How can we improve Accounts Receivable Management?

Accounts receivable management is the process of ensuring your business gets paid for the goods or services it provides. It includes everything from invoicing customers to collecting outstanding payments. Effective accounts receivable management is crucial for maintaining a healthy cash flow, which is the lifeblood of any business. Steady incoming payments are essential for business success. Without them, even profitable companies struggle to cover expenses and invest in growth.

Account Receivable management focuses on minimizing the time needed to convert sales into cash. This involves:

- Accurate Invoicing: Sending out clear, timely, and accurate invoices.

- Credit Management: Assessing the creditworthiness of customers before extending credit.

- Payment Tracking: Monitoring outstanding balances and identifying overdue accounts.

- Collection Processes: Implementing strategies for collecting overdue payments, including friendly reminders and, if necessary, more formal collection procedures.

- Dispute Resolution: Establish a clear dispute resolution process. This prevents payment delays caused by customer invoice disputes.

- Forecasting and Analysis: Forecast cash flow using historical data and trends. Analyze AR metrics. This identifies improvement areas and potential risks.

- Compliance and Legal Considerations: Ensure AR practices comply with laws and regulations. This includes data privacy, debt collection, and consumer protection.

Common Challenges in Managing Accounts Receivable

Many businesses face challenges when managing their AR, leading to delayed payments and cash flow problems. Some common challenges include:

- Inaccurate or Delayed Invoicing: Errors in invoices can lead to customer disputes. Delays in sending invoices can also cause payment delays.

- Poor Credit Management: Extending credit to customers with poor credit histories can result in defaults and bad debts.

- Lack of Follow-up: Failing to follow up on overdue payments can lead to customers neglecting their obligations.

- Inefficient Collection Processes: Ineffective collection strategies can prolong the time it takes to receive payments.

- Disorganized records: Without a proper accounting system, it is very hard to keep track of incoming and outgoing cash.

- Customer Disputes: Beyond simple invoice errors, disagreements about the quality of goods or services rendered can hold up payments.

- Economic Downturns: Broader economic issues can affect customers' ability to pay on time. This increases the risk of delayed payments and defaults.

- Internal Communication Issues: Lack of communication between sales, customer service, and accounting departments can lead to delays in invoicing or addressing customer payment issues.

- Ignoring Payment Patterns: Failing to analyze customer payment history to identify potential slow payers or high-risk accounts.

- Technological Limitations: Using outdated or inadequate accounting software that doesn't offer robust AR management features.

- Global Customer Complexity: Managing AR for international customers can introduce challenges related to currency exchange, different payment customs, and legal complexities.

Inefficient processes have hidden costs that businesses often overlook. Trying to handle everything in-house without understanding these costs can be a costly mistake.

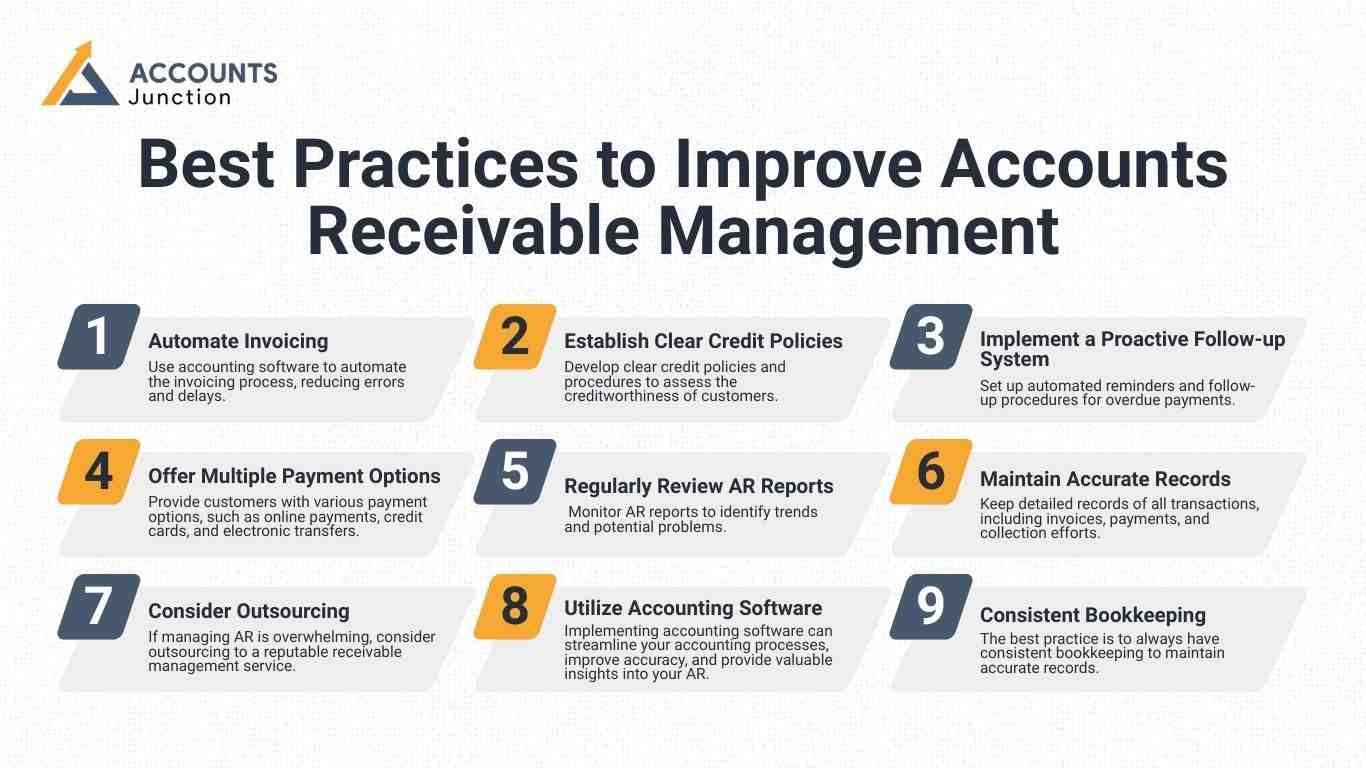

Best Practices to Improve Accounts Receivable Management

To overcome these challenges and improve receivable management services, businesses can implement the following best practices:

- Automate Invoicing: Use accounting software to automate the invoicing process, reducing errors and delays.

- Establish Clear Credit Policies: Develop clear credit policies and procedures to assess the creditworthiness of customers.

- Implement a Proactive Follow-up System: Set up automated reminders and follow-up procedures for overdue payments.

- Offer Multiple Payment Options: Provide customers with various payment options, such as online payments, credit cards, and electronic transfers.

- Regularly Review AR Reports: Monitor AR reports to identify trends and potential problems.

- Maintain Accurate Records: Keep detailed records of all transactions, including invoices, payments, and collection efforts.

- Consider Outsourcing: If managing AR is overwhelming, consider outsourcing to a reputable receivable management service.

- Utilize Accounting Software: Implementing accounting software can streamline your accounting processes, improve accuracy, and provide valuable insights into your AR.

- Consistent Bookkeeping: The best practice is to always have consistent bookkeeping to maintain accurate records.

Implementing these best practices is key to streamlining receivables and securing consistent cash flow.

How Receivable Management Services Can Help Your Business

Outsourcing accounts receivable management services can provide numerous benefits, including:

- Improved Cash Flow: Receivable management services can accelerate the collection of payments, improving your cash flow.

- Reduced Bad Debts: Professional AR managers can effectively manage credit and collection processes, minimizing bad debts.

- Increased Efficiency: Outsourcing frees up your staff to focus on other core business activities.

- Reduced Costs: Outsourcing can be more cost-effective than hiring and training in-house AR staff.

- Expertise: Receivable management services provide access to experienced professionals who understand the complexities of accounts receivable management.

- Better reporting: Utilizing external expertise can lead to improved reporting and a clearer understanding of your business's financial standing.

Many businesses find that utilizing accounts receivable management services allows for a much more predictable cash flow.

Measuring the Success of Your AR Process

How do you know if your receivable management really works? By tracking key signs.

Some useful metrics include:

- Days Sales Outstanding (DSO): Shows how long it takes to get paid.

- Collection Rate: Percentage of invoices collected on time.

- Aging Reports: Group invoices by due dates to see where problems lie.

- Dispute Frequency: Fewer disputes often mean better accuracy.

Measuring helps identify where time and money may be getting stuck. Small adjustments can lead to big improvements.

Why Choose Accounts Junction for Accounts Receivable Management Services?

Accounts Junction offers comprehensive accounts receivable management services. These services can help your business improve cash flow and reduce bad debts. We offer:

- Experienced Professionals: Our team of experienced AR managers has the expertise to handle all aspects of accounts receivable management.

- Customized Solutions: We tailor our accounts receivable management services to meet the specific needs of your business.

- Advanced Technology: We utilize advanced technology and software to streamline AR processes.

- Transparent Reporting: We provide regular reports and updates on the status of your AR.

- Cost-Effective Services: We offer competitive pricing and flexible service options.

We can help you understand the full cost implications of managing your receivables. By using our accounts receivable management services, businesses see a drastic reduction in late payments. Our accounts receivable management services are designed to give business owners peace of mind.

Effective accounts receivable management is vital for healthy cash flow and reduced bad debt. While challenging to manage internally, outsourcing to specialists like Accounts Junction offers a streamlined solution. By using our expertise and technology, businesses can optimize receivables, improve financial stability, and focus on growth. Proactive AR management is a key investment in long-term success.

FAQs

1. What does accounts receivable mean for a business?

- It’s the amount your customers owe for goods or services already received.

2. How often should AR reports be checked?

- Weekly or monthly reviews may help catch trends early.

3. Can offering early-payment discounts help?

- It might. Small discounts can motivate faster payments.

4. What happens if overdue invoices are ignored?

- They may pile up and cause serious cash flow trouble later.

5. How can automation improve accuracy?

- It handles repetitive tasks like invoicing and tracking with fewer mistakes.

6. Why do customers delay payments?

- It may be due to confusion, financial pressure, or missing reminders.

7. Should I charge late fees?

- If done politely, it may encourage timely payments.

8. What’s the best way to solve invoice disputes?

- Quick review and calm communication usually help most.

9. Can outsourcing AR save time?

- Yes. It frees your team from manual work and adds expert support.

10. Is giving credit to new customers risky?

- It can be, so always run a credit check first.

11. What does DSO tell us?

- It shows how fast you collect money after a sale.

12. Why is forecasting important?

- Forecasting may help plan expenses and avoid cash gaps.

13. Can communication reduce late payments?

- Absolutely. Clear updates build trust and reduce delays.

14. Should I track each client’s payment pattern?

- Yes, it helps you identify slow or risky payers.

15. What to do if a client refuses to pay?

- You may seek legal help or use a collection agency.

16. How do AR reports help decision-making?

- They reveal who pays late and where risks may lie.

17. Are too many payment options confusing?

- Not really. More options usually mean faster payments.

18. Can outsourcing affect customer relationships?

- Handled well, it often improves them through better service.

19. Can AR tools fit small businesses too?

- Yes, many affordable tools can suit even small setups.

20. Can better AR practices grow a business?

- Yes. Steady cash flow can fund new ideas, staff, and expansion.