How to Start A Business With Only Virtual CFO

Starting a new business is exciting, but handling finances is difficult. Without proper guidance, small mistakes can quickly become costly problems. Bills may pile up, cash may run low, and budgets fail. A virtual CFO helps manage money and guide smart financial choices when you start a business with a virtual CFO. This expert works remotely, saving costs compared to hiring full-time staff.

Many small business owners avoid hiring a full-time CFO because of costs. Virtual CFOs provide professional help at lower prices than full-time staff. This guide explains how to hire a virtual CFO effectively and efficiently. It also shows the benefits, steps, and tips for sustainable growth.

What is a Virtual CFO?

A virtual CFO is a money expert who works remotely for businesses and supports those who start a business with a virtual CFO for expert guidance. They help plan budgets, track money, and make smart choices daily.

Key Tasks of a Virtual CFO

- Money Planning and Budgeting: They create clear budgets and money plans.

- Cash Flow Control: A virtual CFO ensures cash remains steady.

- Help With Funding: They guide loans, investors, and funding strategies.

- Risk Check: They spot risks and show ways to avoid them.

- Profit and Cost Review: They find profits and suggest cost savings.

- Reports: They make reports for owners and investors to review.

Why Start a Business With a Virtual CFO

Cost Effective Help

- When you start a business with a virtual CFO, you save more since hiring one costs far less than a full-time CFO.

- You only pay for the services that your business requires.

Expert Advice

- A virtual CFO brings real-world experience from many industries, making it easier to start a business with a virtual CFO and grow safely.

- Their guidance helps avoid mistakes that could cost your business heavily.

Better Money Planning

- A virtual CFO creates clear budgets and future money forecasts.

- This planning helps your business stay on track with income.

Reduce Risk

- They identify potential problems and suggest ways to prevent them.

- Businesses can avoid losses and stress by following their advice.

Saves Time

- Managing finances takes time away from growing your business activities.

- A virtual CFO handles numbers while you focus on daily operations.

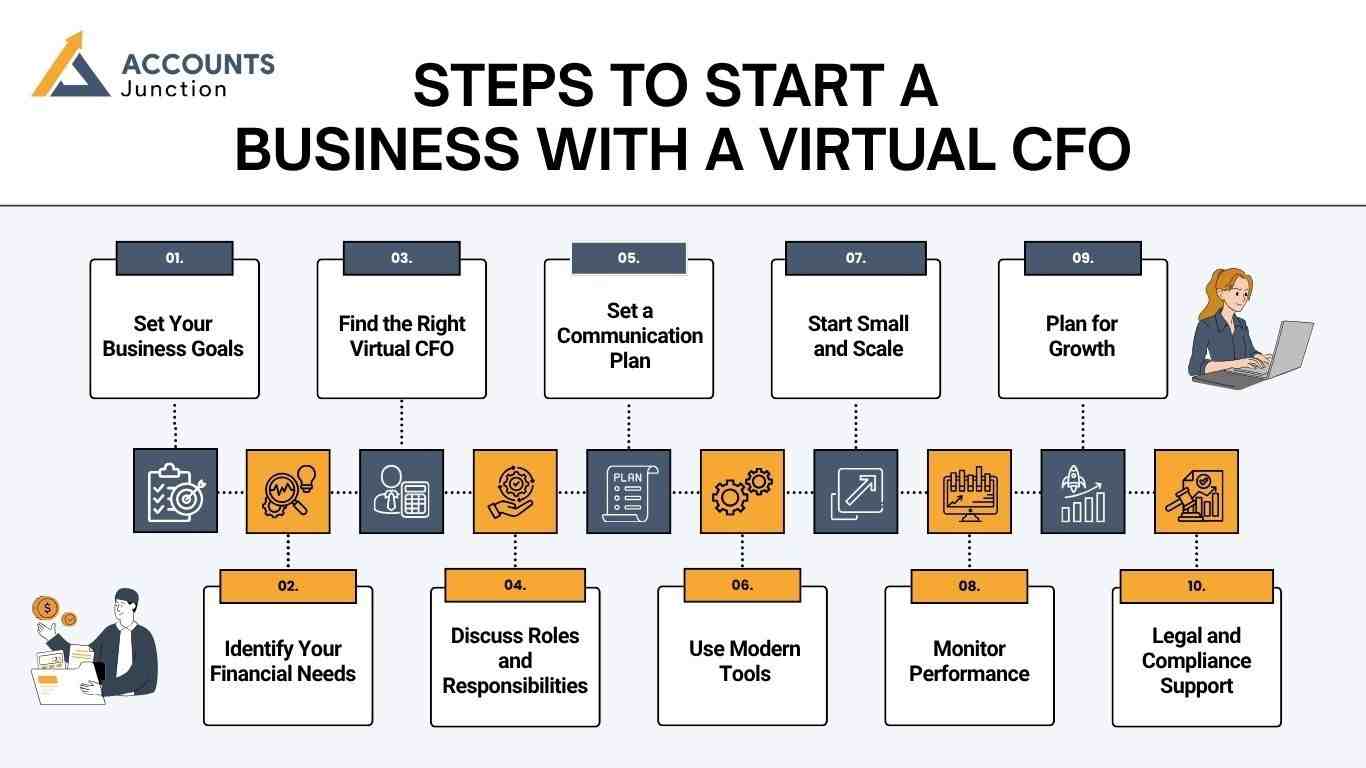

Steps to Start a Business With a Virtual CFO

1. Set Your Business Goals

Define Clear Goals: Know what you want before you start a business with a virtual CFO, as goals guide every financial choice.

This helps guide all choices for smooth business growth daily.

Plan Finances: Clear goals help the CFO make the right decisions.

It ensures money is spent wisely from the very start.

Ask Yourself:

- Do you want fast growth or slow, steady growth?

- Will you need investors to fund your business later?

- What is your budget for hiring a financial expert?

2. Identify Your Financial Needs

List Your Needs: Businesses need different support each day, clearly.

This helps the CFO focus on tasks that matter most.

Prioritize Services: Focus on what is most important for the business.

It also stops wasting time on small, less important work.

Consider Including:

- Track daily income and expenses carefully every day.

- Plan cash flow to manage money coming in and out.

- Create monthly and yearly reports for management and investors.

- Help with fundraising and guidance to secure funding fast.

- Plan taxes and follow laws to avoid fines or penalties.

3. Find the Right Virtual CFO

Choose Carefully: Picking the right virtual CFO is key when you start a business with a virtual CFO to ensure steady growth.

A wrong choice can cause mistakes or lost opportunities easily.

Look for Experience: They must know your business type clearly.

Experience gives better advice for your unique business needs.

Tips to Find:

- Ask for suggestions from trusted business contacts or friends.

- Search online platforms for professional virtual CFO services.

- Interview more than one candidate before making a choice.

- Check references and past client feedback carefully, always.

4. Discuss Roles and Responsibilities

Define Roles: Clear duties stop mistakes and confusion in work.

It makes sure both sides know what must get done.

Examples of Responsibilities:

- Track daily income and expenses for proper control.

- Prepare monthly and quarterly reports for management review.

- Manage payroll and vendor payments on time every month.

- Advise on loans and deals for proper business funding.

- Create financial forecasts to plan future business growth clearly.

5. Set a Communication Plan

Stay Connected: Regular contact with your virtual CFO keeps work on track when you start a business with a virtual CFO. Good talks stop misunderstandings and avoid costly delays always.

Communication Tips:

- Schedule weekly or bi-weekly calls to review updates.

- Share access to accounting and reporting software tools.

- Use messaging apps for fast updates and quick questions.

- Set deadlines for reports and feedback from the CFO.

6. Use Modern Tools

Utilize Technology: Tools help CFO work faster and more accurately.

They also make tracking and reviewing money much easier.

Recommended Tools:

- Cloud accounting software like QuickBooks or Xero for tracking.

- Budget and forecasting apps help plan money for the future.

- Team platforms like Slack or Trello improve work together.

- Dashboards show cash flow and business performance clearly.

7. Start Small and Scale

Begin Slowly: Start with key services, then grow gradually.

This prevents overloading the team or adding extra costs.

Initial Steps:

- Monthly reports help track business performance clearly.

- Cash flow management keeps money stable, coming in and out.

- Budget creation and tracking controls spending carefully every month.

Expand Later:

- Investment planning prepares a business for future growth opportunities.

- Tax guidance makes sure the business follows all legal rules.

- Strategic advice helps gain profit and grow long-term.

8. Monitor Performance

Check Progress: Track how the CFO affects business results.

Regular checks ensure goals are reached on schedule.

Performance Metrics:

- Profit margins and revenue growth improve over several months.

- Cash flow stays steady to avoid shortages or delays.

- Reports must be clear, accurate, and useful for decisions.

- Budget rules help control costs and spending in business.

9. Plan for Growth

Guide Expansion: A CFO helps a business grow smartly and safely.

Their guidance lowers risks while boosting profits steadily over time.

Growth Strategies:

- Identify profitable products or services to gain higher returns.

- Reduce unneeded costs to increase business profit quickly.

- Adjust prices to stay competitive and attract new customers.

- Plan investments carefully for long-term growth and success.

10. Legal and Compliance Support

Stay Legal: A CFO makes sure your business follows all laws.

This prevents fines and protects the company from legal trouble.

Compliance Areas:

- File taxes and plan to avoid mistakes or fines.

- Keep audits and records for clear accountability always.

- Follow the rules for operations and financial reporting properly.

Key Benefits of a Virtual CFO for New Businesses

- Saves Money: A virtual CFO costs far less than hiring a full-time CFO, a big reason many owners start a business with a virtual CFO today. You pay only for services your business actually needs regularly.

- Expert Guidance: They bring knowledge from many different industries and business types. Businesses gain strategic advice that helps avoid costly financial mistakes.

- Flexibility: You can hire a virtual CFO for projects or long-term work easily when you start a business with a virtual CFO. This suits businesses at all stages of growth and development.

- Better Decision Making: Business decisions are based on accurate and timely financial data. This helps reduce mistakes and increase overall profits consistently.

- Focus on Core Business: You can focus on products, marketing, and client services fully. Finances are handled professionally and remain under expert control daily.

How a Virtual CFO Helps in Every Business Stage

A Virtual CFO helps a business plan, grow, and stay safe with money. Their role changes as the business moves through each stage.

Startup Stage

- Budget Planning

A Virtual CFO helps make budgets, track costs, and manage cash. This builds a strong start for a new business. - Investment Help

They guide you in getting funds and choosing the right investors. Early money choices become safer and smarter. - Sales and Growth Plans

They make simple plans for sales, costs, and growth. This helps avoid shocks and keeps things smooth. - Rules and Taxes

They make sure taxes and laws are done on time. This keeps your business safe and fine-free.

Growth Stage

- Profit Check

They track profits and give tips to earn more. This helps your business make smart money moves. - Cash Flow

They handle cash flow so money comes in and goes out correctly. This keeps the business running strong. - Business Plans

They help plan for growth, new ideas, or new markets. Good plans help the business grow fast and steadily. - Risk Control

They spot risks and help reduce them. This saves the business from loss.

Mature Stage

- Reports and Data

They give clear reports that show how the business is doing. This helps leaders make smart choices. - Taxes and Rules

They find ways to save tax and stay legal. This boosts profits and cuts stress. - Growth and Deals

They guide in mergers, new deals, or new branches. Their advice helps grow with less risk. - Future Plan

They make long-term plans for steady growth and success. This keeps the business strong for years to come.

Tips for Working Effectively With a Virtual CFO

- Share Complete Financial Information

Give correct data so your CFO can guide you well. This stops mistakes and helps make the right choices. - Set Clear Expectations

Define roles, tasks, and deadlines to get work done. A clear plan helps both sides avoid confusion. - Maintain Regular Communication

Share updates often to prevent delays or errors in finances. Use calls, emails, or chat apps to stay linked. - Use Modern Tools

Cloud accounting and dashboards make tracking finances simple. Reports are clear, fast, and easy to check. - Review Reports and Advice

Study financial reports carefully and act when needed. This keeps business stable, growing, and money safe.

Common Mistakes to Avoid

- Undefined Roles: Not setting clear roles causes confusion and work delays. Clear roles help avoid missed tasks and lower errors.

- Ignoring Reports: Skipping reports can often cause serious financial mistakes. Always check reports before making key business decisions.

- Unrealistic Expectations: Expecting miracles from a virtual CFO is not fair. They guide you, but your work is also needed.

- Poor Communication: Weak communication slows work and raises the risk of errors. Have regular calls and updates to track finances.

- Using Outdated Tools: Old tools make work slow and reports less accurate. Use new accounting software for better tracking and speed.

Starting a business with a virtual CFO is a smart choice. It saves money, provides expert help, and guides growth steadily. A virtual CFO tracks cash flow, creates budgets, and reduces risks. Owners can focus on products and clients while finances remain secure.

At Accounts Junction, we help businesses hire skilled virtual CFOs efficiently. Our experts guide startups and growing companies in budgeting and reporting. Accounts Junction ensures smart financial choices, fewer mistakes, and growth. With our help, businesses gain affordable, flexible, and professional money guidance.

FAQs

1. What is a virtual CFO?

- A virtual CFO is a remote financial expert managing business finances.

2. Can small businesses hire a virtual CFO?

- Their services are affordable and suitable for small budgets.

3. How often will a virtual CFO work with my business?

- It depends on your needs, ranging from weekly to monthly support.

4. Do I need special software for a virtual CFO?

- Cloud accounting tools improve accuracy and efficiency for work.

5. Can a virtual CFO help with funding?

- They provide guidance for loans, investments, and funding strategies.

6. Is hiring a virtual CFO expensive?

- It is more cost-effective than hiring a full-time CFO.

7. Will a virtual CFO handle taxes?

- They provide tax guidance and often work with accountants for filings.

8. Can a virtual CFO track cash flow?

- They ensure incoming and outgoing money remains steady and clear.

9. Do virtual CFOs make reports?

- Monthly and quarterly reports are prepared for owners and investors.

10. Can a virtual CFO help cut costs?

- They review expenses and suggest savings to improve profits.

11. Can a CFO help plan business growth?

- They guide expansion, investments, and strategy for sustainable growth.

12. Do I need a full-time CFO later?

- Virtual CFOs can provide long-term support effectively.

13. Will they help manage investor relations?

- They prepare reports and advice for current and potential investors.

14. Can a virtual CFO work with my team?

- They coordinate remotely and guide staff efficiently for results.

15. Do I need modern tools for a CFO?

- Cloud software makes tracking money simple and timely daily.

16. How soon will results appear?

- With proper data and tasks, results can show in months.

17. Can they manage payroll for employees?

- Payroll tracking and payment management are handled by the CFO.

18. Do virtual CFOs create budgets?

- Monthly and yearly budgets are prepared and maintained carefully.

19. Can they spot risks early?

- They identify problems and suggest ways to prevent losses.

20. Are virtual CFOs helpful for mature businesses?

- They optimize cash, manage risk, and maintain financial stability.