How Outsourced Accounting Can Transform Your Business Finances

Outsourced accounting is a smart way for businesses to handle their finances without building an in-house team. It helps companies cut costs and save time by relying on skilled external professionals. They can handle tasks like bookkeeping and tax filing. The key lies in selecting appropriate service providers and connecting them in operations. Whether you own a small business or run a larger one, outsourced accounting can help. It improves financial processes and gives you insights for better decision-making.

What Is Outsourced Accounting and How Does It Work?

Outsourced bookkeeping refers to the practice of hiring a third-party provider to manage your finances. This includes talks of record keeping, transactions, bank reconciliation, payroll processing, and tax filings.

Here is a simple breakdown of how it works:

Know your needs

- Determine which accounting tasks you outsource. Whether full-service accounting or just specific tasks like payroll. You can also customize it as per your needs.

Select Provider

- Choose a service provider that specializes in your industry. He has enough experience and technology to handle your needs.

Share Your Data:

- Once you get the person who fits your needs. You can securely transfer your data to a provider through a cloud-based system. This allows you easy collaboration.

Execution :

- The outsourced team takes over all financial tasks. They ensure firmly that everything will be done up-to-date and in compliance.

Regular Reporting

- Once they receive all data, the outsourced team has the responsibility to give regular updates and report to the business. This will keep businesses informed and maintain visibility over their finances.

Key Benefits of Choosing Outsourced Accounting Services

When a company selects outsourced accounting, it comes with a variety of advantages. Here are some key benefits that businesses experience when they outsource their financial tasks:

Cost Savings

- When you hire an in-house team, this incurs the cost of salaries, benefits and training, and much more. But with outsourced accounting, you have to pay for the services you need. This minimizes your overhead costs.

Expertise

- Outsourced accounting provides access to professional accountants who have specialized knowledge in tax laws, financial reporting, and compliance. This ensures your finances are in capable hands.

Scalability

- As business grows, your accounting needs increase. Outsource accounting services are flexible and grow with your business. Whether you need more services or support in high times, outsourcing makes it easy to adjust.

Improved Accuracy

- In outsourced accounting services, Professional accountants use tools and expertise that minimize errors in your financial records. They ensure that your books are accurate and up to date.

More Time for Core Activity:

- Outsourcing your accounting allows you to focus on growing your business. When you have free assurance that Experts are handling your finances, you can be more devoted to strategy and customer satisfaction.

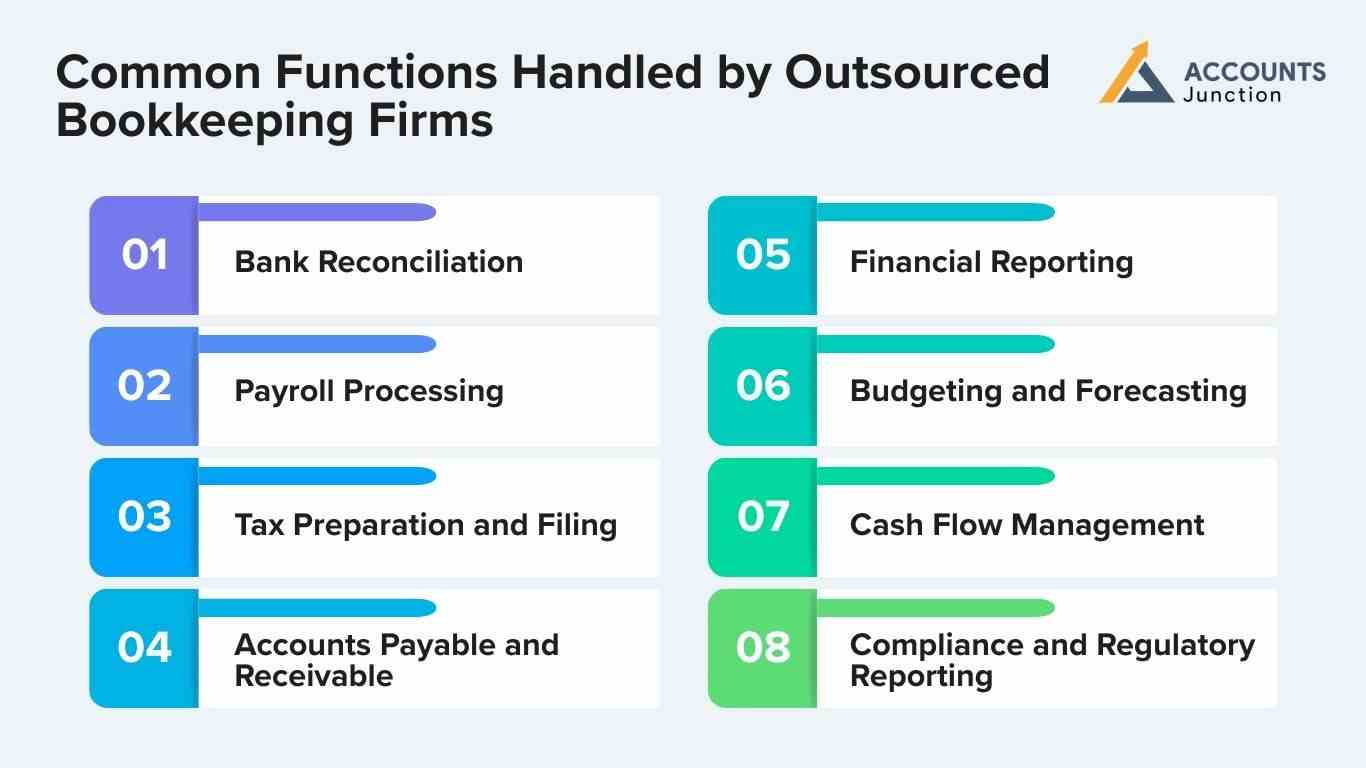

Common Functions Handled by Outsourced Bookkeeping Firms

Whether that is basic bookkeeping or overall financial management, businesses can customize their service as per their requirement. Here are some functions handled by an outsourced accountant:

1. Bank Reconciliation

This is one of your foundational tasks in bookkeeping. Outsourced accounting providers reconcile your business’s internal records with your bank statements to ensure consistency and catch discrepancies.

2. Accounts Payable and Receivable

Outsourced accounting teams streamline invoice creation, track customer payments, and ensure vendor bills are paid on time. This reduces late fees and strengthens business relationships by maintaining financial integrity.

3. Payroll Processing

Outsourced professionals ensure your payroll process is done on time with proper reporting and withholdings:

- Calculating gross and net pay

- Handling tax withholdings and filings

- Managing employee benefits and reimbursement

- Generating payslips and payroll reports

4. Tax Preparation and Filing

Tax season is too much to handle without expert help. Professionals are experts in tax preparation for the filing process. They are also known for ever-changing laws and help businesses benefit from deductions and credits.

5. Financial Reporting

Timely and accurate financial reports are essential for strategic planning and compliance. Outsourced teams generate regular reports such as:

- Profit and Loss Statements

- Balance Sheets

- Cash Flow Statements

- Custom reports based on key performance indicators (KPIs)

These insights help business owners make informed decisions and plan for growth with confidence.

6. Budgeting and Forecasting

Outsourced accounting experts help you create realistic budgets based on historical performance and market trends. They also provide financial forecasts to guide long-term planning and resource allocation.

- Identify revenue trends

- Project future cash flow

- Model various business scenarios

- Monitor performance against the budget

7. Cash Flow Management

Outsourced professionals monitor your inflows and outflows to ensure your company never runs short on working capital. Services may include:

- Analyzing cash position

- Suggesting strategies to shorten receivables

- Extending payables responsibly

- Offering credit control recommendations

Proper cash flow management ensures business continuity.

8. Compliance and Regulatory Reporting

Different industries and regions have strict financial regulations. From tax laws to labor regulations, outsourced accounting providers ensure your business meets all applicable legal and regulatory standards.

Examples include:

- VAT filings and documentation

- Regulatory disclosures for public companies

- Nonprofit compliance reports

- Statutory filings and legal documentation

Challenges and How to Overcome Them with Outsourced Accounting

Data Security

- The confidentiality of financial data is crucial. Always select an outsourced accounting firm that uses encrypted systems and follows strict security protocols.

Communication Issues:

- Working with an external team can sometimes create communication gaps. To avoid this, establish regular check-ins, set clear goals, and utilize collaborative tools to stay on track.

Loss of control:

- You may feel a loss of control over financial tasks. Overcome it by requesting detailed reports, having direct access to accounting platforms, and setting automated notifications for updates.

How to Choose the Right Outsourced Bookkeeping Firm

There are too many outsourced bookkeeping firms in the market, but which is right for you? This business should be selected based on the following factors:

1. Industry Expertise

- Look for firms with experience in your specific industry. Specialized knowledge can improve the accuracy of your reports and compliance with industry regulations.

2. Technology Integration

- Make sure the firm uses modern, cloud-based accounting tools that integrate with your current systems for seamless operations.

3. Customizable Services

- Not all businesses have the same accounting needs. Choose a firm that offers flexible services to match your business size, goals, and budget.

4. Pricing Transparency

- To avoid hidden fees, understand the firm’s pricing. This could be an hourly rate, a monthly fee, or charges for specific tasks.

5. Reputation and References

- Look for testimonials or ask for references from other businesses in your industry to evaluate the firm’s reliability, professionalism, and quality of service.

The size and needs of every business are different. Based on the need to select an appropriate outsourced accounting provider and maintain clear communication, businesses can simplify their financial operations. Account Junction offers outsourced accounting services that reduce your costs, gain expert financial management, and improve efficiency.

FAQ

1. What is outsourced accounting, and how can it benefit my business?

- Outsourced accounting is hiring an external firm to handle financial tasks. It can save costs, improve accuracy, and free up time for business growth.

2. How does outsourced accounting reduce overhead costs?

- By eliminating the need for full-time staff, training, and software, businesses pay only for the services they use.

3. Can outsourced accounting improve financial accuracy?

- Yes, experienced professionals use advanced tools and processes that reduce errors in bookkeeping and reporting.

4. What tasks can outsourced accounting cover?

- It can handle bookkeeping, payroll, tax filings, financial reporting, budgeting, and cash flow management.

5. How does outsourced accounting support small businesses?

- Small businesses gain expert financial management without hiring an in-house team, allowing them to focus on growth.

6. Can outsourced accounting help with tax compliance?

- Yes, providers ensure taxes are filed correctly, taking advantage of deductions and staying updated with regulations.

7. How is data shared securely with outsourced accountants?

- Data is usually transferred via encrypted cloud platforms to maintain confidentiality and accessibility.

8. Can outsourced accounting assist with cash flow management?

- Yes, professionals track inflows and outflows, suggest strategies to maintain working capital, and avoid shortfalls.

9. How do outsourced accounting services adapt to business growth?

- They are scalable, providing more support during busy periods or as financial tasks increase.

10. Can outsourced accounting provide financial insights for strategic decisions?

- Yes, detailed reports and analysis help businesses plan budgets, forecast growth, and evaluate performance.

11. What should I look for when choosing an outsourced accounting firm?

- Check for industry expertise, technology integration, customizable services, transparent pricing, and references.

12. How frequently will I receive financial reports from outsourced accounting services?

- Reports are usually provided monthly, quarterly, or on demand, depending on your business requirements.

13. Can outsourced accounting help reduce tax liabilities?

- Professionals may identify legal deductions and credits, helping your business optimize tax obligations.

14. How does outsourced accounting integrate with my existing systems?

- Most providers use cloud-based software that connects with your current tools for smooth operations.

15. Is outsourced accounting suitable for larger enterprises?

- Yes, large companies can streamline multiple departments, reduce administrative burdens, and improve reporting.

16. What challenges can businesses face with outsourced accounting?

- Common issues include communication gaps, data security concerns, and perceived loss of control, which can be managed with clear protocols.

17. Can outsourced accounting handle budgeting and forecasting?

- Yes, experts create realistic budgets, project cash flow, and model business scenarios to guide decision-making.

18. How do outsourced accountants ensure regulatory compliance?

- They monitor laws, file statutory documents, and maintain accurate records to meet industry-specific regulations.

19. Can outsourced accounting services save time for business owners?

- Absolutely, by handling routine financial tasks, owners can focus on core operations and strategic initiatives.

20. How quickly can I start using outsourced accounting services?

- Implementation can begin within days or weeks, depending on data transfer, software setup, and service customization.

21. Can outsourced accounting help during peak financial periods?

- Yes, firms can scale support for busy seasons, audits, or year-end reporting without hiring temporary staff.