Virtual Accounting Services: Streamlining Your Financial Management

It's simply the process of managing your financial records remotely using virtual accounting services. Instead of having a bookkeeper or accountant working in your office, they work from a different location. They are using technology to access and manage your financial data. Think of it as having a dedicated financial expert, but they're just a click away, not down the hall.

This means you can send your invoices, receipts, and bank statements electronically to your virtual bookkeeper. Your virtual bookkeeper then uses this information to keep your books organized, reconcile your accounts, and generate financial reports. They utilize software and online tools to perform tasks like data entry, categorization of transactions, and preparing financial statements. Essentially, all the tasks a traditional bookkeeper would do, but done remotely.

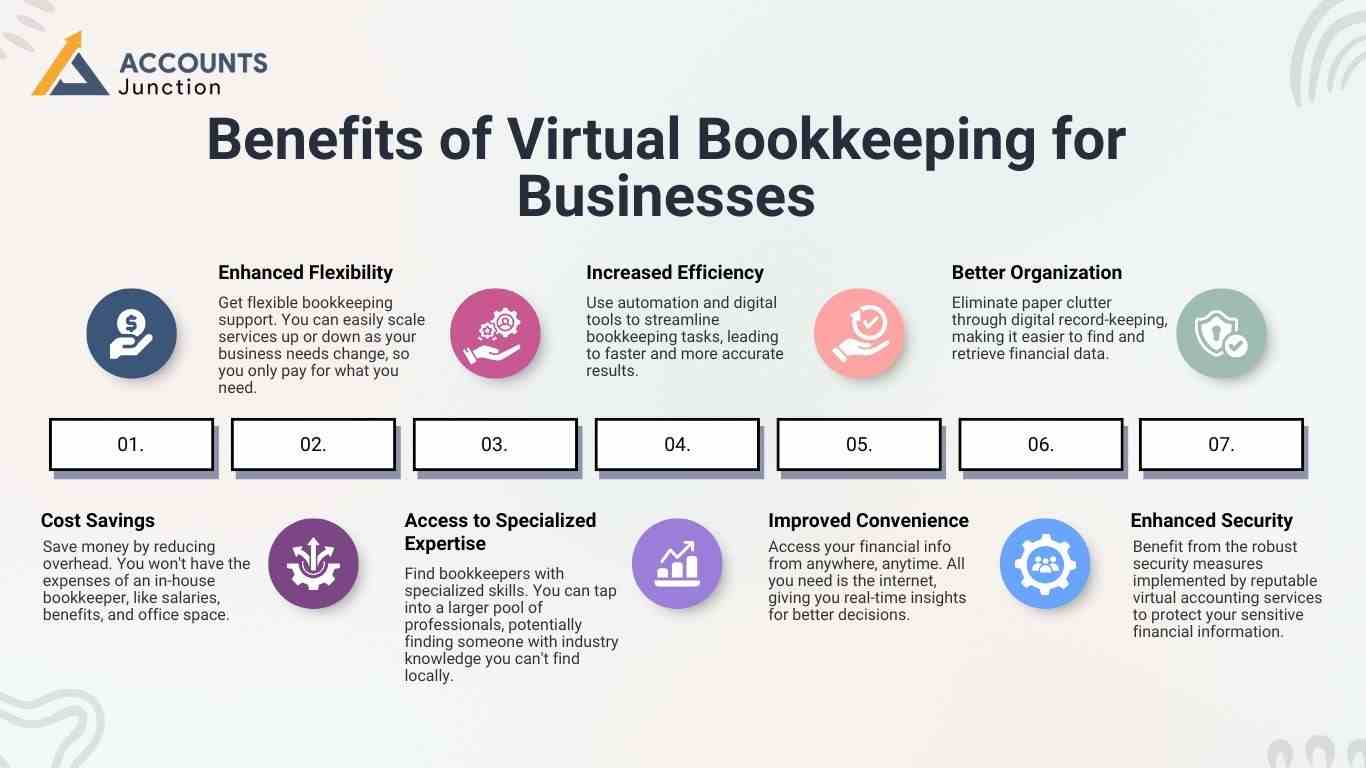

Benefits of Virtual Bookkeeping for Businesses

Embracing virtual bookkeeping offers a multitude of advantages that can significantly impact a business's financial health and overall efficiency. Here's a breakdown of the key benefits:

- Cost Savings: Save money by reducing overhead. You won't have the expenses of an in-house bookkeeper, like salaries, benefits, and office space.

- Enhanced Flexibility: Get flexible bookkeeping support. You can easily scale services up or down as your business needs change, so you only pay for what you need.

- Access to Specialized Expertise: Find bookkeepers with specialized skills. You can tap into a larger pool of professionals, potentially finding someone with industry knowledge you can't find locally.

- Increased Efficiency :Use automation and digital tools to streamline bookkeeping tasks, leading to faster and more accurate results.

- Improved Convenience: Access your financial info from anywhere, anytime. All you need is the internet, giving you real-time insights for better decisions.

- Better Organization: Eliminate paper clutter through digital record-keeping, making it easier to find and retrieve financial data.

- Enhanced Security: Benefit from the robust security measures implemented by reputable virtual accounting services to protect your sensitive financial information.

In essence, the benefits of virtual bookkeeping empower businesses to manage their finances more effectively, efficiently, and affordably, ultimately contributing to growth and success.

Virtual Accounting vs. Traditional Bookkeeping

While both virtual accounting and traditional bookkeeping serve the fundamental purpose of maintaining accurate financial records, they differ significantly in their execution and approach. Understanding these distinctions is crucial for businesses deciding which method best suits their needs.

- Location: The most obvious difference lies in location. Traditional bookkeeping typically involves an in-house professional working within the physical office space of the business. Conversely, virtual accounting services are performed remotely, with the bookkeeper operating from an external location.

- Technology Utilization: Traditional bookkeeping often relies on manual processes and desktop-based software, which can limit accessibility and automation. In contrast, virtual accounting heavily uses cloud-based software, online platforms, and automation tools to manage financial data.

- Cost Structure: The cost implications vary considerably. Employing a traditional bookkeeper usually involves a fixed salary along with employee benefits. Virtual accounting services, however, often operate on a fee-for-service or subscription model. It allows businesses to pay for the specific services they utilize.

- Scalability and Flexibility: Traditional bookkeeping can be less flexible. It's harder to adjust services as your business needs change. Virtual accounting services offer greater scalability, allowing businesses to adjust their level of support as required.

- Access to Talent Pool: Businesses opting for traditional bookkeeping are generally limited to the talent pool available within their geographical area. Virtual accounting opens up access to a wider range of specialists and experienced virtual bookkeepers regardless of location.

- Accessibility of Information: Access to financial data can be restricted to office hours and the physical location with traditional bookkeeping. Virtual accounting services provide 24/7 access to financial information through online platforms, enhancing convenience and real-time insights.

Traditional bookkeeping provides an on-site presence, virtual accounting offers advantages in terms of cost-effectiveness, flexibility, access to expertise, and technological efficiency. The choice between the two depends on a business's specific needs and budget. It also depends on whether they prefer remote or in-person service.

Challenges in Virtual Accounting & How to Overcome Them

While the adoption of virtual accounting offers numerous advantages, businesses may encounter certain challenges. Here's a breakdown of potential hurdles and strategies to navigate them effectively:

- Communication

Challenge: Lack of face-to-face interaction can cause misunderstandings.

Solution: Use regular updates, video calls, and project management tools. - Data Security

Challenge: Remote data sharing increases security risks.

Solution: Choose providers with strong encryption and security policies. - System Integration

Challenge: Integrating virtual accounting with existing software is complex.

Solution: Pick providers familiar with your software and ensure clear migration plans. - Relationship Building

Challenge: Remote bookkeepers require effort to build strong relationships.

Solution: Communicate clearly, provide feedback, and schedule regular check-ins. - Contextual Understanding

Challenge: Important details may be missed without in-person interaction.

Solution: Give detailed instructions, encourage questions, and use visual aids. - Technology Reliance

Challenge: Internet issues or glitches can disrupt workflow.

Solution: Ensure reliable connections and have contingency plans for disruptions

By proactively addressing these potential challenges, businesses can maximize the benefits of virtual bookkeeping and establish a smooth and successful remote financial management system.

How to Choose the Right Virtual Bookkeeper

Selecting the right virtual bookkeeper is crucial for ensuring the smooth and accurate management of your finances. With numerous options available, it's important to consider several key factors to find the best fit for your business. Here's what to look for:

- Experience and Expertise: Assess the bookkeeper's experience in your industry and their proficiency with relevant accounting software. Look for certifications or qualifications that demonstrate their expertise.

- Services Offered: Ensure the virtual bookkeeper offers the specific services your business needs, such as accounts payable/receivable, bank reconciliation, payroll processing, and financial reporting.

- Communication and Availability: Clear and consistent communication is vital in a virtual setting. Inquire about their communication methods, response times, and availability to address your queries.

- Security Measures: Given the sensitive nature of financial data, it's paramount to understand the security protocols they have in place to protect your information. This includes data encryption, secure portals, and confidentiality agreements.

- References and Reviews: Check for testimonials or reviews from other clients to gauge their satisfaction with the bookkeeper's services and reliability.

- Technology Proficiency: Confirm they are proficient in the accounting software you use or are willing to learn it. Familiarity with cloud-based platforms is generally essential for virtual bookkeeping.

- Cultural Fit: While remote, a good working relationship is still important. Assess if their communication style and work ethic align with your business culture.

- Pricing Structure: Understand their pricing model (e.g., hourly, monthly retainer) and ensure it aligns with your budget and the value of services provided.

- Scalability: Consider if the virtual bookkeeper can scale their services as your business grows.

By carefully evaluating these factors, you can confidently choose a virtual bookkeeper who will be a valuable asset to your business's financial management.

How Virtual Accounting Supports Business Growth

Virtual accounting may do more than just keep your books neat. By providing real-time insights, it can help you spot trends and make informed decisions. For instance, seeing your cash flow clearly can allow timely investments or cost adjustments. Some businesses find that forecasting becomes easier with virtual bookkeeping, as automated tools can highlight potential risks or opportunities. In essence, it can act like a financial compass, guiding growth without heavy overheads or extra staff.

Key Points:

- Real-time insights can inform decisions.

- Cash flow tracking helps in planning investments.

- Automated tools can highlight financial risks or opportunities.

- Businesses can scale without adding full-time staff.

Common Misconceptions About Virtual Bookkeeping

Many people assume that virtual bookkeeping is less accurate or reliable than traditional methods. In reality, technology can reduce errors through automation. Another misconception is that remote accountants may not understand your business. However, virtual bookkeepers often specialize in multiple industries and can adapt quickly. Some may worry about security, yet top providers employ encryption and strict protocols.

Key Points:

- Automation can improve accuracy and reduce errors.

- Virtual bookkeepers may have specialized industry knowledge.

- Security is maintained with robust protocols and encryption.

- Remote services can be as responsive as in-office staff.

Tips to Maximize Virtual Accounting Benefits

Even with a skilled virtual bookkeeper, businesses can take steps to get the most out of services. Regular communication and clear instructions can prevent misunderstandings. Providing organized documents upfront may speed up processing. Some businesses also find setting schedules for updates or report reviews keeps everything on track. Lastly, embracing technology fully, like mobile apps or cloud platforms, may make collaboration smoother.

Key Points:

- Maintain regular communication and provide clear instructions.

- Organize documents for faster processing.

- Schedule routine updates and report reviews.

- Fully utilize digital tools and cloud platforms.

Virtual bookkeeping is becoming a key solution for businesses that want efficient, affordable, and flexible financial management. With technology, businesses can access expert bookkeeping services from anywhere, cutting costs and saving time. When choosing a virtual bookkeeping service, focus on experience, range of services, communication, security, and technology skills.

Accounts Junction provides virtual accounting for all types of businesses. We offer custom service plans, use smart tools, and keep your data safe. Our team includes certified experts and provides full support. Partner with us for simple and reliable virtual accounting services.

FAQ

1. What is virtual bookkeeping?

- Virtual bookkeeping is managing financial records remotely using cloud tools and online communication instead of an in-office accountant.

2. How is virtual accounting different from traditional accounting?

- Virtual accounting is done remotely using technology, while traditional accounting usually happens in-office with manual or desktop methods.

3. Can virtual bookkeepers handle all my financial tasks?

- They can manage most bookkeeping tasks, including invoices, reconciliations, and reports. Tax-specific services may require a CPA.

4. Can virtual bookkeepers help with inventory management?

- Yes, some virtual bookkeeping services can track inventory, update stock levels, and provide reports to help manage costs.

5. How do I communicate with a virtual bookkeeper?

- Communication may occur through email, video calls, chat, and project management tools for seamless collaboration.

6. Do virtual bookkeepers charge less than traditional ones?

- Often, yes. Virtual services reduce overhead costs, and pricing can be based on hours or service packages.

7. Can virtual accounting help with financial planning?

- It may provide real-time insights and trend analysis, helping businesses plan budgets and forecast cash flow.

8. What software do virtual accountants use?

- They typically use cloud-based platforms like QuickBooks, Xero, or Zoho Books for automation and collaboration.

9. Are virtual accounting services scalable?

- Yes, businesses can adjust service levels as they grow without hiring full-time staff.

10. Can small businesses benefit from virtual bookkeeping?

- Absolutely. It helps reduce costs, access expert help, and maintain accurate financial records without large teams.

11. How often should I receive reports from a virtual bookkeeper?

- This may vary. Weekly, monthly, or quarterly reporting can be arranged depending on your needs.

12. What industries can use virtual bookkeeping?

- Almost any business can use it. Some services specialize in retail, healthcare, real estate, or tech startups.

13. Can virtual bookkeepers handle payroll?

- Many do. They can process salaries, taxes, and compliance, but some may require additional payroll software.

14. Will I lose personal touch with a virtual bookkeeper?

- Not necessarily. Regular updates, calls, and shared platforms can maintain close collaboration.

15. How quickly can I start using virtual accounting services?

- Usually, setup can be done in a few days to a week, depending on document availability and software integration.

16. Can virtual accounting detect errors faster than traditional methods?

- Automation can highlight discrepancies quickly, though human oversight is still important for context.

17. Can virtual accounting help during audits?

- Yes, virtual accountants can organize records, prepare reports, and provide documentation to make audits smoother.

18. Are virtual bookkeeping services available globally?

- Many are. Since work is remote, you can hire bookkeepers from different countries as long as time zones are managed.

19. How do I choose the right virtual accountant?

- Look for experience, industry knowledge, security protocols, and communication style that fits your business.

20. Can virtual accounting reduce my business stress?

- Yes, keeping books accurate and accessible, it allows business owners to focus on growth instead of daily financial tasks.