Top 05 Important Bookkeeping Skills to become successful.

Bookkeeping is the backbone of any business’s financial management. Whether you're a business owner or a professional, strong basic bookkeeping skills are essential for accurate financial records. Understanding basic bookkeeping principles ensures smooth financial operations, compliance with regulations, and informed decision-making. Developing the right skills in bookkeeping can help professionals manage transactions efficiently and contribute to a company’s success.

Bookkeepers play a vital role in financial transparency. Having basic bookkeeping skills ensure accurate records and support strategic business decisions. This blog covers top basic bookkeeping skills, ways to improve them, and their benefits.

Key Bookkeeping Concepts Every Bookkeeper Should Understand

Double-Entry Accounting

- Each transaction impacts a minimum of two accounts, involving both a debit and a credit.

- Ensures financial accuracy and prevents errors.

- Helps in preparing financial statements systematically.

The Accounting Equation

- Formula: Assets = Liabilities + Equity

- Keeps books balanced and ensures financial stability.

- Essential for analyzing a company’s financial health.

Debits and Credits

- Debits increase assets and expenses; credits increase liabilities and revenue.

- Understanding their impact helps maintain accurate records.

- Used to track financial transactions correctly.

Financial Statements

- Balance Sheet: Shows assets, liabilities, and equity.

- Income Statement: Summarizes revenue and expenses to show profit or loss.

- The Cash Flow Statement records the movement of cash coming in and going out.

- Bookkeepers must know how to prepare and interpret these statements.

Chart of Accounts

- Organizes financial transactions into categories (assets, liabilities, income, expenses).

- Helps in managing business finances efficiently.

- Essential for accurate reporting and budgeting.

Accrual vs. Cash Accounting

- Cash Accounting logs transactions only when money is received or spent.

- Accrual accounting recognizes revenue and expenses at the time they are earned or incurred, regardless of cash transactions.

- Choosing the right method impacts tax reporting and financial analysis.

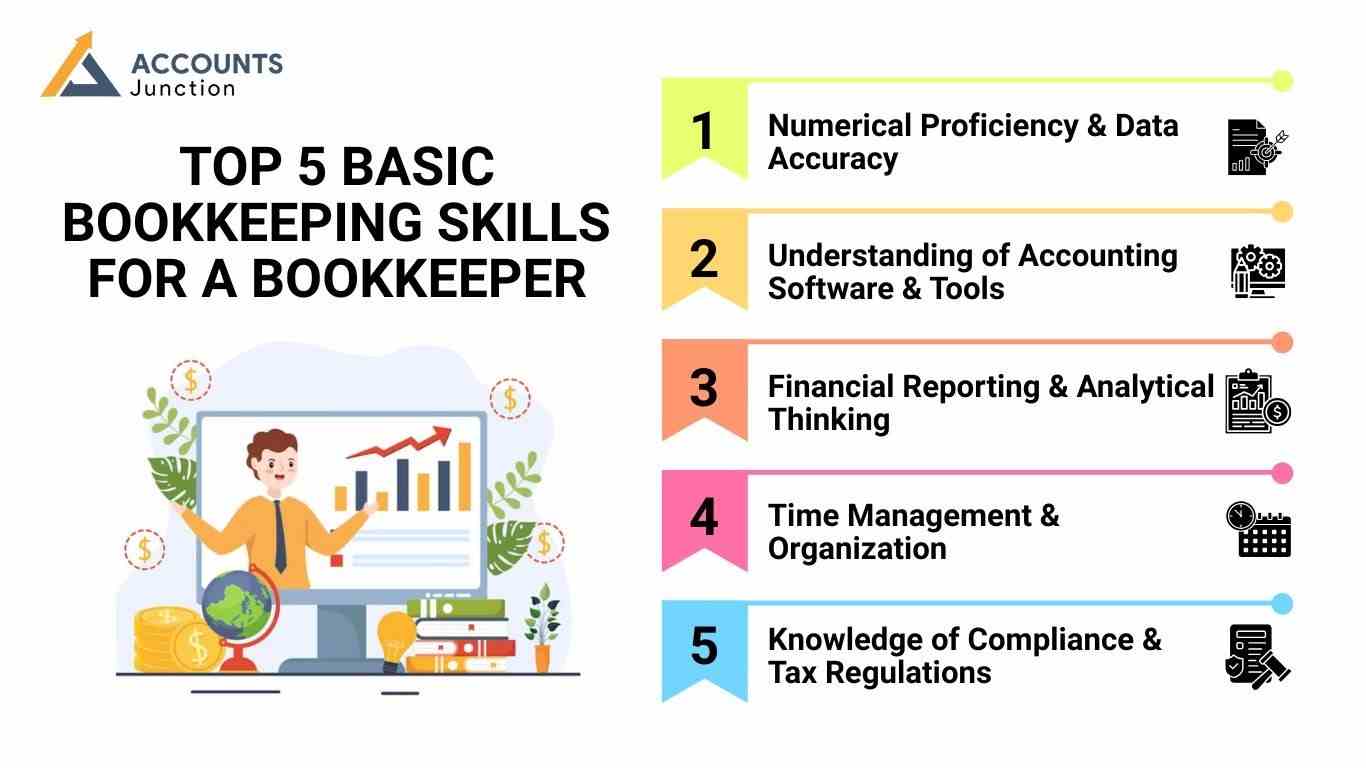

Top 5 Basic Bookkeeping Skills for a Bookkeeper

These 5 basic bookkeeping skills will make you successful in the future:

Numerical Proficiency & Data Accuracy

- Strong mathematical skills are essential for handling financial transactions.

- Ensures precise recording of income, expenses, and balances.

- Helps in detecting discrepancies and avoiding financial errors.

- Accuracy in data entry prevents costly mistakes in financial reports.

Understanding of Accounting Software & Tools

- Proficiency in software like QuickBooks, Xero, Sage, and FreshBooks is crucial.

- Helps automate tasks such as invoicing, reconciliation, and payroll management.

- Enhances efficiency and reduces manual errors in bookkeeping.

- Ability to generate reports and integrate data with other business tools.

Financial Reporting & Analytical Thinking

- Ability to prepare and analyze Balance Sheets, Income Statements, and Cash Flow Statements.

- Helps business owners make informed financial decisions.

- Identifying trends, irregularities, or potential financial risks.

- Provides insights on cost control, budgeting, and financial planning.

Time Management & Organization

- Managing multiple accounts, invoices, and financial records efficiently.

- Prioritizing tasks to meet deadlines for tax filings and financial reporting.

- Keeping records well-organized for easy access and audits.

- Reducing stress by implementing systematic workflows.

Knowledge of Compliance & Tax Regulations

- Understanding tax laws, GST, VAT, and corporate compliance requirements.

- Ensures timely and accurate tax filings to avoid penalties.

- Helps businesses stay compliant with financial regulations and legal requirements.

- Knowledge of payroll laws and employee tax obligations.

How to Improve Your Skills in Bookkeeping

Enhance Numerical & Data Accuracy Skills

- Practice daily calculations and financial transactions.

- Use accounting exercises and online tools to improve accuracy.

- Double-check entries and perform regular reconciliations.

- Develop an eye for spotting discrepancies in financial records.

Gain Proficiency in Accounting Software & Tools

- Take online courses on QuickBooks, Xero, Sage, and FreshBooks.

- Attend software training workshops to stay updated with new features.

- Explore automation features for invoicing, payroll, and reconciliation.

- Experiment with cloud-based accounting tools for better accessibility.

Improve Financial Reporting & Analytical Thinking

- Learn how to prepare and analyze balance sheets, profit & loss statements, and cash flow reports.

- Develop the ability to interpret financial data for decision-making.

- Stay updated on financial trends and industry best practices.

- Practice identifying cost-saving opportunities and inefficiencies.

Strengthen Time Management & Organizational Skills

- Set daily, weekly, and monthly bookkeeping schedules.

- Use task management tools like Trello, Asana, or Excel for better organization.

- Implement systematic workflows to handle multiple accounts effectively.

- Keep financial records properly categorized for quick access.

Stay Updated on Compliance & Tax Regulations

- Regularly review GST, VAT, corporate tax, and payroll laws.

- Take certification courses in tax compliance and business regulations.

- Subscribe to accounting newsletters and government tax updates.

- Attend professional seminars and webinars on financial regulations.

Join Professional Accounting Communities

- Network with experienced accountants and bookkeepers.

- Participate in forums, LinkedIn groups, or professional associations.

- Share knowledge, ask questions, and stay informed about industry changes.

- Gain mentorship opportunities for career growth.

Soft Skills That May Make You a Better Bookkeeper

Numbers may talk, but soft skills let you hear what they mean. A good bookkeeper is not only good with figures but also with people and systems.

1. Communication

- Clear talk helps you explain reports to non-finance people. It builds trust between you and the team.

2. Adaptability

- Rules and tools may change. The ability to adjust quickly can make you stand out in any finance role.

3. Problem Solving

- When something doesn’t add up, a calm and curious mind can save the day. Bookkeepers often fix hidden issues before they grow big.

4. Attention to Detail

- The smallest mistake can change the outcome. A sharp eye can stop a big error before it slips into the books.

Why Choose Accounts Junction for Professional Bookkeeping Services?

Expertise in Industry-Specific Bookkeeping

- Our team has extensive experience handling bookkeeping for diverse industries, including construction, real estate, healthcare, e-commerce, and finance.

- We understand industry-specific accounting standards and compliance requirements.

Accurate & Timely Financial Management

- We ensure precise bookkeeping, preventing financial discrepancies and errors.

- Our experts provide timely financial reports, allowing businesses to make informed decisions.

Use of Advanced Accounting Software

- We specialize in leading accounting tools like QuickBooks, Xero, Sage, FreshBooks, and Wave.

- Cloud-based bookkeeping allows real-time access to financial data.

- Automation tools reduce manual errors and improve efficiency.

Customized Bookkeeping Solutions

- We adapt our services to suit your business requirements, covering cash flow management, tax compliance, and payroll processing.

- Flexible service packages for small businesses, startups, and large enterprises.

Compliance with Tax & Regulatory Requirements

- We stay updated with the latest tax laws, VAT, GST, and corporate tax regulations.

- Our services ensure businesses remain compliant with financial reporting standards.

Developing strong basic bookkeeping skills is essential for accurate financial management. From numerical proficiency to compliance knowledge, mastering skills for a bookkeeper enhances efficiency and reliability in financial transactions. Whether you’re an aspiring bookkeeper or a business owner managing basic bookkeeping, continuous improvement is key to success. For expert assistance, Accounts Junction offers professional bookkeeping services, ensuring financial accuracy and compliance for businesses.

FAQs

1. What are the essential basic bookkeeping skills?

- The essential basic bookkeeping skills include numerical proficiency, understanding of accounting software, financial reporting, time management, and knowledge of tax regulations.

2. What does a bookkeeper actually do every day?

- A bookkeeper records income, expenses, and transactions that help track where money goes and comes from.

3. Is bookkeeping hard to learn for beginners?

- It may feel tricky at first, but with practice and good tools, anyone can get better over time.

4. Can I do bookkeeping without a degree?

- Yes, you can. Many start with online courses or certifications to build practical skills.

5. What is the difference between bookkeeping and data entry?

- Bookkeeping involves more analysis and decision support, while data entry just adds numbers to the system.

6. How much time should I spend on bookkeeping each week?

- It may depend on your business size. Small ones may take a few hours, while larger ones may need daily work.

7. What happens if bookkeeping is done wrong?

- Wrong bookkeeping can lead to tax problems, bad reports, or poor decisions due to wrong data.

8. Can bookkeeping be automated fully?

- Not completely. Software can handle the tasks, but human review keeps things accurate.

9. How often should I update my books?

- Updating weekly or monthly may keep records fresh and reduce end-of-year stress.

10. Do I need special tools for bookkeeping?

-

Not always. Even Excel can work, but software like QuickBooks or Xero can make it easier.

11. What is reconciliation in bookkeeping?

- It means matching your books with bank statements to make sure everything fits perfectly.

12. Can bookkeeping help with budgeting?

- Yes, it can. It shows spending habits and helps plan for future costs.

13. Why do some businesses hire bookkeepers instead of doing it themselves?

- Because bookkeepers can save time and spot issues early, allowing owners to focus on running the business.

14. Is cloud bookkeeping safe?

- Most tools use strong security systems, but you should still keep passwords safe and back up your data.

15. How long should I keep financial records?

- Many keep them for five to seven years, depending on local tax rules.

16. What is accrual accounting, in simple words?

- It records money when it’s earned or spent, even if cash hasn’t moved yet.

17. Can I learn bookkeeping online for free?

- Yes, many free tutorials and videos can help you start from scratch.

18. What kind of reports does a bookkeeper prepare?

- They may prepare balance sheets, profit and loss reports, and cash flow statements.

19. How can a bookkeeper help in business growth?

- By giving clear reports and spotting financial trends that guide better planning.

20. What is the first thing to learn in bookkeeping?

- Start with understanding debits, credits, and how transactions affect accounts.

21. Is bookkeeping a good career choice?

- It can be, especially for those who enjoy working with numbers and helping businesses stay on track.