How can Accounting Outsourcing Services boost your hospitality Business?

In the hospitality field, daily tasks can expand quickly. Many units may face cash stress as guest needs shift. Work may feel smooth one day and far from calm the next day. When such a flow stays in place, owners may search for stable support. For this need, accounting outsourcing services can act as a steady link. These services may give firms a clear path to shape a better workflow.

While the sector stays warm and bright for guests, the back room may feel complex. Bills can rise in waves, and income can drop at odd hours. Staff pay, room rates, vendor dues, and tax tasks can move in many ways. When these tasks grow, owners may want trained eyes to watch their books. A skilled support team outside the firm can add new value. This shift may open space for owners to think about service and guest care.

Why Hospitality Firms May Face Accounting Strain

-

Large daily cash flow

Rooms, meals, travel plans, and event deals can bring a wide daily cash flow. This flow may place a load on staff who lack strong skills. When such work grows, errors may slip in.

-

Shifting guest cycles

In peak days, cash tasks can grow many times. In low days, cash tasks can shrink. This shift may unsettle in-house teams and cause stress.

-

Many cost points

Food stock, room items, staff work, event tools, and vendor dues can add many lines of cost. When these lines shift fast, tracking may turn slow.

-

Compliance pressure

Tax rules and state rules may change at times. When a firm fails to grasp these rules, issues may arise.

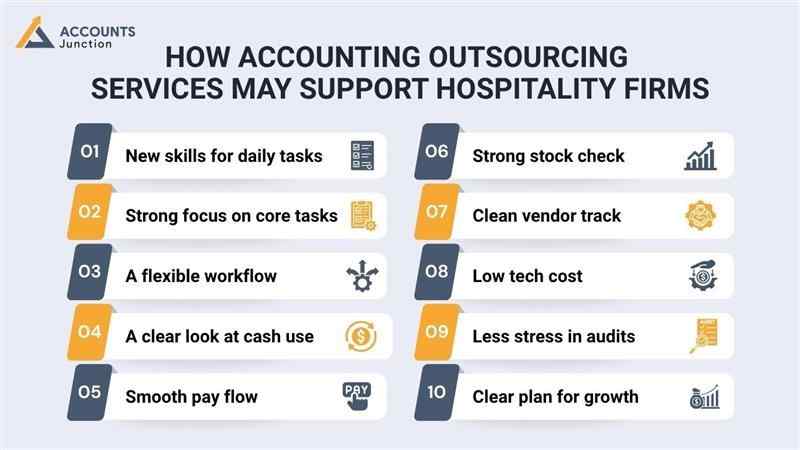

How accounting outsourcing services may support hospitality firms

-

New skills for daily tasks

When trained teams handle books, the work may feel clearer. These teams can use strong tools to track each cash move. Such support may cut errors and lift trust in numbers.

-

Strong focus on core tasks

Hospitality units may want to place more time on guests. With accounting outsourcing services handling cash tasks, owners can focus on service. This shift may raise guest joy and brand trust.

-

A flexible workflow

Outsourced teams may scale tasks when cash flow grows. When days feel slow, these teams can scale tasks down. Such flex can support units on peak and slow days with ease.

-

A clear look at cash use

Outsourced teams may give clean reports that show how funds move. These reports may guide owners to take sound steps for their firm.

-

Smooth pay flow

Many hospitality units may face stress with staff pay. Using accounting outsourcing services for pay work may lower the load. Pay may reach staff on time, and trust may grow.

-

Strong stock check

Food stock, drink stock, room items, and event tools may move in large amounts. Outsourcing teams can track these items with strong care. This may help firms avoid loss.

-

Clean vendor track

Vendor dues may rise fast when units grow. Outsourcing teams can watch vendor bills and clear dues on time. This may build calm ties with vendors.

-

Low tech cost

Buying cash tools can drain funds. Outsourcing teams may use tools they have, which can lower the firm's cost. This may support small units that want smart options.

-

Less stress in audits

When all work stays neat, audits may run more smoothly. Outsourced teams may shape files and reports that audits can use with ease.

-

Clear plan for growth

When owners gain clean insight into funds, they may plan growth. Cash flow reports may show strong or weak areas. Owners can then shape fresh steps.

Key parts of accounting outsourcing services for hospitality

-

Book tasks

Daily bills may need checking and notes. Outsourced teams can record these moves with care. This can keep books clean.

-

Pay tasks

Staff pay may take time each week or month. Outsourcing can shape this task with ease.

-

Vendor tasks

Vendor dues may stay clear when tracking stays strong.

-

Cash flow watch

Firms may gain clear views of cash in and cash out.

-

Stock check

Food and drink stock may stay under full watch.

-

Tax tasks

Changes in tax rules may feel hard to track. Outsourcing may ease this load.

-

Bank check

Bank lines may match book lines with clean steps.

-

Month-end check

Reports at the month-end may show a firm its full view.

Why hospitality units may shift to outsourced teams

-

Low errors and cleaner work

Using accounting outsourcing services may keep tasks more neat and reduce mistakes.

-

More time for guest care

Owners can shift focus to core guest care.

-

Low long-term cost

Firms may avoid the cost of large in-house teams.

-

Smart tools

Outsourced teams can use the latest tools that may add more value.

-

Stable support each day

Even when staff quit or shift, outsourced teams may stay stable.

How it may change day-to-day work

-

More calm for owners

When cash tasks sit with skilled teams, owners may feel calm.

-

Clear view at all times

Reports may stay ready, which can guide day-to-day plans.

-

Smooth chat between units

Teams may share files fast and with a clean format.

-

Ease in slow or peak days

Flex services may change shape with each cycle.

How outsourced teams may shape growth plans

-

Track guest trends

Reports may show what guests like and what they skip.

-

Spot weak cost zones

Reports may point to zones that drain funds.

-

Plan staff use

Pay reports may show if staff use stays sound.

-

Build budget plans

Firms may plan sound budgets with clear cash insight.

Impact of Accounting Outsourcing Services on Various Hospitality Units

Accounting outsourcing services may help different hospitality businesses in many ways. Here is how they may benefit each type of unit:

Hotels

- Large cash tasks: Hotels handle payments from rooms, meals, and events.

- Accurate tracking: Outsourced teams may watch transactions carefully and reduce mistakes.

- Better planning: Clear records may help hotel managers make smart decisions.

Cafes

- Fast cash flow: Cafes see quick daily sales and moving stock.

- Stock control: Outsourcing may track inventory and sales to avoid shortfalls.

- Fewer errors: Skilled teams may lower mistakes in bills and cash work.

Food Chains

- Multi-unit work: Food chains handle stock and sales across many locations.

- Consistent reports: Outsourced teams may keep uniform records for all units.

- Better insight: Accurate reports may show which units perform well or poorly.

Travel Firms

- Rate changes: Travel agencies deal with frequent pricing and guest shifts.

- Transaction check: Outsourced teams may watch bookings, payments, and refunds.

- Clear records: This may help smooth cash flow and reliable reports for management.

How to pick the right outsourcing team

-

Check skill

Look for teams that provide accounting outsourcing services and have past work in hospitality.

-

Check tools

Ensure they use good tools that can track all cash tasks.

-

Check support

Pick teams that can stay with you when tasks grow.

-

Check cost

Look for clean cost plans that may fit your budget.

-

Check data care

Make sure your data stays safe and private.

Steps to start with outsourced teams

-

Step 1:

Share your current cash flow with the new team.

-

Step 2:

Let them check your books and note key needs.

-

Step 3:

Shape a plan that fits your firm’s size.

-

Step 4:

Shift tasks in steps to avoid stress.

-

Step 5:

Check reports often and build a steady link.

Why the shift may feel smart in the long run

Shifting accounting tasks to outsourcing teams may bring clear gains. Hospitality firms may get long-term value in many ways.

1. Cost Savings and Efficiency

- Outsourcing may cut payroll and tool costs for firms. Staff may spend more time on guest service daily. Work may flow smoothly while the overall cost may stay low.

2. Skilled Handling of Finances

- Teams may track cash flow with strong care and speed. Mistakes in books may be reduced, and reports may stay clear. This support may give firms insight into future growth.

3. Flexibility and Scale

- Task load may rise during busy guest periods with ease. During slow days, service may scale down without extra cost. This change may prevent extra staff or resource strain.

4. Clear Financial Insight

- Outsourced teams may send regular reports with full details. Firms may see profits, costs, and trends with more clarity. Better insight may help plan budgets and make smart moves.

5. Less Stress and Growth Focus

- Owners may focus on strategy rather than daily tasks. Stress may drop while guest care and service improve fast. Growth plans may become clearer and easier to follow.

Hospitality units may stand in a busy field where tasks grow fast. When cash tasks sit with trained outsourced teams, owners may gain clear space. This space may help the firm lift guest care, guide staff, and shape a calm plan for growth. With accounting outsourcing services, units may step into a more stable and bright path. At Accounts Junction, we provide accounting outsourcing services for hospitality firms. We have certified experts who manage books, pay, tax, and stock with care. Our team keeps the daily cash flow smooth and reports clear for each firm. Partner with us for a simple and reliable accounting experience.

FAQs

1. How can accounting outsourcing services support hotel cash tasks?

- Room sales, food bills, and event revenue may be tracked with more orders. Daily records can stay clear and updated.

2. How can outsourced accounting improve hospitality cash flow?

- Cash trends may become easier to see with clean reports. Better plans can form from these insights.

3. How can vendor dues stay more organized through outsourcing?

- Vendor bills may pass through a set review stage. Late dues can be avoided with timely checks.

4. Can food and drink stock costs become more stable with outsourcing?

- Stock use may be tracked in detail each day. Waste and loss can drop with better data.

5. How can staff pay tasks run smoothly with outsourced teams?

- Pay cycles may move in a fixed schedule. Staff trust can rise with timely payouts.

6. Can event billing in hotels gain more clarity through outsourcing?

- Event costs may be noted in one clean list. Guest payments can match the planned charges.

7. How can multi-branch chains gain value from outsourcing?

- Data from all units may merge into one view. Leaders can use this view for calm planning.

8. Can real-time financial reports support hospitality units?

- Daily or weekly reports may stay ready for review. Quick steps can form from these updates.

9. How can outsourcing reduce account errors in busy hotels?

- Trained checks may catch wrong entries fast. Clear steps can guide neat bookwork.

10. Can tax tasks for hotels and cafes stay simpler with outsourcing?

- Rule changes may be tracked in advance. Filing can feel smoother with steady prep.

11. How can outsourcing adjust to seasonal hospitality cycles?

- Sales waves may stay watched with care. Workloads can shift in line with demand.

12. Can new hospitality firms gain setup support from outsourcing?

- Clean book formats may start from day one. Growth can feel more stable with a sound structure.

13. How can menu pricing improve with outsourced insight?

- Food cost and sales trends may show needed gaps. Updated rates can support better margins.

14. Can online booking payments stay more accurate through outsourcing?

- Booking entries may match bank lines with strict checks. Online sales can reflect true figures.

15. How can fraud risks be lowered in hospitality accounts?

- Strong checks on stock, bills, and claims may block wrong moves. Clean trails can reveal issues early.

16. Can kitchen cost control grow stronger with outsourced work?

- Stock use may be tracked in detail. Food plans can shift with new insight.

17. How can monthly and yearly reports improve through outsourcing?

- Full performance views may reach owners on time. Growth steps can form from these views.

18. Can guest refunds and cancellations stay more accurate with outsourcing?

- Refunds may follow a clear record path. Revenue lines can stay balanced in the books.

19. How can outsourcing support hotel expansion plans?

- Past cost and income patterns may guide budgets. New units can start with more clarity.

20. Can multi-currency guest payments stay cleaner with outsourced teams?

- Mixed currency entries may get checked line by line. Final books can show correct values.