not because the work is lower in value, but because the cost of living and wages are lower in other countries.

Even when firms outsource complex tasks, they often find the total cost is far less than managing the same tasks in-house. That extra money can go back into product development, hiring, or marketing.

2. Better Access to Skilled Talent

Finding good accountants is hard. It becomes harder when your business is growing fast. Offshoring opens access to a larger pool of skilled professionals. These are not interns or beginners. They are trained experts who know international standards like GAAP, IFRS, and country-specific tax rules.

Many providers offer full teams. You get a bookkeeper, a CPA, and even a team lead to manage them. You do not need to spend time training them or teaching the basics.

3. Focus on Core Business Functions

As a company grows, the focus should stay on clients, growth, and products. Spending hours each week checking cash flow, invoices, or payroll takes energy away from what matters most. With offshoring accounting, your team can focus on core work, while your offshore partner handles numbers, tax filing, and bank reconciliations.

The offshore team becomes an extension of your business. You can give them tasks like reporting, forecasting, and monthly closings. This gives your internal team time to look at growth plans, talk to clients, or fix workflow issues.

4. Flexibility and Scalability

Growing firms have changing needs. During tax season or audits, the accounting workload spikes. During the off-season, it may drop. With accounting offshoring, you can scale your team up or down. You are not tied to long contracts or fixed staff.

If your business adds new services or enters new markets, your offshore team can grow with you. They can add experts in sales tax, international compliance, or financial reporting when needed. You pay for what you use and scale without stress.

5. Improved Accuracy and Compliance

Mistakes in accounting can lead to penalties, missed deadlines, and lost trust. Offshoring firms invest in tools and quality checks. Their teams follow strict rules to ensure every entry, report, and return is accurate.

They also stay updated with tax changes, compliance needs, and new software tools. This means your data stays clean, and your filings are always on time. Most teams also provide audit support and document control.

Hire A Dedicated Team

That Grows With You, Flexible, Scalable and

Always On Your Side

What Tasks Can Be Offshored in Accounting?

Offshoring accounting is not just about payroll or taxes. Many services can be sent offshore, including:

- Bookkeeping: Recording daily sales, expenses, and receipts.

- Accounts payable and receivable: Sending invoices, tracking payments, and managing bills.

- Bank reconciliations: Matching bank statements with accounting records.

- Payroll processing: Calculating salaries, taxes, and benefits.

- Tax preparation: Preparing and filing business taxes as per local rules.

- Management reporting: Creating balance sheets, income statements, and cash flow reports.

- Budgeting and forecasting: Helping with future planning and cash use.

- Inventory accounting: Tracking stock, purchases, and sales value.

- Audit support: Preparing papers, fixing missing items, and giving auditors what they need.

Most providers use accounting tools like QuickBooks, Xero, Zoho Books, FreshBooks, and NetSuite. This makes it easy to share data and control your numbers in real time.

Is Offshoring Accounting Safe?

Data safety is a real concern when offshoring. Reputed firms use strong safety tools. They encrypt data, use secure servers, and follow access rules. Most also sign contracts like NDAs (non-disclosure agreements) and SLAs (service level agreements) to protect your information.

You can also set who can access your software, what files can be seen, and how often you get updates. Many firms use cloud systems that track all changes. This means you can see what was done, when, and by whom.

How to Start with Accounting Offshoring

Getting started is simple, but it needs a clear plan. Follow these steps:

Step 1: Identify What to Offshore

Not every task should be sent offshore right away. Start with simple tasks like bookkeeping or invoicing. Over time, you can add payroll, taxes, and reporting.

Make a list of what your in-house team handles now. Then decide what takes the most time or what you find hard to manage. That becomes your offshoring list.

Step 2: Choose the Right Offshore Partner

Look for a partner with strong reviews, client stories, and clear services. Ask about their tools, team size, and working hours. Make sure they work in your accounting software.

Talk to their team before you sign anything. A good partner will offer trial work or pilot projects. That way, you test before you commit.

Step 3: Set Clear Workflows

Once you start, define who will send files, review reports, and approve tasks. Set timelines and reporting rules. Use tools like Slack, Zoom, Google Drive, or project boards to stay in sync.

Communication is key. Share your expectations and check in often. The more you talk, the better they understand your work style.

Step 4: Monitor and Improve

Offshoring is not about letting go. Check the reports, review errors, and give feedback. Over time, your offshore team will become faster, smarter, and more aligned with your goals.

You can also build custom dashboards to track tasks, hours, and savings. Many tools help you compare in-house vs offshore results.

Myths About Offshoring Accounting

"It’s only for large companies"

Wrong. Many small firms offshore tasks. Even freelancers use offshore bookkeepers. You do not need to hire ten people. You can start with one part-time staff.

"Quality will drop"

Not true. Top offshore firms hire experts, train them well, and offer better accuracy than many in-house setups. Their teams follow checklists, use tools, and stay updated.

"Data will not be safe"

With the right provider, your data stays safe. Cloud tools, access logs, and legal contracts ensure your records stay private and protected.

"Time zones make it hard"

Time zones help in many ways. Work is done while you sleep. You send tasks in the evening, and they are ready by morning. Some teams even match your hours if needed.

How Accounting Offshoring Helps Your Firm Grow

Offshoring accounting does more than save money. It clears your calendar, reduces stress, and gives you more control. When your accounting is in order, you make better choices. You can hire faster, enter new markets, or raise funds.

You also avoid delays in filing taxes or closing books. Your cash flow improves. You get clean reports that help with planning. In short, you become more stable and confident.

Growing firms need fast support. Offshoring gives that without high cost. You do not need a huge office or a full-time team. You get smart, skilled help at a price that fits your budget.

What to Look for in an Offshoring Partner

- Proven experience: Years in business and good reviews

- Trained staff: CPAs, bookkeepers, tax experts

- Tools support: Works with your software

- Clear contracts: NDA, SLA, and defined scope

- Good support: Quick replies, task tracking, and friendly staff

- Custom plans: Pay as you grow, no big upfront fee

- Trial options: Test before signing long term

Conclusion

Offshoring accounting is not a trend. It is a smart move that helps growing firms cut cost, stay lean, and focus on what matters. You do not lose control. You gain time, clarity, and peace of mind.

With the right partner, you can get skilled help for every task from bookkeeping to tax filings. At Accounts Junction, we ensure all our clients stay compliant, get better reports, and reduce risks.

Our offshoring accounting services works for small businesses, startups, and growing firms alike. Whether you need part-time help or a full team, our accounting model offers strong value and real results.

FAQs

1. Is offshoring accounting legal for US companies?

- Yes. It is legal to offshore accounting work. You must ensure data security and meet IRS rules.

2. How much can I save with accounting offshoring?

- Savings range from 40 to 60 percent depending on the task and location.

3. Do offshore teams use tools like QuickBooks or Xero?

- Yes. Most offshore providers use top tools including QuickBooks, Xero, Zoho Books, and NetSuite.

4. How do I communicate with my offshore team?

- You can use email, Slack, Zoom, or shared task boards. Many teams match your time zone or offer overlap hours.

5. What happens if my offshore team makes a mistake?

- Good firms have checks and backups. They correct errors fast and have managers to review reports.

6. Can I offshore just one task to start?

- Yes. You can start small with one or two tasks and increase as you see results.