Growth of Accounts outsourcing from Singapore to India

The rise of accounts outsourcing from Singapore to India may seem like a slow shift at first, but many trends can show a clear change in the way firms choose to manage their finance work. While the shift may not follow one clear path, many parts of this move can point to a broad pattern. In recent years, more firms in Singapore may look to India for finance work such as bookkeeping, tax tasks, payroll tasks, and daily record work. The move can seem driven by cost, skill, time needs, and the use of technology.

As more firms search for lean work plans, the need for smart and safe finance support may grow. This is where India can play a key role. The pace of this rise may not be the same in all fields, yet the trend itself can be clear. In this blog, we explore how this shift may grow, what may spark it, the ways firms can gain from it, and why the trend might keep its pace.

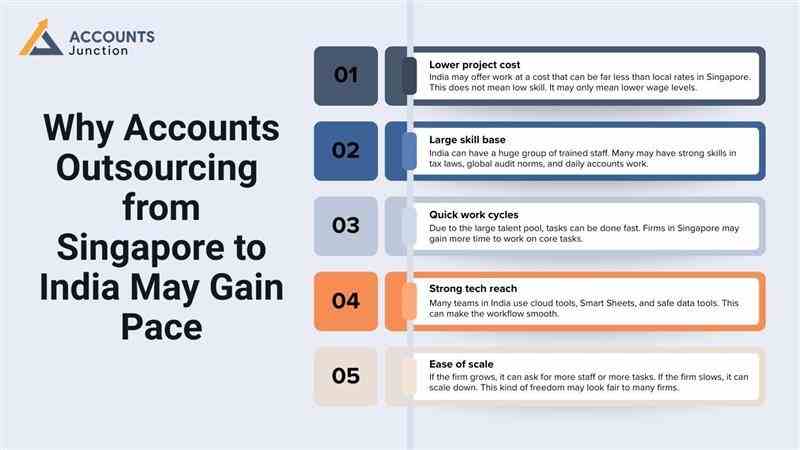

Why Accounts Outsourcing from Singapore to India May Gain Pace

Many firms in Singapore may not want a large fixed staff for all finance tasks. The cost of talent can rise each year. Rent and workspace costs can rise as well. When firms start to add all these costs, they may see value in an outside team.

India may offer strong staff for accounts outsourcing from Singapore to India. The cost may be lower. The tech tools may be strong. Work speed may be high. These traits can push more firms to test this path.

Some key reasons include:

1. Lower project cost

- India may offer work at a cost that can be far less than local rates in Singapore. This does not mean low skill. It may only mean lower wage levels.

2. Large skill base

- India can have a huge group of trained staff. Many may have strong skills in tax laws, global audit norms, and daily accounts work.

3. Quick work cycles

- Due to the large talent pool, tasks can be done fast. Firms in Singapore may gain more time to work on core tasks.

4. Strong tech reach

- Many teams in India use cloud tools, Smart Sheets, and safe data tools. This can make the workflow smooth.

5. Ease of scale

- If the firm grows, it can ask for more staff or more tasks. If the firm slows, it can scale down. This kind of freedom may look fair to many firms.

How the Trend May Start and Grow

This may start with small steps, such as accounts outsourcing from Singapore to India for simple finance tasks. Once the firm sees safe and clear results, it may add more tasks. Over time, this may turn into a long-term work plan.

-

Early phase

This may take place when a small firm in Singapore wishes to cut costs. They may test a small task, such as bank data entry or a small set of tax checks.

-

Growth phase

Once trust is built, the firm may hand more tasks like payroll, vendor data, account close work, and reports.

-

Long-term phase

In the long run, most tasks may move through accounts outsourcing from Singapore to India. This may form a strong link built on trust, clear talk, and clear task flow.

Why India May Fit the Needs of Singapore Firms

India may stand out in accounts outsourcing from Singapore to India due to its large skill pool and fast scale. The link between Singapore and India may also have grown over the years of trade. This can give firms more ease when they share data and tasks.

-

Skill growth in India

India has seen a rise in skill-based study. More young staff take up study paths in accounts, audit, tax work, and cost tasks. Many firms in India train staff in global norms. The staff may learn to use cloud tools and global work laws.

-

Low cost with good quality

Many firms may see that India offers a mix of cost and skill that may be hard to match in many other places. While the cost is low, the work quality may stay strong.

-

Tech support

With the wide use of cloud books, online sheets, smart rules, and safe data tools, teams in India can stay in sync with teams in Singapore.

Types of Work that Singapore Firms May Send to India

There can be a wide range of work. This can shift from basic to high-level tasks.

-

Bookkeeping

Basic entries, bank checks, note checks, and record tasks.

-

Payroll

Staff pay, leave records, and bonus plans.

-

Tax tasks

File prep, rule checks, and draft work for tax needs.

-

Accounts close

Month close, year close, and prep of books for audit.

-

Reports

Cash reports, cost review, fund flow, and profit study.

-

Vendor tasks

Bill checks, due date work, and vendor data tasks.

-

Client tasks

Invoice work, due date checks, and cash collection tasks.

How Trust May Form in Outsourced Work

Many firms may fear that outside teams may not care as much. But trust can grow with time. Clear talk, safe data rules, and set task plans may lead to smooth work.

Clear rules

Each team must know what tasks they do. There must be a set list of tasks.

Safe data rule

Data must stay safe with clear and firm rules. Clear steps and rules must guide how data is kept.

Talk plans

Teams may meet once a week or twice a month. This can keep all tasks in sync.

Fair checks

Firms in Singapore may ask for checks at each stage to make sure work stays on track.

How Tech May Shape the Growth of Accounts Outsourcing from Singapore to India

Tech may play a big role in this growth path. Cloud tools now make it easy for teams to work far away. Teams can see the same sheet at the same time. Work moves faster when all staff view updates quickly. Tasks can be done fast with clear online steps. This helps build trust between firms in India and Singapore.

Cloud-based books

With cloud books, teams need no local hard drive. All records stay in one safe and central place.

Smart workflow

Tools can send alerts to remind teams about tasks. Work flows smoothly when steps are tracked in real time.

Safe file share

These tools help keep all shared data fully safe. Only staff with rights can view or change the files.

Strong audit trail

Each move and change is saved online for review. This makes all work safe, clear, and easy to track.

Why the Trend May Rise in the Next Few Years

Many parts may feed this growth:

Rise in costs in Singapore

As wage and rent costs go up, firms may look for ways to keep costs down.

Rise in skill in India

More trained staff join the field every year.

Rise in cloud tool use

Cloud tools may make the task space smoother.

Rise in trust

More firms now know how this model works.

Challenges that May Come with This Trend

Outsourcing may bring some risks that need good planning. These risks can be fixed with clear and simple steps.

-

Data concerns

Firms may fear that data could leak if not safe. Clear tools and rules can help keep all data safe.

-

Time gap

There is a small time gap between India and Singapore. Work can still go on well despite this small gap.

-

Talk gap

Talk may seem slow between teams in different countries. Clear rules and set times can solve any talk gaps.

-

Rule checks

Some tax rules need strict checks by trained staff. Staff must know all the rules to keep work correct.

How Firms in Singapore Can Pick the Right Team in India

Choosing the right team is key for successful accounts outsourcing from Singapore to India.

-

Look for skill

Check if the team has done work in your field.

Make sure they know tasks like yours well enough.

-

Check tools

See if the team uses cloud and safe tools.

Confirm they can work with the software you also use.

-

Ask for sample work

This can help show how good their skill are.

Look at the results to see if the work meets your needs.

-

Check team size

Pick a team that can grow or shrink easily.

Ensure they have enough staff for bigger work plans.

-

Seek clear talk

Talk must stay clear and fast at all times.

Set rules for regular calls and quick feedback.

-

Ask for safe rules

Check how the team keeps all data fully safe.

Ask for written steps showing how they protect data.

Impact of this Trend on the Singapore Market

The shift to accounts outsourcing from Singapore to India may change how firms run tasks. More small and mid-sized firms may join this path. It can lead to more focus on core work. It can also lead to a rise in new start-ups that can hire small teams and use outside teams for accounts work.

Impact of this Trend on the India Market

India may see more demand for trained staff. Firms may hire more staff. There may be a greater need for training, better tools, and faster workflow. This may push India to grow its role in global finance tasks.

The shift in accounts outsourcing from Singapore to India may rise as more firms look for calm workflow, fair cost, and steady skill. The path may not move in one fixed line, yet the trend can show clear signs of growth as cloud tools and trained staff in India gain more space in global work. This move may also shape new ways for firms to plan their funds and daily books with more ease and less strain on their core team.

Accounts Junction may serve as a strong choice for firms that seek steady work, clear communication, and smooth task flow. Our certified experts can take on each task with close care and full focus, so your work stays in safe hands with no stress on your time. If you want a team that may bring a clean and calm work plan to your books, then partner with us.

FAQs

1. Why are Singapore firms outsourcing accounts to India?

- Singapore firms may save money and get skilled staff in India.

2. Which accounting tasks are most commonly outsourced to India?

- Bookkeeping, payroll, tax filing, account closing, and bill checks.

3. How can outsourcing accounts to India reduce costs?

- Lower wages and flexible teams can cut business spending.

4. Is India equipped to handle complex finance operations?

- Yes, many teams know global accounting rules and methods.

5. How does accounts outsourcing improve efficiency for Singapore firms?

- Work can be done faster with skilled staff and cloud tools.

6. Can small and medium Singapore businesses benefit from outsourcing?

- Yes, small firms can save time and focus on core work.

7. What role does technology play in accounts outsourcing from Singapore to India?

- Cloud software and tools allow live access and safe data.

8. How is data security ensured when outsourcing accounts to India?

- Teams follow clear rules, encryption, and safe access steps.

9. Does outsourcing affect financial control in Singapore firms?

- Control stays with the firm through checks and reports.

10. Can outsourcing scale with business growth in Singapore?

- Yes, teams can grow or shrink based on business needs.

11. Are there risks in outsourcing accounts to India?

- Yes, errors or miscommunication can happen, but they can be limited.

12. How do Singapore firms select the right outsourcing partner in India?

- Check experience, tools, past clients, and compliance standards.

13. What is the trend of accounts outsourcing from Singapore to India?

- The trend may rise due to low cost, talent, and tech use.

14. How does the time zone difference impact outsourced accounts' work?

- The gap is small; tasks can run with shared hours.

15. Can outsourced teams prepare financial reports for Singapore firms?

- Yes, they can create cash flow, profit, and cost reports.

16. Do outsourced teams in India understand Singapore accounting laws?

- Many teams study local rules and global accounting norms.

17. Is outsourcing accounts work from Singapore to India sustainable long term?

- Yes, it may stay due to low cost and skilled teams.

18. How fast can tasks be completed through outsourcing?

- Teams and tools can speed up payroll, bookkeeping, and audits.

19. Can outsourcing improve decision-making for Singapore firms?

- Yes, timely reports and insights may help leaders decide.

20. What future growth can be expected in accounts outsourcing to India?

- More firms may join due to rising costs and skilled staff.