Wave accounting Tax return preparation

Wave Accounting is a cloud-based accounting software designed for small businesses, freelancers, and entrepreneurs. Its user-friendly interface and powerful tools make it a cost-effective choice for businesses. Wave Accounting offers free core features for tracking income, expenses, invoices, and financial reports without monthly fees.

Wave Accounting seamlessly integrates with banks for automatic transaction imports and reconciliations. This reduces manual data entry and minimizes errors, ensuring accurate financial records. Additionally, Wave supports multi-currency transactions, making it suitable for businesses operating internationally.

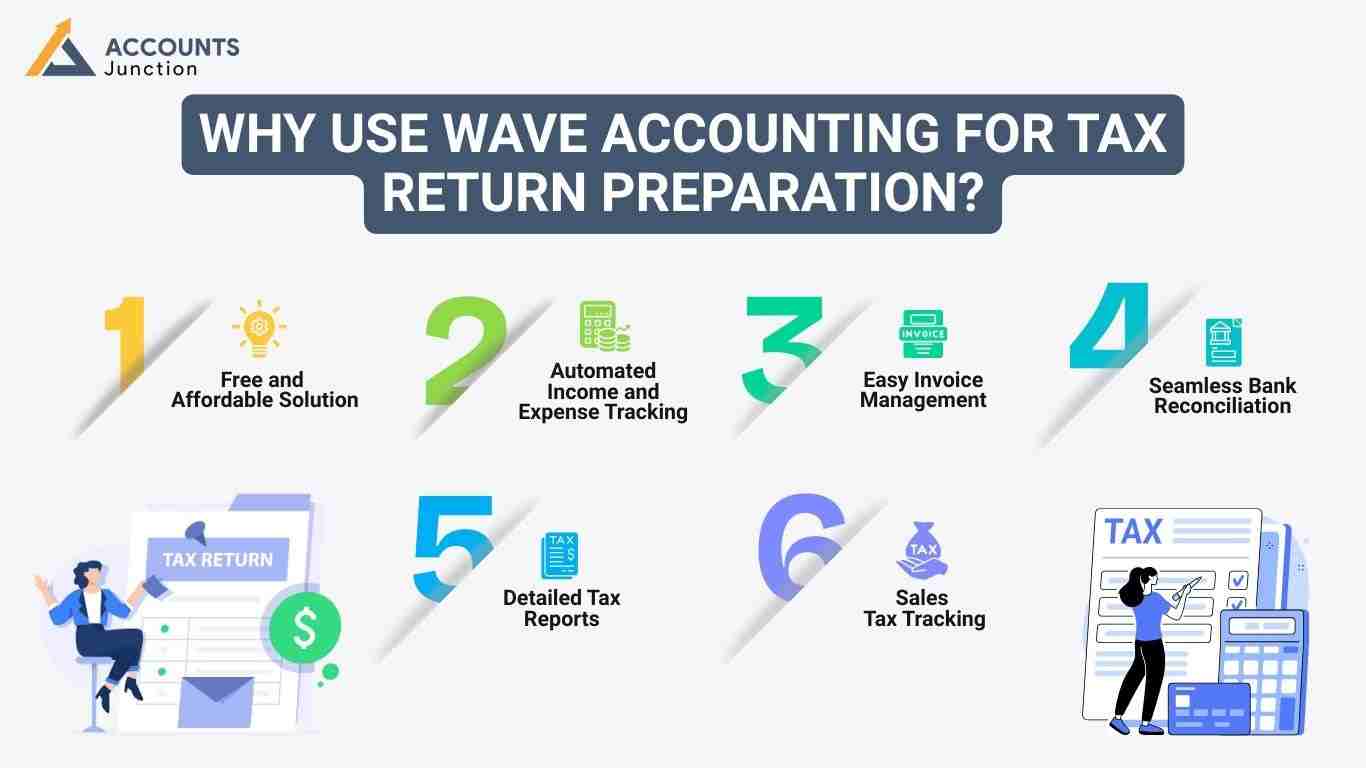

Why use Wave Accounting for Tax Return Preparation?

Tax return preparation can be complex, but the Wave app makes it more manageable. Here are a few reasons why using Wave Accounting for tax return preparation is beneficial:

Free and Affordable Solution

- Wave Accounting provides free core accounting features, making it a cost-effective option for small businesses and freelancers.

- Unlike many other accounting platforms, it does not charge a subscription fee for essential bookkeeping tools.

Automated Income and Expense Tracking

- The software automatically categorizes income and expenses, reducing manual entry errors.

- Users can link their bank accounts to import transactions, ensuring accuracy in financial records.

Easy Invoice Management

- Wave allows users to create and send professional invoices, track payments, and follow up on overdue invoices.

- It provides a clear record of business revenue, which is essential for tax reporting.

Seamless Bank Reconciliation

- The bank reconciliation feature ensures that all transactions are recorded accurately, reducing discrepancies.

- It simplifies the process of verifying income and expenses for tax return preparation.

Detailed Tax Reports

- Wave generates essential financial reports, such as profit and loss statements, balance sheets, and expense summaries.

- These reports provide clear insights into tax liabilities and deductions, making tax filing easier.

Sales Tax Tracking

- Businesses that collect sales tax can set up tax rates in Wave and track taxable transactions.

- This feature helps in accurately reporting sales tax collected and owed during tax filing.

Step-by-Step Guide to Tax Return Preparation Using Wave

- Set Up Your Wave Accounting Profile:

- Sign up for a free Wave app account.

- Enter business details and customize tax settings.

- Connect Your Bank Accounts and Payment Sources:

- Sync bank accounts for automatic transaction imports.

- Review and categorize income and expenses regularly.

- Generate and Send Invoices:

- Use Wave Accounting to create invoices and track payments.

- Set up automatic reminders for outstanding payments.

- Track Business Expenses:

- Upload receipts or manually enter expenses in the Wave app.

- Categorize expenses to ensure accurate deductions during tax return preparation.

- Review Financial Reports:

- Generate profit and loss statements.

- Analyze cash flow and ensure all transactions are recorded correctly.

- Prepare for Tax Filing:

- Use Wave Accounting’s tax reports to gather necessary information.

- Identify eligible expenses for deductions and ensure adherence to tax regulations.

- Export Data or Share with a Tax Preparer:

- Download financial reports.

- Share data with a tax preparer for professional review.

Common Mistakes to Avoid in Wave Accounting Tax Preparation

Even with easy software, mistakes can sneak in. Sometimes one might forget to match invoices, or maybe an expense is put in the wrong category. These small slips may cause big tax issues later. Checking reports before filing can prevent such troubles. It may also help to review your income and expense list every month instead of waiting till year-end.

Key Points:

- Double-check categories before finalizing books

- Reconcile bank accounts often

- Review unpaid invoices and clear them early

Benefits of Combining Wave Accounting with Professional Support

Wave may handle numbers, but a professional may see what the system cannot. A tax expert can explain unclear deductions, fix record mismatches, and even suggest better filing methods. By working together, you can enjoy both automation and accuracy.

You may gain:

- Clarity in tax filing

- Confidence in deduction claims

- Timely report submission

- Reduced risk of penalties

How a Tax Preparer Can Help with Wave Accounting

While the Wave app simplifies tax return preparation, a tax preparer can provide valuable insights and ensure compliance. Here’s how a tax professional can help:

Ensuring Accurate Tax Filing

- A tax preparer reviews financial records in Wave Accounting to ensure all income, expenses, and deductions are correctly recorded.

- They help prevent errors that could lead to audits, penalties, or delays in tax processing.

Maximizing Tax Deductions

- Tax preparers analyze transactions and categorize expenses to identify deductible costs.

- They ensure businesses take advantage of deductions related to office expenses, travel, marketing, and business-related purchases.

Generating Essential Tax Reports

- Wave Accounting provides reports such as profit & loss statements, balance sheets, and cash flow statements.

- A tax preparer helps interpret these reports, ensuring accurate tax return preparation.

Handling Sales Tax Compliance

- Tax preparers ensure accurate sales tax rates, track taxable sales, and file returns correctly.

- They ensure compliance with state and federal sales tax regulations.

Reconciling Bank Transactions

- A tax preparer verifies that all transactions imported into Wave from bank accounts match actual business expenses and income.

- This prevents discrepancies and ensures complete financial records.

Managing Payroll Taxes

- If using Wave’s payroll feature, a tax preparer ensures payroll taxes are correctly calculated and filed.

- They help businesses comply with employment tax regulations and avoid payroll tax penalties.

Why Choose Accounts Junction for Wave Accounting and Tax Preparation?

Accounts Junction offers expert services in Wave Accounting and tax return preparation. Here’s why businesses trust us:

- Experienced Professionals: Our team has extensive experience handling tax return preparation using Wave Accounting.

- Personalized Support: We customize our services to meet the unique needs of small businesses and freelancers.

- Seamless Wave App Integration: We ensure your financial records are accurate and up to date.

- Maximized Deductions: Our tax preparers identify all possible deductions to reduce tax liabilities.

- Reliable and Affordable Services: We provide cost-effective solutions for Wave Accounting users.

Wave Accounting is a powerful tool for small businesses, making financial management and tax return preparation easier. By utilizing the Wave app, businesses can automate bookkeeping, track expenses, and generate tax-ready reports. However, working with a tax preparer further enhances accuracy and compliance. Accounts Junction provides expert assistance in Wave Accounting and tax return preparation, ensuring a stress-free tax season. Whether managing finances alone or with a tax preparer, Wave Accounting ensures smooth financial operations.

A tax preparer plays a crucial role in ensuring accuracy, optimizing deductions, and keeping your business tax-compliant. They reconcile transactions, generate tax reports, and manage payroll and sales tax, minimizing errors and penalties. With professional tax preparation services, business owners can confidently prepare and file their taxes while focusing on growth.

FAQs

1. Is Wave Accounting free?

- Yes, the Wave app offers free accounting, invoicing, and expense tracking features.

2. Can I use Wave Accounting for tax return preparation?

- Yes, Wave Accounting provides financial reports and tax summaries to help with tax filing.

3. Do I need a tax preparer if I use Wave Accounting?

- While Wave simplifies tax preparation, a tax preparer ensures accuracy and compliance.

4. How do I share my Wave Accounting data with a tax preparer?

- You can export financial reports from the Wave app and share them securely.

5. Why should I choose Accounts Junction for Wave Accounting services?

- We offer expert support, ensuring your tax return preparation is efficient and accurate.

6. Can Wave Accounting handle multiple businesses in one account?

- Yes, you may add and manage different business profiles separately in the same account.

7. How can Wave Accounting help during audit season?

- Wave keeps all financial data organized, so reports may be easily shared when needed.

8. Can I track both income and personal expenses in Wave?

- It is better to keep only business transactions in Wave to avoid confusion in tax filing.

9. Does Wave support automatic tax calculations?

- Wave can help track sales tax, but income tax usually needs to be reviewed by a tax preparer.

10. How do I categorize business expenses in Wave?

- Wave provides a list of expense types. You can pick one that best matches your spending.

11. Can Wave Accounting link with PayPal or Stripe?

- Yes, it can connect with several payment platforms for smoother record imports.

12. What reports should I check before filing taxes?

- Profit and loss, balance sheet, and expense summaries may give a clear tax picture.

13. Can Wave generate 1099 reports for contractors?

- Yes, Wave can track contractor payments and prepare reports for 1099 filing.

14. How can Wave help reduce tax errors?

- By automating entries and matching bank feeds, Wave may cut manual mistakes.

15. Can I use Wave Accounting on my phone?

- Yes, Wave offers a mobile app so you can check income or record expenses on the go.

16. Does Wave Accounting work well for freelancers?

- Yes, freelancers may find it ideal since it is free and easy to manage single-person finances.

17. How secure is my financial data on Wave?

- Wave uses encryption and secure servers, though it is still wise to back up reports.

18. Can Wave Accounting remind me about tax deadlines?

- Wave itself may not send direct reminders, but you can set up alerts using linked calendars.

19. How often should I reconcile my Wave account?

- Doing it weekly or monthly may help prevent end-of-year rushes and missed records.

20. Can I track sales tax for different regions in Wave?

- Yes, you may set up separate sales tax rates for various locations.

21. How do I prepare my Wave data for a tax preparer?

- Export profit and loss, balance sheet, and cash flow reports, then share them securely.

22. Does Wave Accounting allow receipt uploads for deductions?

- Yes, you can upload and attach receipts directly to transactions.

23. Can I switch from another software to Wave easily?

- Yes, most financial data can be imported through CSV files.

24. Is Wave suitable for larger companies too?

- It may work for small or mid-sized firms, but bigger companies might need advanced systems.

25. What is the best time to start using Wave for taxes?

- Starting at the beginning of a financial year may help track all records in one clean cycle.