What is the Accounts Payable Process Life Cycle?

When a business pays a vendor, it may look like a simple transaction. But behind that single payment lies a chain of steps that keep everything balanced. This chain is called the accounts payable process life cycle — a flow of requests, verifications, and approvals that may turn expenses into structured action.

It may sound like a technical term, yet this cycle is what keeps a business from falling into financial confusion. Let us explore how it works, how it moves, and how every stage may help a business stay organized and aware.

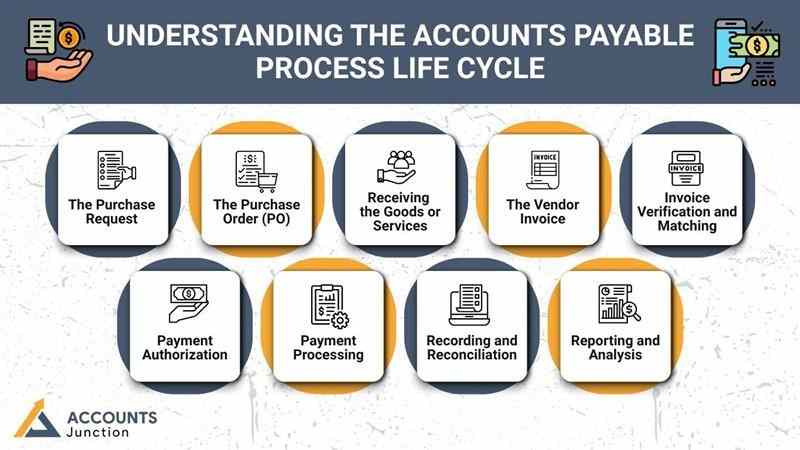

Understanding the Accounts Payable Process Life Cycle

At its heart, the accounts payable process life cycle can be seen as a chain. A chain that moves from one step to another until the business pays what it owes.

Each link in this chain may connect vendors, invoices, purchase orders, and final payments. When the links are smooth, the whole system moves with ease. When they are weak, problems may appear — missed payments, double entries, or unbalanced books.

So, what does this cycle include? Let’s walk through its stages one by one.

Stage 1: The Purchase Request

Everything starts with a need. A team or department may need goods, tools, or services. They make a purchase request, also known as a requisition.

This request often includes:

- What is needed

- Why it is needed

- The cost estimate

- The vendor or source

Once it’s made, the request moves to the next step for approval.

This first stage is more than just a form. It signals the start of a financial promise — a promise that may soon turn into a payable amount.

Stage 2: The Purchase Order (PO)

Once the request gets approval, the business issues a purchase order. This document tells the vendor, “We agree to buy this, under these terms.”

A PO may include:

- Quantity and description of goods

- Agreed price and payment terms

- Delivery details

It acts like a handshake — formal yet flexible.

When both sides agree, the vendor begins preparing the order.

The purchase order is vital because it sets clear expectations and reduces confusion later in the cycle.

Stage 3: Receiving the Goods or Services

The goods arrive. The service gets completed. Now comes the receiving stage. Someone in the business checks if what arrived matches what was ordered. They may compare it with the purchase order and ensure that:

- The quantity is correct

- The quality is fine

- Nothing is missing or damaged

A receiving report is often made here to record that the order is complete. This step may seem small but it builds trust between buyer and seller.

When a business ignores this, it may end up with errors. A business may face wrong payments or damaged goods without careful checking.

Stage 4: The Vendor Invoice

The vendor now sends an invoice — the formal request for payment.

An invoice may include:

- Invoice number and date

- Vendor details

- List of items supplied

- Payment amount and due date

This is where the payable officially enters the system. The accounts payable team receives this invoice and starts the next step — verification.

Invoices may come through email, paper, or digital portals. In modern setups, software can scan and capture invoice data automatically.

Stage 5: Invoice Verification and Matching

Now begins the critical part — three-way matching.

In this step, the invoice is compared with the purchase order and the receiving report. All three must match.

For example:

- If the purchase order says 10 chairs at $50 each

- The receiving report confirms 10 chairs received

- The invoice must also show 10 chairs at $50 each

If everything aligns, the invoice can move forward for approval.

If not, the accounts payable team may reach out to vendors or departments to fix the mismatch.

This stage ensures accuracy and protects the business from paying for something it never got.

Stage 6: Payment Authorization

Once the invoice is verified, it must be approved. The authorization step ensures that the right person signs off before money leaves the account.

Depending on the company’s structure, this may involve:

- Department heads

- Finance managers

- The CFO or controller

Each may have a different limit of approval based on the amount. For example, small payments might need one approval, while large ones may need multiple.

This stage builds control and accountability, two vital elements in financial management.

Stage 7: Payment Processing

After authorization, the invoice enters the payment processing phase. Payments can be made in many ways:

- Bank transfer

- Check

- Credit card

- Online platforms

Timing also matters. Paying too early may affect cash flow. Paying too late may harm vendor relationships.

The accounts payable team schedules payments so that they are timely, accurate, and aligned with company policies.

This is where the actual outflow of funds happens — the final act in the payable story.

Stage 8: Recording and Reconciliation

Once payment is made, the record must be updated.

The recording and reconciliation step ensures that:

- The payment is marked against the right invoice

- The ledger balances match

- Vendor statements reflect accurate details

Reconciliation helps identify missing entries or double payments. It may also reveal if any invoice was overlooked.

A clean record builds a clear picture of what was paid and what remains due.

Stage 9: Reporting and Analysis

At the end of each cycle, reports may be made. These show:

- Total payables

- Pending payments

- Average payment time

- Vendor history

Analysis of this data may reveal trends. Perhaps some vendors are always late with invoices. Or maybe certain departments spend more than planned.

Such insights can help a business plan budgets better, improve cash flow, and build stronger supplier relations.

The life cycle may repeat, but each round teaches something new about how money moves in the system.

Why the Accounts Payable Process Life Cycle Matters

The life cycle may seem routine, yet it holds deep value for every business.

Here’s why:

- Controls spending – Every purchase goes through checks and approvals.

- Prevents errors – Verification steps catch mistakes early.

- Improves cash flow – Payments are planned, not random.

- Builds trust – Vendors feel confident when payments are smooth.

- Gives data clarity – Reports show where money goes and how often.

When this process is managed well, a business may grow with stronger roots and fewer surprises.

Automation in the Accounts Payable Process Life Cycle

Modern tools can simplify this process.

Automation can handle invoice capture, data entry, matching, and even payment scheduling. It may reduce manual effort and the risk of human error.

Benefits may include:

- Faster processing time

- Lower operational cost

- Better tracking and audit trails

- Easier compliance management

Still, human judgment remains vital. Even the best system needs eyes to review exceptions, handle disputes, and make sense of unusual cases.

Common Challenges in the Accounts Payable Process

Even when the system looks solid, small cracks can appear.

Some challenges may include:

- Duplicate payments – When two invoices for the same order get paid twice.

- Lost invoices – When a paper or email invoice is missed.

- Slow approvals – When too many layers delay payment.

- Vendor errors – Wrong pricing or missing details.

- Manual entries – Human mistakes during data input.

Over time, these small issues can add up. That’s why many firms now move toward paperless, automated workflows.

Best Practices for a Smooth Accounts Payable Process

To make the life cycle run like a well-tuned machine, some practices may help:

- Use standard purchase orders for all buys.

- Set clear approval limits for every level.

- Automate data entry where possible.

- Schedule payments smartly to balance cash flow.

- Keep vendor records updated for smooth coordination.

- Reconcile regularly to avoid confusion.

- Train teams to understand each step deeply.

A well-documented process may not only save time but also strengthen trust inside and outside the business.

Impact on Business Growth

When the accounts payable process life cycle runs smoothly, it may lift the whole organization.

Payments go out on time, vendors stay happy, and records stay clean. Managers get better visibility into spending, which can help them make informed choices.

In the long run, it’s not just about paying bills. It’s about building a rhythm where money moves with purpose, not panic.

The accounts payable process life cycle may seem simple to understand — receive, verify, pay, and record. Yet, beneath that simplicity lies a strong balance of control, timing, and trust.

Each stage adds balance to the next. Together, they shape the backbone of how money flows within a business.

When done right, this process doesn’t just manage payments. It creates order, builds confidence, and keeps the company ready for growth. Do you want to make accounts payable process life cycle of your business strong and steady? At Accounts Junction, we help businesses make their payables process life cycle consistent and accurate. Contact us now and automate payables in your business.

FAQs

1. What is the accounts payable process life cycle?

- It is the complete journey of managing payments owed to vendors, from purchase request to final settlement.

2. Why is the life cycle important for a business?

- It may help control spending, prevent mistakes, and maintain healthy vendor relations.

3. What starts the accounts payable process?

- It begins when a team raises a purchase request for goods or services.

4. What is a purchase order used for?

- It defines what the business agrees to buy and under what terms.

5. What happens after goods are received?

- A receiving report is made to confirm the quantity and condition of goods.

6. What is three-way matching?

- It is the comparison of the invoice, purchase order, and receiving report to ensure accuracy.

7. Who approves the invoice before payment?

- Usually, department heads or finance managers approve it depending on the amount.

8. How are payments made?

- Payments can be made by check, bank transfer, or online systems.

9. What is the role of reconciliation?

- It ensures that payments and records match perfectly in the books.

10. How can automation help in the process?

- Automation may speed up data entry, reduce errors, and make tracking easier.

11. What problems can occur in accounts payable?

- Duplicate payments, lost invoices, or delayed approvals may often occur.

12. Why should invoices be verified?

- To confirm that what was billed matches what was ordered and received.

13. How can businesses avoid missed payments?

- By keeping proper records and using reminders or automated alerts.

14. What reports come from this process?

- Reports may include payable aging, vendor history, and payment summaries.

15. Can small businesses use the same life cycle?

- Yes, but they may simplify it based on their size and needs.

16. What are common approval limits?

- These may vary but usually depend on the amount and department authority.

17. How can errors in invoices be handled?

- By contacting the vendor and updating or reissuing the invoice.

18. What happens if invoices are unpaid?

- Vendors may stop supplies or charge late fees if not handled on time.

19. How often should reconciliation be done?

- Monthly reconciliation may keep records clean and up to date.

20. Can technology fully replace human review?

- Not entirely, as judgment and exception handling still need human insight.