Law Office Bookkeeping: A Practical Guide for Modern Law Firms

Law office bookkeeping is key to keeping law firm finances clear and correct. Mistakes in accounts can lead to fines or lost client trust quickly. Law offices handle money for clients, pay staff, and track bills every day. Proper law office bookkeeping helps track all income, costs, and client funds correctly.

Many lawyers focus on cases and client work, leaving books unchecked. Without proper records, client funds and office money can get mixed up easily. Following simple bookkeeping rules keeps accounts clear, avoids mistakes, and saves time. Using legal bookkeeping services can help ensure all tasks are done right.

Why Law Office Bookkeeping Matters

-

Follow Rules

Good bookkeeping helps law firms follow financial rules and laws. It keeps the firm safe and avoids fines for errors.

-

Build Trust

Clear records through legal bookkeeping services help build trust. Keeping client funds separate shows the firm is careful and fair.

-

See Finances

Organized books help lawyers see what money comes in or goes out. It helps plan for costs, payroll, and future expenses clearly.

Core Parts of Law Office Bookkeeping

-

Client Accounts

Daily checks with legal bookkeeping services help avoid mistakes. Legal bookkeeping services help record all client funds every day.

-

Track Costs

Record office rent, bills, and staff costs right away. It helps stop overspending and keep budgets under control.

-

Track Income

Record all client payments and retainers properly in books. Law office bookkeeping ensures all money is counted and correct.

-

Staff Pay

Track salaries, benefits, and bonuses for staff carefully. Errors in payroll can upset staff and create law problems.

-

Taxes

Keep books ready for tax filings to avoid last-minute stress. Legal bookkeeping services help find deductions and avoid fines.

How Legal Bookkeeping Services Help Law Firms

-

Expert Help

Outsourcing bookkeeping gives firms trained experts to check books. It saves time and ensures all entries are correct and clear.

-

Fewer Errors

Experts spot mistakes that busy staff may not see. They reduce errors in client funds, income, and bills.

-

Reports on Time

Get reports on money coming in, going out, and payroll. Reports help plan spending, billing, and budgeting easily.

-

Audit Support

Legal bookkeeping services prepare books for smooth audits. This keeps the firm safe from fines or rule breaches.

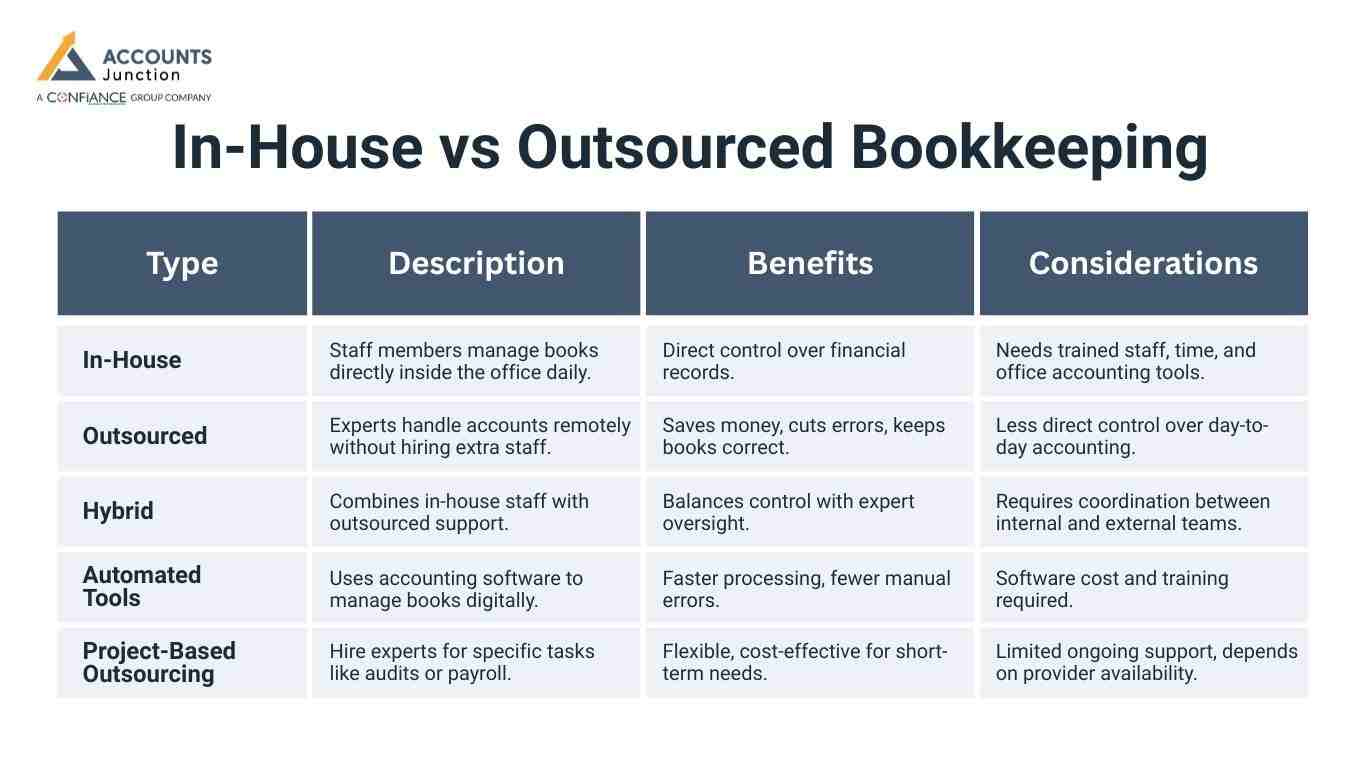

In-House vs Outsourced Bookkeeping

|

Type |

Description |

Benefits |

Considerations |

|

In-House |

Staff members manage books directly inside the office daily. |

Direct control over financial records. |

Needs trained staff, time, and office accounting tools. |

|

Outsourced |

Experts handle accounts remotely without hiring extra staff. |

Saves money, cuts errors, keeps books correct. |

Less direct control over day-to-day accounting. |

|

Hybrid |

Combines in-house staff with outsourced support. |

Balances control with expert oversight. |

Requires coordination between internal and external teams. |

|

Automated Tools |

Uses accounting software to manage books digitally. |

Faster processing, fewer manual errors. |

Software cost and training required. |

|

Project-Based Outsourcing |

Hire experts for specific tasks like audits or payroll. |

Flexible, cost-effective for short-term needs. |

Limited ongoing support, depends on provider availability. |

Best Practices in Law Office Bookkeeping

-

Check Daily

Check client and office accounts every day without fail. This prevents errors and ensures books stay accurate at all times.

-

Keep Digital Records

Store invoices, receipts, and bills digitally to stay safe. Digital storage reduces paper loss and simplifies audits and checks.

-

Clear Bills

Send bills that are easy to read and correct. Clients pay faster when invoices are simple and clear.

-

Do Regular Checks

Review accounts weekly or monthly to spot mistakes early. Regular checks keep all entries correct and reduce stress later.

-

Watch Costs

Record staff and office costs clearly each day. It stops overspending and helps plan future budgets.

-

Use Software

Use simple accounting tools for bills, payroll, and income. Software reduces mistakes and saves time for lawyers and staff.

Common Challenges in Law Office Bookkeeping

-

Mixing Funds

Mixing client and firm money can create big problems. Professional legal bookkeeping services prevent mixing and record everything clearly.

-

Late Bills

Late invoices hurt cash flow and client trust. Services help track payments and send reminders on time.

-

Lost Records

Missing receipts or unclear expenses cause accounting issues. Structured record-keeping ensures every transaction is recorded properly.

-

Not Following Rules

Failing to track client money carefully breaks the law. Professional services make sure all transactions follow the required rules.

-

Slow Reporting

Manual reports take too long and may be wrong. Software and expert help give fast, correct financial reports.

Software Tools for Law Office Bookkeeping

-

Track Payments

Software used in law office bookkeeping records payments each day. It makes reconciliation of accounts faster and more accurate.

-

Track Costs

Record office bills and staff expenses clearly using software. It keeps budgets under control and avoids overspending.

-

Check Bank

Software checks bank accounts against client accounts daily. It prevents mistakes and ensures all money is tracked.

-

Reports

Software gives charts and reports for quick financial insight. Reports help lawyers make smart spending and billing choices.

-

Payroll

Software calculates salaries, taxes, and benefits automatically. It avoids mistakes and keeps payroll compliant with rules.

Tips for Effective Law Office Bookkeeping

-

Separate Accounts

Law office bookkeeping keeps client and office funds apart. This avoids confusion and keeps money safe and clear.

-

Record Fast

Write down transactions as soon as they happen. Fast recording reduces mistakes and keeps accounts up to date.

-

Check Often

Check accounts every day or week to catch errors early. Regular checks make books reliable and trustworthy.

-

Send Clear Bills

Use simple, clear invoices for all clients. Clear bills improve payment speed and reduce disputes.

-

Audit Often

Check accounts monthly or quarterly for accuracy. Audits help find mistakes early and keep accounts honest.

-

Use Cloud

Use online software to see accounts anytime from anywhere. Cloud systems make work faster and easier for staff and lawyers.

Benefits of Outsourcing Legal Bookkeeping Services

-

Fewer Errors

Experts keep all books correct and follow the rules. Errors are reduced, and client funds are handled carefully.

-

Saves Time

Outsourcing gives lawyers more time for clients. Experts handle all bookkeeping tasks accurately and quickly.

-

Saves Money

Hiring experts costs less than in-house staff in many cases. It reduces overhead while keeping books correct and clear.

-

Good Reports

Get clear reports on costs, income, and cash flow. Reports help lawyers plan spending and billing smartly.

-

Audit Ready

Books are ready for internal or external audits anytime. This keeps the firm safe and clients confident.

The Role of Bookkeeping in Law Firm Growth

-

Financial Planning

Good bookkeeping helps law firms plan for growth and new work. Tracking money in and out shows where funds can be used best.

-

Profitability Analysis

Clear records show which cases bring the most money to the firm. Firms can make better choices about staff, time, and client work.

-

Budget Management

Law office bookkeeping helps the firm stay within its plan. It stops overspending and keeps money available for needed work.

-

Forecasting

Books help predict future income and office costs for planning. Firms can prepare for slow periods or bigger expenses ahead.

-

Resource Allocation

Records guide lawyers on where to use staff and money. This makes work finish on time and keeps costs under control.

Importance of Staff Training in Bookkeeping

-

Employee Awareness

Staff need to know how to record money correctly each day. Good training cuts mistakes and keeps all accounts up to date.

-

Internal Controls

Training makes staff follow clear rules for approval and payments. It stops making mistakes and keeps books safe and correct.

-

Accountability

Staff who are trained take care to enter data correctly. This cuts errors and keeps financial records true and steady.

-

Regular Updates

Staff must learn new rules and changes to software often. This keeps the team up to date and working correctly at all times.

-

Team Communication

Good training helps staff share money information clearly with each other. Teams can spot mistakes early and keep bookkeeping work consistent.

Law office bookkeeping is key to clear accounts and smooth operations. Professional legal bookkeeping services reduce mistakes, save time, and keep money safe. Firms that follow simple practices run better and serve clients well.

Accounts Junction offers expert bookkeeping tailored for law firms. We manage client accounts, staff pay, and office costs daily. Our team of experts provides fast reports and keeps books ready for audits. Partnering with Accounts Junction lets lawyers focus on cases while experts handle finances. Law firms gain trust, reduce risk, and grow faster with their support.

Investing in bookkeeping ensures law offices run well, avoid mistakes, and plan for growth. Simple, clear, and accurate records give lawyers confidence in all financial decisions.

FAQs

1. What is law office bookkeeping?

- It is the work of tracking all law firm and client funds. It helps firms see money flow and plan costs clearly.

2. Why do law firms need legal bookkeeping services?

- They keep accounts right, track client money, and follow rules. They also cut down mistakes and save time for lawyers daily.

3. How do legal bookkeeping services handle client trust accounts?

- They keep client money separate from firm money at all times. This keeps client funds safe and avoids legal or money issues.

4. Can law office bookkeeping prevent compliance issues?

- Yes, it helps firms follow rules and pass all audits. It also makes sure firms meet state laws and avoid fines.

5. How often should law firms reconcile accounts?

- Daily checks help avoid errors and keep client money safe. Regular checks also make reports easy and prevent cash flow gaps.

6. What software works best for law office bookkeeping?

- Simple accounting tools that track client funds, costs, and income work best. Cloud-based tools are handy and allow access from anywhere safely.

7. Should small law firms outsource bookkeeping services?

- Yes, outsourcing cuts errors, saves time, and keeps accounts right. It also lets small teams focus more on clients and casework.