A Complete Guide to US Accounting Services for Growing Businesses

US Accounting services play a crucial role in ensuring financial accuracy, compliance, and strategic growth for businesses operating in the US. These services suggest professional services that guide businesses and individuals in financial record keeping, advisory services, and tax preparations. These services cover bookkeeping, Payroll management, strategy planning, tax filing, and more. They also help you in report generation for better analysis of your business’s financial health.

The Importance of Hiring Professionals for US Accounting Services

Many small firms do their accounting and bookkeeping in-house. Because of the time commitment and complex structure, it creates a need for professional help. Picking up the best accounting firms offers v

- Accuracy and Compliance: Professionals are known with US rules and regulations. This reduces the chance of penalties. This ensures the business follows federal and state requirements.

- Time Savings and Focus: Businesses, after outsourcing their financial activities, can save time and resources. So they can prioritize core business work.

- Expertise and Insights: Accounts have broad knowledge and expertise. It provides valuable insights into financial performance. It identifies areas of improvement and offers strategic financial advice.

- Access to Technology: Many US accounting services use advanced accounting software and tools. This streamlines processes and provides real-time financial data.

- Reduced Risk of Fraud: Implementing robust internal controls and having an external perspective from accounting professionals can help detect and prevent financial irregularities.

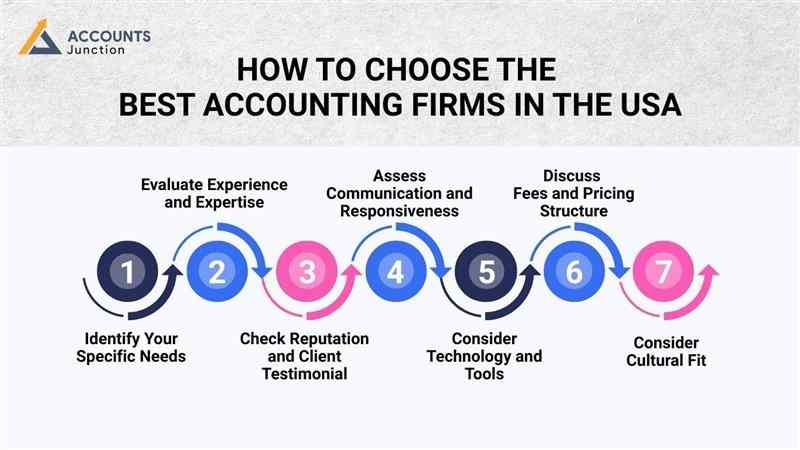

How to Choose the Best Accounting Firms in the USA

When businesses plan to outsource their accounting services, many questions come to mind. To answer these questions, businesses have to do research about which one is the best accounting firm.

-

Identify Your Specific Needs

First firm has to understand its business size, industry, and the accounting services it requires. This helps you to fulfil your requirements.

-

Evaluate Experience and Expertise

When you identify your need, look for firms that have a strong track record and relevant experience in your industry. You have to ensure that they are well-known and are qualified professionals who can manage your finances effectively.

-

Check Reputation and Client Testimonial

While selecting the right one, first businesses research online reviews and take references from other businesses. Asking other firms helps you gauge the firm’s reliability and the satisfaction level of clients.

-

Assess Communication and Responsiveness

Prioritize firms that communicate, respond promptly, and demonstrate a willingness to explain complex financial information understandably.

-

Consider Technology and Tools

Evaluate the firm's use of modern accounting software and technology. This ensures efficient service delivery and easy access to your financial data.

-

Discuss Fees and Pricing Structure

Understand the firm's pricing model. Ensure their fees are transparent and align with your budget, while also considering the value they bring.

-

Consider Cultural Fit

Choose a firm whose values and communication style resonate with yours. This helps foster a comfortable and collaborative working relationship.

Common Accounting Challenges Faced by US Businesses

When your businesses are in the US, you must face a unique set of accounting challenges. Solving these challenges requires the expertise of professionals for US accounting services. Below are the accounting challenges faced by US businesses:

- Managing Transaction Volume and Paperwork: One of the fundamental challenges for businesses is storing large volumes of financial data. That needs to be managed and tracked properly.

- Tax Compliance: As you start a business in different countries, it is obvious that their tax filing system would be different. That is why understanding US tax regulations is an important and often complex challenge for businesses.

- Cash Flow Management: Ensuring a steady and sufficient flow of cash is critical for business survival. Effective cash flow management can be challenging.

- Financial Reporting: Producing insightful and accurate reports is necessary for understanding the financial health of the business.

- Keeping Up with Evolving Accounting Technology: Technology is constantly changing. Businesses are required to adopt advanced accounting technology. Integrating with new tools can be challenging.

- Managing Payroll: As businesses operate in the US, their law regarding payroll can be different. This task for payroll requires specialized knowledge and attention.

- Dealing with Audits and Tax Examinations: One of the major challenges is dealing with auditors or tax examinations. Businesses can do careful preparation with the guidance of experts. They can be free from the fear of audit.

- Keeping Abreast of Changing Accounting Standards and Regulations: As Accounting standards may change constantly. And business must update with such standards, but that change always demands ongoing attention and understanding.

Benefits of Long-Term Accounting Partnerships

Building a long-term relationship with one accounting firm may provide stability and efficiency for your business.

Understanding Your Business

- Professionals become familiar with your processes, goals, and financial patterns.

- They may anticipate challenges before they arise.

Strategic Advice and Planning

- Long-term partners may provide better financial insights.

- Helps in making informed decisions for growth and expansion.

Consistency and Accuracy

- Reduces errors by maintaining a continuous workflow.

- Speeds up reporting and simplifies audits.

Choosing the Right Partner

- Look for a firm that can grow with your business.

- Focus on experience, communication, and reliability over short-term cost savings.

Best Practices for US Bookkeeping and Accounting

Businesses must implement fundamental practices to maintain accurate financial records and ensure compliance within the US business environment.

- Stay Organized: Businesses keep receipts, invoices, and statements in order.

Well-organized records make tax time smoother and reduce audit risks. - Reconcile Monthly: Regular bank reconciliations catch issues early.

It helps ensure your reported balances match actual cash flow. - Automate Where You Can: Use cloud software to simplify and speed up processes.

Automation also reduces manual errors and gives real-time visibility. - Track All Expenses: From large purchases to petty cash, record everything.

Detailed tracking helps identify cost-saving opportunities and stay within budget. - Outsource Strategically: A reliable US bookkeeping and accounting service can handle complex tasks so you can focus on growth.

This allows your internal team to prioritize core business activities.

Cost Considerations When Hiring US Accounting Services

Budgeting for accounting services is an important part of choosing the right firm. Costs can vary depending on your business needs.

Pricing Models

- Some firms charge a fixed monthly fee.

- Others may bill hourly, depending on tasks or projects.

Factors Affecting Cost

- Business size and complexity of accounts.

- Additional services such as audits, payroll, or tax planning.

Value Over Price

- Cheaper options may exist, but reliability and experience are more important.

- Hidden charges can appear for special reports or consultations.

Tips to Avoid Surprises

- Ask for clear, upfront pricing.

- Compare packages to find the best value for your business.

Emerging Trends in US Accounting Services

US accounting services are constantly evolving. Businesses that stay updated with trends may gain an advantage. Here are some key trends to consider:

Cloud Accounting

- Provides access to financial data anytime and anywhere.

- Reduces the need for physical record storage.

Artificial Intelligence and Automation

- AI tools may detect errors automatically.

- Can forecast financial trends to support strategic decisions.

Virtual Accounting Services

- Outsourcing is increasingly moving online.

- Reduces the need for a physical office and allows remote access.

Real-Time Reporting

- Offers instant insights into your business finances.

- Helps decision-making become faster and more informed.

Staying aware of these trends can keep your business ahead and improve efficiency.

Handling finances in the US takes more than just basic record-keeping. It needs the right support, careful handling, and smart decisions. US accounting services provide the help businesses need to avoid errors, plan better, and grow steadily.

Selecting the right accounting partner can strengthen your business operations. At Accounts Junction, we provide comprehensive accounting and bookkeeping services tailored to your needs. With our team of certified experts, your financial processes are handled accurately and efficiently. Partner with us for reliable and professional support that lets your business thrive.

FAQs

1. What are US accounting services?

- They are professional services that manage finances, bookkeeping, payroll, and taxes for businesses operating in the US.

2. Why should I hire US accounting professionals?

- They may reduce errors, ensure compliance, save time, and provide insights into your financial health.

3. Can small businesses afford these services?

- Yes, many firms offer packages tailored for small businesses, making them cost-effective and scalable.

4. How do I choose the right accounting firm?

- Consider experience, reputation, technology, communication style, and transparent pricing before deciding.

5. What is the role of bookkeeping in accounting services?

- Bookkeeping records every financial transaction, forming the foundation for accurate accounting reports.

6. Can accounting firms handle taxes for my business?

- They may prepare, file, and review federal and state tax returns to help avoid penalties.

7. How often should accounts be reconciled?

- Monthly reconciliations can help spot errors and ensure your records match your cash flow.

8. Do accounting services provide financial advice?

- Many firms may suggest strategies to save costs, manage cash flow, and plan for growth.

9. What technology is used in US accounting services?

- Cloud software, AI tools, and real-time reporting systems are commonly adopted for efficiency.

10. Can I outsource payroll management?

- Yes, outsourcing payroll can keep you compliant with laws and reduce administrative stress.

11. How do accounting services help with audits?

- They may prepare records, review statements, and support you throughout the audit process.

12. Are virtual accounting services reliable?

- Remote services can be secure, efficient, and give real-time access to your financial data.

13. How can accounting firms improve cash flow management?

- They may track income, forecast expenses, and suggest strategies to maintain liquidity.

14. Do accounting services assist with financial reporting?

- Yes, they prepare reports showing profit, loss, and overall business performance.

15. How quickly can I get reports from accounting services?

- Many firms provide reports in real-time or on a scheduled basis, depending on your needs.

16. Can accounting services help with business growth strategies?

- They may analyze financial data to suggest cost reduction, investments, and scaling plans.

17. How often should I consult my accounting partner?

- Check-ins may be monthly, quarterly, or as needed for strategic decisions.

18. Do all accounting firms offer the same services?

- No, offerings vary depending on the firm's expertise, size, and the software they use.

19. Can accounting services detect fraud?

- They may implement checks, review transactions, and spot unusual patterns early.

20. Why is a long-term partnership with an accounting firm beneficial?

- Consistency helps them understand your business, reducing errors and improving planning.