What is Payroll? Managing Payroll with QuickBooks in 2025

Running a business means doing many tasks each day. One key task is paying staff on time and right. Understanding what is payroll is the first step to managing payments correctly. Payroll is the process of giving pay, taking out taxes, and making other cuts. Knowing payroll helps your business run smoothly and avoid mistakes. Tools like QuickBooks make payroll easy. They track hours, count pay, and handle taxes. Using QuickBooks saves time, cuts errors, and keeps your business legal. This guide shows what payroll is and how to use QuickBooks to manage it with ease.

What is Payroll?

- Payroll Defined

Payroll is the process of paying staff for their work. It covers wages, bonuses, and tax deductions. This section explains what is payroll and why it matters for every business. Payroll also keeps track of payments for legal needs. - Main Parts of Payroll

Payroll includes pay, benefits, and mandatory deductions. Keeping clear records makes payroll easier and correct. - Why Payroll Matters

Knowing what is payroll helps businesses avoid fines and errors. Good payroll builds trust with staff and helps the business grow.

Why Payroll is Important

- Follow the Law

Payroll ensures the business follows federal and state rules. Missing rules or deadlines can cause fines and issues. - Keep Staff Happy

Paying staff on time keeps them loyal and focused. Happy staff improve work quality and productivity. - Plan Finances

Payroll data helps plan budgets and future expenses. Clear payroll records make financial decisions easy. - Be Accurate

Correct payroll avoids errors and builds staff trust. Accurate records help with audits and reports.

Types of Payroll

- Hourly Payroll

Staff are paid for the hours they work each week. Keeping track of hours correctly avoids wrong payments. - Salary Payroll

Staff get a fixed salary each month. This type is easy to manage and avoids errors. - Commission Payroll

Staff get paid plus a bonus based on sales. QuickBooks can calculate commissions automatically for accuracy. This makes it easy to understand what is payroll for sales staff. - Contractor Payroll

Contractors get paid for work or projects. Their taxes are handled differently from staff payroll.

Payroll Process Made Simple

- Collect Staff Details

Get names, addresses, tax info, and bank numbers. Correct details ensure a smooth payroll and no errors. - Calculate Pay

Multiply hours worked by pay rates for hourly staff. QuickBooks does this automatically to save time. Payroll with QuickBooks ensures calculations are fast and error-free. - Deduct Taxes

Take out taxes, insurance, and other contributions rightly. Correct deductions keep the business safe from fines. - Pay Staff

Pay via bank transfer or checks safely. QuickBooks creates pay slips for all staff. - Keep Records

Store payroll info for law and audits. Keeping clear records shows you understand what is payroll and how it works.

Common Payroll Problems

- Tax Confusion

Different states have different tax rules. QuickBooks helps calculate taxes correctly every time. - Hours Tracking

Hourly staff need accurate hour tracking. QuickBooks reduces mistakes with automatic tracking. - Late Payments

Late pay makes staff unhappy. Schedule payroll to avoid delays and complaints. - Law Changes

Payroll rules often change. Stay updated to prevent fines or legal issues. - Record Loss

Paper records can be lost or wrong. QuickBooks keeps records safe in the cloud. Managing payroll with QuickBooks avoids these common mistakes.

How QuickBooks Helps Payroll

- Auto Calculations

QuickBooks calculates wages, taxes, and deductions automatically. This saves time and cuts mistakes. - Direct Bank Pay

Staff get paid directly to their accounts. QuickBooks ensures payments are fast and correct. - Tax Filing Help

QuickBooks calculates and files federal and state taxes. This saves work and reduces errors. - Safe Records

Payroll info is stored safely online. You can access it anytime without worry. - Works With Accounts

QuickBooks links payroll to accounting. This keeps records correct and helps with reports.

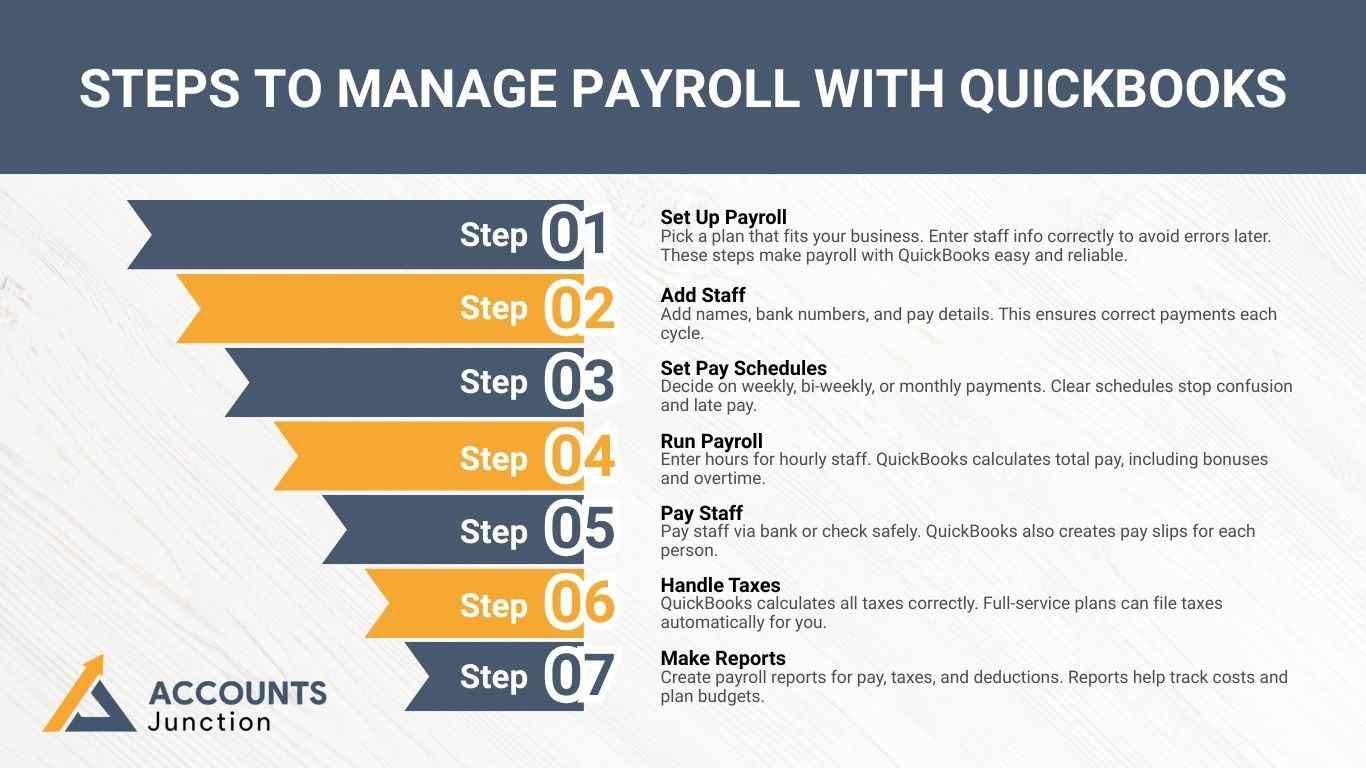

Steps to Manage Payroll with QuickBooks

- Step 1: Set Up Payroll

Pick a plan that fits your business. Enter staff info correctly to avoid errors later. These steps make payroll with QuickBooks easy and reliable. - Step 2: Add Staff

Add names, bank numbers, and pay details. This ensures correct payments each cycle. - Step 3: Set Pay Schedules

Decide on weekly, bi-weekly, or monthly payments. Clear schedules stop confusion and late pay. - Step 4: Run Payroll

Enter hours for hourly staff. QuickBooks calculates total pay, including bonuses and overtime. - Step 5: Pay Staff

Pay staff via bank or check safely. QuickBooks also creates pay slips for each person. - Step 6: Handle Taxes

QuickBooks calculates all taxes correctly. Full-service plans can file taxes automatically for you. - Step 7: Make Reports

Create payroll reports for pay, taxes, and deductions. Reports help track costs and plan budgets.

Benefits of QuickBooks Payroll

- Saves Time

Automation reduces repeated calculations and saves hours. Payroll tasks finish faster than manual work. Using payroll with QuickBooks is a key reason for time savings. - Keeps Pay Accurate

Calculations for pay and taxes are correct. This avoids mistakes and staff complaints. - Follows Law

QuickBooks updates tax rules automatically. Your business stays safe from fines and penalties. - Safe Payroll Data

All info is stored online securely. Cloud storage prevents data loss and theft. - Staff Satisfaction

Staff get paid on time and correctly. Happy staff stay loyal and motivated.

Tips for Smooth Payroll

- Update Staff Info

Update salaries, benefits, and bank details often. This keeps payroll calculations correct. - Check Reports Monthly

Look at payroll reports each month. Fix mistakes before they cause problems. - Set Pay Reminders

Plan payroll dates to avoid late pay. Reminders make sure payments are always on time. - Train Your Staff

Show staff how payroll works and how to check slips. Knowledgeable staff reduces confusion. - Know Tax Rules

Even if QuickBooks updates taxes, stay informed. This prevents unexpected penalties.

Payroll Mistakes to Avoid

- Late Payments

Late pay lowers staff trust. Always schedule payroll on time. - Wrong Tax Deductions

Wrong deductions cause legal trouble. QuickBooks helps calculate taxes correctly. - Mix Staff and Contractor Pay

Contractors have different tax rules. Keep them separate to avoid errors. - Lose Records

Paper files can be lost. QuickBooks Cloud keeps payroll safe. - Ignore Law Updates

Payroll laws change often. Stay informed to avoid fines.

QuickBooks Payroll Plans

- Core Plan

Basic payroll, tax calculations, and direct pay. Good for small businesses. - Premium Plan

Includes HR support, onboarding, and reports. Great for growing businesses. - Elite Plan

Full tax service, 24/7 support, and HR tools. Best for large businesses.

QuickBooks for Small Businesses

- Easy Payroll

Small businesses save time with automated payroll. A few mistakes mean smooth operations. - Better Budgeting

Payroll reports show clear costs. This helps plan future spending accurately. - Law Compliance

QuickBooks helps follow federal and state laws. Small businesses avoid fines.

QuickBooks for Large Businesses

- Multiple Pay Rates

Large teams have different salaries. QuickBooks handles all rates correctly. - Overtime and Bonuses

Overtime and bonuses are included automatically. Saves manual calculation time. - Multi-State Tax

Staff in many states need different taxes. QuickBooks calculates them correctly. - Bulk Payroll

Pay many staff at once. QuickBooks reduces errors and saves time.

Payroll and Accounting Integration

- Auto Updates

Payroll info updates accounts automatically. This keeps books accurate. - Real-Time Insights

See payroll costs instantly. Makes financial decisions faster. - Easy Reconciliation

Linking payroll and accounting simplifies bank checks. Saves time and errors.

Payroll Security Tips

- Strong Passwords

Use strong, unique passwords to protect QuickBooks payroll access. - Limit Access

Allow only essential staff members to view payroll information. - Back Up Payroll

Regularly save payroll copies; QuickBooks Cloud backs up automatically. - Watch Activity

Monitor account activity closely for errors or unusual access attempts.

Payroll in 2025

- Automation

Many payroll tasks run on their own to save time.

Staff can spend more time on their main work. - Cloud Payroll

Check payroll online from any place with a secure cloud.

Owners can pay staff from anywhere at any time. - AI Insights

AI finds errors and trends to make payroll clear.

It helps make payroll work fast, smooth, and safe. - Self-Service

Staff can see pay and change details online quickly.

This tool cuts HR work and gives staff control.

Understanding what is payroll is key to running a business well. Payroll ensures staff are paid correctly and on time. Using payroll with QuickBooks in 2025 makes payroll faster, safer, and accurate.

Businesses save time, reduce mistakes, and follow the law easily. Small and large businesses both benefit from QuickBooks payroll. Accounts Junction offers expert payroll services and bookkeeping. We help set up QuickBooks payroll, manage payments, and ensure all reports are correct. With Accounts Junction, businesses focus on growth while payroll stays smooth and error-free.

FAQs

1. What is payroll?

- Payroll is paying staff on time. It includes wages, bonuses, and tax deductions.

2. Why is payroll important?

- Payroll keeps staff happy and meets the law. It also helps plan money.

3. Can QuickBooks handle payroll taxes?

- Yes, QuickBooks figures out and files taxes. It saves time and cuts mistakes.

4. How often should payroll run?

- Payroll runs weekly, every two weeks, or monthly. It depends on business rules.

5. Can QuickBooks pay contractors?

- Yes, it pays contractors separately from staff. Contractor taxes are different.

6. Is QuickBooks safe for payroll?

- Yes, data is stored in the cloud and locked with strong passwords.

7. Does QuickBooks provide payroll reports?

- Yes, it shows pay, taxes, and deductions. Reports help check finances.

8. Can small businesses use QuickBooks Payroll?

- Yes, it saves time and cuts errors. Even solo businesses can use it.

9. What is direct deposit?

- Direct deposit sends pay straight to a bank. It is fast and safe.

10. Can QuickBooks calculate overtime?

- Yes, it adds extra hours' pay. Staff are paid correctly.

11. Does QuickBooks handle bonuses?

- Yes, you can add bonuses. Taxes on bonuses are calculated too.

12. Can I pay staff in many states?

- Yes, QuickBooks figures state taxes correctly. Multi-state pay is simple.

13. How does QuickBooks keep payroll safe?

- It uses cloud storage and encryption. Only allowed users can access it.

14. What if I make a payroll mistake?

- QuickBooks lets you fix errors before or after pay runs.

15. Can QuickBooks track hourly staff?

- Yes, it records hours and pay. Overtime is added correctly.

16. Does QuickBooks send pay stubs?

- Yes, staff get digital or printed stubs. They can see pay and taxes.

17. How do I set up QuickBooks payroll?

- Add company and staff info. Then pick a payroll plan that fits.

18. Can QuickBooks file taxes automatically?

- Yes, full-service payroll files federal and state taxes. No manual work needed.

19. Can staff access payroll online?

- Yes, staff can see pay stubs and tax forms. They can update info too.

20. Does QuickBooks work with accounting?

- Yes, payroll updates accounting automatically. Books stay correct.

21. What payroll mistakes should I avoid?

- Avoid late pay, wrong taxes, and lost records. QuickBooks lowers these risks.

22. Can QuickBooks handle contractor taxes?

- Yes, it tracks 1099s and taxes separately.

23. How can QuickBooks help with compliance?

- It updates payroll rules automatically. This keeps the business safe.

24. Can I run payroll from anywhere?

- Yes, cloud payroll works from any place. Owners can manage staff pay easily.

25. Is QuickBooks Payroll good for large businesses?

- Yes, it handles many pay rates, bonuses, and bulk payroll easily.