Understanding the Tax Clearance for Singapore Employees Process

Tax clearance for Singapore employees is a process that helps ensure all tax duties are settled before an employee leaves Singapore or ends their job. This process may be required by the Inland Revenue Authority of Singapore (IRAS) to confirm that taxes are reported and paid correctly. While it mainly applies to foreign employees, some local employees may also need to complete tax clearance under certain conditions.

This blog explains tax clearance for Singapore employees. It covers the steps, roles, timelines, documents, common issues, and tips for smooth completion.

What is Tax Clearance for Singapore Employees?

Tax clearance for Singapore employees is the formal process of reporting and paying taxes to IRAS before leaving Singapore or ending employment. The main goal is to follow the law and avoid future disputes.

Employers usually submit Form IR21. This form has details about the employee’s salary, bonuses, and allowances. IRAS uses this form to calculate any tax owed. Even if an employee has no tax to pay, filing may still be needed to keep proper records.

Tax clearance may also be needed when employees get final payments or bonuses that affect tax totals.

Who May Require Tax Clearance?

Tax clearance for Singapore employees may be needed in these cases:

- Foreign employees leaving Singapore for good or for a long time.

- Employees on Employment Pass, S Pass, or Work Permit ending their job.

- Contract or temporary staff finishing their assignment.

- Employees getting final payments or bonuses that affect taxes.

Local employees may not need tax clearance unless they leave Singapore permanently or under special cases.

Why Tax Clearance is Important

Completing tax clearance is important for several reasons.

- Follow the Law: Filing ensures both the employer and employee meet IRAS rules. It avoids fines.

- Accurate Records: Tax clearance provides proof that all taxes are paid.

- Smooth Final Payment: Taxes may be deducted from the last salary. Clearance ensures salary is released on time.

- Prevent Future Problems: Proper filing reduces the risk of tax issues after leaving the job.

Both employees and employers benefit from timely tax clearance.

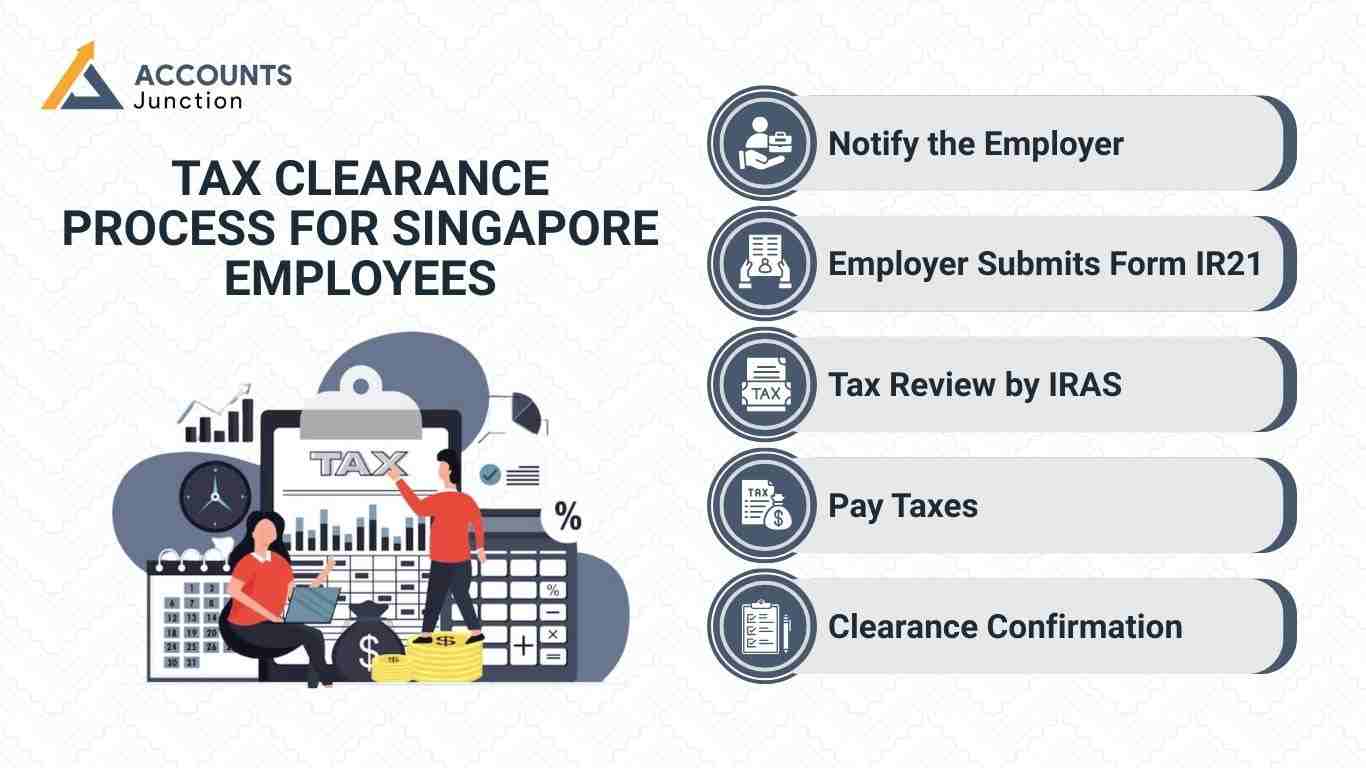

Tax Clearance Process for Singapore Employees

The process of tax clearance for Singapore employees has these steps.

Step 1: Notify the Employer

Employees should tell their employer about their planned leave or resignation. Early notice gives the employer time to prepare and submit forms to IRAS.

Step 2: Employer Submits Form IR21

Form IR21 is filed at least one month before the employee’s last day. It includes:

- Employee personal details.

- Job duration and contract type.

- Salary, bonuses, and other pay.

- Other income if any.

Step 3: Tax Review by IRAS

IRAS reviews the form and calculates taxes. This may include standard tax and extra tax on bonuses.

Step 4: Pay Taxes

Taxes can be paid from the final salary or directly to IRAS. Employers ensure all taxes are cleared before the employee leaves.

Step 5: Clearance Confirmation

After taxes are paid, IRAS may issue a clearance note. This proves the employee has met tax duties and avoids future disputes.

Tax Clearance in Singapore: A Complete Guide

- Personal ID

Employees must give a valid passport or ID card. - Work Records

The work contract and job records must be ready. - Salary and Bonus Papers

Payslips, bonus papers, and pay records are needed. - Tax Form

Form IR21 must be filled and sent to IRAS. - Organize Your Papers

Having all papers ready helps speed up the process.

Timelines for Tax Clearance

- Form Filing

Form IR21 must reach IRAS at least one month before. - Final Salary Taxes

All taxes on the last pay must be paid. - Leaving Confirmation

Foreign staff may need IRAS clearance before leaving. - Meet Deadlines

Following deadlines keeps you safe from fines and delays. - Plan Early

Planning early lowers the risk of late fees or errors.

Employer Duties

- File on Time

Employers must send Form IR21 to IRAS on time. - Check Taxes

They must check that all taxes are correct. - Talk with IRAS

Employers must solve issues by speaking with IRAS. - Match Final Pay

Final pay must match the taxes that are owed. - Avoid Fines

Not doing these tasks may lead to penalties.

Employee Duties

- Give Correct Info

Staff must give correct personal and work details. - Send Papers on Time

All papers must be sent by the set deadline. - Follow Up

Check with HR or IRAS to track progress. - Pay Taxes

Make sure all taxes due are paid before leaving. - Work with Employer

Good teamwork stops errors and slows down the process.

Common Problems

- Late Form

Sending Form IR21 late is a common problem. - Salary Errors

Wrong pay or bonus figures can cause issues. - Unpaid Taxes

Not paying taxes affects the last salary. - Missing Papers

Missing or wrong papers can slow the process. - Plan Ahead

Early planning fixes most problems before they start.

Tips for Smooth Clearance

- Tell Early

Tell your employer early about leaving the job. - Keep Records

Keep clear papers of salary, bonuses, and pay. - Check Taxes

Look at all deductions to avoid mistakes. - Send on Time

Send all needed papers on time to IRAS. - Track Form

Check that Form IR21 is submitted and approved. - Follow Steps

Doing all steps keeps the process smooth and fast.

Digital Filing for Tax Clearance

-

Electronic Submission of Form IR21

IRAS allows employers to submit Form IR21 online easily.

-

Employer Responsibilities for Online Filing

Employers can file the form directly through the IRAS portal.

-

Employee Access to Clearance Status

Employees can check their tax clearance status online anytime.

-

Advantages of Digital Filing

Submitting forms online reduces errors and saves time for all.

Common Scenarios

-

Foreign Employee Leaving

Foreign staff usually need tax clearance before leaving Singapore. Employers file Form IR21, calculate taxes, and get IRAS approval.

-

Local Employee Receiving Bonus

Local staff with end-of-service bonuses may also need clearance. This ensures correct reporting and prevents tax problems.

-

Contract or Temporary Staff

Short-term employees may need clearance. Employers should check each employee’s situation.

Benefits of Tax Clearance

-

Reduces Risk of Fines

Doing tax clearance on time helps avoid fines.

Following the steps keeps all staff safe from penalties.

-

Ensures Smooth Salary and Refunds

Clearance helps last pay and refunds go out on time.

Staff get payments without delays or mix-ups.

-

Proof of Tax Rules Followed

It shows that all tax rules were followed correctly.

This helps staff and firms keep clear records.

-

Official Record Keeping

Staff get official papers for personal or work files.

These papers can be used later for pay or tax needs.

-

Helps All Staff

Even staff with little tax to pay benefit from clearance.

Tax clearance for Singapore employees keeps everyone safe and covered.

Common Misconceptions About Tax Clearance

-

Only Foreign Staff Need Clearance

Not only foreign staff, some local staff need it too. All staff should check if clearance rules apply to them.

-

Taxes Are Automatic

Taxes are not always automatic; staff should check. Checking deductions stops errors that may affect last pay.

-

Clearance Is Not Optional

Clearance is often required and not just a choice. Not doing it can lead to fines or delays later.

-

The Steps Are Easy

With planning, the tax clearance steps are easy to follow. Following the steps makes tax clearance for Singapore employees simple.

Tax clearance for Singapore employees is key to following tax laws and getting final pay smoothly. Employers file Form IR21 and calculate taxes. Employees must provide accurate data and submit documents.

Early preparation, following deadlines, and correct reporting reduce fines and problems. Both employees and employers benefit from efficient clearance. Proper records and communication make the process smooth and confirm all taxes are paid before departure. Accounts Junction offers tax clearance for Singapore staff. We have certified staff who complete all forms and check all taxes with IRAS. Our team manages the full process, including Form IR21 and final pay. Partner with us for a smooth and safe tax clearance.

FAQs

1. What is tax clearance for Singapore employees?

- It is the process of paying and reporting taxes to IRAS before an employee leaves Singapore or ends a job.

2. Who needs to do tax clearance in Singapore?

- Foreign workers leaving Singapore and staff on Employment Pass, S Pass, or Work Permit may need it.

3. Which form is used for tax clearance?

- Employers must send Form IR21 to IRAS for tax clearance.

4. When should Form IR21 be sent?

- It should be sent at least one month before the worker’s last day.

5. Can employees do tax clearance on their own?

- Usually, the employer sends the form. Employees must give correct job and pay details.

6. How does IRAS check taxes for leaving staff?

- IRAS checks pay, benefits, and deductions to see if any tax is due.

7. What papers are needed for tax clearance?

- Workers should give passport, job contract, payslips, and bonus slips.

8. Can tax clearance be done online?

- Yes, employers can send Form IR21 online and track its status.

9. What happens if tax clearance is late?

- Late filing may lead to fines, hold on final pay, or issues with pass cancelation.

10. Do local staff leaving Singapore need tax clearance?

- It may be needed if they leave for good or have tax owed.

11. How long does tax clearance take?

- It can take a few weeks. Filing early helps finish it on time.

12. Can mistakes in Form IR21 delay tax clearance?

- Yes, wrong or missing details can cause delays and need fixing.

13. Can employers be fined for not filing Form IR21?

- Yes, they may get fines or penalties if they file late or not at all.

14. Will tax clearance affect final pay?

- Yes, unpaid taxes may be taken from the last pay.

15. Can workers get a tax refund after clearance?

- Yes, if too much tax was paid, IRAS can give a refund.

16. Is tax clearance different for foreign and local staff?

- Foreign workers leaving Singapore must do clearance for tax and pass rules. Locals only do it in some cases.

17. How can employees check tax clearance status?

- Workers can ask HR or check online if the employer filed Form IR21.

18. Must tax clearance be done before canceling an Employment Pass?

- Yes, IRAS usually requires clearance before the pass can be canceled.

19. Do short-term contract staff need tax clearance?

- It depends on job length, pass type, and pay that is taxed.