Why Hospital Accounts Receivable Outsourcing Is the Smartest Move for Healthcare Providers

Hospitals prioritize patient care. But to sustain that care, they need a steady cash flow. Billing and payments are vital to that process. Still, it is hard to track claims and get paid on time. It takes skill, focus, and hours each day. Many hospitals now use Hospital Accounts Receivable Outsourcing. It helps them get paid fast and fix claim issues quickly. With an outside team to handle billing, staff can focus on care, not forms.

Outsourcing cuts stress and saves money, too. It helps cash flow stay smooth. Hospitals can grow without adding new staff or tools. The billing team stays clear and quick. In this blog, we will see how Hospital Accounts Receivable Outsourcing helps healthcare teams save time, cut costs, and grow stronger.

What Is Hospital Accounts Receivable Outsourcing?

Hospital Accounts Receivable Outsourcing means a hospital lets another team do its billing work. That team sends claims, checks payments, and fixes denied bills. Their job is to get cash in fast and cut errors.

-

What Are Accounts Receivable?

Accounts receivable (AR) means money that the hospital should get but has not received yet. It may come from a patient or an insurance group. When bills stay unpaid, cash slows down, and growth stops.

-

Why Outsourcing Works Better

Doing AR inside a hospital takes time and staff. If your team is small or busy, unpaid bills build up. With outsourcing, experts take care of all billing steps. They send clean claims, follow up fast, and bring cash in on time.

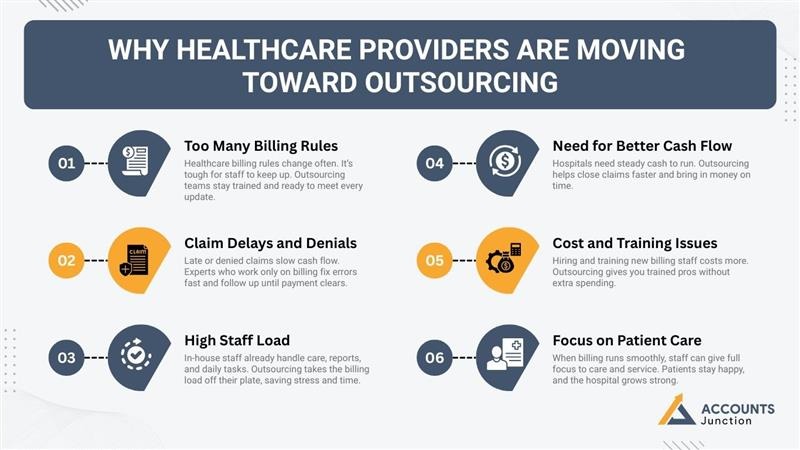

Why Healthcare Providers Are Moving Toward Outsourcing

Hospitals face many billing issues each day. Rules change fast, claim steps grow longer, and staff must do more with less time. To stay strong and keep cash moving, many turn to Hospital accounts receivable outsourcing. It helps them work smart, not hard.

1. Too Many Billing Rules

Healthcare billing rules change often. It’s tough for staff to keep up. Outsourcing teams stay trained and ready to meet every update.

2. Claim Delays and Denials

Late or denied claims slow cash flow. Experts who work only on billing fix errors fast and follow up until payment clears.

3. High Staff Load

In-house staff already handle care, reports, and daily tasks. Outsourcing takes the billing load off their plate, saving stress and time.

4. Need for Better Cash Flow

Hospitals need steady cash to run. Outsourcing helps close claims faster and bring in money on time.

5. Cost and Training Issues

Hiring and training new billing staff costs more. Outsourcing gives you trained pros without extra spending.

6. Focus on Patient Care

When billing runs smoothly, staff can give full focus to care and service. Patients stay happy, and the hospital grows strong.

Key Benefits of Hospital Accounts Receivable Outsourcing

Hospital accounts receivable outsourcing gives many clear benefits to healthcare providers.

1. Faster Cash Flow

Outsourced AR teams track claims daily. They follow up early and fix issues fast. With fewer pending claims, money comes in quicker and smoothly.

2. Fewer Denials and Mistakes

Billing experts use the right codes and double-check claims before sending them. This reduces errors and denials, which means more approved payments and less rework.

3. Lower Costs, Higher Output

Outsourcing removes the need for large billing teams. Hospitals save on hiring and training costs. They get better results at a lower cost.

4. Clear Reports and Insights

Good outsourcing partners share real-time reports on claims, payments, and trends. This helps hospital leaders make better and faster choices.

5. More Time for Patient Care

When finance teams aren’t stuck with billing issues, they can focus on what matters: giving better care and improving patient experience.

How Outsourcing Helps in Revenue Cycle Management

A healthy revenue cycle keeps hospitals stable. Hospital Accounts Receivable Outsourcing helps at every step from patient check-in to final payment.

-

Smooth Billing Steps

Outsourced teams handle all billing steps entering patient data, coding, sending claims, and tracking payments. Their speed and skill cut delays.

-

Fast Denial Handling

If a claim gets denied, the team finds out why and fixes it fast. They also track patterns to stop future denials.

-

Strong Data and Reports

Accurate data helps plan and grow. Outsourced teams give clean reports that show where money is stuck and how to improve.

How to Choose the Right Outsourcing Partner

The right partner can change how your billing runs. Here’s what to check before you pick one.

1. Strong Industry Skill

Pick a team that knows hospital billing, claim steps, and codes. Their skill helps cut errors and keep the work smooth.

2. Smart Tech Use

Good partners use smart tools and simple AI. These tools speed up billing and make reports easy to read.

3. Safe Data Care

Patient info must stay safe. The team should follow HIPAA rules and guard all data at every step.

4. Flexible Service

As your hospital grows, needs will rise. Pick a partner who can scale fast and handle more work with ease.

Real Results from Hospital Accounts Receivable Outsourcing

Hospitals that outsource see strong results, such as better cash flow, fewer denials, and happier staff.

Case 1: Faster Payments

A medium-sized hospital had a large backlog of unpaid claims. After outsourcing, over 80% of claims were cleared in three months. Cash flow rose, and stress dropped.

Case 2: Lower Costs and Fewer Errors

Another hospital cut billing errors by 40% and saved 30% on admin costs. Their claim approval rate also went up sharply.

Case 3: Happier Patients

When billing is clear and smooth, patients face fewer disputes and delays. They trust the hospital more and feel better cared for.

Common Myths About Outsourcing

Many people still have doubts about outsourcing. Let’s clear up some common myths.

“We’ll Lose Control”

Outsourcing doesn’t mean losing control. Hospitals still get full access to reports, dashboards, and performance data.

“It’s Only for Big Hospitals”

Not true. Smaller hospitals and clinics often gain the most. They save money and improve billing without hiring more staff.

“It Hurts Quality”

In fact, quality goes up. Outsourced teams are experts in healthcare billing and work with strict standards.

Simple Steps to Start Hospital Accounts Receivable Outsourcing

Starting Hospital Accounts Receivable Outsourcing is easy when you plan it right. Follow these short steps to start smoothly and see fast results.

1: Check Your Billing System

- Look at how your billing works now. Find slow spots, late claims, or missed pay. Know what needs to change before you start.

2: Set Clear Goals

- Think about what you want, like quick pay, fewer claim cuts, or lower spend. Simple goals make your plan easy to track.

3: Pick a Good Partner

- Choose a team with skills in hospital billing. Check their work, tools, and client notes. A strong team keeps billing safe and fast.

4: Plan the Change

- Plan each move like data share, team roles, and start date. A clear plan helps avoid mix-ups and lost time.

5: Track the Results

- Check your reports often. Watch claim speed, pay time, and errors. Fix weak spots fast to keep growth strong.

The Future of Hospital Accounts Receivable Outsourcing

Hospital Accounts Receivable Outsourcing is not just a quick fix. It’s a smart move that shapes the future of hospital finance. As care grows and billing gets complex, outsourcing will play a key role in keeping systems fast and cash flow steady.

-

Smart Tech and AI

AI tools will help spot claim issues before they happen. They will track errors, speed up follow-ups, and make billing clean and simple. This cuts work time and boosts revenue.

-

Data-Driven Choices

Hospitals will use AR data to plan budgets and spot weak areas. With real-time reports, they can act fast, cut waste, and grow with clear insight.

-

Cloud and Remote Systems

Cloud tech will let billing teams work from anywhere. Safe data links will keep info secure while helping hospitals access updates any time they need.

-

Partner Growth and Skill

Outsourcing firms will grow stronger with more trained pros and smart tools. They’ll act as full partners, not just support, helping hospitals reach new goals.

-

Focus on Core Care

As tech and experts handle billing, hospitals can stay focused on their real goal, which is patient care. Smooth cash flow means less stress and more time for healing.

Hospitals today face rising costs, complex billing, and higher patient demands. To stay efficient, many are turning to smarter ways to manage cash flow. One effective approach is Hospital Accounts Receivable Outsourcing, which helps reduce claim delays, fix errors, and free up staff for patient care.

At Accounts Junction, we provide hospitals with receivable management services with skill and care. Our team brings years of experience in billing, denial tracking, and revenue follow-up. We use smart tools, real-time reports, and clear systems to keep your payments on track and cash flow smooth.

Outsource your receivable management to Accounts Junction today and see how simple, fast, and reliable your cash flow can be, Book your Consultations Now!

FAQs

1. How do I know if my hospital needs AR outsourcing?

- If your unpaid claims pile up or cash flow is slow, it’s time to consider outsourcing.

2. Will outsourcing fix delayed insurance payments?

- Yes. AR experts track each claim and follow up until it’s cleared.

3. Can outsourcing work with my current billing software?

- Most partners can connect with your system or suggest simple tools that fit your setup.

4. How fast can outsourcing improve cash flow?

- You can start seeing steady payments within the first few billing cycles.

5. What if I already have a billing team?

- You can keep them. Outsourcing adds extra support for denied or old claims.

6. Is my patient data safe with outsourcing?

- Yes. Partners follow HIPAA and use strong data encryption to keep all records secure.

7. Can outsourcing lower admin costs?

- Yes. It removes hiring, training, and overtime costs for in-house billing teams.

8. Will outsourcing help reduce billing stress for staff?

- It does. Your team can focus more on care, while experts handle payment work.

9. How do I measure if outsourcing works?

- Check reports for claim speed, error rates, and monthly cash flow trends.

10. What happens to old pending claims?

- Experts can review and recover old unpaid claims while handling new ones, too.

11. Can I choose which parts of billing to outsource?

- Yes. You can start small, like a denial follow-up, and expand later.

12. How long does setup take?

- Most setups take two to four weeks, depending on data size and process flow.

13. Who trains the outsourcing team on our system?

- The partner trains their team based on your rules, forms, and software.

14. How does outsourcing help during staff shortages?

- It fills the gap by keeping billing active even when in-house staff are short.

15. Can outsourcing grow with my hospital?

- Yes. Services can scale as your patient count and billing volume rise.