Risks of Startup Formation for Startup Investors

Starting a new business is an exciting journey full of opportunities and innovation. These challenges matter to startup investors as well, since they study how the business handles risk. The formation of a startup involves turning an idea into a functional business. Understanding these risks and proactively addressing them can be the difference between success and failure for a new company.

One of the most significant challenges faced by entrepreneurs is managing the financial, legal, and operational risks. As a startup, entrepreneurs often have limited resources and experience. This makes it crucial to carefully navigate the complexities of business formation. Startups face financial, legal, and operational risks. Proper accounting services can help mitigate these challenges.

Key Financial Risks Faced by a Startup Company

Financial risks are perhaps the most pressing concerns for any startup company. Without adequate capital, a business may struggle to grow and maintain operations. Understanding and managing these risks is essential to ensuring the long-term viability of the company.

1. Insufficient Capital: One of the primary risks startups face is running out of capital before reaching profitability. Startup costs can quickly add up. Many entrepreneurs struggle to secure enough funding to keep the business running. Investors, especially startup investors, carefully evaluate a startup's capital structure. They also consider the funding requirements before investing.

2. Cash Flow Management: A major risk for any small business start-up is managing cash flow. Startups often struggle with managing daily expenses. They may also face delays in receiving payments from clients or customers. Startups need to create a strong financial plan and track expenses carefully.

3. Overestimating Revenue: Many new startups tend to overestimate their expected revenue, often driven by the excitement of their new venture. This can lead to unrealistic budgeting and spending, which can strain finances. Accounting services for startups help create a realistic financial forecast. They also monitor income and expenses to avoid financial strain.

4. Debt Risks: Many startups rely on loans or other forms of debt to fund their operations. However, failure to manage this debt can lead to financial distress. This may reduce its ability to attract future investors or lenders.

How Startup Investors Evaluate Risk Before Investing

Startup investors focus on small business start-ups and carefully evaluate the risks involved. They take a detailed approach when assessing new businesses. Before investing in a startup, investors want to ensure the business has long-term potential. They look for signs of success in the future.

1. Business Model: Investors first assess the business model of the startup. They want to understand how the business plans to generate revenue and its long-term sustainability. A scalable and profitable business model is often key to attracting investment.

2. Management Team: The experience and skill set of the management team play a significant role in the investment decision. Startup investors look for a strong leadership team. This team should be able to handle startup challenges and manage risks effectively.

3. Market Potential: The market opportunity and demand for the startup’s product or service are crucial. Investors will evaluate whether the startup has the potential to grow and capture a significant market share. A well-defined target audience and an understanding of market trends can help reduce the perceived risk.

4. Financial Health: Startup investors will review the business's financial health. This includes analyzing cash flow, revenue projections, and past financial performance. A strong financial foundation and realistic projections are important for investors to feel confident in the startup’s future.

Common Legal and Compliance Risks for Small Business Startups

Legal and compliance issues are major risks for any startup. Navigating them can be challenging for new entrepreneurs. Not following regulations or structuring the business correctly can lead to fines and penalties. In some cases, it may even result in legal action. Some common legal and compliance risks include:

1. Business Structure: A good structure also gives more comfort to startup investors, as it lowers legal stress and tax issues. Whether it’s a sole proprietorship, partnership, corporation, or LLC, each structure comes with different legal and tax implications. A poorly chosen structure can expose the business to liability risks and tax burdens.

2. Intellectual Property Issues: Protecting intellectual property (IP) such as patents, trademarks, and copyrights is another common legal risk for startups. Failing to secure the necessary IP rights can result in losing valuable assets or facing legal challenges from competitors.

3. Employment and Labor Laws: As a startup grows, it must adhere to labor laws, including employee contracts, benefits, and workplace safety regulations. Violations of these laws can result in lawsuits or costly settlements. Ensuring compliance with labor laws is a crucial aspect of risk management for startups.

4. Regulatory Compliance: Many industries are subject to strict regulatory frameworks, and failing to comply with these regulations can have severe consequences. Startups need to stay up to date with all relevant laws and regulations to avoid potential penalties.

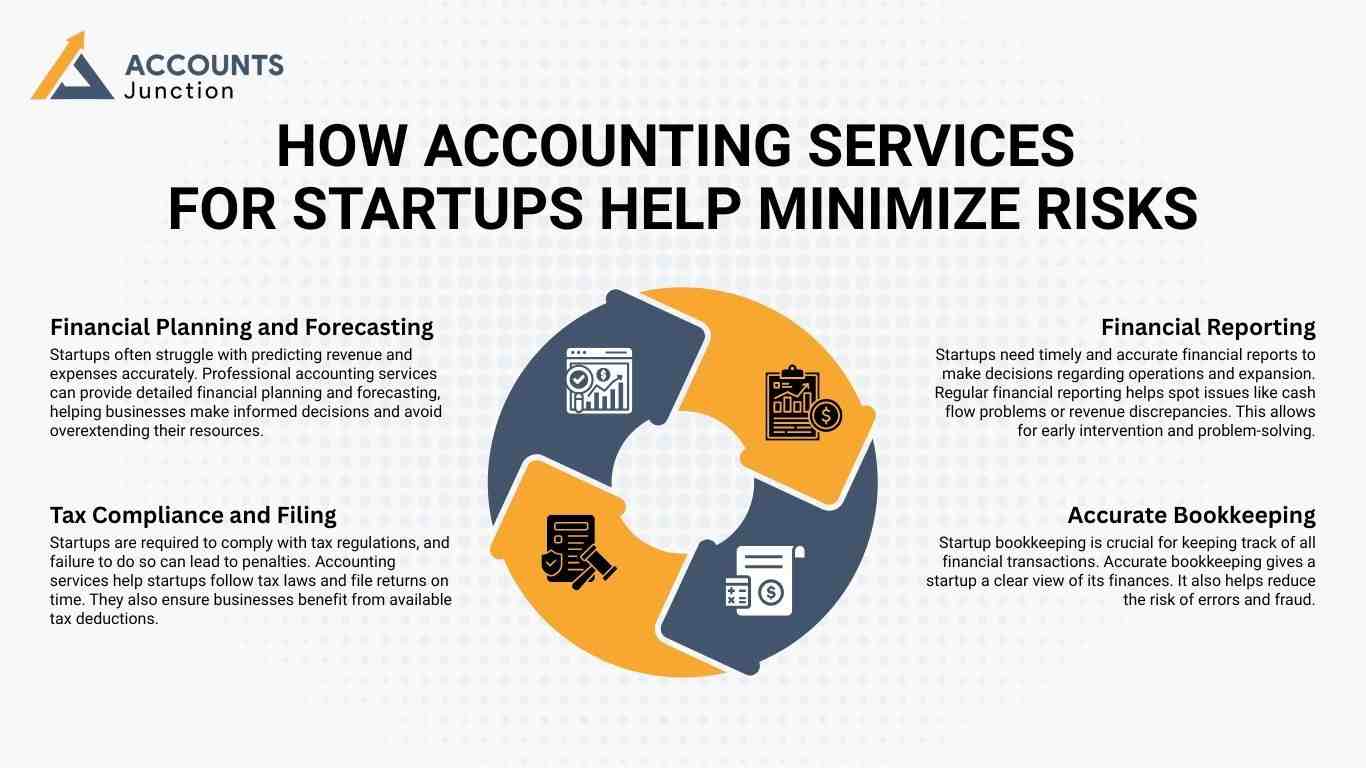

How Accounting Services for Startups Help Minimize Risks

Accounting services for startups play a vital role in reducing financial, legal, and operational risks. A strong accounting system helps a startup follow regulations and keep clear financial records. It also ensures better cash flow management.

1. Financial Planning and Forecasting: Startups often struggle with predicting revenue and expenses accurately. Professional accounting services can provide detailed financial planning and forecasting, helping businesses make informed decisions and avoid overextending their resources.

2. Tax Compliance and Filing: Startups are required to comply with tax regulations, and failure to do so can lead to penalties. Accounting services help startups follow tax laws and file returns on time. They also ensure businesses benefit from available tax deductions.

3. Accurate Bookkeeping: Startup bookkeeping is crucial for keeping track of all financial transactions. Accurate bookkeeping gives a startup a clear view of its finances. It also helps reduce the risk of errors and fraud.

4. Financial Reporting: Startups need timely and accurate financial reports to make decisions regarding operations and expansion. Regular financial reporting helps spot issues like cash flow problems or revenue discrepancies. This allows for early intervention and problem-solving.

Operational Risks That May Affect Startup Success

Beyond money and laws, the daily running of the business carries its own set of risks. The smooth flow of operations may decide whether the company moves forward or gets stuck.

-

Weak Internal Processes

Some startups run on excitement instead of systems. They work without proper guidelines or roles. This lack of order may also worry startup investors, as they look for stable internal systems. Customers may feel disappointed. Employees may feel lost. Investors may sense instability.

-

Technology Failures

Most startups depend on digital tools. A sudden software glitch or system crash can break the workflow. If the startup does not back up its data or fails to maintain tools, it may lose important information. Recovering from such loss may take time and money.

-

Supply Challenges

Startups that depend on suppliers, vendors, or external partners may face delays. If a vendor fails to deliver on time, the entire business may slow down. Having alternative sources may reduce this risk.

-

Customer Service Issues

A single bad customer experience may spread quick dislike across the market. When customer support is slow or unclear, trust breaks. Once trust fades, it becomes hard to rebuild.

Market and Competition Risks That New Ventures Often Overlook

Even when the startup is doing well internally, the outside world can change in ways the founders never predicted.

-

Shifts in Customer Behavior

People change their preferences often. What excites them today may bore them tomorrow. If the startup fails to adapt, it may fall behind.

-

Strong Competitors

New competitors may enter the market with better offers or lower prices. If the startup does not improve its product, it may lose customers.

-

Economic Changes

Slow markets, price rises, and uncertain economic conditions may reduce buying power. Startups that depend on fast sales may feel pressure.

-

Industry Trends

When industry rules or trends change, startups must move with them. Staying outdated can turn into a major risk.

How Startup Investors Can Reduce Their Own Investment Risks

Investors also have ways to protect themselves. Their approach may change the future of the startup.

-

Detailed Due Diligence

Before investing, they may study the business from every angle. They check the market, the team, the product, and the finances.

-

Regular Monitoring

Many investors prefer to stay active. They may ask for monthly reports and may guide the founders when needed.

-

Diversified Investments

Instead of placing all money into one startup, they invest in many. This spreads the risk.

-

Mentor Support

Some investors give not only money but also advice. They help founders avoid mistakes and plan smarter steps.

Starting a new business comes with risks that every entrepreneur should understand. Having the right accounting support—such as accurate bookkeeping, financial planning, and risk management- can help your startup grow while avoiding common pitfalls.

Accounts Junction offers specialized accounting services for startups. We provide accurate bookkeeping, tax compliance, and cash flow management, helping your business stay organized and make informed financial decisions.

With expertise in QuickBooks, Xero, and Zoho Books, we make accounting simple and reliable, so you can focus on growing your startup while we handle your finances efficiently.

FAQs

1. What are startup formation risks?

- These are uncertainties that may appear when a new business is created. They can affect investor confidence and long-term growth.

2. Why do startup investors examine risks before investing?

- They do this to understand how stable the startup may be in the coming years. It helps them judge the safety of their investment.

3. How can insufficient capital become a risk for investors?

- Low funds can stop operations and stall growth. This may reduce the chances of investor returns.

4. Why is cash flow risk important for startup investors?

- Poor cash flow can interrupt daily tasks. Investors may see this as a sign of weak financial control.

5. Can unrealistic revenue projections increase the risk for investors?

- Yes, inflated revenue forecasts may hide financial gaps. Such gaps can affect investor trust.

6. Why do investors assess the startup’s leadership team?

- A strong team may handle problems with better clarity. Investors often feel safer when leadership appears capable.

7. How can weak market demand raise investor risk?

- Low demand can slow product adoption. This may delay or reduce the investor’s expected return.

8. Why does the choice of business structure matter to investors?

- The structure can affect taxes, compliance, and liability. A poor choice may expose investors to higher risks.

9. How do intellectual property issues affect investor decisions?

- Weak IP protection may lead to disputes or loss of unique ideas. This can reduce the value of the startup.

10. Can compliance failures increase investment risk?

- Yes, regulatory mistakes may bring penalties or lawsuits. These issues can reduce investor confidence.

11. Why is financial transparency important for investors?

- Clear records help investors understand the company’s health. Lack of transparency may signal hidden risks.

12. Can poor financial forecasting worry startup investors?

- Yes, weak forecasting may lead to bad decisions. Investors may see it as a sign of poor planning.

13. How does high debt create investor risk?

- Heavy debt can limit growth and cash flow. Investors may fear delayed returns.

14. Why do investors review financial reports carefully?

- Reports may reveal risks not visible on the surface. They also show how funds are being managed.

15. Can operational risks reduce investor confidence?

- Yes, unclear processes or weak systems may slow progress. Investors may see this as a structural weakness.

16. How can vendor dependence create risk for investors?

- If one vendor fails, operations may stop. This can affect revenue and investor returns.

17. Why do market changes matter to startup investors?

- Sudden shifts in demand can reduce sales. Investors may view this as a long term threat.

18. Can strong competitors increase investor risk?

- Yes, powerful competitors may take market share. This can reduce the startup’s growth pace.

19. How do data security issues affect investors?

- Data leaks may damage brand trust. This can reduce the value of the investment.

20. Can technology failures impact investor confidence?

- Yes, system breakdowns may interrupt key services. Investors may consider this an operational weakness.

21. Why do investors care about proper accounting systems?

- Good accounting may reflect discipline and accuracy. Poor systems can hide financial problems.

22. Can poor tax planning raise investor concerns?

- Yes, tax mistakes may lead to penalties. This may reduce profits and investor returns.

23. Why is regular financial reporting valuable for investors?

- Reports help investors track progress and stability. They also offer early signs of risk.

24. Can reliable forecasting attract more investors?

- Yes, strong forecasts may show preparedness. This can reduce the perception of risk.

25. How does solid financial management protect investor interests?

- It ensures smoother operations and steady growth. Investors may feel safer when the finances are well managed.