In-house vs Virtual CFO Services - Which Is Better?

Running a business may look easy from the outside. But once you step in, the numbers start to swirl, taxes appear out of nowhere, and the word cash flow suddenly becomes your daily thought. Somewhere between growth plans and payroll, a CFO becomes that guiding light. Yet, the question may rise — should it be an in-house CFO or a virtual one?

Let’s go slow, walk through both sides, and see which may truly fit your business.

What Does a CFO Actually Do?

Before diving into In-house vs Virtual CFO, it helps to know what a CFO may bring to the table.

A Chief Financial Officer, or CFO, doesn’t just count money. They plan, forecast, and guide your business’s financial path. From building budgets to managing investors, from reviewing reports to finding leaks in expenses — a CFO can shape your financial future.

But how that guidance reaches you may differ. Some prefer having the CFO sit right inside their office — an in-house CFO. Others may choose an expert who works remotely, often through digital channels — a virtual CFO.

Understanding In-house CFO Services

Who is an In-house CFO?

An in-house CFO is a full-time leader who works as part of your company’s internal team. They handle everything finance-related, from audits and compliance to strategy and reporting.

You may see them in meetings, guiding the management, or discussing budgets with department heads.

Possible Benefits of an In-house CFO

1. Deep Company Knowledge

An in-house CFO can develop a strong understanding of your company’s pulse. They may grasp every small financial pattern, culture, and internal issue.

2. Constant Availability

Need quick numbers? Want to adjust a plan? The CFO may just walk across the room to help.

3. Team Integration

Being part of your staff means they can work closely with all departments. Collaboration feels smooth and personal.

4. Direct Control

You can monitor their performance and direct their efforts easily.

Possible Drawbacks of an In-house CFO

1. High Cost

Hiring an in-house CFO can be expensive. Salaries, benefits, office space — the total can stretch beyond the budget, especially for small or mid-sized firms.

2. Limited Exposure

An internal CFO may only see your company’s view. This may restrict them from new ideas that come from serving multiple industries.

3. Replacement Delays

If they leave, the process of finding and onboarding another may take months.

4. Less Flexibility

They follow a set schedule and may not always adapt quickly to sudden changes or temporary projects.

Understanding Virtual CFO Services

Who is a Virtual CFO?

A Virtual CFO (vCFO) offers similar expertise but through remote or outsourced services. They can manage your finances virtually, using cloud tools and communication platforms.

Virtual CFOs may not sit in your office, but they stay connected through reports, dashboards, and regular meetings.

Possible Benefits of a Virtual CFO

1. Cost-Effective Expertise

You pay for the services you need. That may mean access to senior-level expertise at a much lower cost.

2. Flexibility

Virtual CFOs can scale their work based on your business stage — less during quiet seasons, more during growth.

3. Diverse Experience

Many vCFOs work with multiple businesses across industries. They can bring wider insights, strategies, and tools.

4. Tech-Driven Decisions

They rely on digital tools, real-time dashboards, and analytics, which may enhance clarity and speed in decision-making.

5. Quick Setup

You may onboard them fast, with no long hiring cycles or office space needs.

Possible Drawbacks of a Virtual CFO

1. Lack of Physical Presence

You might miss that personal face-to-face touch.

2. Dependence on Technology

A poor internet connection or tech failure can slow communication.

3. Limited Cultural Connection

They may not always understand the deep internal culture of your company.

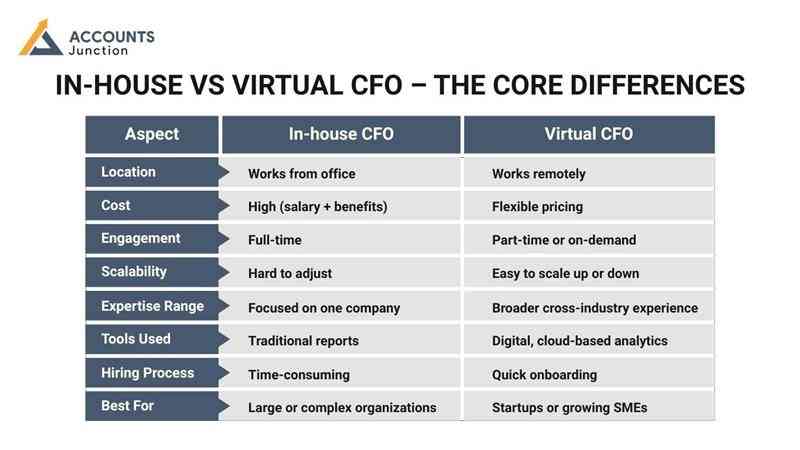

In-house vs Virtual CFO – The Core Differences

|

Aspect |

In-house CFO |

Virtual CFO |

|

Location |

Works from office |

Works remotely |

|

Cost |

High (salary + benefits) |

Flexible pricing |

|

Engagement |

Full-time |

Part-time or on-demand |

|

Scalability |

Hard to adjust |

Easy to scale up or down |

|

Expertise Range |

Focused on one company |

Broader cross-industry experience |

|

Tools Used |

Traditional reports |

Digital, cloud-based analytics |

|

Hiring Process |

Time-consuming |

Quick onboarding |

|

Best For |

Large or complex organizations |

Startups or growing SMEs |

When May an In-house CFO Be the Right Choice?

An in-house CFO can fit well when:

- Your company handles multiple divisions or complex transactions

- You need full-time financial oversight daily

- You want face-to-face collaboration for strategic decisions

- You can afford a long-term, high-salary financial officer

Large enterprises or corporations may see strong returns with this model since they need continuous financial leadership.

When May a Virtual CFO Be the Right Choice?

A virtual CFO may make sense when:

- You are a small or mid-sized business that cannot afford a full-time CFO

- You need flexible hours or part-time support

- You want quick access to experts from diverse backgrounds

- You use cloud-based tools and digital accounting systems

Startups, small businesses, and growing firms often find this model smart, affordable, and adaptable.

Comparing the Long-term Value

When looking at In-house vs Virtual CFO, value often depends on the business stage.

An in-house CFO can become your long-term strategist, guiding every move with deep company knowledge. But that comes at a cost.

A virtual CFO can deliver strategic insight and flexibility without breaking the bank. For many small firms, this balance can create faster growth.

Still, neither choice is perfect for all. The best fit may depend on how you want your business to grow — slowly with depth or fast with flexibility.

How Businesses May Combine Both

Some companies even try a blended model.

They keep an internal finance manager for daily operations but bring a virtual CFO for strategy and oversight. This may help maintain both control and expertise while cutting costs.

Such hybrid models may be the future of financial leadership — practical, flexible, and balanced.

How to Decide Between In-house vs Virtual CFO

Here’s a short framework you can use before deciding:

1. Check Your Business Size and Stage

If you’re in the early stage, you may not need a full-time CFO. A virtual one may do.

2. Look at Your Budget

An in-house CFO can be costly. Ask yourself if your company can handle the ongoing expense.

3. Define Your Financial Needs

Do you need long-term planning or just periodic strategy reviews?

4. Consider Your Work Culture

If your team values close in-person guidance, an in-house CFO may fit better.

5. Think About Technology

If your business runs digitally, a virtual CFO may blend in naturally.

As business turns more digital, the role of the CFO is changing. Virtual CFOs may become a norm for growing companies. They bring affordability, adaptability, and instant insights through technology.

But in-house CFOs will still hold importance for large corporations that need continuous involvement and leadership.

At Accounts Junction, we have been providing virtual CFO services for businesses around the world. If you wish to have a professional virtual CFO that understands your business, contact us now!

FAQs

1. How can a business know which CFO type may fit better?

- It may depend on your growth stage, how fast you move, and how close you want your finance head to stay.

2. Why do some firms move from in-house CFO to virtual CFO?

- They may want to cut cost, gain more flexibility, or get new ideas from experts who work across many industries.

3. Can a virtual CFO guide a company as deeply as an in-house CFO?

- Yes, a virtual CFO can plan, monitor, and guide with equal depth using online tools and regular check-ins.

4. When might an in-house CFO become a smarter pick?

- When daily control, face-to-face talks, and instant guidance matter most, an in-house CFO may suit better.

5. Can a virtual CFO handle complex financial systems?

- They often can. Many use modern dashboards and real-time apps to keep every number within sight.

6. How may cost shape the choice between in-house and virtual CFO?

- An in-house CFO can raise fixed costs, while a virtual one may offer flexible rates that adjust as you grow.

7. Why might startups favor virtual CFOs more?

- Startups may find it cheaper and faster to hire part-time experts who guide without taking full-time space.

8. Can a virtual CFO manage investor reports and funding plans?

- Yes, they can prepare forecasts, funding decks, and reports to help attract and manage investors.

9. How may company culture affect this choice?

- If teamwork and in-person talks matter, an in-house CFO may blend better. A digital culture may lean virtual.

10. Do virtual CFOs bring new industry ideas?

- They often do, since they serve many clients and may spot trends your team has not yet seen.

11. Can a firm switch from virtual CFO to in-house later?

- Yes, many start virtual and move in-house once they expand and need daily financial presence.

12. How may technology influence CFO performance?

- Strong tech can lift both types, but virtual CFOs depend more on real-time tools for faster insight.

13. Can both CFO types work together in one firm?

- Yes, a company may blend both — one guiding daily numbers and the other shaping overall direction.

14. How can a virtual CFO stay transparent while remote?

- They may share live dashboards, regular reports, and online reviews to keep every step clear.

15. Which CFO type can react faster during sudden shifts?

- Virtual CFOs may adjust plans quickly with data tools, while in-house CFOs can act faster in person.

16. How may a CFO model shape long-term growth?

- An in-house CFO can build depth over years, while a virtual CFO may bring new views as your business evolves.

17. What kind of firm may gain most from an in-house CFO?

- Large firms with steady income and complex teams may gain from having one full-time in the office.

18. How may small firms benefit from virtual CFOs?

- They can get senior-level advice without heavy salaries and use expert guidance only when needed.

19. Can virtual CFOs help during audits or tax seasons?

- Yes, they can handle audits, tax planning, and compliance through digital records and cloud systems.

20. Which CFO model may scale better with business growth?

- Virtual CFOs can scale services faster since you can expand hours or scope without long hiring gaps.