How do you Analyze a cash flow statement?

Hire A Dedicated Team

That Grows With You, Flexible, Scalable and

Always On Your Side

What is a Cash Flow Forecast and Why Does it Matter?

A cash flow forecast estimates future cash inflows and outflows over a specific period. It helps businesses plan for upcoming expenses, identify potential cash shortages, and make informed investment decisions.

Why is Cash Flow Forecasting Important?

- Ensures sufficient cash availability to cover expenses.

- Helps in making investment and expansion decisions.

- Assists in securing loans or attracting investors.

- Prevents financial crises by identifying cash shortfalls in advance.

Businesses that outsource bookkeeping for small businesses benefit from expert forecasting, ensuring accurate predictions and better financial planning.

Key Pitfalls to Avoid in Cash Flow Assessment

Even experienced businesses can make errors in cash flow analysis. Below are frequent pitfalls to be mindful of:

- Ignoring Non-Cash Expenses : Many businesses fail to account for depreciation and amortization, which can distort cash flow analysis.

- Overestimating Revenue Collections : Assuming that all sales will convert into immediate cash can lead to liquidity issues. Outsourced bookkeeping services help track outstanding receivables accurately.

- Underestimating Expenses : Businesses sometimes overlook upcoming expenses, leading to budget shortfalls. Regular cash flow forecasting reduces this risk.

- Neglecting Seasonal Variations : Industries with seasonal fluctuations must account for periods of low revenue to ensure smooth operations throughout the year.

- Not Using Professional Accounting Services : Mistakes in cash flow analysis can be expensive. That is why businesses often outsource accounting for accurate financial information. Companies that outsource bookkeeping gain expert financial insights, ensuring accuracy and efficiency.

Get Help from Account Junction for Your Cash Flow Analysis

Managing cash flow effectively is critical for business success. Account Junction provides professional outsourced bookkeeping services, ensuring accurate and timely financial reporting. Our experts help businesses outsource bookkeeping for small businesses, delivering personalized solutions that improve financial visibility and decision-making.

Why Choose Account Junction?

- Expertise in outsourced bookkeeping and financial analysis.

- Custom solutions for outsourcing accounting needs.

- Timely and accurate cash flow reporting.

- Advanced tools and software for precise forecasting.

Effective cash flow management requires clear tracking of financial transactions. Professional outsourced bookkeeping services provide expert support, ensuring stability and informed decision-making.

Conclusion

A well-analyzed cash flow statement is key to understanding a company’s financial health. By evaluating cash movements in operating, investing, and financing activities, businesses can make informed decisions to sustain growth. Regular cash flow forecasting helps prevent financial shortfalls and ensures smooth operations.

Accounts Junction provides expert outsourced bookkeeping services to help businesses manage their cash flow efficiently. Whether you need help with cash flow analysis, forecasting, or financial reporting, their professional services ensure accuracy, compliance, and better financial decision-making.

FAQs

1. What is the ideal frequency for analyzing my cash flow statement?

It’s advisable to review your cash flow statement monthly to stay updated on your financial health.

2. Can I perform cash flow analysis without professional help?

Yes, but professional outsourced bookkeeping services provide accuracy and insights that improve financial management.

3. How does outsourcing bookkeeping help in cash flow management?

When businesses outsource bookkeeping, they receive expert tracking, forecasting, and reporting, reducing errors and improving cash flow visibility.

4. What tools are used for cash flow analysis?

Popular tools include QuickBooks, Xero, and specialized cash flow forecasting software.

5. How do I improve cash flow?

To enhance cash flow, improve collections, reduce unnecessary expenses, and seek professional outsourced bookkeeping support.

6. Why should businesses outsource accounting?

Many businesses outsource accounting to streamline financial management, reduce errors, and ensure compliance with financial regulations.

What is a Cash Flow Statement?

A cash flow statement is a crucial financial document that tracks a business’s inflows and outflows of cash. It shows how a company uses its cash to pay for operations, investments, and financial activities. Unlike the income statement, which emphasizes profitability, the cash flow statement focuses on liquidity. Businesses that outsource bookkeeping for small businesses get accurate and timely cash flow reports. This helps them make better financial decisions.

The cash flow statement is divided into three main parts:

- Operating Activities: Cash transactions related to daily business operations.

- Investing Activities: Cash used for or generated from asset investments.

- Financing Activities: Cash movements related to debt, equity, and dividends.

Breaking Down the Cash Flow Statement

Understanding a cash flow statement requires breaking it down into its key components. Each section provides valuable insights into how cash moves within a business and impacts overall financial health.

To fully understand a cash flow statement, you need to know its three main parts. Each part is important for financial stability:

Operating Activities

This section includes revenue and expenses from core business activities. It reflects cash collected from sales, payments to suppliers, wages, taxes, and other operational costs. A positive cash flow from operations indicates a profitable and sustainable business.

Investing Activities

This part covers the purchase or sale of assets, including real estate, equipment, and securities. A company that invests a lot in assets may have negative cash flow. However, this isn't always bad if it helps future growth. Businesses that outsource bookkeeping for small businesses ensure accurate tracking of these transactions.

Financing Activities

This section records cash movements related to loans, equity financing, and dividends. A company that issues new shares or gets loans will have positive cash flow. However, repaying debt or paying dividends leads to cash outflows.

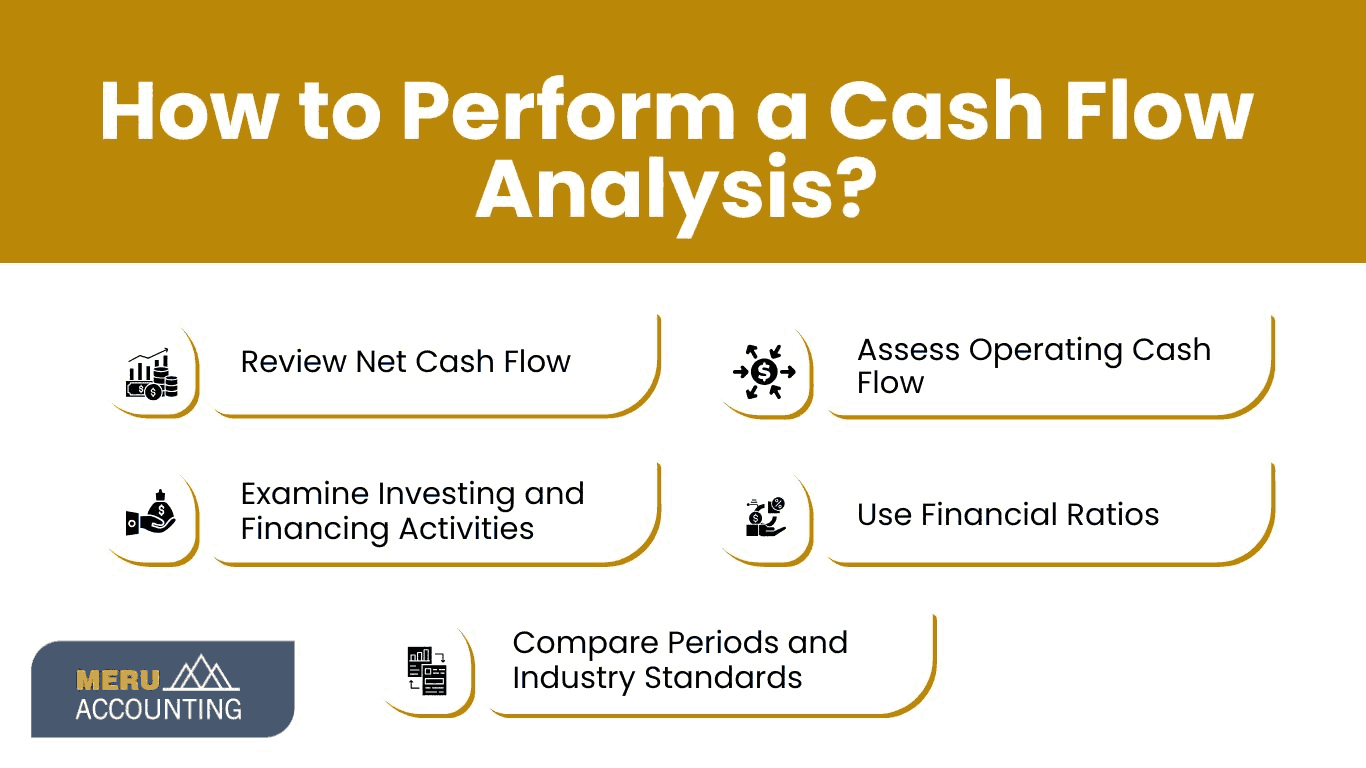

How to Perform a Cash Flow Analysis?

Analyzing a cash flow statement helps businesses understand their financial stability and make informed decisions. Here’s a step-by-step approach:

Step 1: Review Net Cash Flow

Start by analyzing the net increase or decrease in cash. A positive cash flow means the company makes enough money to pay its bills. A negative cash flow can show financial problems.

Step 2: Assess Operating Cash Flow

Compare net income with operating cash flow. If operating cash flow is consistently lower than net income, it may suggest aggressive revenue recognition or poor collections. Businesses often outsource accounting to professionals to monitor these metrics effectively.

Step 3: Examine Investing and Financing Activities

A healthy balance between investment in assets and financial obligations is crucial. Continuous negative cash flow in these areas might indicate over-expansion or excessive borrowing.

Step 4: Use Financial Ratios

Key cash flow ratios help us understand financial stability. The Operating Cash Flow Ratio is determined by dividing the Operating Cash Flow by Current Liabilities. Free Cash Flow is found by subtracting Capital Expenditures from Operating Cash Flow.

Step 5: Compare Periods and Industry Standards

Analyzing cash flow trends over multiple periods and benchmarking against industry standards helps in making strategic decisions. Companies often outsource accounting and bookkeeping to ensure proper comparisons and error-free analysis.

Hire A Dedicated Team

That Grows With You, Flexible, Scalable and

Always On Your Side

What is a Cash Flow Forecast and Why Does it Matter?

A cash flow forecast estimates future cash inflows and outflows over a specific period. It helps businesses plan for upcoming expenses, identify potential cash shortages, and make informed investment decisions.

Why is Cash Flow Forecasting Important?

- Ensures sufficient cash availability to cover expenses.

- Helps in making investment and expansion decisions.

- Assists in securing loans or attracting investors.

- Prevents financial crises by identifying cash shortfalls in advance.

Businesses that outsource bookkeeping for small businesses benefit from expert forecasting, ensuring accurate predictions and better financial planning.

Key Pitfalls to Avoid in Cash Flow Assessment

Even experienced businesses can make errors in cash flow analysis. Below are frequent pitfalls to be mindful of:

- Ignoring Non-Cash Expenses : Many businesses fail to account for depreciation and amortization, which can distort cash flow analysis.

- Overestimating Revenue Collections : Assuming that all sales will convert into immediate cash can lead to liquidity issues. Outsourced bookkeeping services help track outstanding receivables accurately.

- Underestimating Expenses : Businesses sometimes overlook upcoming expenses, leading to budget shortfalls. Regular cash flow forecasting reduces this risk.

- Neglecting Seasonal Variations : Industries with seasonal fluctuations must account for periods of low revenue to ensure smooth operations throughout the year.

- Not Using Professional Accounting Services : Mistakes in cash flow analysis can be expensive. That is why businesses often outsource accounting for accurate financial information. Companies that outsource bookkeeping gain expert financial insights, ensuring accuracy and efficiency.

Get Help from Account Junction for Your Cash Flow Analysis

Managing cash flow effectively is critical for business success. Account Junction provides professional outsourced bookkeeping services, ensuring accurate and timely financial reporting. Our experts help businesses outsource bookkeeping for small businesses, delivering personalized solutions that improve financial visibility and decision-making.

Why Choose Account Junction?

- Expertise in outsourced bookkeeping and financial analysis.

- Custom solutions for outsourcing accounting needs.

- Timely and accurate cash flow reporting.

- Advanced tools and software for precise forecasting.

Effective cash flow management requires clear tracking of financial transactions. Professional outsourced bookkeeping services provide expert support, ensuring stability and informed decision-making.

Conclusion

A well-analyzed cash flow statement is key to understanding a company’s financial health. By evaluating cash movements in operating, investing, and financing activities, businesses can make informed decisions to sustain growth. Regular cash flow forecasting helps prevent financial shortfalls and ensures smooth operations.

Accounts Junction provides expert outsourced bookkeeping services to help businesses manage their cash flow efficiently. Whether you need help with cash flow analysis, forecasting, or financial reporting, their professional services ensure accuracy, compliance, and better financial decision-making.

FAQs

1. What is the ideal frequency for analyzing my cash flow statement?

It’s advisable to review your cash flow statement monthly to stay updated on your financial health.

2. Can I perform cash flow analysis without professional help?

Yes, but professional outsourced bookkeeping services provide accuracy and insights that improve financial management.

3. How does outsourcing bookkeeping help in cash flow management?

When businesses outsource bookkeeping, they receive expert tracking, forecasting, and reporting, reducing errors and improving cash flow visibility.

4. What tools are used for cash flow analysis?

Popular tools include QuickBooks, Xero, and specialized cash flow forecasting software.

5. How do I improve cash flow?

To enhance cash flow, improve collections, reduce unnecessary expenses, and seek professional outsourced bookkeeping support.

6. Why should businesses outsource accounting?

Many businesses outsource accounting to streamline financial management, reduce errors, and ensure compliance with financial regulations.