Online accounting services for eCommerce entrepreneurs

The eCommerce industry has changed how businesses work. It brings many new chances to grow. Still, tracking money and expenses can be hard. That’s where online accounting services for e-commerce help. They make it easy to manage cash and keep records correct. When finances are in order, business owners can focus on growth.

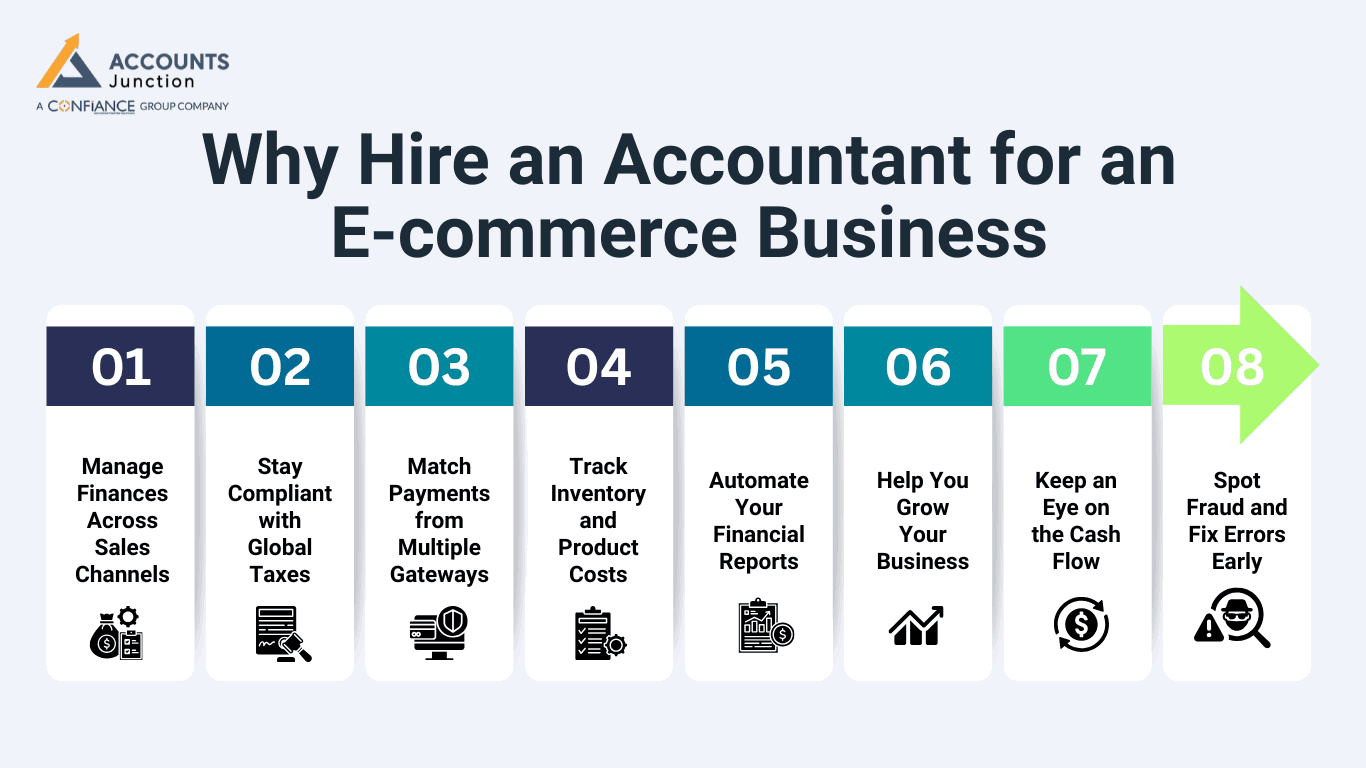

Why Hire an Accountant for an E-commerce Business

Running an online store isn’t easy, especially when managing money. A skilled accountant can help. They keep your records organized and your finances in good shape. That’s why hiring one is a smart move.

- Manage Finances Across Sales Channels

Selling on platforms like Shopify, Amazon, or Flipkart? An accountant keeps your financial data clear and in sync across all channels.

- Stay Compliant with Global Taxes

They handle VAT, GST, and income tax filings, making sure your business meets tax rules in different countries.

- Match Payments from Multiple Gateways

Whether it’s PayPal, Stripe, or Razorpay, accountants match incoming payments to sales, helping prevent errors.

- Track Inventory and Product Costs

They monitor your inventory and calculate the true cost of goods sold across each platform.

- Automate Your Financial Reports

Automation cuts down on manual entry. You get fast, accurate financial reports with fewer mistakes.

- Help You Grow Your Business

As your store expands, accountants adjust their support and offer advice to guide your decisions.

- Keep an Eye on the Cash Flow

They track your cash in and out to prevent shortfalls and keep your operations running smoothly.

- Spot Fraud and Fix Errors Early

A good accountant can catch problems before they grow, reducing the risk of fraud or costly mistakes.

Importance of E-commerce Bookkeeping Services

1. Keeps Your Financial Records Organized

- Tracks daily sales, expenses, and transactions.

- Provides a clear picture of your business performance.

- Reduces the risk of missing important expenses or entries.

2. Ensures Accurate Tax Compliance

- Helps avoid mistakes in tax filings.

- Maintains proper documentation for audits and reporting.

- Keeps you prepared for deadlines and tax requirements.

3. Simplifies Budgeting and Planning

- Offers clear insights into cash flow and spending patterns.

- Makes it easier to plan for growth and future investments.

- Supports informed decision-making with reliable data.

4. Strengthens Financial Health

- Builds a strong base for your business’s financial stability.

- Helps identify areas of profit and loss effectively.

- Reduces errors and improves overall financial control.

5. Benefits of Adding Accounting Services

- Provides deeper insights into revenue, expenses, and profits.

- Helps in creating more accurate financial reports.

- Enhances control over your finances and business decisions.

What to Expect from Accounting Services for E-commerce

Running an online store means handling more than just sales. Good financial support helps you stay organized, plan smarter, and grow with less stress.

Accounting services for e-commerce cover everything from bookkeeping and tax filing to cash flow planning and financial reports. These services are tailored to meet the unique needs of online sellers.

With accounting services for e-commerce, you can expect:

- Regular checks and matching of bank and sales platform transactions

- Monitoring inventory and calculating the cost of goods sold (COGS).

- On-time filing of VAT, GST, and income tax returns

- Profit and loss reports, sorted by each sales channel

- Forecasting tools to plan for peak seasons and inventory purchases

These services make day-to-day tasks easier. They ensure your e-commerce bookkeeping services support long-term growth and financial stability.

Top Online Accounting Services for eCommerce Businesses

If you run an eCommerce business, you need simple tools that grow with you. Here are the top online accounting picks:

Finaloop

- Tracks sales and costs live.

- Shows clear data to guide your choices.

Pilot

- Handles books, and taxes, and pays for your shop.

- Grows with your business needs.

LedgerGuru

- Tracks stock and orders with ease.

- Gives simple reports you can trust.

- Works with Shopify, Amazon, and more.

Acuity

- Cuts errors by doing tasks for you.

- Builds custom reports to show your wins.

eComBalance

- Tracks sales from Etsy, Walmart, Amazon, and Shopify.

- Focuses on clean books and eCom rules.

Invensis

- Fits its help to your goals and shop size.

- Links with QuickBooks, Xero, and eCom tools.

Xero

- Simple accounting software for growing eCommerce.

- Syncs with platforms like Shopify, eBay, and Amazon.

- Tracks cash flow and expenses with ease.

These tools help you stay on top of money tasks. They boost trust, save time, and guide smart moves.

Choosing E-commerce Accounting Services

Choosing the right accounting service is crucial for your online business. Here are key factors to keep in mind:

- Inventory Management

Track your stock correctly. Choose a service that helps you manage items and costs across all sales platforms. - Tax Compliance

Selling in different regions means different tax rules. A good accountant ensures timely filings and keeps you compliant with tax laws. - Multiple Revenue Streams

Selling on platforms like Amazon and Flipkart means income from many places. Clear bookkeeping keeps these records in order. - Payment Gateway Reconciliation

Using multiple payment methods can make records tricky. Reliable accounting services ensure all payments are matched and recorded accurately. - Software Integration

Make sure the accounting service connects with your sales platforms (Shopify, Amazon) and tools (Xero, QuickBooks). This ensures real-time, error-free data syncing. - E-commerce Experience

Pick a service with experience in online sales. They’ll manage returns, fees, and platform rules more efficiently. - Scalability

As your business grows, your accounting needs will too. Choose a provider that can keep up with your expanding sales and products.

Financial Forecasting for E-Commerce

What is Financial Forecasting?

Financial forecasting uses past business data to predict future trends in sales, expenses, and cash flow.

Why It Matters

- Plan for busy seasons: Prepare inventory and staffing for peak times.

- Handle slow periods: Avoid cash crunches during slower months.

- Guide investments: Decide wisely on marketing campaigns or stock purchases.

How It Helps

- Enables smarter budgeting.

- Reduces surprises in cash flow.

- Supports long-term growth strategies.

Benefits of Cloud-Based Accounting

What is Cloud Accounting?

Cloud accounting stores your financial data online, allowing real-time access from anywhere.

Key Advantages

- Access anywhere: View and update your books from any device.

- Error reduction: Automated entries lower the chance of mistakes.

- Collaboration: Work seamlessly with accountants or team members.

- Automatic updates: Your financial data is always current.

- Security and backup: Protect sensitive business information with strong encryption.

Integrating Accounting with Marketing and Operations

Why Integration is Important

Accounting is not just about numbers—it works best when connected with other business areas.

Benefits of Integration

- Identify profitable campaigns: See which marketing efforts yield the highest returns.

- Track product performance: Know which products or services generate more profit.

- Optimize spending: Allocate resources efficiently across operations and marketing.

- Make agile decisions: Quickly adjust strategies based on real-time financial insights.

How to Implement

- Use software that connects accounting, marketing, and inventory.

- Monitor reports regularly to spot trends and opportunities.

- Align budgets with business goals for smarter decision-making.

Running an online business comes with financial challenges. But with the right support, you don’t have to face them alone.

A skilled accountant and expert e-commerce bookkeeping services give you clarity and control. With accounting services for e-commerce, we help you stay organized, compliant, and ready to grow.

FAQs

1. What are e-commerce bookkeeping services?

- Services that track your online sales, expenses, taxes, and financial records to keep your e-commerce business organized.

2. Why is e-commerce bookkeeping important for online sellers?

- It helps manage cash flow, simplify tax filing, and gives clear insights into business performance.

3. Which platforms do e-commerce bookkeeping services support?

- Most services integrate with Shopify, Amazon, eBay, WooCommerce, and other major online marketplaces.

4. Can e-commerce bookkeeping services handle multiple sales channels?

- Yes, they track income from all marketplaces and unify records for accurate reporting.

5. How do bookkeeping services help with tax compliance?

- They organize transactions, calculate VAT, GST, and income tax obligations, and generate reports for filing.

6. Do e-commerce bookkeeping services track inventory?

- Yes, they monitor stock levels, calculate cost of goods sold, and alert you to discrepancies.

7. Can e-commerce bookkeeping services detect financial errors?

- Yes, they reconcile accounts and highlight mismatched transactions or unusual activity.

8. Are cloud-based e-commerce bookkeeping services safe?

- Yes, most use encryption, backups, and secure logins to protect your financial data.

9. How often should I receive financial reports?

- Reports can be daily, weekly, or monthly depending on your business needs.

10. Can these services handle international sales taxes?

- Yes, many track VAT, GST, and regional tax rules for cross-border transactions.

11. Do bookkeeping services work with multiple payment gateways?

- Yes, they can sync with PayPal, Stripe, Razorpay, and other payment processors.

12. How do e-commerce bookkeeping services save time?

- By automating entries, syncing platforms, and generating ready-to-use reports.

13. Can they help identify my most profitable products?

- Yes, sales and expense tracking reveal high-performing items and channels.

14. Are these services suitable for small e-commerce stores?

- Absolutely, they scale to fit businesses of any size.

15. Can e-commerce bookkeeping services prepare profit and loss statements?

- Yes, they provide detailed P&L reports for better decision-making.

16. Do these services integrate with accounting software like QuickBooks or Xero?

- Yes, integration ensures smooth data flow and reduces manual work.

17. Can forecasting tools in bookkeeping services help plan for peak seasons?

- Yes, they predict cash flow and inventory needs during busy periods.

18. How do bookkeeping services handle refunds and returns?

- They adjust sales, inventory, and tax records automatically to keep books accurate.

19. Can an accountant review e-commerce bookkeeping for accuracy?

- Yes, accountants validate reports, suggest improvements, and ensure compliance.

20. How do I choose the right e-commerce bookkeeping service?

- Look for platform integration, tax expertise, real-time reporting, and scalability.