Tax Preparation Software for Preparers: What It Is and Why It Matters

Tax preparation software for preparers is now a key tool. Many tax staff face stress because rules change each year. Using tax preparation software for preparers can save time and reduce errors for staff. Staff who use tax software for tax preparers work fast and gain client trust.

Even small firms find this software very useful today. It helps track forms, tax breaks, and client files. Staff with many clients find that work becomes fast and smooth. The right tool helps avoid errors and penalties for clients.

Software helps save time and reduces stress for staff. Clients feel confident that their taxes are done right. Professionals can focus on more work with this tool. Every accounting firm can benefit from proper tax software.

What Is Tax Preparation Software for Preparers

Tax preparation software for preparers is a tool for taxes. It helps sort, check, and file client forms quickly. The tool makes sure all math is correct and clear. Staff can handle more files without extra effort every day.

-

Automation

Tax preparation software for preparers works fast with numbers and client forms. This reduces mistakes and saves time for accounting staff. Many preparers finish returns quickly without losing accuracy at all. Automation allows staff to focus on more complex issues.

-

Client Management

The software keeps client data safe and easy to access. Staff can view past files anytime when needed easily. Client history is easy to check for audits or questions. It allows smooth service and better communication with clients.

-

Updates

The tool updates rules by itself every single year. Staff do not need to check laws manually or often. It keeps forms correct with the new federal and state rules. Updates ensure compliance and reduce the risk of errors consistently.

This software is different from basic accounting programs today. It is made for people who manage taxes daily. Features help both small and larger accounting firms work better.

Why Tax Software for Tax Preparers Is Important

-

Accuracy

Tax preparation software for preparers reduces mistakes in numbers and forms every time. Staff can prepare correct reports without fear of errors. Accurate work lowers the risks of fines and audits for clients.

-

Efficiency

Filing client taxes becomes faster with automated tools available. Preparers can handle more returns without extra hours or stress. Faster work does not reduce correctness when software is used.

-

Compliance

Tax preparation software for preparers stays updated with federal and state rules automatically every year. It prevents fines caused by wrong or outdated forms filed. Using software helps all filings meet the required tax laws.

-

Record Management

It keeps all client files neat and easy to access. Staff do not lose documents or waste time searching files. Digital records allow audits and reviews to go smoothly every time.

-

Client Trust

Professional software improves confidence in your accounting services consistently. Clients feel sure that their taxes are done properly. Accurate work helps maintain long-term trust and client loyalty.

Key Features to Look for in Tax Preparation Software

-

Form Support

Covers all common federal and state tax forms each year. Helps clients file correctly without errors.

-

Data Integration

Imports client data from sheets or other software quickly. Cuts repeated entry and stops mistakes. Saves time and eases staff work.

-

Automation

Calculates taxes from client numbers automatically. Finds deductions or credits often missed. Prepares forms faster and lowers errors.

-

Security

Keeps client data safe with strong locks and storage. Stops theft or unwanted access. Builds client trust and meets rules.

-

Ease of Use

Offers simple menus for new and skilled staff. Quick access to forms, reports, and old client files. Cuts learning time and speeds work.

-

Support

Gives live chat, phone, or email help anytime. Fixes issues fast to keep work smooth. Good support keeps staff and clients happy.

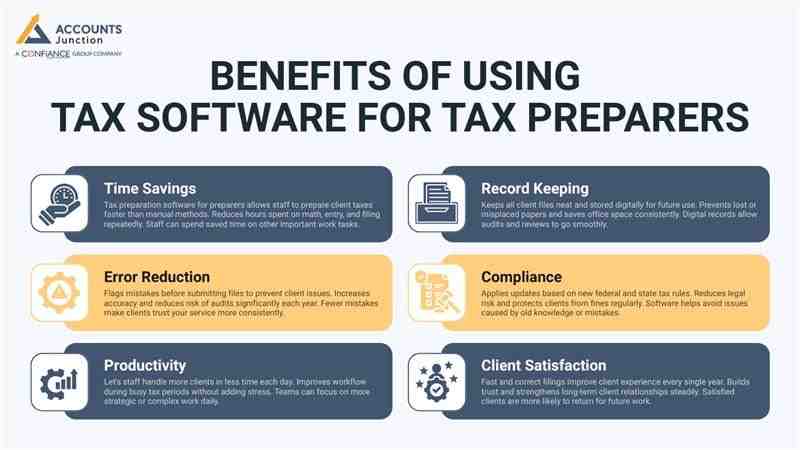

Benefits of Using Tax Software for Tax Preparers

-

Time Savings

Tax preparation software for preparers allows staff to prepare client taxes faster than manual methods. Reduces hours spent on math, entry, and filing repeatedly. Staff can spend saved time on other important work tasks.

-

Error Reduction

Flags mistakes before submitting files to prevent client issues. Increases accuracy and reduces risk of audits significantly each year. Fewer mistakes make clients trust your service more consistently.

-

Productivity

Let's staff handle more clients in less time each day. Improves workflow during busy tax periods without adding stress. Teams can focus on more strategic or complex work daily.

-

Record Keeping

Keeps all client files neat and stored digitally for future use. Prevents lost or misplaced papers and saves office space consistently. Digital records allow audits and reviews to go smoothly.

-

Compliance

Applies updates based on new federal and state tax rules. Reduces legal risk and protects clients from fines regularly. Software helps avoid issues caused by old knowledge or mistakes.

-

Client Satisfaction

Fast and correct filings improve client experience every single year. Builds trust and strengthens long-term client relationships steadily. Satisfied clients are more likely to return for future work.

Who Can Benefit from Tax Preparation Software

-

Individual Preparers

Helps manage client files each year with ease. Supports pros handling a small client base well. Even solo preparers can give better service using tax software for tax preparers to manage clients easily.

-

Small Firms

Tax software for tax preparers handles many clients without adding staff or stress. Improves speed and cuts errors for each client. Staff can focus on key tasks and daily plans.

-

Large Firms

Supports high-volume work with correct results each time. Ensures teams handle many returns with no mistakes. Let's firms serve more clients in busy months.

-

Freelancers

Gives clear steps for solo tax staff each week. Helps freelancers work right and cut mistakes each time. Builds trust and shows dependability for small clients.

Tips for Choosing the Best Tax Software

-

Form Coverage

Check software supports all forms used by your staff. Verify it handles federal and state filings correctly each year. Automatic updates save time and reduce mistakes during filing.

-

Interface

Pick software with simple and clear navigation for staff. Easy access to forms, reports, and client data is key. A simple interface reduces training time and increases daily speed.

-

Security

Check encryption and safe storage for client information daily. Keeps files protected from theft or unwanted access constantly. Strong security builds trust and meets all privacy rules.

-

Support

Ensure customer service is ready for technical or usage problems. Live chat, email, or phone support should be fast and reliable. Good support keeps staff productive and clients happy consistently.

-

Pricing

Compare costs to fit your firm's size and needs well. Consider subscription or one-time payments depending on the firm's usage. Balance cost with features when you choose tax software for tax preparers to get good value.

-

Automation Features

Look for automatic calculations and suggested deductions for clients. Reduces repeated tasks and saves staff hours every day. Automation ensures faster filing with fewer human errors consistently.

Challenges Without Tax Preparation Software

-

Manual Errors

Manual sums often cause costly mistakes and fines. Human slip-ups raise stress during peak tax times each year. Errors may lead to audits or client complaints often.

-

Time Consumption

Repeating data entry wastes hours each day for staff. Slows workflow and cuts overall output in the office. Fewer returns get done in the same time frame.

-

Tracking Deadlines

Handling many client due dates by hand is hard. The risk of late filings rises without software help each year. Clients may face fines for late or wrong forms.

-

Record Mismanagement

Manual files raise the risk of lost key client papers. Sorting old records takes a long time and is very slow. Makes audits or client checks take more time than needed.

-

Compliance Risk

Old knowledge can cause wrong client forms each year. Raises the risk of fines and loss of client trust. Tax pros face legal issues without updated software use often.

Future Trends in Tax Preparation Software

-

Cloud Access

Lets staff work from any place safely and easily. Client files are accessible online anytime when needed quickly. Improves flexibility and speed for firms of all sizes.

-

Smart Assistance

AI suggests deductions and credits automatically for clients. Helps staff work faster and improves accuracy for returns. Reduces workload during busy tax seasons every single year.

-

Integration

Links with accounting, payroll, and bookkeeping software easily. Reduces repeated entry and speeds up workflow for staff. Ensures reports are correct across multiple financial systems consistently.

-

Real Time Updates

Software updates tax rules itself automatically each year. Ensures staff follow all new regulations constantly without stress. Avoids mistakes caused by old laws or forms easily.

-

Security Enhancements

Gives strong encryption and controls who can see data. Protects client information from theft or unwanted access. Clients feel safe and trust your firm consistently every year.

Using tax preparation software for preparers increases accuracy, speed, and client trust. Staff save time and manage many clients with ease. Choosing proper software ensures compliance with federal and state laws.

Accounts Junction provides accounting and bookkeeping services for all firms. We have certified experts who ensure accurate and smooth work using the latest software. Clients can trust that their taxes and accounts are handled correctly and on time. Partner with us for reliable accounting and bookkeeping services.

FAQs

1. What is the best tax preparation software for preparers?

- It is a tool that helps users prepare client taxes fast. It also stores data and keeps all math free from errors.

2. Which tax software do top tax preparers use?

- Good preparers use software to file taxes right and fast. It also helps track many clients and meet all deadlines.

3. How does tax preparation software for preparers work?

- It keeps client info safe and does math on its own. It also shows deductions and makes sure rules are followed.

4. Can tax software for tax preparers handle multiple clients?

- Yes, it works with many clients using clear digital files. It also tracks deadlines and keeps all records in one place.

5. Is tax software for preparers safe for sensitive data?

- Yes, it keeps client info safe with strong protection. It also stops access by people who should not see it.

6. Does tax preparation software reduce filing mistakes?

- Yes, checks in the software stop common errors and missed items. It also flags wrong entries before forms are sent in.

7. Can small firms benefit from tax software for preparers?

- Yes, it makes work easier and tracks many clients well. It also saves time and lowers the need for extra staff.