What are the main points of financial planning?

Financial planning is an important process that may guide individuals and businesses toward their financial goals. It is not just about saving money but managing it wisely. Companies and professionals can use financial planning & analysis to make better decisions. Planning may help anticipate future expenses and potential income. It may also reduce financial risks and improve long-term stability.

Understanding the main points of financial planning may provide clarity for both personal and business finances. This blog explores key elements, their importance, and practical ways to implement them effectively.

What Is Financial Planning?

Financial planning may be defined as a structured approach to managing finances. It often includes budgeting, investment planning, risk management, and tax planning. For businesses, it may include forecasting, scenario analysis, and financial modeling. Companies use financial planning & analysis to predict revenue, control costs, and identify growth opportunities.

Financial planning may not guarantee success, but it can reduce uncertainties. It may help individuals and organizations plan for the short and long term.

Why Is Financial Planning Important?

Financial planning may bring several benefits, including:

- Better financial control: It may prevent overspending and improve savings.

- Future preparedness: Planning may protect against unforeseen emergencies.

- Investment guidance: Helps decide where and how much to invest.

- Debt management: May assist in managing loans efficiently.

- Business growth: Financial planning & analysis may highlight opportunities for expansion.

Without proper planning, financial decisions may become reactive rather than strategic. Planning may offer a roadmap to achieve both personal and business financial goals.

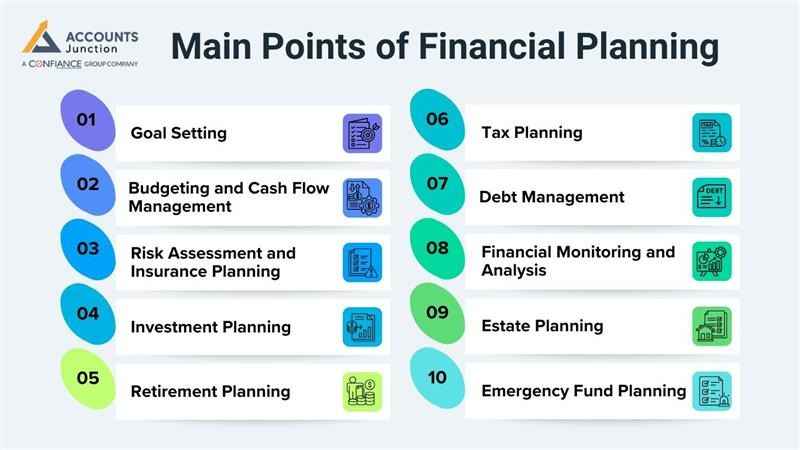

Main Points of Financial Planning

Effective financial planning may involve multiple components. Each element plays a specific role in shaping financial stability.

1. Goal Setting

Goals may define the direction of your financial planning.

- Short-term goals may include buying a car or paying off a loan.

- Long-term goals may include retirement savings or expanding a business.

- Goals should be specific, measurable, achievable, relevant, and time-bound.

Setting goals may provide clarity and focus, helping prioritize resources efficiently.

2. Budgeting and Cash Flow Management

Budgeting may be the foundation of financial planning.

- Track monthly income and expenses to understand financial patterns.

- Allocate funds for necessities, savings, and discretionary spending.

- Cash flow analysis may prevent shortages and manage surplus effectively.

Proper budgeting may improve financial discipline and prevent unnecessary debt.

3. Risk Assessment and Insurance Planning

Financial risks may impact both personal and business finances.

- Identify potential financial risks such as illness, accidents, or market fluctuations.

- Plan insurance coverage to protect against unforeseen events.

- Evaluate life, health, property, and liability insurance as part of risk management.

Risk planning may provide financial security and may reduce potential losses.

4. Investment Planning

Investments may help achieve financial growth.

- Assess risk tolerance before selecting investment options.

- Diversify investments across assets like stocks, bonds, and real estate.

- Use financial tools to monitor returns and adjust strategies as needed.

Investment planning may increase wealth over time and may complement savings goals.

5. Retirement Planning

Retirement planning may ensure financial stability in later years.

- Estimate the required retirement corpus based on lifestyle and expenses.

- Consider pension plans, provident funds, and retirement accounts.

- Review plans regularly and adjust based on income and inflation.

Early planning may reduce stress and may allow a comfortable retirement.

6. Tax Planning

Tax planning may help minimize liabilities.

- Identify applicable tax-saving schemes and exemptions.

- Align investments and expenses with tax optimization strategies.

- Regularly review tax regulations and update financial plans accordingly.

Proper tax planning may improve net savings and may enhance financial efficiency.

7. Debt Management

Debt management may improve financial health and creditworthiness.

- Identify high-interest debts and prioritize repayment.

- Avoid unnecessary loans and maintain a manageable debt-to-income ratio.

- Consolidate debts if necessary to reduce interest and simplify payments.

Debt management may prevent financial strain and may enhance long-term planning.

8. Financial Monitoring and Analysis

Regular monitoring may ensure that financial plans remain effective.

- Track actual performance against planned budgets and investments.

- Adjust plans as per market changes and personal circumstances.

- Use financial planning & analysis tools for forecasting and decision-making.

Monitoring may prevent deviations and ensure that financial goals remain achievable.

9. Estate Planning

Estate planning may secure assets for future generations.

- Prepare a will and define beneficiaries clearly.

- Consider trusts, powers of attorney, and healthcare directives.

- Review and update estate plans regularly as circumstances change.

Estate planning may reduce legal complications and may protect family wealth.

10. Emergency Fund Planning

An emergency fund may cover unexpected expenses.

- Maintain at least 3 to 6 months of living expenses in a liquid form.

- Use the fund only for genuine emergencies.

- Replenish funds after usage to maintain financial security.

Emergency fund planning may provide peace of mind and may prevent financial disruption.

Key Principles of Financial Planning

While financial planning may vary for individuals and businesses, some principles are common:

- Clarity in goals: Clear goals may guide all financial decisions.

- Discipline in execution: Following a plan consistently may yield results.

- Flexibility and review: Plans may need adjustments based on changing circumstances.

- Risk management: Identifying and mitigating risks may prevent losses.

- Data-driven decisions: Use financial planning & analysis to support choices.

Following these principles may improve financial confidence and help achieve long-term objectives.

Role of Financial Planning & Analysis in Businesses

Financial planning & analysis may assist businesses in several ways:

- Forecasting revenue and expenses may aid strategic decisions.

- Identifying growth opportunities and cost-saving areas may improve profitability.

- Scenario analysis may prepare businesses for economic changes.

- Budget monitoring may prevent overspending and financial inefficiency.

By integrating financial planning & analysis, companies may strengthen financial health and achieve sustainable growth.

Common Challenges in Financial Planning

Financial planning may face several challenges that require attention:

- Unrealistic goals may create frustration and failure.

- Inconsistent monitoring may lead to deviations from plans.

- Market uncertainties may affect investments and returns.

- Unexpected emergencies may disrupt cash flow.

- Poor risk assessment may result in financial losses.

Awareness of these challenges may help plan better and may prevent mistakes.

Tips for Effective Financial Planning

- Start planning as early as possible to maximize benefits.

- Review goals and budgets regularly to stay on track.

- Use tools and apps to simplify tracking and analysis.

- Consult financial advisors for expert guidance when needed.

- Focus on both short-term and long-term priorities equally.

Following these tips may improve financial confidence and support sustainable growth.

Accounts Junction provides comprehensive financial planning services for both personal and business needs. With our certified experts, we focus on goal setting, budgeting, investments, risk management, and retirement planning. Using financial planning & analysis, we deliver insights that support informed decisions and sustainable growth. Partner with us for a stronger financial future.

FAQs

1. What is financial planning?

- Financial planning may be a process to manage finances wisely. It may help achieve personal or business goals.

2. Why is financial planning important?

- It may reduce financial risks and improve decision-making. It may also provide a roadmap for future goals.

3. What is the difference between financial planning and analysis?

- Financial planning may focus on budgeting and goals. Analysis may provide insights using data and forecasts.

4. Can financial planning help businesses grow?

- Yes, proper planning may identify cost-saving areas. It may also highlight revenue growth opportunities.

5. How often should financial plans be reviewed?

- Plans may be reviewed annually or when circumstances change. Regular reviews may keep goals realistic.

6. Is financial planning only for wealthy individuals?

- No, anyone can benefit from planning. It may improve money management at any income level.

7. What is a cash flow analysis?

- It may track money coming in and going out. It may help maintain liquidity.

8. How can investments fit into financial planning?

- Investments may help grow wealth and achieve long-term goals. Proper risk assessment may be essential.

9. What role does insurance play in planning?

- Insurance may protect against financial losses. It may cover health, life, or property risks.

10. Should debt be included in financial planning?

- Yes, debt management may improve financial health. It may help plan repayment efficiently.

11. What is an emergency fund?

- It may cover unexpected expenses. It may provide peace of mind.

12. Can financial planning reduce taxes?

- Yes, tax planning may optimize liabilities. Proper strategies may improve net savings.

13. How does retirement planning work?

- It may estimate the needed savings for retirement. It may include pensions, investments, and savings accounts.

14. What is estate planning?

- Estate planning may secure assets for future generations. It may include wills and trusts.

15. Can businesses use financial planning & analysis tools?

- Yes, they may forecast revenue, track costs, and plan budgets efficiently.

16. What is risk assessment in financial planning?

- It may identify potential financial threats. Planning may minimize possible losses.

17. How important is goal setting in financial planning?

- Goals may define priorities and guide decisions. Clear goals may improve focus.

18. What is the first step in financial planning?

- The first step may be setting clear financial goals. It may guide all subsequent actions.

19. Can financial planning adapt to changing circumstances?

- Yes, flexibility may allow adjustments. Regular monitoring may ensure continued relevance.

20. How does financial planning improve money management?

- It may track spending and savings efficiently. It may also reduce financial stress.

21. What are common mistakes in financial planning?

- Unrealistic goals, inconsistent monitoring, and ignoring risks may be common issues.

22. Can financial planning & analysis increase business profitability?

- Yes, by identifying cost-saving areas and growth opportunities. Planning may improve overall efficiency.

23. Is financial planning a one-time process?

- No, it may require ongoing review. Circumstances and goals may change over time.

24. How can I start financial planning?

- Begin by assessing income, expenses, and financial goals. Small steps may lead to long-term results.

25. Can financial planning reduce financial stress?

- Yes, planning may create clarity and control. It may also be prepared for emergencies.