VAT Accounting in the UK: A Clear and Efficient Approach for Businesses

VAT accounting in the UK plays an important role in the tax system. VAT is considered a value-added tax. It is generally levied on most goods and services sold by businesses registered under VAT.

If your business is running in the UK, you must understand the VAT structure like how VAT works, and how to manage VAT accounting. If you understand the structure well, it helps you avoid fines.

In VAT accounting, first, you have to collect VAT from your customers and forward it to HMRC. However, you can reclaim your VAT paid on eligible business-related purchases.

VAT Calculation: How it Works in the UK

VAT Rate differs depending on the types of services and goods you offer. Understanding how VAT calculation works is necessary when you deal with VAT accounting in the UK.

Here are the main VAT rates in the UK:

|

VAT Rate |

Percentage |

Applies To |

|

Standard Rate |

20% |

Most goods and services |

|

Reduced Rate |

5% |

Used for Items like: Home energy, children’s car seats, mobility aids |

|

Zero Rate |

0% |

Applies to essentials: Food, books, children’s clothing, public transport |

Simple VAT Calculation Formula:

VAT = Net Price x VAT Rate

Example: If you sell a particular product at the price of £200, the standard VAT rate applies

(20%), the VAT amount is £200 × 20% = £40. The invoice is made of £240.

Accurate VAT calculation ensures your VAT return is correct and aligns with VAT accounting in the UK rules. You are required to calculate how much VAT you’ve paid on your business purchases; this input tax can be reclaimed. The difference between what you owe and what you can claim back determines your final VAT position.

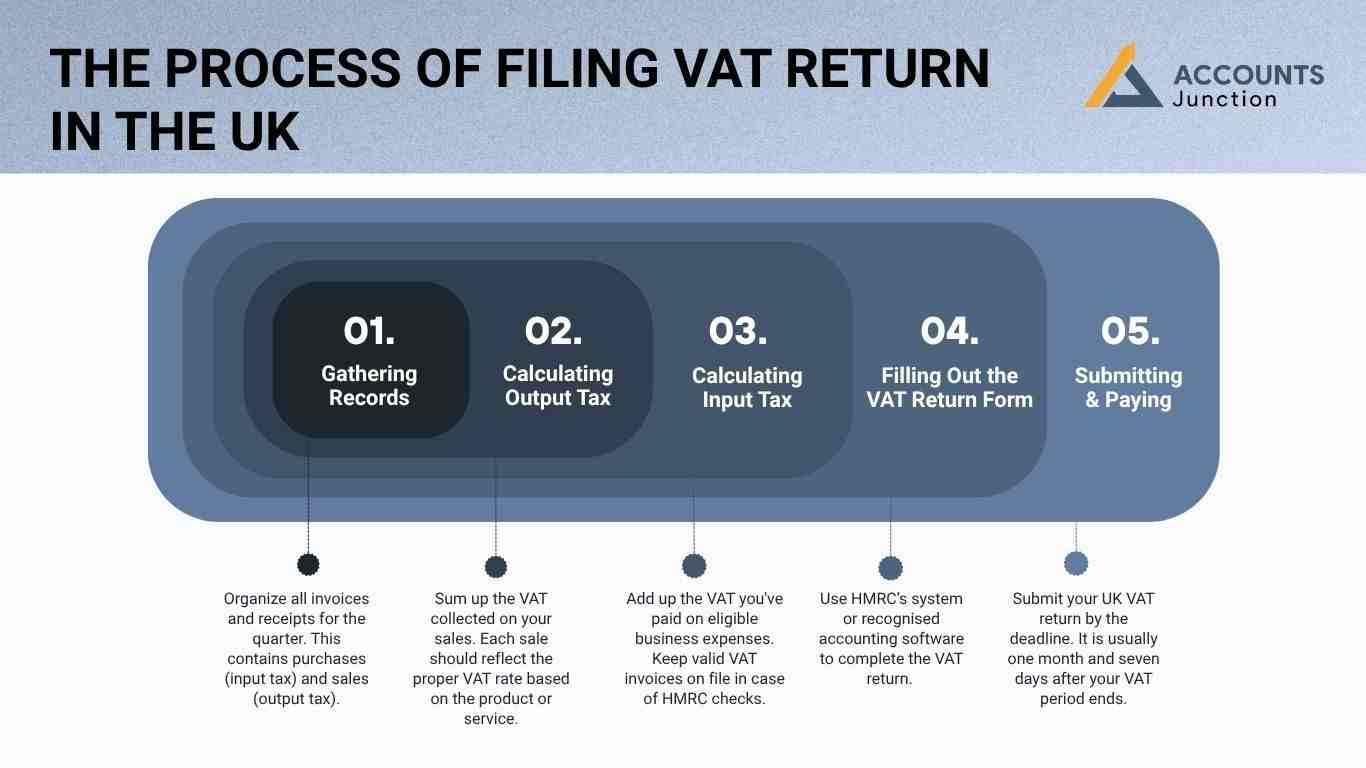

The Process of Filing VAT Return in the UK

Filing a VAT return is a key part of VAT accounting in the UK for most registered firms. The submission of VAT returns in the UK is done every quarter. It is done either through HMRC's online portal or supported software under the Making Tax Digital ( MTD) initiative.

1. Gathering Records

Organize all invoices and receipts for the quarter. This contains purchases (input tax) and sales (output tax). Good VAT accounting in the UK always starts with clear and well-kept records.

2. Calculating Output Tax

Sum up the VAT collected on your sales. Each sale should reflect the proper VAT rate based on the product or service.

3. Calculating Input Tax

Add up the VAT you've paid on eligible business expenses. Keep valid VAT invoices on file in case of HMRC checks.

4. Filling Out the VAT Return Form

Use HMRC’s system or recognised accounting software to complete the VAT return. The form will ask for your total sales, purchases, VAT collected, VAT reclaimed, and net VAT due or refundable.

5. Submitting & Paying

Submit your UK VAT return by the deadline. It is usually one month and seven days after your VAT period ends. If you are liable for VAT, this is also the due date for making your payment.

A mistake here can lead to penalties. That’s why many businesses use accounting software or professional services to manage this efficiently.

How VAT Registration and Exemptions Work in the UK

VAT accounting in the UK and the need for VAT registration both depend on your business’s taxable turnover. As of April 2024, the threshold for mandatory registration is £85,000. If your turnover goes over the limit, you must register. However, even if you're below this limit, voluntary registration can still be a smart move if you regularly incur VAT on expenses.

Understanding VAT Exemptions

Some goods and services are completely excluded from VAT These include:

- Financial services

- Health and medical services

- Education and training services

Unlike goods with Zero tax (which are taxable at 0%), exempt items are entirely outside the scope of VAT. Because of this, you can’t reclaim VAT on any expenses linked to those exempt activities. To keep your VAT accounting in the UK accurate, it is key to know the difference between zero-rated and non-taxable supplies. This helps ensure your VAT calculation is correct when filing your VAT return in the UK.

Challenges in VAT Accounting and How to Overcome Them

VAT accounting sounds simple, but Businesses often run into issues along their journey. Here are some of the challenges and solutions to overcome:

1. Understanding Complex Rules

VAT rules change often, and staying updated is key for smooth VAT accounting in the UK.

Solution: Subscribe to HMRC updates or consult a VAT expert to stay informed.

2. Determining the Correct VAT Rate

Products or services might fall into different rate categories or a mix of them.

Solution: Research carefully or get advice from professionals before applying rates in your VAT calculation.

3. Accurate Record Keeping

Poor records mean inaccurate returns and that can lead to penalties.

Solution: Use digital tools for real-time tracking and storage of invoices and receipts.

4. Meeting Deadlines

Missing the deadline for a UK VAT return is more common than you think.

Solution: Set automated calendar reminders and avoid last-minute filing.

5. MTD

All VAT-registered firms must follow Making Tax Digital rules, which are now a big part of VAT accounting in the UK.

Solution: Use Making Tax Digital-approved software to handle VAT accounting and submission.

6. International VAT Challenges

Selling goods or services abroad adds more steps to VAT accounting in the UK.

Solution: Seek guidance on VAT treatment for imports, exports, and services outside the UK.

Advanced VAT Accounting Strategies for Growing Businesses

As businesses grow, VAT accounting in the UK may become more complex. Larger operations often face multiple VAT rates, varied product categories, and higher transaction volumes. Managing VAT effectively at this stage can prevent errors that may attract penalties.

Key Strategies for Managing VAT in Growing Businesses

- Automate Calculations: Using accounting software can streamline VAT calculations, keeping input and output VAT up to date.

- Real-Time Reconciliation: Digital tools may help reconcile VAT records instantly, reducing the risk of mistakes.

- Outsource Complex Tasks: Certain VAT tasks can be delegated to professionals, saving time and allowing focus on business growth.

- Stay Updated on Regulations: VAT rules may change, so subscribing to HMRC updates or consulting experts can keep compliance intact.

Handling VAT on Imports and Exports

Trading beyond the UK adds additional layers of complexity to VAT accounting. Businesses dealing with imports or exports need to carefully follow VAT rules to avoid fines and delays.

Managing Imports

- VAT may be charged at the border or deferred depending on the scheme used.

- Maintaining proper documentation of shipments and invoices is crucial for compliance.

- Small errors can result in penalties or delayed VAT recovery.

Managing Exports

- Exported goods may qualify for zero-rated VAT treatment.

- Proper records and supporting documentation must be kept for HMRC verification.

- Using digital systems can simplify tracking and reporting for international transactions.

VAT Accounting Best Practices for Small Businesses

For small businesses, keeping VAT accounting simple yet accurate is essential. Adopting good practices can reduce stress and ensure smooth compliance.

Tips for Small Businesses

- Review Invoices and Receipts Regularly

- Even minor transactions should be checked to avoid discrepancies.

- Set Reminders for VAT Submissions

- Preparing in advance can prevent last-minute rushes and missed deadlines.

- Choose the Right VAT Scheme

- Standard, flat rate, or cash accounting schemes may suit different businesses.

- Professional advice can ensure the correct selection.

- Use Certified Experts

- Engaging a qualified accountant may help maintain compliance and accuracy.

- Organize Digital Records

- Keeping all VAT-related documents in one system saves time during audits.

Understanding the structure of VAT accounting in the UK is key to staying compliant and avoiding fines. From knowing how VAT calculation works to filing your UK VAT return correctly. Understanding each step and following each item is a key role in financial operations.

By addressing these challenges and using expert support, you can hassle out the process. At Accounts Junction, we make VAT accounting easy, giving you the freedom to focus on what you do best for the smooth running of your business.

FAQs

1. Who needs to register for VAT in the UK?

- Any business with taxable turnover above £85,000 must register. Voluntary registration is also possible below this threshold.

2. What are the VAT rates in the UK?

- The standard rate is 20 percent, the reduced rate is 5 percent, and zero rate is 0 percent. Rates depend on goods or services.

3. How often should I submit a VAT return?

- Most businesses submit quarterly returns, but some schemes may allow monthly or annual submissions.

4. What is the deadline for submitting a VAT return?

- Usually, one month and seven days after the end of your VAT period. Missing it may lead to penalties.

5. Can I reclaim VAT on my business purchases?

- Yes, if purchases are related to taxable business activities. Some items may not qualify if exempt.

6. What is the difference between zero-rated and exempt items?

- Zero-rated items are taxable at 0 percent and allow VAT recovery. Exempt items cannot reclaim VAT.

7. What is Making Tax Digital (MTD)?

- A UK initiative requiring digital records and VAT submission through approved software.

8. Are there VAT exemptions in the UK?

- Yes, some financial services, education, and healthcare may be exempt. No VAT can be reclaimed on these.

9. How do I calculate VAT for my products?

- Multiply the net price by the applicable VAT rate. This gives the VAT amount to add to the invoice.

10. What happens if I make a mistake in VAT filing?

- HMRC may issue penalties or require corrections. Using software may reduce errors.

11. Can VAT rules change often?

- Yes, rates or exemptions may change. Staying updated with HMRC guidance is important.

12. How can small businesses manage VAT efficiently?

- Organizing records, reconciling monthly, and using accounting tools may help. Expert advice may also be useful.

13. Are digital tools necessary for VAT accounting?

- Not required, but may simplify calculations, filing, and compliance with MTD.

14. Can international sales affect UK VAT?

- Yes, exports and imports may have different VAT treatment. Professional guidance is recommended.

15. What is input tax?

- VAT paid on business purchases that can be reclaimed from HMRC if eligible.

16. What is output tax?

- VAT collected from sales of goods or services, which must be paid to HMRC.

17. Is voluntary VAT registration beneficial?

- It may help reclaim VAT on purchases and enhance business credibility.

18. How can I avoid VAT penalties?

- Submit returns on time, keep accurate records, and follow MTD rules.

19. Are there software options approved by HMRC for VAT?

- Yes, several cloud-based platforms comply with MTD and automate VAT calculations.

20. Can VAT accounting be done without professionals?

- Yes, but mistakes may be costly. Using tools or occasional expert advice can help.