The Ultimate Guide to Retail Accounting in 2026

If you run a shop, or think about starting one, you might wonder how to manage your accounts. In this blog, we will look at everything you need to understand about retail accounting. We will see how to record and manage transactions when you do business in the retail world.

When we talk about accounting for retail business, we mean all the extra bits that a retailer must think about: stock, returns, sales channels, overheads, and more. As we move into 2026, things may look different than they did in past years. New tools, new trends, new expectations — all of these may change how retail accounting works.

Why Retail Accounting is Different

You may already know how regular accounting works for service firms or small businesses. Retail adds more layers. Here’s why:

1. Inventory matters a lot

- In a retail business you buy goods, hold them, sell them, maybe return them, maybe discount them. Counting that stuff, valuing it, and showing how it changes is a big part of accounting for retail business.

2. Many sales channels

- Today, you might sell in your physical store, online, through a phone, maybe via social media. Each channel has its costs and income streams. For retail accounting, you must capture sales from all channels, subtract returns, handle shipping, taxes.

3. Margin pressure and cost control

- Retail businesses often have tight margins. A little extra cost or inefficiency can eat up profit quickly. So, bookkeeping may need to track not just how much you sold, but how much you actually made after costs (stock, labour, utilities, rent, etc).

4. Compliance, tax and regulation

- Depending on where you are, there may be special tax rules, sales reporting, discounts, promotions, loyalty programmes. All of it feeds into how you do accounting for retail business.

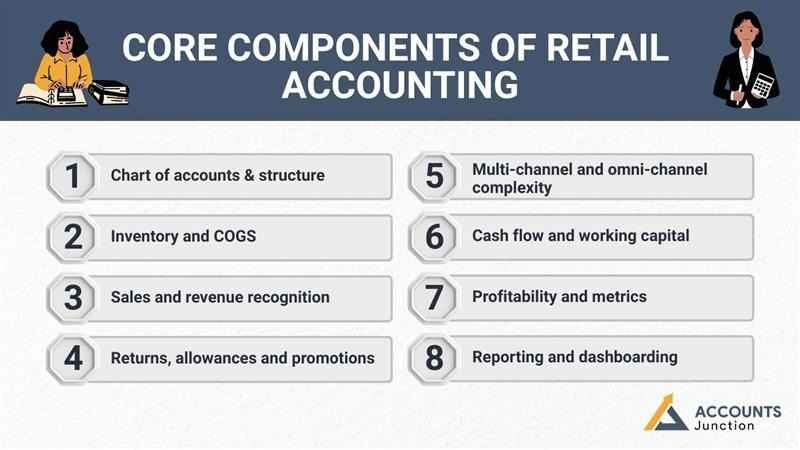

Core Components of Retail Accounting

Let’s break down the main parts of retail accounting.

1. Chart of accounts & structure

You might already have an account list (sales, cost of goods sold, wages, rent, utilities). For retail business you might want to add or emphasise:

- Sales by channel (in-store, online, marketplace)

- Returns and allowances

- Discounts and promotions

- Inventory adjustments (wastage, shrinkage, spoilage)

- Cost of goods sold (COGS) tied to inventory

- Stock purchases and stock on hand

- Freight in / shipping, if you pay for delivery etc

- Store overheads (rent, utilities, cleaning)

- Technology / e-commerce platform costs

By organising this clearly you gain better “visibility” of where money is coming from and where it’s going.

2. Inventory and COGS

A big part of retail accounting is tracking inventory correctly. If you get this wrong you will misstate profit. Here are key steps:

- Count your stock regularly (physical counts)

- Value your stock: choose a method (FIFO, weighted average, etc)

- Record purchase of goods (when you buy, when you receive)

- Record sales of goods (when you sell, what cost you assign)

- Adjust for returns, damaged stock, theft/shrinkage

- At period end adjust stock on hand and calculate cost of goods sold

3. Sales and revenue recognition

In retail you often recognise revenue when a sale is final (customer pays, product delivered). But with multiple channels you might have different timing for online orders, shipping, returns, etc. For instance:

- A customer orders online, you receive payment, but you ship later → when do you recognise revenue?

- A sale happens in-store but the customer returns next week → you need to record allowances or reserves for returns.

- Discounts and loyalty programmes may complicate the net revenue figure.

4. Returns, allowances and promotions

Returns are common in retail and they reduce revenue and cost. You might want to record an allowance for expected returns. Promotions may reduce your effective price and hence your margin. For strong accounting for retail business you should track:

- How many returns occur, and why

- How much of your sales are via promotion/discount

- If your margin is shrinking because of heavy discounting

5. Multi-channel and omni-channel complexity

You might sell via your store, via your website, via a third-party marketplace. You may fulfil from store or from warehouse. Each of these brings accounting complexity:

- Inventory may move between warehouse and store

- Shipping might be free or paid by you

- Fees from third-party platforms

- Different tax jurisdictions (if you ship interstate or overseas)

- Data feeding from multiple systems into one accounting ledger

6. Cash flow and working capital

In retail your cash flow may bounce: you buy stock upfront, you sell later, you might pay rent and staff anyway. Good retail accounting pays attention to cash:

- How fast you turn your stock (stock turnover)

- How many days you carry unsold stock

- Payment terms with suppliers

- When your big costs (rent, utilities, staff) fall

- Seasonality (maybe you sell more in festive seasons)

7. Profitability and metrics

Numbers alone don’t tell you everything. For good accounting for retail business you’ll monitor metrics:

- Gross margin = (Sales − COGS) / Sales

- Net margin after all expenses

- Return on stock (profit relative to stock investment)

- Average order value (online)

- Sales per square foot (physical store)

- Inventory turnover (how many times stock is sold/ replenished in a year)

These help you judge if your business is healthy and going in the right direction.

8. Reporting and dashboarding

In 2026 you may want more than spreadsheets. A dashboard may help you glance and spot issues:

- Which items are slow-moving

- Which channel is under-performing

- Where cost is creeping up

- Returns trend

- Cash position

Good retail accounting will make these insights easier to get.

Steps to Set Up or Improve Your Retail Accounting in 2026

Whether you are starting fresh or upgrading your retail business, here’s how you can improve your retail accounting:

Step 1: Define your business model and channels

- Know how you sell: store, online, marketplaces, social media. List your channels. Know where your inventory will sit and how you will fulfil orders. This helps shape the accounting flows.

Step 2: Choose your accounting software and integrations

- Pick software that can handle multi-channel retail. Make sure it can integrate/receive data from your POS, e-commerce platform, marketplace sales. If you use multiple systems that don’t talk to each other you’re going to waste time reconciling.

Step 3: Map your accounts and set up your chart of accounts

- Create or modify your chart of accounts to include the extra items in retail accounting (stock movement, returns, promotions, multi-channel costs). Clear structure means less mess later.

Step 4: Implement inventory controls & counting

- Decide how you count stock (monthly, quarterly, annually). Decide how you value it (FIFO etc). Ensure your system records purchase and sale properly. Set up procedures for damaged goods, returns, shrinkage.

Step 5: Record sales properly and reconcile channels

- Make sure each sale is recorded. Match your sales channels to the ledger. Track returns and allowances. Reconcile bank deposits with actual sales data. If you use online marketplaces check their fees and treat them correctly in accounting.

Step 6: Track cost of goods sold and margins

- You must link what you paid for stock with what you sold it for. That allows you to compute gross margin. Monitor margin trends. If margin falls you need to know why (discounts? higher cost? slow turnover?).

Step 7: Monitor and manage cash flow

- Keep an eye on when you pay suppliers, when you collect from customers, when you must pay rent/staff/utilities. Use cash-flow forecasting. In retail especially you may face seasonal highs and lows.

Step 8: Build dashboards and reports

- Decide which metrics matter for your business. For example: stock turnover, sales per channel, average order value, returns percentage, gross margin. Create regular reports (weekly, monthly) so you can spot issues early.

Step 9: Review and adjust policies

- Maybe you offer discounts too freely. Maybe returns are too high. Maybe you carry too much slow-moving stock. Use your accounting insights to adjust your policies: purchase less, discount smarter, control returns, optimize stock.

Step 10: Stay compliant and secure

- Ensure your system complies with tax, local regulation, data security. With more data and more channels you may face more risk. A robust accounting system helps with audits, tax filings,

If you focus on the core components (inventory, sales, costs, metrics), invest in good systems, and review your business regularly, you’ll be in a much stronger position. Need help with accounting for your retail business? At Accounts Junction, we provide complete accounting and bookkeeping services for retail businesses. Contact us now to know more about our retail accounting services.

FAQs

1. What is retail accounting?

- Retail accounting refers to the practice of recording, classifying and analysing financial transactions specific to a retail business (where goods are bought and sold).

2. Why is inventory so important in accounting for retail business?

- Because unsold goods sit on your books as assets and when sold they become cost of goods sold; mis-counting leads to wrong profit numbers.

3. How often should I count my stock?

- You may count monthly or quarterly depending on volume, but at minimum once a year; frequent counts reduce surprises.

4. What is gross margin and why does it matter?

- Gross margin is (sales-cost) ÷ sales; it shows how much you keep before overheads; shrinking margin often signals trouble.

5. How do returns in retail business affect the books?

- Returns reduce net sales and may increase costs (restocking, wastage); you must record them so profit isn’t overstated.

6. What additional accounts do retail businesses need?

- They may need accounts for sales by channel, inventory adjustments, promotions, shipping/fulfilment, returns and allowances.

7. Why is multi-channel selling a challenge for accounting?

- Because each channel might have different fees, timing, fulfilment costs and data flows, so reconciliation becomes harder.

8. What does ‘stock turnover’ mean?

- It’s how many times you sell and replace your average stock in a year; higher turnover often means efficient business.

9. How can technology help retail accounting?

- Tools can automate data entry, integrate sales/inventory channels, generate dashboards, and reduce manual errors.

10. What are typical retail business costs I must track?

- Stock costs, labour, rent, utilities, shipping/fulfilment, marketing/promotions, platform fees, shrinkage.

11. What happens if I mis-value inventory?

- Profit will be wrong, assets mis-stated, tax or investor trust may be at risk; tracking value properly is crucial.

12. How does the shift to online affect retail accounting?

- More channels mean more data, more fees, more complexity in tracking sales, returns and costs across platforms.

13. Should I track metrics every week or monthly for retail accounting?

- Weekly check-ins are good for spotting issues early; monthly deeper reviews help with trends and strategy.

14. What is a good dashboard for retail accounting?

- One that shows sales by channel, margin, inventory turnover, slow-moving items, returns rate, cash-flow forecast.

15. How will accounting for retail business change in 2026?

- It may lean more into automation, real-time reporting, advisory insights, multi-channel integration and stronger compliance.

16. What margin is typical in retail?

- It varies greatly by type of goods and region; what matters is tracking your own margin and trending it over time.

17. What if I have high returns in a retail business?

- You should investigate cause (quality, description, service), record the cost, and adjust your policies to reduce them.

18. How do promotions impact profit in retail businesses?

- Promotions increase sales but may reduce margin; if done without tracking, you may boost volume but lose money.

19. Is it okay to have slow-moving stock?

- It’s common, but you must monitor it. Slow-moving stock ties up cash, may get obsolete or go to waste; you may need to discount or ditch it.