Outsourcing Tax Return Preparation & Planning by Expert CPAs

Many businesses and individuals now look at outsourcing tax return preparation as a way to reduce their burden. Expert CPAs can eliminate all the pressure you may face during the tax season. They can make the process smoother, smarter, and even more reliable. But is it worth outsourcing these tasks to CPAs? Why do so many companies prefer an external CPA team instead of doing it all in-house? In this blog, we’ll answer all your questions related to outsourcing tax return preparation.

Understanding Outsourcing in Tax Preparation

What It Means

Outsourcing tax return preparation simply means letting an outside professional or CPA firm handle your tax tasks. Instead of doing every entry or form yourself, you rely on experts who live and breathe tax laws.

It may sound like handing over control, but it often feels like gaining peace. Expert CPAs know where details hide and what numbers mean when matched with the right rule.

Why It’s Becoming Common

Outsourcing has become more common for a few simple reasons:

- Complex Tax Laws – Tax rules keep changing, and it can be hard to keep up.

- Time Saving – What takes you hours may take a CPA only minutes.

- Error Reduction – Small mistakes can cost a lot later. CPAs know how to spot them early.

- Focus on Core Work – You can focus on your business while experts handle the forms.

How Expert CPAs Handle Tax Return Preparation

When you work with an experienced CPA firm, every step feels more structured. Here’s how the process usually unfolds.

1. Data Collection and Review

The CPA first gathers all financial records — invoices, receipts, bank details, and payroll data. Every document is checked for clarity. Missing papers may be requested before the process starts.

2. Verification of Entries

Numbers are verified one by one. The CPA ensures that every figure aligns with official statements. Any mismatch is clarified before filing.

3. Applying Tax Rules

Tax codes can be confusing, but CPAs know how to match them to each case. Deductions, credits, and adjustments are used carefully to lower the tax burden where possible.

4. Filing the Return

Once everything is reviewed, the return is filed on time. A good CPA will also guide you on submission status, confirmation, and any future notices.

5. Post-Filing Support

The work doesn’t end after filing. CPAs may offer post-filing support, like responding to tax queries or audits, and keeping your records ready for next year.

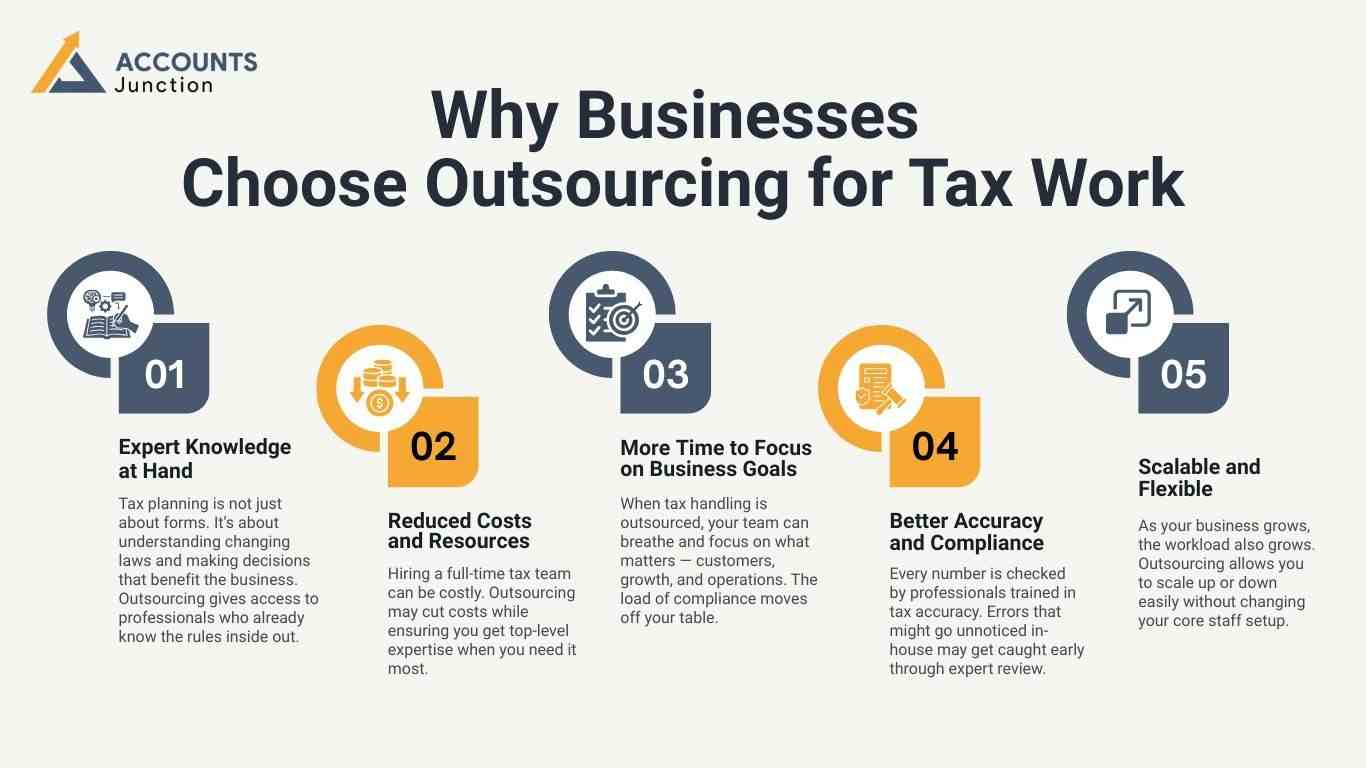

Why Businesses Choose Outsourcing for Tax Work

Expert Knowledge at Hand

Tax planning is not just about forms. It’s about understanding changing laws and making decisions that benefit the business. Outsourcing gives access to professionals who already know the rules inside out.

Reduced Costs and Resources

Hiring a full-time tax team can be costly. Outsourcing may cut costs while ensuring you get top-level expertise when you need it most.

More Time to Focus on Business Goals

When tax handling is outsourced, your team can breathe and focus on what matters — customers, growth, and operations. The load of compliance moves off your table.

Better Accuracy and Compliance

Every number is checked by professionals trained in tax accuracy. Errors that might go unnoticed in-house may get caught early through expert review.

Scalable and Flexible

As your business grows, the workload also grows. Outsourcing allows you to scale up or down easily without changing your core staff setup.

Tax Planning and Strategy Through Outsourcing

The Role of CPAs in Tax Planning

Tax planning is not only about filing returns. It’s about preparing the future. Expert CPAs analyze your financial structure and find ways to reduce tax liability within legal limits.

They look at income, expenses, and timing. When handled smartly, planning may help save money and prevent tax shocks.

Strategic Steps CPAs Often Take

- Identifying Deductions – CPAs may point out deductions that most people miss.

- Adjusting Income Timing – Income deferral or prepayment can influence tax outcomes.

- Expense Management – Knowing when to spend or record expenses can make a difference.

- Investment Planning – Certain investments can bring tax benefits, and CPAs guide you on those.

Year-Round Support

Many think of taxes only during the season, but outsourced CPAs often work year-round. They track your numbers, plan your strategy, and prepare reports long before deadlines.

The Benefits of Outsourcing Tax Return Preparation

Here are some key benefits of outsourcing tax return preparation:

1. Less Stress, More Confidence

Tax work may be full of deadlines and small errors. Outsourcing gives you peace, knowing that trained professionals are managing every number.

2. Access to Updated Knowledge

Tax rules change often. CPAs stay updated with every revision, saving you from confusion.

3. Cost Efficiency

Instead of paying for full-time staff, you only pay for services when needed. That means fewer fixed costs and better budgeting.

4. Faster Turnaround

Outsourced firms use advanced tools and trained staff to complete returns faster and more efficiently.

5. Security of Data

Professional CPA firms usually follow strict data protection measures. Your financial information stays private and safe.

6. Planning Support

Beyond return filing, you gain advice on how to plan for next year’s taxes in a smarter way.

What to Look for When Outsourcing Tax Return Preparation

Choosing the right CPA or firm matters more than most realize. Here are a few things to check before you hand over your tax data.

- Experience and Credentials – Always check for proper certification and experience in handling similar cases.

- Reputation – Look for reviews, references, or client feedback.

- Service Range – Some firms only file returns, while others offer planning and advisory services.

- Data Security – Make sure the firm uses secure systems to protect your files.

- Pricing Structure – Ask for clear quotes and avoid hidden fees.

- Communication – Smooth and open communication helps avoid delays or confusion.

How Outsourcing May Change Your Tax Approach

From Reactive to Proactive

When taxes are handled in-house, most people rush when deadlines near. With outsourcing, planning becomes proactive. CPAs monitor your books all year, not just in tax season.

From Uncertain to Confident

Knowing experts are reviewing your numbers can bring calm. Every small doubt about compliance may fade away with time.

From Manual to Digital Ease

Most outsourced services now use cloud tools. You may upload documents, review updates, and even get reminders online. Everything becomes simpler.

Possible Challenges in Outsourcing Tax Return Preparation

While outsourcing has clear benefits, a few challenges may arise if not managed well.

1. Communication Gaps

If instructions are unclear or updates are missed, errors can happen. Setting up clear channels from the start helps.

2. Data Security Concerns

Always confirm how the firm stores and transfers data. Reputed firms use encrypted systems to ensure safety.

3. Dependence on External Teams

Some feel less control when tasks are done externally. Yet with the right CPA, this worry may fade once trust builds.

When Should You Consider Outsourcing?

You might wonder when the right time is. Here are a few signs that outsourcing may help:

- You spend too much time on taxes and less on core work.

- You feel unsure about new tax laws.

- You’ve had errors or penalties in past filings.

- You want better insight into future tax planning.

- Your business has grown and needs expert attention.

If even two of these sound familiar, outsourcing may be worth exploring.

In-House vs. Outsourcing Tax Return Preparation

|

Aspect |

In-House |

Outsourced |

|

Cost |

Fixed salary and resources |

Pay per project or season |

|

Expertise |

Limited to team skill |

Access to expert CPAs |

|

Flexibility |

Less flexible |

Highly scalable |

|

Compliance |

May miss updates |

Regularly updated |

|

Time Use |

Focus split |

More focus on business |

How CPAs Bring Long-Term Value

CPAs don’t just prepare taxes. They bring vision. A good CPA looks beyond numbers to find patterns — ways to grow, save, and plan better.

When they manage your tax preparation, they also help you build a stronger future. With time, that support can turn into a partnership that keeps your finances clear and your mind calm. At Accounts Junction, we have CPAs who work for companies around the world. By outsourcing tax return preparation to us, you no longer have to worry about missing deadlines. Contact us now to outsource tax return preparation to experts.

FAQs

1. What does outsourcing tax return preparation mean?

- It means hiring an external CPA or firm to manage and file your tax returns.

2. Can outsourcing save time during tax season?

- Yes, CPAs handle the full process faster than internal teams.

3. Is it safe to share financial data with outsourced CPAs?

- Reputed firms use secure systems and keep your data protected.

4. How do outsourced CPAs reduce errors?

- They review each document and cross-check entries with current laws.

5. Does outsourcing cost more than hiring an employee?

- Usually not. You pay for the service only when you need it.

6. Can CPAs help in tax planning too?

- Yes, most provide both preparation and long-term tax planning advice.

7. What type of businesses outsource tax preparation?

- Small, medium, and even large firms often outsource to save time and resources.

8. Do outsourced firms handle individual tax returns too?

- Yes, many assist both individuals and businesses.

9. Will I still have control over my tax data?

- Yes, you always have access and final approval over every filing.

10. How do I choose the right CPA firm?

- Check their experience, reputation, pricing, and data security.

11. Can outsourcing help with year-round tax management?

- Yes, CPAs can monitor records and prepare plans through the year.

12. What happens after filing the return?

- CPAs provide reports and may support you in case of any queries.

13. Can I outsource only part of my tax process?

- Yes, some firms offer flexible packages to match your needs.

14. How early should I start the outsourcing process?

- Starting a few months before the deadline gives the best results.

15. Do outsourced CPAs work with cloud software?

- Most do. It makes sharing and tracking documents much easier.

16. Can outsourcing help avoid tax penalties?

- Yes, accurate and timely filing helps prevent unnecessary fines.

17. Are outsourced services affordable for small businesses?

- Yes, pricing is often tailored to small business budgets.

18. How can outsourcing improve future planning?

- CPAs analyze trends to guide better financial and tax decisions.

19. What if I’m not happy with the service?

- You can switch firms anytime. Contracts are usually flexible.

20. Is outsourcing useful for freelancers or professionals?

- Yes, even independent professionals benefit from expert CPA help.