Make Smarter Financial Moves with E-Commerce Accounting Outsourcing

Managing finances in an e-commerce business can be hard. Sales come with all sorts of receipts from different platforms, and the inventory is updated almost daily. There is a constant tax rule change that makes it more difficult to manage accounts without sufficient time and expertise. Hence, the smart and practical use of outsourcing in accounting for e-commerce could come in quite sharply. E-Commerce accounting outsourcing professionals minimize errors and improve accuracy. It also ensures you follow tax laws correctly. Experts handle tasks like bookkeeping, tax returns, inventory tracking, and financial reporting for you.

This lets you relax and avoid costly mistakes. Reliable financial data and clear insights provide a better basis for making decisions and planning the future. Outsourcing saves not just time and effort, but it also provides inexpensive support for long-term growth.

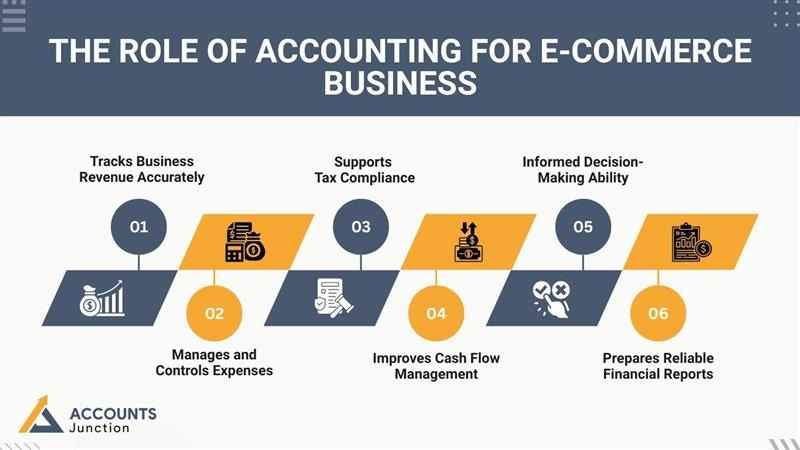

The Role of Accounting for E-commerce Business

Effective accounting is a dominant factor for an e-commerce business in stability and growth. Below are the key roles accounting serves in driving success for an e-commerce business:

1. Tracks Business Revenue Accurately

Accounting monitors revenue from all possible income sources, whether obtained through one or several channels like Amazon, Shopify, eBay, etc. Accurate revenue tracking allows business owners to understand which products or platforms are performing well.

2. Manages and Controls Expenses

E-commerce businesses have many expenses. These include inventory, shipping, marketing, and platform fees, among others. The costing system includes keeping track of these costs and ensuring they are optimized in management to maintain healthy profit margins

3. Supports Tax Compliance

Different regions have different tax requirements. Accounting ensures an accurate collection, proper recording, and filing of sales taxes, thus minimizing the risk related to penalties and legal issues.

4. Improves Cash Flow Management

Accounting offers the tools needed to see into income and expenses very clearly, which helps keep a balanced cash flow. Cash flow is important to keep things moving during slow sales periods or to handle sudden expenses.

5. Informed Decision-Making Ability

Accurate financial information assists the owner of the business in making sound decisions. It supports efforts to launch new products, modify pricing, or enter a new market.

6. Prepares Reliable Financial Reports

A good accounting professional helps keep all financial statements (profit & loss, balance sheet, cash flow statement) accurate and always up to date. These reports help measure the company's performance.

Key Accounting Challenges Faced by E-Commerce Businesses

Some accounting challenges are faced while doing an e-commerce business, all of which need proper financial management.

1. Multi-channel sales tracking: Selling on platforms like Amazon, Shopify, and eBay implies managing multiple streams of income. Tracking sales per different platform and bringing them onto a common financial report can be very repetitive and time-consuming.

2. Sales tax compliance: Different states and countries have different tax regulations. E-commerce businesses sell to customers in varying regions. It is important to ensure accurate tax collection and tax filing, and compliance with the tax laws of each jurisdiction.

3. Inventory management: Keeping accurate stock records is important to avoid overstocking or running out of goods. Multi-warehouse inventory management and real-time stock level updates could prove extremely difficult.

4. Payment reconciliation: E-commerce businesses receive payments through credit cards, PayPal, and bank transfers. Here and there, the payments would be compared with the sales transactions, and refunds can also be repetitive.

5. Fluctuating cash flow: The economic cycles are often affected by seasonality or are specific to marketing efforts. Market trends can also affect the cash flow. For example, a sudden drop in sales would create a cash flow problem that made unit cost-bearing expenses difficult. .

6. Foreign currency transactions: Most e-commerce businesses invest in international markets and deal in multiple currencies at the same time. Fluctuations in exchange rates concerning transaction fees must be recorded accurately to ensure profit maximization.

7. Refunds and chargebacks: Consumers typically return goods they buy or question the price being charged to their accounts to have refunds or chargebacks on their accounts. Monitoring these operations while keeping foolproof financial records may present problems.

8. Shipping and fulfillment costs: Shipping and packaging costs are an integral part of the operational costs of an E-commerce company. Transportation by third-party logistics must also be included in these charges. These charges differ for the number of orders and the destinations they are sent to.

E-commerce accounting outsourcing can help businesses navigate these complexities efficiently. Professional accounting services ensure accurate financial tracking, tax compliance, and effective cash flow management, allowing business owners to focus on growth and scalability.

Benefits of Professional Accounting for E-Commerce Businesses

It is indeed a good outsourcing of accounting for e-commerce businesses, providing them benefits, expertise, and solving problems in making financial and accounting operations simpler.

- Accurate financial reporting: Well-versed accountants ensure proper recording of all transactions to compile credible financial reports in accordance with tax rules and regulations.

- Time efficiency: Outsourcing accounting enables business owners to free up precious time so that it can be used for strategic activities such as marketing, product development or customer engagement.

- Cost savings: Hiring an in-house accountant can be prohibitively expensive for small- to medium-sized e-commerce businesses.

- Improved decision-making: Professional accounting services empower businesses with real-time financial insights that allow a superior understanding for good decision-making.

- Improved cash flow management: e-commerce companies can forecast expenses and profits very well due to professional accountants managing exchanges between accounts.

- Risk management: Professional accounting services help in identifying financial risks and executing strategies for mitigating them.

- Tax savings: Expert accountants know how to maximize tax deductions and credits, ensuring that e-commerce businesses pay the minimum tax required.

- Financial strategy development: Outsourced accounting also customizes long-term financial strategy building for budgeting and forecasting investments.

Outsourcing accounting for e-commerce businesses optimizes financial management within companies. Sufficiency in saving time and expenditure allows for well-informed decision-making to grow profits and effectiveness in the organization.

How E-Commerce Accounting Outsourcing Can Save Time and Costs

E-commerce accounting outsourcing is a cost-effective solution that allows businesses to:

- Integration of Technology: Outsourcing partners are using sophisticated accounting software. This will save businesses from investing in costly systems and provide inexpensive access to up-to-the-minute financial data.

- Less Errors: Professional accountants are very much far from errors; hence their financial reports are devoid of mistakes. This would prevent one from facing huge penalties or fines from the tax authorities.

- Save Time: Professional accountants deal with tax laws, invoices, and financial reports. This saves valuable time, which would otherwise be spent on other activities, such as product development, marketing, and customer service.

- Risk Management: Professional accounting services are necessary to businesses so that they know, at all times, the current status of financial regulations and tax laws. Therefore, it minimizes the risk of being non-compliant or managing finances inaccurately.

- Improved Cash Flow Management: Outsourced accounting firms will do more than improve cash flow forecasting and management. They will ensure that it is possible to open the floodgates when it is critically needed to maintain operations.

- Control on Cost: Outsourcing generally costs less than hiring such staff on a full-time basis. This point stands stronger when proper consideration is given to benefits plus training, and any other indirect costs.

- Financial Insight Access: Professional accountants can deliver valuable insight and analytics concerning the financial health of the business for better decision-making and planning.

- Faster Tax Filing and Refunds: Accounting Outsourcing is very useful for businesses as they file tax returns on time, resulting in speedy refunds and less risk of late fees or penalties.

- Better Financial Planning: The outsourced accountants assist the firms in budgeting, forecasting the financial aspects, and planning investments. They help businesses keep on the right track for long-term success.

Essential Accounting Services for E-Commerce Businesses

To maintain financial stability, e-commerce businesses require the following accounting services:

- Bookkeeping: Recording daily transactions and maintaining financial accuracy.

- Sales tax compliance: Ensuring correct tax calculations and filings.

- Inventory accounting: Tracking inventory costs and stock movements.

- Financial reporting: Generating profit & loss statements, balance sheets, and cash flow reports.

- Payroll management: Ensuring employees are paid correctly and on time.

- Tax preparation and filing: Managing business taxes efficiently.

E-commerce accounting outsourcing is quite a smart way of saving time, reducing overhead costs, and keeping your business in line with the growing economic changes. Outsourcing all of your accounting duties, for one thing, saves time and reduces overhead costs, and keeps your business profitable while taking care of the ever-changing regulations of money. Expert accounting services can help with bookkeeping, tax preparation, and financial reporting. Streamlining the processes, increasing efficiency, and providing support for sustainable growth. Choose Accounts Junction for in-depth knowledge about valuable e-commerce accounting services. Our team offers an e-commerce accounting solution that suits the needs of a particular e-commerce company. Bookkeeping automation and tax filing through advanced technology ensure accuracy and efficiency. In this way, yet reasonably priced is the other way by which your company can grow whilst managing its finances adequately. Partner with Accounts Junction and find personalized assistance to steer you through growth and generate financial success.

FAQs

1. What is e-commerce accounting outsourcing?

- It is hiring experts to handle your online store’s accounting tasks. This helps save time and reduces mistakes in financial records.

2. Why should e-commerce businesses outsource accounting?

- Outsourcing lowers costs and ensures accurate bookkeeping. It also allows owners to focus on sales and growth strategies.

3. What tasks are included in e-commerce accounting outsourcing?

- Experts handle bookkeeping, tax filing, payroll, inventory, and financial reports. These services simplify daily accounting work.

4. How does outsourcing improve bookkeeping accuracy?

- Professional accountants record sales and expenses correctly. This gives reliable data for decision-making.

5. Can outsourcing track sales from multiple platforms?

- Yes, it consolidates sales from Amazon, Shopify, eBay, and other channels. This provides a clear view of total revenue.

6. Does outsourcing handle sales tax compliance?

- Experts calculate, record, and file taxes for all regions. This ensures your store follows the law and avoids fines.

7. How can outsourcing manage inventory accounting?

- It tracks stock, costs, and warehouse levels in real time. This prevents overstocking or running out of products.

8. Will outsourcing help manage cash flow?

- Yes, experts monitor money coming in and out of the business. This ensures funds are available when needed.

9. How does outsourcing support financial decisions?

- Accurate reports help owners plan pricing, new products, and marketing. This improves business strategy and profitability.

10. Can outsourcing reduce errors in financial records?

- Yes, accountants catch mistakes in transactions, taxes, and reports. This lowers the risk of penalties and losses.

11. How does outsourcing save time for online stores?

- Owners spend less time on accounting tasks. This frees them to focus on customers and business growth.

12. Is outsourcing cheaper than hiring full-time staff?

- Yes, it avoids salaries, benefits, and training costs. It also provides expert support at a lower price.

13. Can outsourced accounting handle international sales?

- Yes, experts record foreign currency transactions accurately. They also track exchange rate changes to protect profits.

14. How are refunds and chargebacks managed?

- Accountants track returns and refunds carefully. This keeps accounts accurate and prevents errors.

15. Does outsourcing track shipping and logistics costs?

- Yes, all delivery and packaging costs are recorded. This helps understand total product expenses.

16. Can outsourcing improve tax filing speed?

- Experts prepare and file taxes on time. This reduces penalties and ensures faster refunds.

17. What financial reports do outsourced accountants provide?

- They create profit & loss statements, balance sheets, and cash flow reports. These reports help track store performance.

18. Can outsourced accounting manage payroll?

- Yes, accountants calculate salaries and deductions correctly. They ensure employees are paid on time.

19. How does outsourcing help business growth?

- Accurate data reduces mistakes and improves planning. Owners can focus on expanding sales and products.

20. Is technology used in outsourced accounting?

- Yes, experts use accounting software to automate tasks. This saves time and increases accuracy.

21. Can outsourcing assist with budgets and forecasts?

- Yes, it helps predict costs, profits, and cash flow. This allows better planning for the future.

22. How does outsourcing reduce financial risk?

- Experts follow rules and track all transactions carefully. This prevents fines and costly mistakes.

23. Is e-commerce accounting outsourcing suitable for small businesses?

- Yes, it gives small stores access to expert support at a low cost. This avoids the need for full-time staff.

24. Why choose specialized e-commerce accounting services?

- They understand online store finances and challenges. Their solutions ensure accuracy and support growth.

25. How does outsourcing help in long-term financial planning?

- Experts provide reliable data for budgets and investments. This helps owners plan for future profits.