What Are Accounting Software Add-Ons and Why Are They Important?

In the modern business world, managing finances can be complex. Accounting software add-ons may provide a simple way to extend software functionality. They can help businesses automate tasks and reduce manual work. Many organizations may not fully realize how much these add-ons can improve efficiency. This blog explores the concept, benefits, and significance of accounting software add-ons for modern businesses.

What Are Accounting Software Add-Ons?

Accounting software add-ons are extra tools that work with your main software, like Xero or QuickBooks. They help to do more things that your main system might not handle properly. These add-ons save you time automating your major tasks. These tasks are invoicing, managing payroll, tracking expenses, and generating reports.

A reporting add-on can show how much money you are making or spending. Using the right Xero add-ons or QuickBooks add-ons can make your work easier, help you stay organized, and keep your business running smoothly.

Key Features to Look for in Accounting Software Add-ons

Not all add-ons are created equal. Here are some essential features to consider before choosing an accounting software add-on:

-

Integration ease

It doesn't require a complex setup. The Add-on connects smoothly with your existing system. With a simple setup, you don't require expert help.

-

Automation capabilities

Always look at the add-ons that automate your routine tasks. This includes invoicing, expense tracking, or bank reconciliation. With automation, you can save time and reduce the risk of errors.

-

Data synchronization

Live data updates help maintain precision and avoid repeated or mismatched entries. When your tools are connected instantly, your records remain current and trustworthy.

-

User-friendly interface

Easy navigation and setup reduce the learning curve. A clean and simple interface helps your team use the tool efficiently with little to no training.

-

Scalability

Your chosen solution should grow with your business. Look for add-ons that can handle more users, data, or features as your needs expand.

-

Support and updates:

Opt for add-ons with active customer support and regular updates. This ensures you always have help when you require it and can access new updated features and security improvements.

Why Businesses May Need Accounting Software Add-Ons

As business needs grow, standard accounting software may not cover every function. Add-ons may bridge these gaps by offering specialized solutions. They can address unique challenges like multi-currency handling or compliance with local tax laws.

1. Improved Efficiency

Add-ons may automate tasks that otherwise take hours of manual work. Tasks like bank reconciliation, invoice processing, and payroll calculations may be streamlined.

- Can reduce human errors in financial data

- May free staff for more strategic tasks

- Could improve cash flow visibility

2. Enhanced Reporting and Insights

Basic accounting software may provide limited reporting. Add-ons may offer advanced dashboards, custom reports, and analytics. Businesses may make faster decisions with better insights.

- Provides clearer visibility into financial performance

- Helps identify areas needing improvement

- May allow scenario planning and forecasting

3. Better Compliance Management

Tax regulations and reporting standards often change. Accounting software add-ons may help businesses stay compliant with legal requirements.

- Can update automatically to reflect new tax rules

- May generate audit-ready reports

- Could reduce the risk of penalties

4. Customization for Specific Needs

No two businesses operate in exactly the same way. Add-ons may allow companies to adapt their software to specific requirements.

- Industry-specific templates or modules may be available

- May integrate with existing business tools

- Could provide scalability as the business grows

5. Cost-Effectiveness

While add-ons may come with a cost, they may reduce overall operational expenses. Automating tasks and improving accuracy may save money in the long term.

- Less manual labor may reduce staffing costs

- May prevent costly accounting mistakes

- Could optimize financial resource allocation

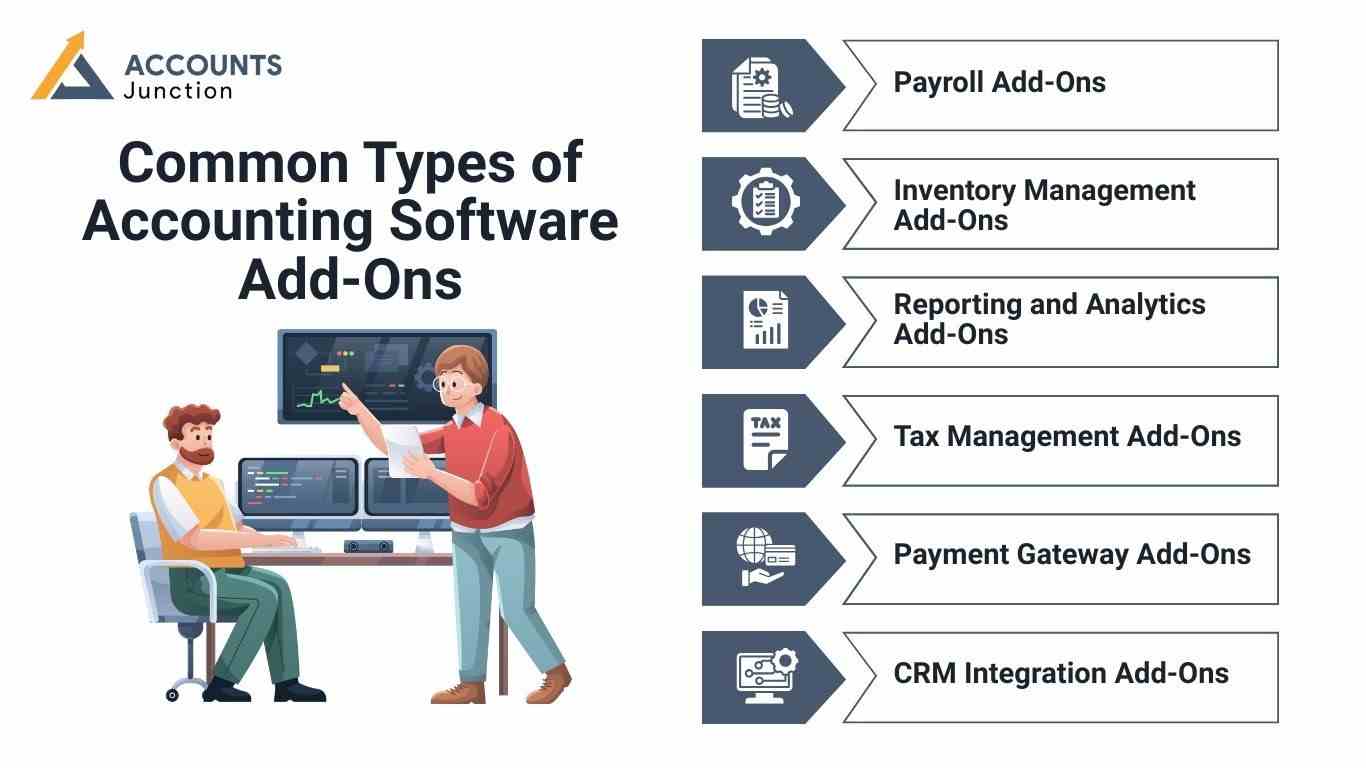

Common Types of Accounting Software Add-Ons

Accounting software add-ons may vary widely depending on the software provider. Here are some commonly used types:

1. Payroll Add-Ons

Payroll management can be time-consuming. Add-ons may help calculate salaries, deductions, and taxes automatically. Some may even allow direct employee payments.

2. Inventory Management Add-Ons

For product-based businesses, tracking inventory is crucial. Inventory add-ons may provide real-time stock updates and reorder alerts.

3. Reporting and Analytics Add-Ons

Businesses may require detailed financial insights. Reporting add-ons may generate customizable charts, graphs, and dashboards.

4. Tax Management Add-Ons

Tax rules may change frequently. Tax add-ons may automate tax calculations and filing processes. They may ensure compliance with local or international tax laws.

5. Payment Gateway Add-Ons

Payment processing can be simplified with add-ons. They may allow online payments directly from invoices and track payment statuses efficiently.

6. CRM Integration Add-Ons

Some businesses may want to link accounting software with their customer relationship management systems. CRM integration add-ons may improve client billing and revenue tracking.

How to Choose the Right Accounting Software Add-Ons

Selecting the right add-on may depend on business size, industry, and specific needs. Choosing incorrectly may result in wasted money or underutilized software.

Factors to Consider:

- Business Requirements: Identify tasks that require automation or improvement.

- Integration: Ensure add-ons integrate smoothly with existing systems.

- Ease of Use: Choose add-ons that your staff can operate without steep learning curves.

- Scalability: Consider add-ons that grow with your business.

- Cost vs Benefit: Analyze whether the add-on’s efficiency gains justify the price.

Challenges Businesses May Face with Add-Ons

While add-ons offer many benefits, they may introduce challenges if not managed carefully.

1. Compatibility Issues

Some add-ons may not integrate well with existing software. This may lead to errors or duplicate work.

2. Security Risks

Financial data is sensitive. Add-ons may introduce security vulnerabilities if not properly vetted.

3. Training Requirements

Employees may need time to learn how to use new add-ons. Lack of training may reduce the expected efficiency gains.

4. Hidden Costs

Add-ons may involve subscription fees, updates, or maintenance costs. Businesses may overlook these while calculating ROI.

Despite these challenges, proper planning and selection may help businesses leverage add-ons successfully.

Benefits That May Make Add-Ons Indispensable

- Automation: Reduce repetitive manual work

- Accuracy: Minimize human errors in accounting

- Flexibility: Adapt software to unique business processes

- Insights: Access detailed financial reports

- Compliance: Ensure adherence to tax regulations

- Growth Support: Scale software capabilities with business expansion

Many businesses may realize that accounting software add-ons are not just optional tools, but strategic investments for smoother operations.

Popular Accounting Software Add-Ons Examples

- Xero Add-Ons: Payroll, inventory, and reporting extensions

- QuickBooks Add-Ons: CRM, payment processing, and advanced analytics

- Zoho Books Add-Ons: Expense tracking, project management, and workflow automation

Each software may have a marketplace or partner ecosystem offering numerous specialized add-ons.

Implementing Add-Ons Successfully

Implementing accounting software add-ons may require careful planning:

- Assess Needs: Identify what tasks require automation or better tracking.

- Select Add-Ons: Compare features, costs, and integration options.

- Test and Train: Pilot test the add-ons and provide staff training.

- Monitor Performance: Evaluate whether add-ons deliver expected benefits.

- Regular Updates: Keep add-ons updated to avoid bugs and compliance issues.

Accounting software add-ons may provide businesses with tools to simplify financial management. They may automate tasks, enhance reporting, and improve accuracy. Customizable add-ons may align software functions with business needs. They may also help businesses stay compliant and scale efficiently. At Accounts Junction, we provide accounting services and integrate top accounting software add-ons to boost productivity. We have certified experts ready to support your financial operations. Partner with us for smarter accounting solutions.

FAQs

1. How can accounting software add-ons benefit CPA firms?

- They may automate reporting and tax tasks, reducing manual effort for CPAs.

2. Can add-ons improve outsourced accounting accuracy?

- Yes, they may minimize errors and ensure precise client financial records.

3. Are add-ons suitable for managing multiple client accounts?

- Many add-ons may streamline multi-client bookkeeping and reporting efficiently.

4. How do add-ons support tax compliance for clients?

- They may automatically calculate taxes and generate compliant reports for clients.

5. Can add-ons integrate with CPA firm workflows?

- Yes, most may connect with existing accounting systems and client platforms.

6. Do add-ons help with real-time financial reporting?

- Yes, they may provide instant dashboards and up-to-date insights for clients.

7. Are add-ons useful for small business clients?

- They may simplify bookkeeping and reporting, allowing CPAs to focus on strategy.

8. Can add-ons handle payroll for multiple clients?

- Many payroll add-ons may automate salary calculations across different businesses.

9. How do add-ons improve efficiency for outsourced accounting teams?

- They may automate repetitive tasks and allow focus on high-value financial analysis.

10. Can add-ons track expenses and invoices for clients?

- Yes, they may monitor transactions and ensure accurate client reporting.

11. Do add-ons support multi-currency and international clients?

- Some add-ons may manage foreign currencies and global tax requirements.

12. Can CPAs customize add-ons for specific client needs?

- Yes, many add-ons may adapt to client-specific reporting or compliance requirements.

13. Are add-ons secure for handling sensitive client data?

- Properly implemented add-ons may follow encryption and access control standards.

14. Can add-ons integrate with cloud accounting for remote work?

- Yes, they may provide seamless access for CPAs and outsourced teams online.

15. How do add-ons help reduce errors in outsourced accounting?

- Automation may prevent manual mistakes and improve financial statement accuracy.

16. Can add-ons support financial audits for clients?

- Many may generate audit-ready reports to simplify the review process.

17. Are add-ons cost-effective for CPA firms?

- They may save time and resources, offsetting subscription costs effectively.

18. Can add-ons streamline client invoicing and payment tracking?

- Yes, they may automate invoice generation and monitor payment status.

19. Do add-ons improve scalability for growing CPA practices?

- They may handle increasing client accounts without requiring extra staff.

20. How do add-ons enhance outsourced accounting service quality?

- By improving accuracy, efficiency, and timely reporting for clients consistently.