How Accounting for Developers Enhances Financial Management for Web Developers

Web developers do more than just code; they handle lots of projects, clients, and different ways of earning money. Regular accountants may not understand things like unsteady paychecks or tech-related costs, which is why accounting for developers is crucial. Accountants for web developers know your world and help you manage money without distracting you from your work. They save you time, prevent expensive errors, and make sure you get the most tax deductions for web developers, making a tough job easy.

Unique Financial Challenges Faced by Web Developers

Web developers face money-related hurdles that set them apart from other professions. Here’s a quick look at some of the biggest challenges:

- Irregular Income Streams: Freelancers might go weeks without a paycheck, while agency owners deal with delayed client payments.

- Tracking Multiple Projects: Managing finances across various clients or gigs can get messy without the right system.

- High Software Costs: From coding tools to hosting services, expenses pile up fast and need careful tracking.

- Tax Complexity: Tax deductions for web developers can be tricky. This includes things like home office costs or equipment, and guidance is helpful.

- Global Clients: Working with international clients means handling currency conversions and foreign tax rules.

These challenges can overwhelm even the most organized developer, but expert accounting for developers offers a clear path forward.

Key Accounting Areas Web Developers Should Focus On

Managing money well starts with focusing on a few key areas every web developer should know, which are the foundation of good accounting for developers.

Income Tracking & Invoicing

Keeping track of your earnings is a must, and proper accounting for developers ensures nothing is missed. Accountants for web developers can help you stay organized and get paid on time.

Expense Management & Software Costs

Tools like design software and hosting aren’t cheap, but they can be tax deductions for web developers if tracked right.

Handling Recurring Payments & Subscriptions

Subscriptions and renewals can drain your budget, so monitoring them keeps your cash flow smooth.

Prioritizing these areas helps web developers stay financially healthy with less stress.

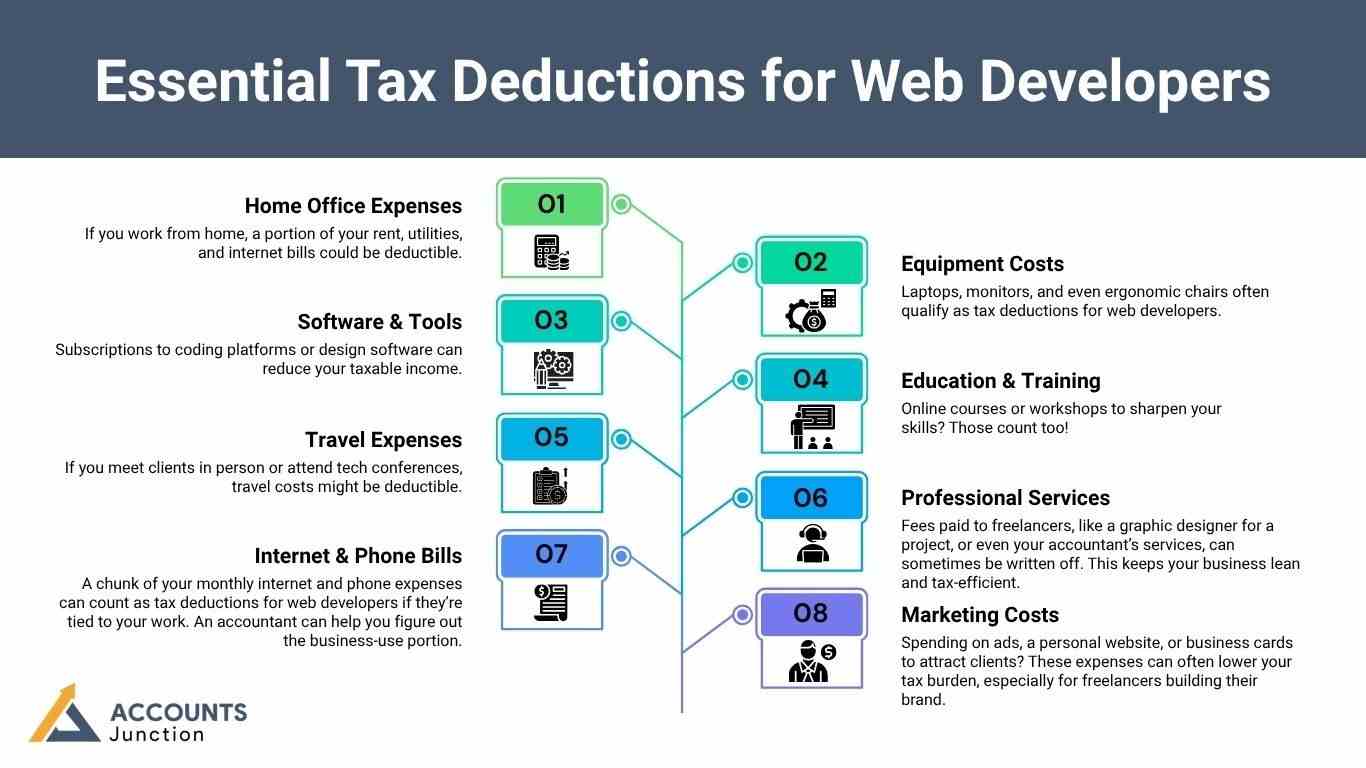

Essential Tax Deductions for Web Developers

Taxes don’t have to be a headache. With the right approach, you can lower your tax bill significantly. Here are some must-know tax deductions for web developers:

- Home Office Expenses: If you work from home, a portion of your rent, utilities, and internet bills could be deductible.

- Equipment Costs: Laptops, monitors, and even ergonomic chairs often qualify as tax deductions for web developers.

- Software & Tools: Subscriptions to coding platforms or design software can reduce your taxable income.

- Education & Training: Online courses or workshops to sharpen your skills? Those count too!

- Travel Expenses: If you meet clients in person or attend tech conferences, travel costs might be deductible.

- Professional Services: Fees paid to freelancers, like a graphic designer for a project, or even your accountant’s services, can sometimes be written off. This keeps your business lean and tax-efficient.

- Internet & Phone Bills: A chunk of your monthly internet and phone expenses can count as tax deductions for web developers if they’re tied to your work. An accountant can help you figure out the business-use portion.

- Marketing Costs: Spending on ads, a personal website, or business cards to attract clients? These expenses can often lower your tax burden, especially for freelancers building their brand.

Specialized accounting for developers helps spot these opportunities and ensures you claim all eligible deductions.

Freelancers vs. Agency Owners – Different Accounting Needs

Not all web developers have the same financial setup, so tailored accounting for developers is needed for freelancers and agency owners alike. Freelancers and agency owners face distinct challenges, and their accounting needs reflect that. Here’s how they differ:

- Freelancers:

- Solo income tracking with irregular paychecks.

- Focus on personal tax deductions for web developers, like home office costs.

- Simpler bookkeeping but higher risk of missing deadlines or payments.

- Agency Owners:

- Managing payroll for employees or contractors.

- Handling larger budgets and multiple client contracts.

- More complex tax filings, but access to bigger tax deductions for web developers, like office rent or marketing expenses.

Specialized accounting for developers adapts to these differences, ensuring both freelancers and agency owners thrive.

Cash Flow Management for Web Developers

Managing money isn’t just about tracking earnings or expenses—it’s about knowing where your cash goes and making sure enough is available for bills, software, and taxes. Web developers may earn one month and have little the next. Specialized accountants can help forecast cash flow, plan for lean periods, and avoid unnecessary borrowing. They may also suggest strategies for saving for taxes or unexpected costs. Smart cash flow management can prevent stress and keep projects on track.

Key Tips:

- Set aside a percentage of income for taxes each month.

- Track recurring costs and subscriptions carefully.

- Maintain a buffer for slow-paying clients.

- Review cash flow monthly to spot gaps early.

Accounting Software and Tools for Developers

Technology is at the heart of a web developer’s work, and it can also help with finances. Choosing the right tools for accounting for developers may simplify invoicing, tax tracking, and expense management. Some software offers automated tracking for multiple clients or projects, which can save hours every week. Specialized accountants may recommend tools tailored for developers rather than generic solutions.

Popular Tools for Developers:

- Invoicing and payment platforms to speed up collections.

- Expense trackers that categorize software and hardware costs.

- Cloud accounting software that syncs across devices.

- Tax prep tools designed for freelancers and small agencies.

Planning for Growth and Expansion

For developers running agencies or planning to scale, accounting is not just bookkeeping—it can guide business growth. Knowing profit margins, client costs, and recurring expenses may help make better decisions. Accountants for web developers may also advise on hiring contractors versus employees or expanding to new markets. Strategic financial planning can make growth sustainable, prevent overspending, and maximize deductions.

Growth Tips:

- Analyze project profitability before taking new clients.

- Plan budgets for hiring or outsourcing work.

- Keep track of recurring revenue streams to predict growth.

- Seek professional guidance on investments in software or marketing.

Web developers are creative and skilled builders of the digital world. However, managing finances shouldn't slow them down. Accounts Junction provides comprehensive financial solutions designed specifically for tech professionals. Our services cater to web developers, offering income tracking, expense management, and strategies to optimize tax deductions. With a deep understanding of the unique financial challenges faced by developers, from variable freelance income to growing agency operations, we provide tailored support. Through a combination of expert guidance and user-friendly tools, Accounts Junction simplifies accounting, allowing developers to focus on their work without the burden of financial management.

FAQs

1. Why do web developers need specialized accountants?

- Regular accountants may not understand tech costs or freelance pay cycles. Specialized accountants can guide developers on taxes and deductions.

2. What are the common income challenges for web developers?

- Freelancers often face irregular payments and delayed client fees. Agencies may deal with multiple project invoices at once.

3. Can accountants help track multiple client projects?

- Yes, they may set up systems to separate earnings and costs per client. This makes tax time and reporting simpler.

4. Are software subscriptions tax-deductible for web developers?

- Yes, tools like coding platforms or design software may lower taxable income. Accountants help calculate the right amount to claim.

5. How do home office costs affect a developer’s taxes?

- Rent, utilities, and internet may be partially deductible if used for work. Accountants may ensure these claims follow rules.

6. Do freelancers and agency owners need different accounting strategies?

- Yes, freelancers focus on personal deductions and irregular income. Agencies manage payroll, contracts, and larger budgets.

7. Can accountants help with international client payments?

- Yes, they may guide currency conversion and foreign tax rules. This reduces mistakes and unexpected fees.

8. What is project-based expense tracking?

- It means noting costs separately for each client or project. This helps monitor profits and claim accurate deductions.

9. Are hardware purchases deductible for web developers?

- Yes, laptops, monitors, or peripherals may qualify as business expenses. Proper tracking ensures no deductions are missed.

10. How can accountants manage recurring subscriptions?

- They may track software, hosting, or tools automatically. This prevents overspending and keeps cash flow smooth.

11. Why is cash flow management important for web developers?

- Income may come irregularly while bills stay fixed. Accountants can forecast and suggest savings to cover low-income periods.

12. Are online courses or workshops deductible?

- Yes, if they improve skills used in web development. Accountants can determine how much of the cost qualifies.

13. How can web developers handle taxes on freelance income?

- Paying quarterly estimates and tracking deductions is key. Accountants may simplify the process and reduce mistakes.

14. Are client meeting or conference travel costs deductible?

- Yes, trips related to work may qualify for deductions. Keeping accurate records helps claim them correctly.

15. How do accountants help agency owners with payroll?

- They may calculate salaries, contractor fees, and taxes for multiple employees. This ensures payments are accurate and timely.

16. Can web developers deduct marketing and website costs?

- Yes, spending on ads, personal sites, or branding may reduce taxes. Accountants track these expenses efficiently.

17. How do accountants handle billing for multiple clients?

- They may create clear invoices and track payments per project. This avoids errors and ensures income is recorded properly.

18. Why should web developers separate personal and business accounts?

- Mixing finances can cause tax errors and missed deductions. Accountants help keep clear separation for easier management.

19. Can accountants help plan for slow freelance months?

- Yes, they may suggest savings strategies and cash buffers. This prevents stress when client payments are late or low.

20. How does specialized accounting save web developers time?

- By managing finances, deductions, and invoices, accountants free developers to focus on coding. Less time is wasted on paperwork or chasing payments.