Why Every Healthcare Organization Needs a Specialized Medical Accountant

In healthcare, managing money is as important as treating patients. Every hospital and clinic must track income, handle claims, and follow rules with care. A trained medical accountant helps keep books clear, costs low, and rules met. Without the right help, even strong healthcare teams can lose money, face fines, or slow their growth.

This blog shows why a medical accountant matters, how they add value, and what to check before hiring one. By the end, you’ll see how the right expert keeps your funds steady and your focus on care.

What Does a Medical Accountant Do?

A medical accountant is not a regular accountant. They work only with healthcare organizations like clinics, hospitals, labs, and private practices. They know how medical billing, insurance claims, and healthcare tax rules work.

A healthcare accountant helps healthcare owners manage accounts, payroll, taxes, and budgets while making sure all legal and health rules are met.

1. Key Skills of a Healthcare Accountant

A good accountant is both smart with numbers and aware of healthcare systems.

Here are a few top skills they need:

- Strong knowledge of medical billing and coding

- Deep understanding of healthcare tax rules

- Experience with financial software and EMR systems

- Skills to plan budgets and reduce costs

- Clear communication with doctors and staff

2. Why Regular Accountants Are Not Enough

Many healthcare owners think a normal accountant can handle their books. But healthcare is different. Regular accountants may not understand insurance claims, patient billing, or medical tax codes.

A medical finance expert knows all these and helps avoid costly errors.

The Role of a Medical Accountant in Healthcare Success

A medical accountant plays a big role in helping healthcare setups stay stable and grow. They handle not just money but also systems that affect patient billing and compliance.

1. Managing Finances Well

- An Accountant tracks income and costs, keeps budgets on track, and makes sure each dollar is used right. This helps care teams see where the money goes and plan for the next steps.

2. Meeting Legal Rules

- Money laws in care are strict. Errors in reports can bring checks or fines. An accountant makes sure all tax work, forms, and claims meet both the law and plan needs.

3. Handling Payroll and Staff Payments

- In healthcare, payroll can be complex with doctors, nurses, part-timers, and admin staff. A healthcare Accountant makes sure everyone gets paid on time and that all taxes and benefits are correct.

Medical Accountant vs Regular Accountant: What’s the Difference?

Not all accountants fit every business. In healthcare, money rules are stricter and detailed. A medical accountant is not the same as a Regular Accountant. Here’s a clear look at how they differ in work and value.

|

Point |

Medical Accountant |

Regular Accountant |

|

Main Focus |

Works only with clinics, hospitals, and doctors. |

Works with any type of business. |

|

Key Skills |

Knows billing, claims, and healthcare rules. |

Knows general accounts and tax rules. |

|

Compliance |

Follows health laws and medical billing norms. |

Follows normal tax and finance laws. |

|

Software Used |

Uses EMR and medical billing tools. |

Uses general tools like QuickBooks or Xero. |

|

Reports Made |

Prepares billing, claims, and cost reports for healthcare. |

Prepares income and expense reports for any business. |

|

Tax Knowledge |

Knows medical tax codes and health write-offs. |

Knows general tax systems only. |

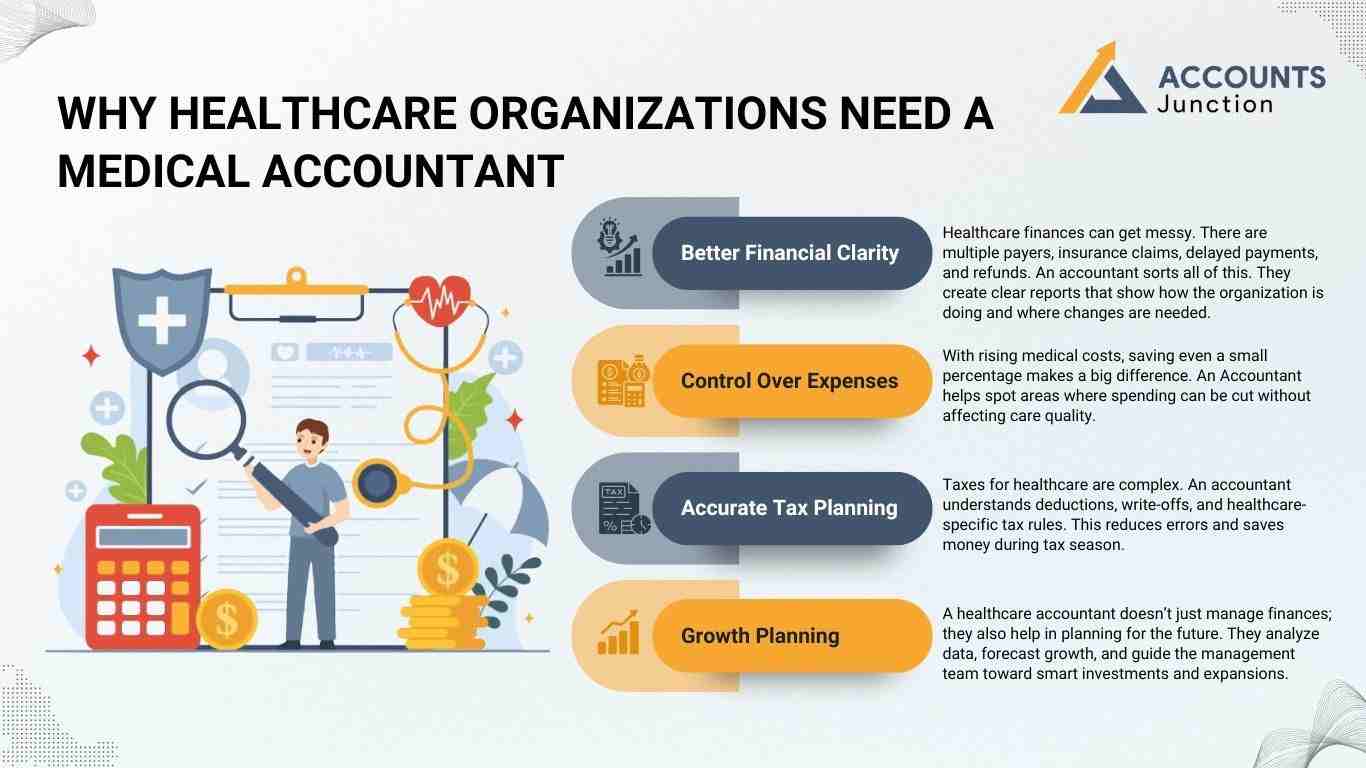

Why Healthcare Organizations Need a Medical Accountant

There are many reasons why healthcare setups must have a dedicated medical accountant. From managing claims to cutting down costs, they bring value to every part of the organization.

1. Better Financial Clarity

- Healthcare finances can get messy. There are multiple payers, insurance claims, delayed payments, and refunds. An accountant sorts all of this. They create clear reports that show how the organization is doing and where changes are needed.

2. Control Over Expenses

- With rising medical costs, saving even a small percentage makes a big difference. An Accountant helps spot areas where spending can be cut without affecting care quality.

3. Accurate Tax Planning

- Taxes for healthcare are complex. An accountant understands deductions, write-offs, and healthcare-specific tax rules. This reduces errors and saves money during tax season.

4. Growth Planning

- A healthcare accountant doesn’t just manage finances; they also help in planning for the future. They analyze data, forecast growth, and guide the management team toward smart investments and expansions.

How a Healthcare Accounting Expert Simplifies Healthcare Finances

Running a healthcare practice involves hundreds of daily transactions. Without an organized system, tracking payments and expenses becomes difficult. A medical accountant brings order to this by simplifying every step of financial management.

-

Tracking Payments and Claims

They monitor insurance claims, track patient payments, and ensure that pending claims are followed up on. This keeps cash flow smooth and avoids income loss.

-

Reducing Billing Errors

Small billing errors can cost big money. Accountants double-check all entries to prevent such issues. This also improves the organization’s trust among patients and insurance companies.

-

Automating Financial Systems

Modern accountants use digital tools to track and report finances. This reduces manual work, saves time, and ensures accuracy.

The Benefits of Having a Healthcare Accountant

Apart from regular accounting tasks, a medical accountant provides several hidden benefits that help the business side of healthcare thrive.

1. Better Decision Making

- A healthcare accountant gives clear and timely data that helps leaders make smart choices like hiring new staff, buying tools, or growing services.

2. Financial Transparency

- Having transparent accounts builds trust between owners, staff, and investors. With proper reports and audits, everyone can see how the organization is performing.

3. Reduced Stress for Doctors

- Doctors should focus on patients, not numbers. An accountant takes care of the financial stress so healthcare professionals can give their full attention to care and treatment.

Common Mistakes Healthcare Organizations Make Without a Medical Accountant

Many clinics and hospitals try to handle accounts on their own or use a general accountant. This often leads to mistakes.

1. Inaccurate Billing and Claims

Without an accountant, billing errors go unnoticed. These errors delay payments and sometimes lead to denied claims.

2. Missed Tax Deductions

General accountants may miss healthcare-specific deductions or credits. An accountant ensures that every valid deduction is claimed.

3. Weak Financial Planning

Without expert planning, healthcare organizations may overspend or mismanage funds. A healthcare accountant creates realistic budgets and growth plans.

How to Choose the Right Medical Accountant

Selecting the right healthcare accountant is vital. They must not only be skilled but also familiar with your type of healthcare setup.

-

Check Their Healthcare Experience

Make sure the accountant has worked with other clinics, hospitals, or health businesses. Healthcare finance is unique and needs special experience.

-

Ask About Tools and Systems

Modern accounting tools make a huge difference. A medical accountant who uses updated software can provide faster and more accurate results.

-

Look for Good Communication Skills

An Accountant must explain complex financial data in simple terms so that doctors and staff understand what’s happening.

Real-Life Example:

A mid-sized clinic was losing money each month, even with full patient appointments. After hiring an Accountant, they found billing gaps and missed claims worth thousands. Within three months, they fixed these issues, increased profit, and gained clear financial control.

This is the power of a skilled accountant, not just balancing numbers but building growth.

At Accounts Junction, we provide finance and accounting services for healthcare organizations. Our services include medical bookkeeping, billing, payroll, tax filing, and cost accounting. We use updated software and tools to secure cloud base systems to track pay, manage claims, and meet all rules. With our steady support, healthcare teams can focus on patients while we manage their funds and growth.

FAQs

1. What does a medical accountant do?

- They handle billing, payroll, and tax work for clinics, hospital industry, and doctors.

2. Why do healthcare setups need a skilled accountant?

- They keep all money records right and help meet strict health rules.

3. Can a regular accountant manage healthcare finances?

- Not well, since healthcare needs special billing and tax skills.

4. What skills should a healthcare accountant have?

- They should know billing codes, insurance claims, and care tax rules.

5. How do they help with cost control?

- They find waste, track expenses, and help plan smart budgets.

6. Do small clinics need a full-time accountant?

- Yes, even small setups gain from steady cash flow and clean reports.

7. What tools do healthcare accountants use?

- They use billing apps, EMR tools, and finance software built for care.

8. How can an accountant reduce billing errors?

- By checking claims, tracking payments, and fixing missed items fast.

9. Do they handle payroll and staff pay?

- Yes, they make sure all staff get the correct pay with taxes filed correctly.

10. What tax work do they manage?

- They handle sector-specific tax codes, credits, and claim reports.

11. Can they help during audits?

- Yes, they keep all data clear and ready for audit checks.

12. How often should reports be reviewed?

- Monthly or quarterly reviews keep finances up to date.

13. What happens without a trained accountant?

- You may face missed claims, errors, or loss of profit.

14. How does a good accountant save money?

- They plan taxes, fix billing gaps, and prevent waste.

15. Can they work online?

- Yes, many offer remote help using safe and secure systems.

16. What should be checked before hiring one?

- Their healthcare experience, tools, and clear way of sharing reports.

17. What impact do they have on growth?

- They guide smart plans, boost profits, and build stable systems.

18. Why is hiring the right accountant worth it?

- Because they bring order, save time, and help your team focus on care.