How much does it cost to outsource accounts payable?

To outsource accounts payable means hiring a third-party provider to handle a company's AP tasks. Instead of managing invoices, payments, and vendor communication internally, businesses outsource these tasks to specialized AP companies. This approach helps organizations improve accuracy, reduce costs, and streamline financial operations while focusing on their core business activities.

Accounts payable is essential for tracking and processing outstanding invoices from suppliers and vendors. It ensures timely bill payments, avoids late fees, strengthens vendor relationships, and improves cash flow. However, managing this process manually can be time-consuming and prone to errors. If you outsource accounts payable, you get automation, analytics, and expert oversight to streamline AP processes.

Why Businesses Are Choosing to Outsource Accounts Payable

Here are some main reasons why businesses are choosing to outsource accounts payable:

1. Cost Savings

- Eliminates the need for hiring, training, and retaining in-house AP staff.

- Reduces expenses related to office space, software, and equipment.

- Lowers costs by leveraging economies of scale from outsourcing providers.

2. Increased Efficiency and Accuracy

- Automation speeds up invoice processing and reduces manual work.

- Minimizes errors in data entry, duplicate payments, and miscalculations.

- Improves payment accuracy, reducing late fees and penalties.

3. Access to Advanced Technology

- Outsourcing providers use AI-driven automation, machine learning, and cloud-based tools.

- Enables real-time tracking, reporting, and analytics for better financial decisions.

- Ensures seamless integration with existing ERP and accounting software.

4. Compliance and Risk Management

- Ensures adherence to tax laws, financial regulations, and industry standards.

- Reduces fraud risks with built-in security measures and audit trails.

- Helps businesses maintain transparency and accountability in financial transactions.

5. Scalability and Flexibility

- Easily adjusts to business growth without additional staffing or infrastructure costs.

- Handles seasonal fluctuations in invoice volumes efficiently.

- Customizable service packages to fit different business needs.

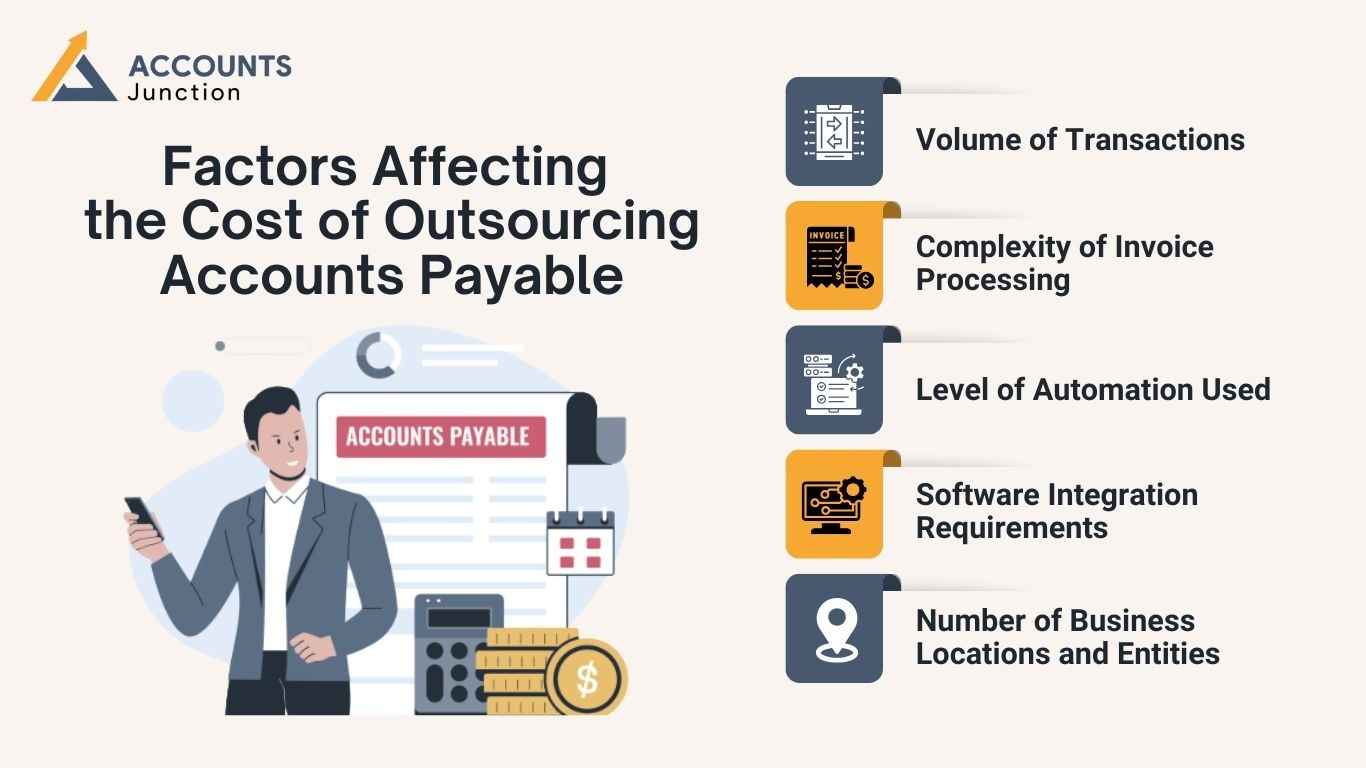

Factors Affecting the Cost of Outsourcing Accounts Payable

1. Volume of Transactions

- The number of invoices processed per month affects pricing.

- Higher transaction volumes often lead to lower per-invoice costs due to economies of scale.

- Businesses with fluctuating volumes may opt for flexible pricing models.

2. Complexity of Invoice Processing

- Simple invoices with standard formats cost less to process.

- Complex invoices requiring manual data entry, multi-level approvals, or currency conversions increase costs.

- Industries like construction, healthcare, and manufacturing often have more complex AP needs, impacting pricing.

3. Level of Automation Used

- Advanced AI-driven automation reduces manual intervention and processing time.

- More automation leads to cost savings, but initial setup fees for automated systems may apply.

- Optical Character Recognition (OCR) for invoice scanning and automated payment workflows may come at an additional cost.

4. Software Integration Requirements

- Businesses using QuickBooks, Xero, SAP, Oracle, or NetSuite may require seamless integration.

- The complexity of integration affects pricing—custom integrations cost more than standard plug-and-play solutions.

- Data migration from legacy systems may require additional fees.

5. Number of Business Locations and Entities

- Multi-location and multi-entity businesses may require consolidated AP management.

- Handling multiple currencies, tax structures, and regulatory requirements increases costs.

- Businesses operating in different time zones may require 24/7 support, impacting pricing.

Breaking Down Cost to Outsource Accounts Payable

The cost of accounts payable outsourcing services depends on the pricing model offered by the provider. Some common pricing structures include:

- Per Invoice Pricing: Businesses are charged based on the number of invoices processed.

- Fixed Monthly Fees: A set fee is charged regardless of the volume of transactions.

- Hybrid Pricing: A combination of fixed and variable pricing, depending on service usage.

Companies should assess budget, transaction volume, and service needs to find a cost-effective AP outsourcing solution.

How to Choose the Right Accounts Payable Outsourcing Company

If you want to outsource accounts payable management of your business, here are a few things you may consider:

1. Assess Your Business Needs

- Identify your AP process challenges (e.g., high invoice volumes, late payments, compliance issues).

- Determine the level of automation and integration required.

- Decide if you need end-to-end AP services or just specific functions (invoice processing, reconciliation, vendor management).

2. Industry Experience and Expertise

- Choose a provider with experience in your industry (e.g., manufacturing, retail, healthcare).

- Ensure they understand regulatory compliance and tax laws relevant to your business.

- Check their expertise in handling international payments and multi-currency transactions if needed.

3. Technology and Automation Capabilities

- Look for AI and machine learning-driven solutions to reduce errors and improve efficiency.

- Ensure compatibility with your existing accounting or ERP software (e.g., QuickBooks, SAP, NetSuite).

- Verify if they offer cloud-based access and real-time reporting.

4. Data Security and Compliance

- Check for data protection measures like encryption and multi-factor authentication.

- Confirm compliance with financial regulations (e.g., SOX, GDPR, PCI-DSS).

- Assess their disaster recovery and business continuity plans.

5. Scalability and Flexibility

- Make sure the provider can expand their services as your business grows.

- Look for flexible pricing models to accommodate fluctuations in invoice volumes.

- Verify if they offer customized solutions based on your business needs.

How Our Accounts Payable Outsourcing Services Improve Efficiency

1. Automated Invoice Processing

- Uses AI-powered tools to capture, validate, and process invoices.

- Eliminates manual data entry, reducing human errors.

- Increases invoice processing speed, ensuring timely payments.

2. Faster Invoice Approvals

- Implements automated workflows for invoice approval.

- Sends real-time notifications to approvers, reducing delays.

- Ensures compliance with approval hierarchies and spending limits.

3. Seamless Integration with ERP & Accounting Software

- Connects with popular ERP and accounting platforms like QuickBooks, Xero, SAP, and Oracle.

- Eliminates duplicate data entry and manual reconciliation.

- Ensures smooth data flow between accounts payable and other financial systems.

4. Real-Time Tracking and Reporting

- Provides access to real-time dashboards and reports for invoice status and cash flow analysis.

- Enables better decision-making with up-to-date financial data.

- Improves visibility into outstanding payables, avoiding late fees.

5. Reduced Processing Errors and Duplicate Payments

- Uses machine learning to detect duplicate invoices and prevent overpayments.

- Implements three-way matching (invoice, purchase order, and receipt).

- Ensures accurate payment processing, reducing financial discrepancies.

6. Compliance and Risk Management

- Ensures adherence to tax laws, financial regulations, and corporate policies.

- Ensures a transparent record of all transactions for auditing purposes.

- Reduces the risk of fraud and unauthorized payments.

Accounts Junction’s accounts payables services can help businesses streamline their financial operations and focus on their core activities. Choosing the right accounts payable outsourcing company ensures long-term success and improved financial management.

Outsourcing accounts payable boosts efficiency, reduces costs and improves accuracy through automation. It streamlines invoices, payments, and vendor management while minimizing errors and ensuring compliance. A reliable provider enhances financial control, detects fraud, and strengthens supplier relationships. Businesses gain insights for better decision-making and seamless scaling without extra staffing. Choosing the right partner turns accounts payable into a strategic advantage, supporting growth and profitability.

FAQs

1. Why should a company outsource accounts payable?

- Outsourcing accounts payable helps businesses save costs, improve efficiency, and reduce errors while ensuring compliance with financial regulations.

2. How much does it cost to outsource accounts payable?

- The cost varies based on transaction volume, service complexity, and the outsourcing provider’s pricing model.

3. What should I look for in accounts payable outsourcing companies?

- Look for experience, technology integration, compliance, customer support, and flexible service options.

4. How do accounts payable outsourcing services improve efficiency?

- These services use automation, expert oversight, and streamlined processes to ensure fast, accurate, and cost-effective accounts payable management.

5. Can outsourcing accounts payable reduce fraud risk?

- Yes, outsourcing providers use advanced security measures and compliance protocols to minimize fraud risks.

6. What tasks are included when you outsource accounts payable?

- Outsourced AP teams handle invoice receipt, data entry, approvals, vendor communication, and payment processing. They also track due dates and manage reconciliations to keep records clean and current.

7. Is outsourcing accounts payable suitable for small businesses?

- Yes, small businesses may benefit the most. It cuts overhead costs, saves time, and allows owners to focus on growing their business instead of handling bills and paperwork.

8. Can accounts payable outsourcing work with my existing accounting software?

- Most outsourcing firms integrate smoothly with tools like QuickBooks, Xero, SAP, and NetSuite. They use APIs or direct links to sync invoice data and payment records without manual input.

9. How secure is it to outsource accounts payable?

- Top providers use encryption, access controls, and secure cloud platforms. They follow financial standards such as GDPR and PCI-DSS to protect all sensitive business data.

10. How long does it take to set up outsourced accounts payable services?

- The setup time may range from a few days to a few weeks. It depends on how complex your system is, how many invoices you process, and the tools you want integrated.

11. Will outsourcing affect my relationship with vendors?

- No, it may even improve it. Vendors get paid faster, communication becomes smoother, and errors are reduced. Some providers also offer a dedicated vendor helpdesk.

12. Can I customize which AP functions I outsource?

- Yes, you can outsource only parts of your process. Some businesses keep approvals in-house but outsource invoice entry and payment handling to reduce workload.

13. What kind of reports can I get from an outsourced AP provider?

- You can access reports on invoice status, payment timelines, aging analysis, and cash flow trends. Real-time dashboards make it easy to track everything at a glance.

14. Do outsourced accounts payable services support multi-currency payments?

- Yes, many providers handle multi-currency payments and global vendor invoices. They manage exchange rates, compliance, and tax details across regions.

15. How does outsourcing help in financial compliance?

- Outsourced teams follow accounting standards, maintain audit trails, and ensure tax compliance. This reduces the risk of penalties and keeps financial records transparent.

16. What if I want to switch providers later?

- You can easily migrate to another provider. Most firms help with data transfer and system setup to ensure there is no disruption in your payment cycle.

17. Can I track invoices in real time after outsourcing?

- Yes, cloud-based dashboards allow full visibility. You can see every invoice, payment, and approval step anytime, from anywhere.

18. Are there hidden costs in outsourcing accounts payable?

- Good providers maintain transparent pricing. However, extra costs may appear for custom integrations, complex workflows, or rush payments.

19. How does automation fit into outsourced accounts payable?

- Automation reads invoices, matches purchase orders, and routes approvals automatically. It minimizes manual effort and speeds up the full AP cycle.

20. How can outsourcing accounts payable improve cash flow?

- By ensuring timely payments, avoiding late fees, and providing better visibility into upcoming expenses, outsourcing helps you manage cash flow more wisely and plan ahead.