What is the importance of managing accounts receivable?

Every business runs on money that comes and goes. Some cash comes fast, some takes time. When customers buy now and pay later, that unpaid amount is called accounts receivable. It may look small on paper, but it holds great weight. If those payments do not come on time, cash flow may slow down. Hence, managing accounts receivable matters a lot.

It helps a business track what is owed, when it is due, and who must pay. It also makes sure that money does not stay locked outside for too long. Good receivable management may not only keep cash steady, but also build trust with customers. It can show discipline, care, and respect for both sides of a deal.

In this blog, we will walk through what managing accounts receivable means, why it can be so important, and how businesses may handle it better to stay strong and worry free.

Understanding Accounts Receivable

Every time a company sells goods or gives services but does not receive cash right away, that due amount sits as accounts receivable.

It can be thought of as money that will soon walk in, but not yet. It rests in the books, waiting for customers to pay.

Why It Exists

In simple words, businesses often allow customers to buy first and pay later. This may build trust, help close more sales, and create loyal buyers. But it also means waiting for payment.

When payments get delayed, the balance can grow. And when it grows too long, cash can shrink. So, managing accounts receivable becomes more than record keeping—it becomes a way to protect the company’s pulse.

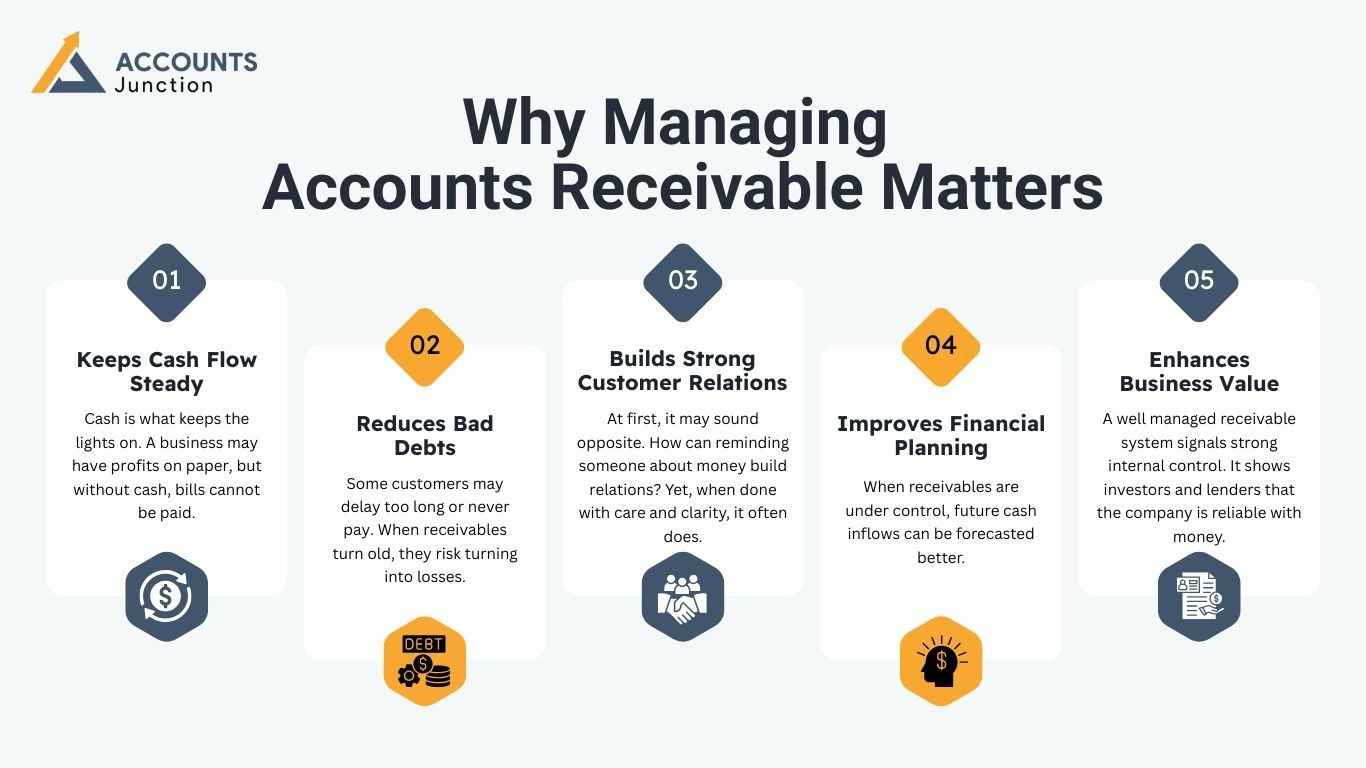

Why Managing Accounts Receivable Matters

Money due from customers can sound harmless. Yet, if not tracked, that harmless figure may cause trouble. Managing accounts receivable may seem simple on paper, but in practice, it decides whether the company runs smooth or stumbles.

Let’s walk through the main reasons why managing accounts receivable holds such weight.

1. Keeps Cash Flow Steady

Cash is what keeps the lights on. A business may have profits on paper, but without cash, bills cannot be paid.

When accounts receivable are managed well, cash comes in on time. That steady inflow may support daily needs, salaries, and new stock purchases. It can also keep owners from borrowing unnecessarily.

2. Reduces Bad Debts

Some customers may delay too long or never pay. When receivables turn old, they risk turning into losses.

With proper management, reminders go out early, and overdue accounts can be spotted fast. That means fewer bad debts and fewer unpleasant surprises during audits.

3. Builds Strong Customer Relations

At first, it may sound opposite. How can reminding someone about money build relations? Yet, when done with care and clarity, it often does.

Clear terms, polite follow ups, and consistent communication show professionalism. Customers may respect that, and trust grows when both sides stay transparent.

4. Improves Financial Planning

When receivables are under control, future cash inflows can be forecasted better.

A company may plan expenses, investments, and projects with more confidence. Sudden shortages may get avoided because the timing of payments is known.

5. Enhances Business Value

A well managed receivable system signals strong internal control. It shows investors and lenders that the company is reliable with money.

When due amounts stay within reasonable limits, the balance sheet looks healthier. That can increase credibility and open doors to better funding.

How to Manage Accounts Receivable Effectively

Managing accounts receivable is not just about collecting payments. It’s about setting systems that make payment delays less likely.

Below are some practical steps that may help any business stay ahead.

Step 1: Set Clear Credit Policies

Before allowing any customer to buy on credit, clear rules should exist.

Points to consider:

- How much credit can be given?

- What will be the payment period?

- Are there discounts for early payment?

- What happens if payment delays?

Such clarity can reduce confusion later and make collections smoother.

Step 2: Send Invoices Promptly

A delay in billing may cause a delay in payment. Once a sale is done, invoices should go out fast.

Tips for better invoicing:

- Mention due dates clearly.

- Include payment methods and contact details.

- Keep records organized.

This small habit may prevent large payment gaps.

Step 3: Track Payments Regularly

Every invoice sent should be tracked until payment arrives.

Businesses can use accounting software to record each transaction and monitor pending amounts. A regular review of the aging report may show which accounts need attention.

It’s often easier to remind customers early than to chase long overdue ones.

Step 4: Communicate Often but Kindly

Collection calls need not sound harsh. A simple reminder or a friendly message may work better.

Gentle communication can maintain goodwill while keeping payments on track.

Step 5: Offer Payment Options

Sometimes, delays happen because customers find the payment method hard. Allowing multiple options like online transfers, cards, or digital wallets can speed up the process.

Flexibility often brings results faster.

Step 6: Monitor Credit Limits

Even loyal customers may go through financial trouble. Reviewing their payment behavior and adjusting their credit limit may prevent future losses.

This doesn’t mean cutting relations but balancing trust with safety.

Step 7: Use Automation Tools

Modern accounting tools can send automatic reminders, update payment records, and show aging reports instantly.

Automation reduces manual work and may reduce errors too. It saves time and helps focus on strategy instead of chasing payments.

Step 8: Analyze Receivable Trends

Monthly or quarterly analysis can reveal patterns. For instance:

- Which customers delay often?

- Which regions pay faster?

- What percentage turns overdue?

Such insights may help redesign credit terms or improve customer selection.

The Link Between Cash Flow and Receivables

Cash flow and receivables walk hand in hand. When one suffers, the other follows.

Even if sales increase, if receivables pile up, the cash flow may still stay weak.

Timely management ensures that every sale eventually becomes usable cash. Without that, paper profits may exist, but real growth may freeze.

Businesses that monitor receivables weekly often find fewer surprises at month end.

Common Challenges in Managing Accounts Receivable

Managing accounts receivable can sometimes feel like juggling. Let’s look at a few common roadblocks and how they may be handled.

1. Late Payments

Some customers may simply forget or ignore due dates. Early reminders and incentives for prompt payment may fix this.

2. Disputed Invoices

Errors in invoices may cause delay. Double checking before sending may prevent confusion.

3. Poor Record Keeping

Unorganized records can make tracking tough. Using software may make it cleaner.

4. Lack of Credit Checks

Extending credit without checking a customer’s background may invite risk. A basic check can save future losses.

5. Weak Follow-Up

If follow-ups stop too soon, overdue accounts grow. Consistency matters more than pressure.

Building a Receivable Management Strategy

Every business, big or small, can have a simple receivable plan. It may include:

- Credit approval process – Who decides the credit limit?

- Invoice cycle – When and how are invoices sent?

- Follow-up schedule – How often are reminders sent?

- Escalation steps – What happens if payment crosses 60 or 90 days?

- Review meetings – How often is the receivable aging reviewed?

A routine system reduces stress and brings order.

Signs That Receivable Management Needs Attention

Sometimes, the numbers themselves speak. Here are some signs that managing accounts receivable needs tightening:

- Cash balance keeps dipping even when sales rise.

- Many invoices cross the due date.

- Staff spends too much time chasing payments.

- Customer complaints about unclear terms keep rising.

- Credit notes or adjustments grow too frequent.

When these signs appear, it may be time to review the process.

Long-Term Benefits of Managing Accounts Receivable

Beyond short-term relief, a good receivable process may bring lasting advantages:

- Stronger financial stability

- Better relationships with customers

- Improved trust with investors

- More predictable revenue

- Lower borrowing needs

Each of these outcomes builds over time through consistency and care.

Simple Tips for Small Businesses

For small firms that may not have a full finance team, here are easy habits:

- Keep invoices simple and clear.

- Record every sale on the same day.

- Set reminders for follow-up.

- Stay polite in every message.

- Review unpaid amounts weekly.

Even small improvements may make big differences over months.

How Accounting Professionals Can Help

Hiring an accountant or using outsourced accounting services may reduce the burden.

Professionals can track due amounts, prepare reports, and communicate with clients. They can also create a plan to keep receivables under control. At Accounts Junction, we house professional bookkeepers who manage accounting and bookkeeping for companies around the world. Our support allows business owners to focus more on sales and less on chasing payments.

Contact us now for smooth receivables management services.

FAQs

1. What does managing accounts receivable mean?

- It means tracking and collecting payments owed by customers after sales made on credit.

2. Why is managing accounts receivable important?

- It helps maintain steady cash flow and prevents payment delays.

3. How does poor receivable management affect a business?

- It may cause cash shortages and increase bad debts.

4. What is an aging report?

- An aging report shows how long customer invoices have remained unpaid.

5. Can technology improve receivable management?

- Yes, accounting software can automate tracking and reminders.

6. How often should businesses review receivables?

- Most businesses review them weekly or monthly.

7. What is the best way to remind customers about payments?

- Polite emails or phone calls before the due date may work well.

8. How can small businesses manage receivables without a finance team?

- They can use simple invoicing tools and track due dates regularly.

9. What happens if receivables turn into bad debts?

- They become losses and reduce overall profit.

10. How do credit terms affect receivables?

- Shorter credit terms may bring cash faster but reduce flexibility for customers.

11. Why should invoices be sent quickly?

- Because faster invoicing often means faster payments.

12. What is a credit policy?

- It defines who can get credit, how much, and for how long.

13. How do discounts help in receivable management?

- Offering small discounts for early payment can encourage faster cash inflow.

14. Can managing accounts receivable improve customer relations?

- Yes, clear communication builds trust and avoids disputes.

15. Why do some invoices get disputed?

- They may have errors or unclear descriptions.

16. How do overdue accounts affect business reputation?

- Too many overdue accounts may signal weak control to investors.

17. Should old debts be written off?

- Yes, if recovery becomes unlikely after all efforts.

18. How can businesses reduce overdue payments?

- By sending timely reminders and setting clear terms before sales.

19. What tools help manage receivables?

- Tools like QuickBooks, Xero, and Zoho Books are common choices.

20. How does managing accounts receivable support business growth?

- It ensures steady cash that funds operations and expansion.