Smart Tax Planning for Doctors: Are You Maximizing Your Benefits?

As a doctor, managing finances efficiently is essential. Doctors earn income through a salary or private practice. Effective tax planning for doctors is crucial to maximizing savings and complying with tax laws. Understanding doctor taxation helps in reducing tax liability while maintaining financial stability.

Doctors often face complex tax structures due to multiple income streams, including salary, consultation fees, investments, and business earnings. Proper tax planning for doctors ensures you take advantage of deductions and credits to optimize your taxable income. Whether you are self-employed or salaried, knowing your tax obligations helps in better financial planning.

Key Tax Deductions and Credits Available for Medical Professionals

Tax laws offer various deductions and credits specifically designed for medical professionals. Knowing these tax benefits can help reduce your overall tax liability. Some of the most common tax deductions available in doctor taxation include:

- Education and Training Expenses: Courses, seminars, and certifications required to enhance professional skills are deductible.

- Medical Equipment and Supplies: Doctors often purchase medical tools, diagnostic equipment, and supplies for their practice. The cost of these essential items is tax-deductible.

- Office and Clinic Expenses: Rent, utilities, and maintenance costs for clinics or offices can be claimed.

- Professional Membership Fees: Membership fees paid to medical associations or professional organizations are deductible.

- Insurance Premiums: Malpractice insurance, professional liability insurance, and even health insurance premiums may qualify as tax-deductible expenses.

- Travel and Vehicle Expenses: If you travel for work, you can deduct fuel, vehicle maintenance, and business travel costs.

- Home Office Deduction: If you work from home, deduct a portion of rent, internet, and utilities.

- Retirement Contributions: Contributions to retirement plans reduce taxable income and provide long-term financial benefits.

Understanding and utilizing these deductions helps optimize tax planning for doctors and lowers tax burdens significantly.

Tax Planning for Doctors: Strategies to Reduce Tax Liability

Effective tax planning for doctors involves strategic financial decisions to minimize tax liabilities legally. Here are some key strategies to consider:

- Incorporating Your Practice: Operating as an independent contractor or forming a professional corporation can help doctors take advantage of business tax benefits.

- Income Splitting: Allocate income to family members (spouse, children) via salaries or dividends to reduce taxes.

- Investing in Tax-Advantaged Accounts: Lower taxable income by contributing to HSAs, retirement accounts, and TFSAs.

- Deferring Income: Postponing income to the next tax year can help stay within lower tax brackets.

- Maximizing Business Expenses: Keeping detailed records of all professional expenses ensures maximum deductions.

- Hiring a Tax Consultant: You can find opportunities for tax savings by working with a tax professional. They also ensure you comply with all doctor taxation laws.

Proper tax planning for doctors ensures maximum savings while maintaining compliance with tax regulations.

Complexities in Self-Employed vs. Salaried Doctor Taxation

Doctors work under different employment structures, each with unique tax obligations. Understanding the difference between self-employed and salaried doctor taxation helps in making informed financial decisions.

|

Aspect |

Self-Employed Doctors |

Salaried Doctors |

|

Tax Responsibility |

Pay self-employment tax, including Social Security and Medicare contributions. |

Taxes are deducted at the source. |

|

Expense Deductions |

Can claim business expenses, professional costs, and office expenses. |

Limited deductions, mainly for memberships and education. |

|

Income Control |

Greater control over income and tax planning. |

Fixed salary with fewer tax planning options. |

|

Retirement Contributions |

Can set up retirement plans with higher contribution limits. |

Contributions typically made through employer-provided plans. |

|

Complexity in Tax Filing |

More complex tax filings due to multiple deductions. |

Simpler tax filing process. |

Both self-employed and salaried doctors should engage in tax planning for doctors to maximize their benefits and reduce liabilities.

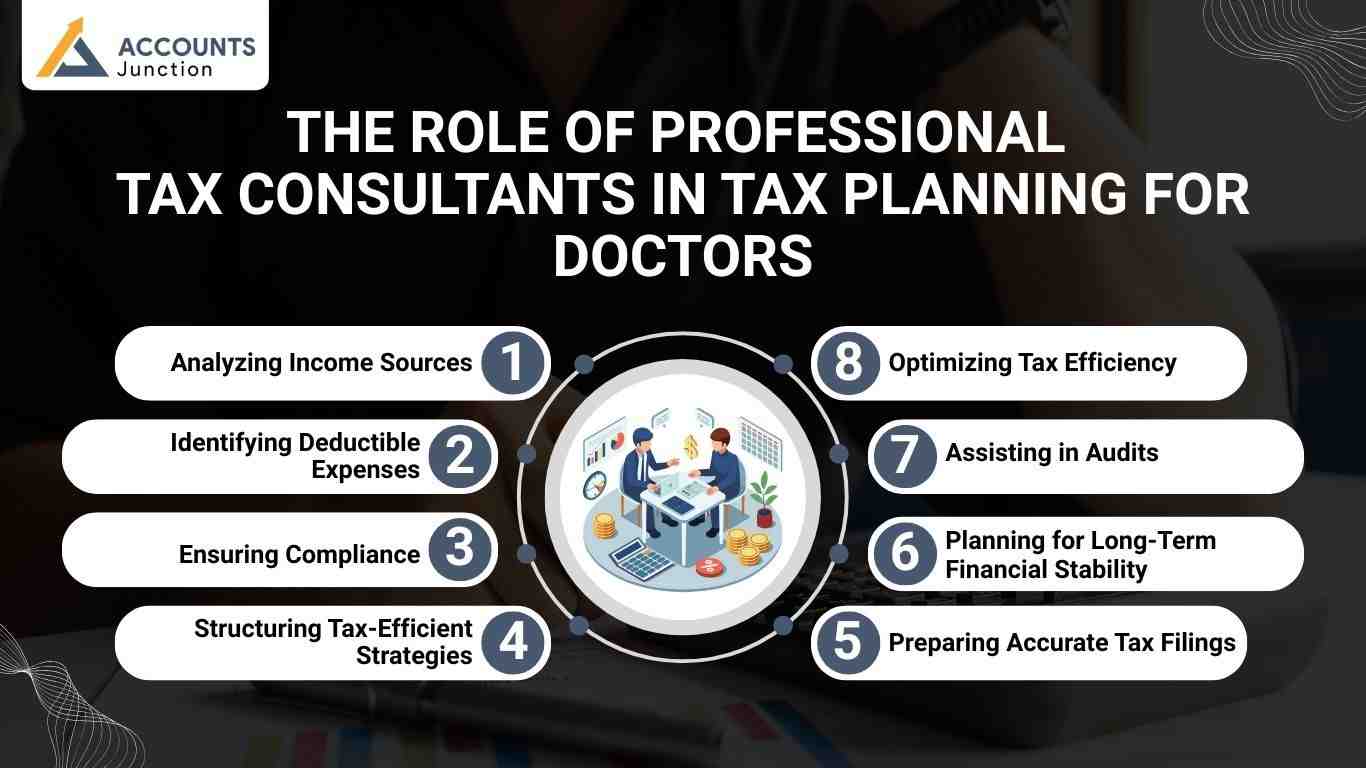

The Role of Professional Tax Consultants in Tax Planning for Doctors

Professional tax consultants play a crucial role in ensuring doctors navigate complex tax laws efficiently. They help medical professionals manage tax obligations while optimizing financial benefits.

- Analyzing Income Sources: Tax consultants assess various income streams, ensuring accurate tax reporting.

- Identifying Deductible Expenses: They pinpoint tax-deductible expenses to help minimize taxable income.

- Ensuring Compliance: Tax professionals stay updated with tax laws and ensure doctors adhere to legal requirements.

- Structuring Tax-Efficient Strategies: They develop customized tax strategies to optimize financial benefits.

- Preparing Accurate Tax Filings: Ensuring error-free tax filing and submission within deadlines.

- Planning for Long-Term Financial Stability: They assist in tax-efficient retirement and investment strategies.

- Assisting in Audits: Providing support in case of tax audits to resolve any compliance issues.

- Optimizing Tax Efficiency: Helping doctors reduce financial risks while maximizing tax benefits.

With the support of tax consultants, doctors can concentrate on patient care while maintaining compliance with tax laws and securing their financial future.

Smart Investment Options for Doctors

Investing wisely can complement your tax planning strategy. Doctors often have the advantage of high earning potential, but mismanaged investments may reduce overall benefits. Choosing tax-efficient investment instruments can help grow wealth while minimizing taxes.

- Tax-Free or Tax-Deferred Accounts: Contributions to retirement accounts may lower taxable income now. Some investments may grow without immediate tax liability.

- Real Estate Investments: Buying property for clinics or rentals may offer depreciation benefits.

- Diversified Portfolios: Investing in stocks, bonds, or mutual funds can reduce risk while potentially offering long-term gains.

- Professional Guidance: Consulting a financial advisor may help align investments with tax strategies and future goals.

Common Mistakes Doctors Make in Tax Planning

Even well-intentioned tax planning can go wrong if mistakes are made. Doctors may unknowingly miss deductions or mismanage income, leading to higher taxes. Recognizing these pitfalls can improve outcomes.

- Ignoring Business Expenses: Some doctors forget to claim eligible expenses for their practice.

- Failing to Track Receipts: Without proper documentation, deductions may be denied.

- Overlooking Retirement Contributions: Missing opportunities to contribute can cost tax savings.

- Mixing Personal and Professional Finances: Keeping separate accounts is crucial for clarity and compliance.

- Not Consulting Experts: Attempting tax planning without guidance may reduce potential benefits.

Planning for Retirement and Long-Term Financial Health

Doctors often focus on immediate earnings but planning for the future is equally important. Strategic retirement planning can reduce current taxes while securing financial stability.

- Maximize Contributions: Doctors may contribute more than typical employees to tax-advantaged retirement accounts.

- Use Pension Plans: Certain professions offer specific plans with unique tax benefits.

- Health Savings Accounts: HSAs can serve as a long-term investment tool with tax advantages.

- Regular Reviews: Adjusting contributions and investments periodically may improve outcomes.

- Combine Tax and Retirement Planning: Integrating these can ensure lower taxes today and sufficient income tomorrow.

Doctors can reduce tax liabilities by leveraging deductions, structuring income efficiently, and adopting strategic financial planning. Understanding the differences between self-employed and salaried doctor taxation is essential for optimizing tax benefits. Engaging a tax consultant can simplify compliance and enhance savings. Accounts Junction provides specialized tax planning services tailored for doctors, ensuring accurate tax filings, strategic financial management, and maximum tax benefits. Account Junction offers accounting and bookkeeping services for doctors. We handle taxes, records, and compliance to keep finances accurate and organized. Our team ensures all work is done on time and follows the rules, so doctors can focus on their patients and practice without worry.

We provide full services for both self-employed and salaried doctors. This includes bookkeeping, tax filing, expense tracking, and payroll management. Our solutions follow all rules, save money, and make financial work easier. By using Account Junction, doctors can have clear records, lower stress, and more time to focus on their medical work.

FAQs

1. What is doctor taxation?

- It is the tax system that applies to doctors’ income from jobs, clinics, or private work.

2. Why do doctors need tax planning?

- Doctors have multiple income streams, so planning can reduce taxes legally.

3. Which work costs can doctors claim?

- Doctors may claim tools, clinic rent, bills, insurance, and membership fees.

4. Are courses and certifications deductible?

- Yes, classes or workshops for skill growth may be claimed.

5. How can self-employed doctors lower their taxes?

- They can claim business costs, save in retirement accounts, or delay income.

6. What tax benefits does incorporating a clinic give?

- It can reduce personal tax, allow business deductions, and help plan retirement.

7. Can doctors claim car costs for visits?

- Yes, fuel, repairs, and trips for work may be claimed if documented.

8. What is income splitting for doctors?

- Doctors may share income with family to reduce total tax legally.

9. Are malpractice and liability insurance premiums deductible?

- Yes, paying for malpractice or liability insurance may lower taxable income.

10. How do retirement contributions affect taxes?

- Saving in approved plans can reduce taxes and help future funds.

11. Can doctors defer income to save tax?

- Yes, delaying pay or bonuses may reduce the current year’s tax.

12. Which home office costs can doctors claim?

- Rent, internet, and utility bills may count if the space is used for work.

13. Why should doctors hire a tax consultant?

- They can find all deductions, plan income, and ensure tax rules are met.

14. What common tax mistakes do doctors make?

- Missing business costs, mixing personal and clinic accounts, or skipping savings are common.

15. Can doctors claim depreciation on medical tools?

- Yes, expensive tools can be written off over the years to lower taxes.

16. Are travel and conference costs deductible?

- Trips for work, seminars, or training may be claimed.

17. How do self-employed doctors handle social taxes?

- They pay self-employment tax, which covers Social Security and Medicare.

18. Can tax planning be linked to investments?

- Yes, using retirement accounts or tax-saving investments may reduce taxes.

19. How often should doctors review tax plans?

- Checking yearly can ensure deductions are claimed and rules are followed.

20. Can professional memberships reduce taxes?

- Yes, fees for medical societies or associations may be claimed as deductions.