What is payroll processing outsourcing & how does it work?

Handling payroll is key, but it can be hard and slow. Many firms face errors, late pay, and law issues. Payroll processing outsourcing can cut mistakes and office work. It lets companies focus on core tasks and growth. Outside payroll firms manage staff pay, taxes, and reports. Small firms may lack staff to handle payroll correctly. Large companies face fines if payroll work is wrong. A payroll service gives safe, timely, and scalable support.

What Is Payroll Processing Outsourcing?

Payroll processing outsourcing means hiring a firm for payroll. The firm handles pay, taxes, benefits, and reports. It reduces mistakes and lowers staff workload in offices. Payroll firms use software to calculate pay quickly and safely. Staff get paid on time, including bonuses or overtime. Payroll follows local tax and labor rules strictly. Firms stay compliant as providers track law changes. Outsourcing lets companies focus on growth and key tasks.

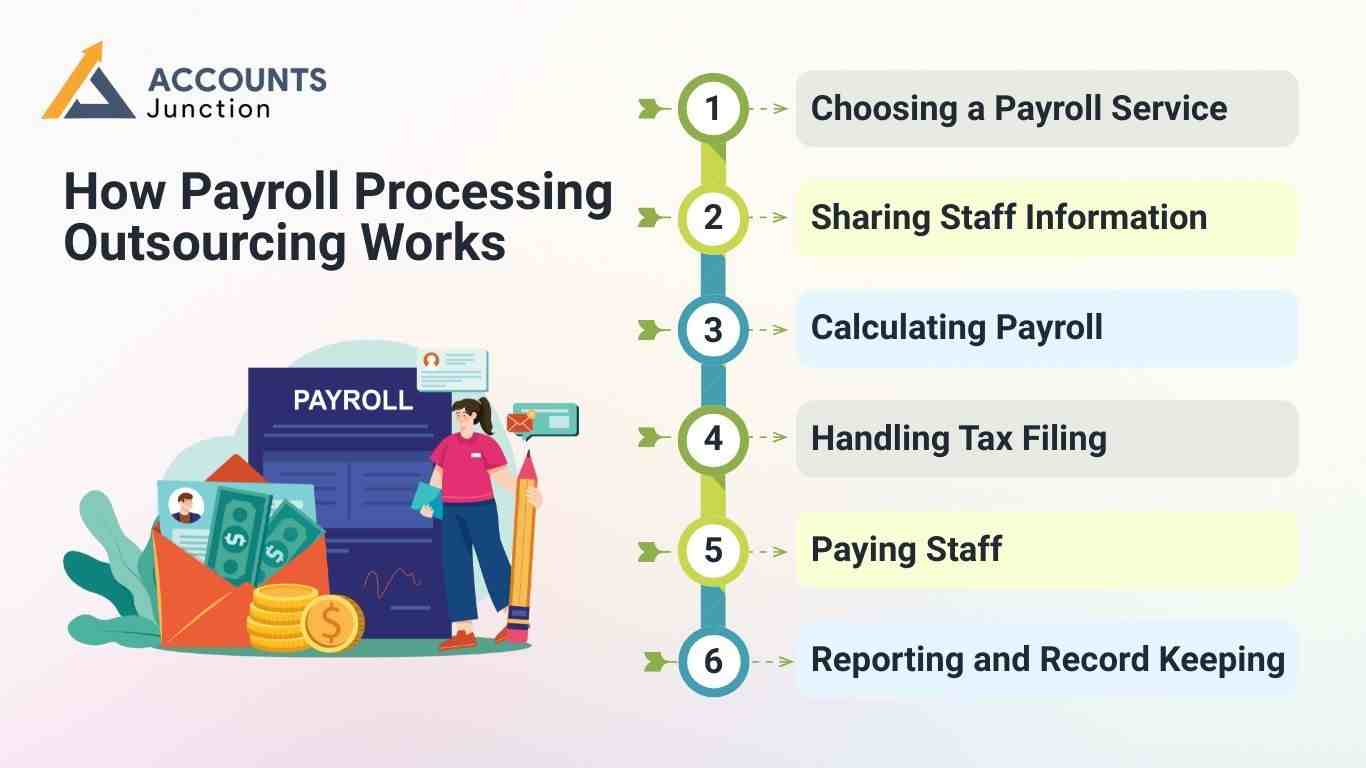

How Payroll Processing Outsourcing Works

Step 1: Choosing a Payroll Service

- Firms look at services for payroll processing outsourcing based on price and support.

- Some provide only software for small firm payroll tasks.

- Full-service firms handle all payroll tasks for larger firms.

- Key points: cost, software, law knowledge, and support.

- Choice depends on firm size, payroll load, and needs.

Step 2: Sharing Staff Information

- Firms send staff data to the payroll firm securely.

- Data includes pay, tax, hours, and benefits clearly.

- Encrypted portals keep information safe and private always.

- Updates for new staff, exits, or raises are key.

- Correct staff data prevents mistakes in payroll processing outsourcing.

- Payroll firms track leave, hours, and benefits properly.

Step 3: Calculating Payroll

- Payroll firms calculate pay, bonuses, overtime, and deductions.

- Software cuts human mistakes and ensures correct results.

- Calculations follow tax and labor rules carefully, always.

- Firms check results before sending pay to accounts.

- Outsourcing cuts paperwork and workload for internal staff.

- Correct payroll boosts staff trust and reduces complaints.

Step 4: Handling Tax Filing

- Payroll services file staff taxes and contributions on time.

- On-time filing avoids fines and legal payroll issues.

- Payroll processing outsourcing keeps firms compliant without tracking the laws themselves.

- Providers watch changes in labor and tax rules daily.

- The expert advice ensures payroll work meets all legal rules.

Step 5: Paying Staff

- Salaries are sent safely to staff bank accounts monthly.

- Electronic payslips are shared for clear record-keeping purposes.

- Firms can pay via bank transfer, check, or other ways.

- Staff receive pay on time, even during holidays or leave.

- Payslips show pay, taxes, deductions, and benefits clearly.

- Timely pay builds trust and confidence in payroll systems.

Step 6: Reporting and Record Keeping

- Payroll firms keep records for audits and compliance needs.

- Firms can access monthly, quarterly, and yearly reports easily.

- Reports show salary, taxes, deductions, and benefits info.

- Dashboards let leaders check payroll status in real time.

- Payroll processing outsourcing ensures data is correct, safe, and accessible.

- Proper records help with planning and budgeting effectively.

Benefits of Payroll Processing Outsourcing

1. Reduced Office Work

- Staff spend less time on payroll tasks each month.

- Employees can focus on business and strategic projects.

- Leaders spend less time on payroll and office work.

- Payroll services reduce stress from complex rules clearly.

2. Fewer Payroll Errors

- Payroll software prevents mistakes in calculations effectively.

- Wrong salaries and tax deductions are greatly cut.

- Correct pay increases staff satisfaction and company trust.

- Errors are caught early to avoid fines or issues.

3. Following Law and Rules

- Payroll firms track tax and labor law changes.

- Firms avoid fines for late or wrong filings.

- Outsourcing lowers risks from in-house payroll errors.

- Following the law keeps payroll safe and correct always.

4. Enhanced Data Security

- Payroll firms use software to protect staff information.

- Data breaches are less likely than in-house systems.

- Staff trust that personal and pay information stays private.

- Outsourcing adds security without extra cost to firms.

5. Cost and Resource Savings

- Payroll services cost less than hiring full-time staff.

- Firms save on software, training, and office expenses.

- Payroll continues without stopping normal office work.

- Staff can focus on areas that help grow the business.

6. Expert Advice

- Payroll firms give advice on laws and payroll steps.

- Firms get expert guidance without in-house payroll staff.

- Providers suggest tools and ways to boost payroll work.

- Expert help keeps payroll correct, safe, and legal.

7. Scalable Solutions

- Payroll services grow with the firm and staff size.

- Adding new staff does not increase internal payroll work.

- Services handle changes while keeping payroll correct always.

- Scalable solutions support firm growth without disruption.

Common Payroll Services

- Pay calculation including overtime, bonuses, and deductions.

- Tax filing for all staff on time.

- Salary transfers via bank, check, or digital methods.

- Payslip creation for records and staff clarity.

- Record keeping for audits and law compliance.

- Leave and attendance tracking are affecting staff pay.

- Benefits handling: health, insurance, retirement, and perks.

- Updates on law and tax changes regularly.

- Payroll reporting for monthly, quarterly, and yearly reviews.

- Payroll consulting to improve workflow and policies.

Choosing a Payroll Service

- Check payroll volume and complexity before deciding.

- Compare payroll processing outsourcing services, software, and client reviews carefully.

- Ensure software is safe, fast, and easy to use.

- Confirm the provider knows local tax and labor rules.

- Check support for issues and questions clearly.

Challenges to Consider

- Data privacy may be a concern with external services.

- Less internal control may slow payroll access sometimes.

- Extra or hidden fees may happen with some firms.

- Software may not always match the company's accounting systems.

- Dependence on providers may delay payroll if errors occur.

- Companies still need to track law and tax updates.

Tips for Effective Payroll Management

- Check provider credentials before signing any contracts.

- Use safe methods to share staff payroll info.

- Communicate schedules, duties, and reporting tasks clearly.

- Audit payroll processing outsourcing reports often to check for errors.

- Update staff info quickly to avoid pay mistakes.

- Set expectations for reporting and legal compliance clearly.

- Choose flexible providers who can handle company growth.

- Review pricing carefully to avoid extra costs or fees.

- Have backup plans for payroll in emergencies.

- Keep staff aware of payroll processes regularly.

Payroll processing outsourcing is a strong business solution. It cuts work, prevents mistakes, and follows the law. Data safety and control issues can be managed. Choosing the right provider is key to success. Outsourcing lets firms focus on staff and growth. Experts handle payroll accurately, safely, and on time. It is a smart step for correct, scalable payroll. Firms gain efficiency, accuracy, and legal compliance. At Accounts Junction, we provide payroll services for all businesses. Our certified experts can handle salaries, taxes, compliance, and reports. Companies can trust our secure systems to keep employee data safe. With flexible solutions, payroll can grow as your team expands. Partner with us to manage payroll and ensure accurate results.

FAQs

1. What is payroll processing outsourcing?

- It is hiring a company to handle payroll work. This may let businesses focus on other core tasks.

2. Why should companies outsource payroll processing?

- Outsourcing may cut errors, save time, and follow rules. It may also reduce office work for staff.

3. Which businesses benefit most from payroll outsourcing?

- Small and mid-sized firms may save time and money. Large firms may also find payroll easier to manage.

4. How does outsourcing handle tax compliance?

- Providers may work out and file taxes on time. They may also keep track of changing tax rules.

5. Can payroll outsourcing help with legal compliance?

- Yes, providers may follow laws and avoid fines. This may also make audits smoother and easier.

6. What tasks are included in payroll processing outsourcing?

- Pay calculation, tax work, staff payments, and reporting. Some may also handle leave and extra hours.

7. How is employee data secured with outsourcing?

- Providers may use safe systems to keep data private. They may also back up information for added safety.

8. Can outsourcing reduce payroll errors?

- Yes, automated systems may stop many mistakes. Staff checks may still catch errors that appear.

9. How does payroll outsourcing integrate with HR systems?

- Many providers may connect payroll with HR and accounts. This may give live updates and easier record-keeping.

10. Can outsourced payroll handle multiple locations or states?

- Yes, providers may manage payroll and rules in many areas. This works well for firms with offices in several states.

11. How often is payroll processed through outsourcing?

- It may be weekly, biweekly, or monthly as needed. Providers may also change schedules to suit the company.

12. Does outsourcing include benefits and leave management?

- Yes, leave, insurance, and retirement may be tracked. Some providers may also manage flexible benefits for staff.

13. How do companies monitor outsourced payroll performance?

- Providers may share reports, dashboards, and audit notes. Regular checks may ensure accurate pay and timely work.

14. Can payroll outsourcing support multinational employees?

- Yes, some providers may handle pay and rules in other countries. They may also work out taxes and benefits locally.

15. How does outsourcing impact payroll costs?

- It may cut staff, software, and office costs. Outsourcing may also remove the need for system updates.

16. What should businesses consider when choosing a provider?

- Check services, price, compliance, tech, and support. Reviews and examples may also help in choosing wisely.

17. Can outsourced payroll provide consulting and expert advice?

- Yes, providers may suggest process improvements and automation. This may help firms follow payroll best practices.

18. How quickly can a company start outsourcing payroll?

- It may take a few days to a few weeks. Providers may also guide staff to make the change smooth.

19. Can payroll outsourcing scale with business growth?

- Yes, providers may handle more staff without extra work. Outsourcing may also adjust to seasonal or sudden growth.