Why Balance Sheet Reconciliation Is Crucial for Financial Health?

A balance sheet can act like a window that lets you look inside your business. Through it, you may see what your company owns, what it owes, and what remains as value.

But like any window, it can gather dust over time. When the view gets cloudy, mistakes and mismatches may hide behind the glass. Balance Sheet Reconciliation is the simple act of wiping it clean, so the picture looks honest again.

It may seem like a task meant only for accountants, but in truth, it can act as a heartbeat check for the entire business. Without it, the body may still move, though weakly. With it, each part may work in rhythm.

In this blog, we will see what it really means, how it works, and why it can shape the financial health of a business in ways one might not expect.

What Is Balance Sheet Reconciliation?

Balance Sheet Reconciliation means matching the figures in your books with what actually exists. It is like holding two mirrors to each other — one from your records and another from reality — and seeing if the reflection stays clear.

It can reveal gaps, hidden errors, or old mistakes that may have been sitting quietly. When done well, it can make sure your numbers tell the same story from every side.

Why it matters in the real world

Sometimes what the books say and what the bank says may not match. Maybe a payment got delayed. Maybe an entry was skipped. These small gaps may grow larger with time. Reconciliation helps catch them before they break trust.

It may also give leaders, investors, and staff a sense of peace that what they see on paper truly connects with what lies in accounts.

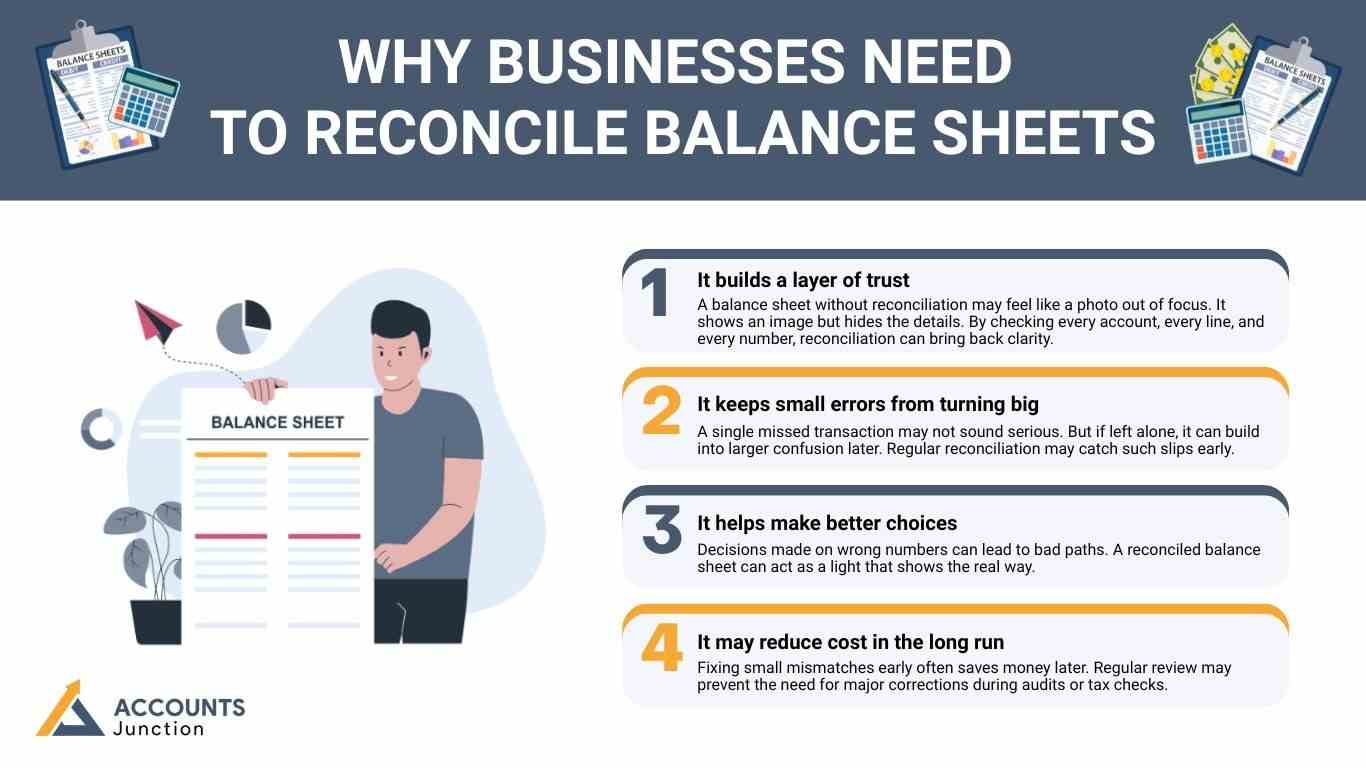

Why Businesses need to reconcile balance sheets

1. It builds a layer of trust

- A balance sheet without reconciliation may feel like a photo out of focus. It shows an image but hides the details. By checking every account, every line, and every number, reconciliation can bring back clarity.

- When the numbers make sense, trust follows. Clients may believe reports. Investors may feel calm. And teams may know where they stand.

2. It keeps small errors from turning big

- A single missed transaction may not sound serious. But if left alone, it can build into larger confusion later. Regular reconciliation may catch such slips early.

- It may stop an unnoticed entry from spreading across reports. And it may also prevent extra hours spent in confusion during audits.

3. It helps make better choices

- Decisions made on wrong numbers can lead to bad paths. A reconciled balance sheet can act as a light that shows the real way.

- It may help managers decide when to spend, when to save, and how to plan growth.

4. It may reduce cost in the long run

- Fixing small mismatches early often saves money later. Regular review may prevent the need for major corrections during audits or tax checks.

- It may not promise big savings right away, but it can quietly guard against losses that come from bad data.

How to do Balance Sheet Reconciliation

Step 1: Gather every document

- The first move is simple. Collect all your records — bank statements, invoices, ledgers, receipts, and loan files. Without these, the puzzle stays half empty.

Step 2: Compare the balances

- Once you have everything, check if your books match your external records.

- If the cash account in your ledger says ₹1,00,000 and the bank statement says ₹99,000, there is a difference that needs attention.

Step 3: Find the reason behind the gap

- This is where you may play detective. Sometimes a cheque is cleared late. Sometimes an expense is recorded twice. These small details can explain the bigger difference.

Step 4: Adjust and record corrections

- After finding what went wrong, note it down. Adjust the balance sheet to reflect the true figures. Keep track of what was changed and why.

Step 5: Review and save your notes

- Once done, store all proof and explanations. It can help you in future reconciliations or audits. A clear record of old work often saves hours later.

Common Errors Found During Balance Sheet Reconciliation

- Missed or double transactions

- Old outstanding entries

- Incorrect posting to wrong accounts

- Unrecorded expenses or receipts

- Data entry errors from automation tools

When spotted early, such mistakes can be fixed easily. When ignored, they may hide for months and twist the numbers that leaders rely on.

How Often Should You Reconcile Your Balance Sheet?

No strict rule fits all. The frequency may depend on the size of the business, how often it trades, and how complex its accounts are.

- Large firms may reconcile monthly.

- Small firms may do it quarterly.

- Fast-moving businesses like retail may need weekly reviews.

The main goal is not speed but habit. A steady rhythm of review may protect the books better than a rushed one done once a year.

How Balance Sheet Reconciliation Supports Financial Health

1. Brings transparency

- When every number is checked, the picture turns out to be honest. It may remove guesswork from decision-making.

2. Prevents fraud and misuse

- Regular checking may uncover odd entries or movements that seem out of place. Fraud may not always be visible, but reconciliation may reveal its signs.

3. Builds confidence during audits

- When auditors come, reconciled accounts may make their job easy. Clear records reduce questions and confusion.

4. Improves control over cash flow

- A reconciled sheet may show where money truly lies. It may tell when funds are free or stuck. This helps plan better for future needs.

5. Strengthens investor faith

- Investors like clarity. When they see reconciled figures, they may trust the business more. Confidence often grows where confusion ends.

Risks of Ignoring Balance Sheet Reconciliation

- Numbers may drift from reality.

- Reports may mislead management.

- Fraud may stay hidden longer.

- Cash flow gaps may appear late.

- Audits may take more time and money.

- Business may lose trust from investors or banks.

Ignoring reconciliation may not hurt right away, but slowly it can weaken the roots of financial health.

Simple Practices to Improve Reconciliation

Keep clean records

- Order in data often means order in results. Keep all supporting papers ready before starting reconciliation.

Stay consistent

- Fix a schedule and stick with it. Regular review builds discipline and reduces surprises.

Use reliable software

- Tools like QuickBooks, Zoho Books, or Xero may make comparisons faster. Still, manual checking should not be ignored.

Assign clear roles

- If a team handles reconciliation, each member should know their area — one for banks, one for assets, one for payables, and so on.

Keep past reconciliations handy

- Looking back may reveal trends. If the same account shows frequent mismatch, it signals a deeper issue.

The Connection Between Reconciliation and Other Financial Reports

Every statement in finance links together.

- Income statements may rely on accurate balances for revenue and expenses.

- Cash flow reports may draw from reconciled bank accounts.

- Audit reports may need verified data to confirm results.

If one part stays unchecked, the rest may wobble. A reconciled balance sheet can keep the entire financial system steady.

Signs That You Need Better Reconciliation

- Accounts often show unexplained changes.

- Vendors or customers complain about missing payments.

- Reports take longer to prepare.

- Bank statements never match book balances.

- Auditors raise frequent questions.

When such signs appear, it may be time to strengthen your reconciliation process.

How Balance Sheet Reconciliation Can Shape the Future of a Business

For growth and stability

- A reconciled balance sheet may show a clear base for expansion. Investors and lenders often trust such clarity before offering funds.

For control and planning

- It may help leaders see what is real instead of what appears. With that truth, plans can become more solid and less risky.

For peace of mind

- At times, the biggest gift reconciliation gives is time saving. When numbers are in order, you can get free time.

Simple Example to Understand It

Imagine a store that thinks it has ₹2,00,000 in its bank account. During reconciliation, it finds that ₹20,000 worth of cheques have not been cleared yet.

Without that check, the owner may plan to buy stock that money cannot yet cover. Reconciliation may save the store from a cash crunch.

It shows that sometimes small reviews may prevent big mistakes.

Balance Sheet Reconciliation holds great power. It can protect a business from confusion, loss, or distrust. This practice holds the key to every stable business. When done with care, it can build a bridge between what is written and what truly exists. At Accounts Junction, we handle books of companies and businesses around the world. Reconciliation is our regular practice for them. If you want to outsource accounting or bookkeeping of your business to experts, contact us now!

FAQs

1. What does Balance Sheet Reconciliation mean for a business?

- Balance Sheet Reconciliation means comparing records in the books with real financial accounts to ensure both sides match. This process may reveal missing entries or wrong postings that affect how money appears in reports.

2. Why should every company perform Balance Sheet Reconciliation?

- Reconciliation helps confirm that financial data reflects real transactions. Without it, a company may make choices based on unclear or misleading figures.

3. How can Balance Sheet Reconciliation improve financial health?

- When all balances stay accurate, business planning becomes smoother. Clear numbers may also guide better spending and reduce the fear of hidden errors.

4. What are the main reasons mismatches appear in a balance sheet?

- Timing gaps, double entries, or missed payments may cause figures to differ. Sometimes manual errors or delayed postings can also lead to confusion.

5. How often should a business perform Balance Sheet Reconciliation?

- Most businesses may review their balances every month or quarter. Firms with daily transactions may find weekly reconciliation more reliable.

6. Who is responsible for performing Balance Sheet Reconciliation?

- The accounting or finance team usually manages the reconciliation process. Larger firms may even assign a separate group to handle these reviews.

7. What happens when differences are found during reconciliation?

- The team may track the reason for every mismatch and make corrections. Once the cause is noted, balances are adjusted and records are updated.

8. How does Balance Sheet Reconciliation prevent fraud?

- Regular checking can reveal patterns that seem unusual or suspicious. Unapproved payments or false invoices often surface during the review.

9. Why is documentation important after reconciliation?

- Every change made during reconciliation should have proof attached. Strong documentation helps future audits and builds trust in reports.

10. Can Balance Sheet Reconciliation help in audits?

- Yes, reconciled accounts may make the audit process faster and easier. Auditors often trust records that show recent and clear reconciliation notes.

11. What role does technology play in Balance Sheet Reconciliation?

- Modern accounting software may compare data and detect mismatches quickly. Still, a human review remains vital to understand the reason behind each error.

12. How does Balance Sheet Reconciliation affect cash flow?

- Accurate balances may show where real cash stands in the business.

- This clarity can help plan payments, investments, and future spending.

13. Why may small businesses ignore Balance Sheet Reconciliation?

- Many small firms believe their records stay simple and error free.

- Yet even minor slips can harm those firms if not corrected on time.

14. How can Balance Sheet Reconciliation build investor trust?

- Investors prefer numbers that match across reports and accounts.

- Reconciled statements may signal care, honesty, and strong internal control.

15. What accounts usually require regular reconciliation?

- Cash, bank, payables, receivables, and asset accounts need the most focus.

- These accounts often carry the highest volume of changes each month.

16. How does poor reconciliation affect business decisions?

- Wrong balances can lead to false confidence in available funds.

- Managers may spend more or less than needed because the base data stays wrong.

17. Can Balance Sheet Reconciliation improve long-term stability?

- Yes, consistency in checking accounts may create lasting financial strength.

- A business that reconciles often may face fewer shocks during audits or reviews.

18. What mistakes should be avoided during reconciliation?

- Avoid rushing through reviews or skipping small mismatches.

- Each difference, even tiny, may point to something larger underneath.

19. Is outsourcing Balance Sheet Reconciliation a good idea?

- Some firms hire outside experts for deeper and faster checking.

- Outsourcing may help when internal teams lack time or trained staff.

20. What is the biggest benefit of Balance Sheet Reconciliation?

- The biggest benefit may be peace of mind that all numbers tell the same story.

- When records and reality match, business owners can plan with confidence.