How do you write a financial statement analysis report?

The financial analysis report is a critical tool in the business world, providing a comprehensive understanding of a company’s financial health. A financial statement analysis report dives deep into a company’s financial statements, offering insights into its performance, profitability, and cash flow. Writing a compelling financial statement analysis report requires both technical skill and the ability to weave a captivating narrative.

This guide will equip you with the tools and steps to craft a report that informs, persuades, and empowers stakeholders, whether you're an investor seeking opportunities, a business owner strategizing for growth, or a creditor evaluating risk.

What is a Financial Statement Analysis Report?

A financial statement report reviews a company’s main numbers. It shows trends, risks, and patterns in clear words. Analysts make it to guide choices and plan ahead.

Purpose

-

Guide Decisions

Shows strong and weak points for smart choices. Helps leaders act fast and avoid major mistakes.

-

Plan Growth

Highlights trends and predicts changes in income. Supports plans to grow the business over time.

-

Investor Support

Gives key facts for investors to judge performance. Builds trust by showing clear and honest numbers.

-

Monitor Operations

Tracks staff work, efficiency, and weak areas. Shows where changes are needed to improve results.

Key Components

-

Income Statements

Shows revenue, costs, and net profit each month. Helps track performance and compare with past results.

-

Balance Sheets

Shows assets, debts, and owner’s equity clearly. Gives a simple view of the company's financial strength.

-

Cash Flow Statements

Tracks cash coming in and going out. Ensures enough money for daily operations and needs.

-

Financial Ratios

Shows profit, liquidity, and efficiency over time. Helps compare company results with past periods easily.

Understanding how to write a financial analysis report

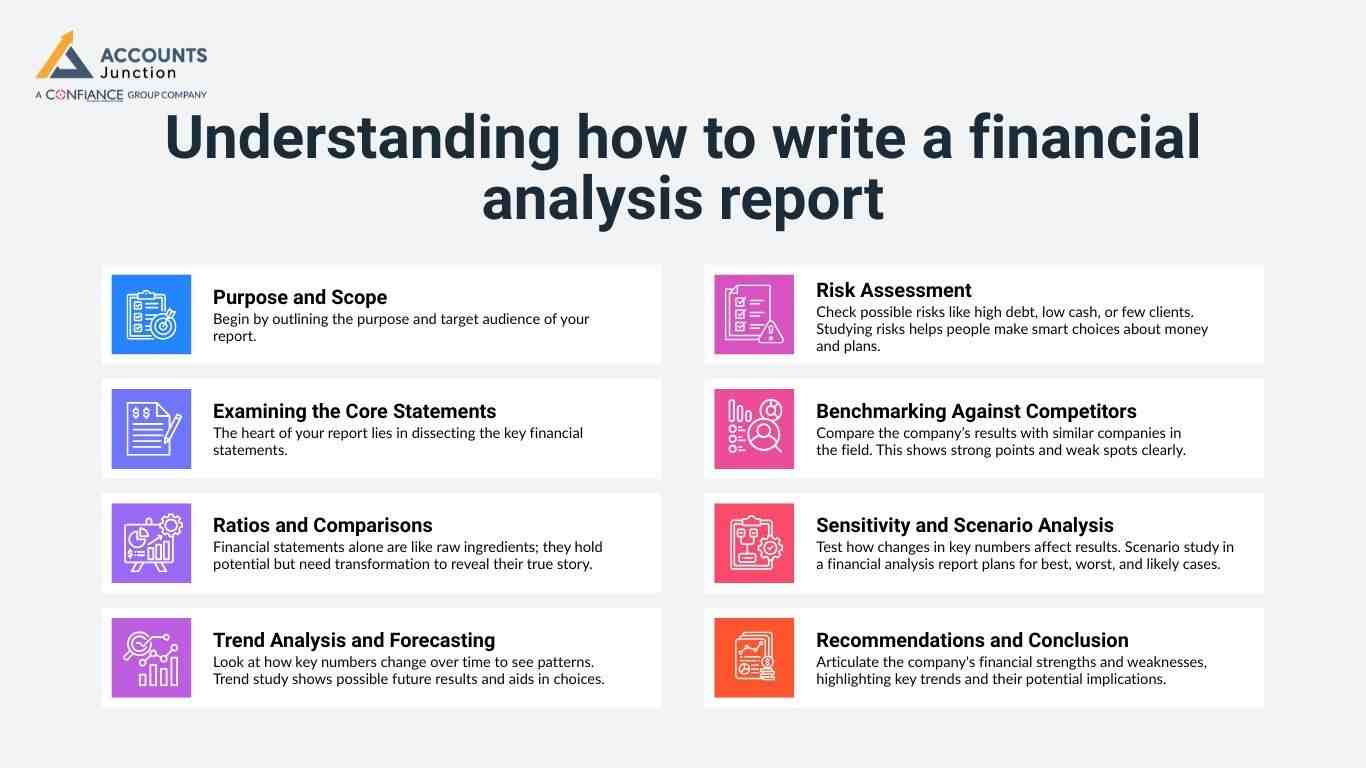

Purpose and Scope

Begin by outlining the purpose and target audience of your report. Are you evaluating a potential investment, presenting your company's financial health to lenders, or analyzing internal performance? This objective will dictate the depth and focus of your analysis. Next, define the scope. Will you be analyzing multiple years or focusing on a specific period? Establishing these parameters ensures your report is relevant and impactful.

Examining the Core Statements

The heart of your report lies in dissecting the key financial statements. The income statement reveals the company's profitability and scrutinizes revenue growth, expense trends, and profit margins. The balance sheet paints a picture of financial stability, with a focus on liquidity ratios, debt levels, and asset composition. Finally, the statement of cash flows sheds light on how the company generates and uses cash, a crucial indicator of operational efficiency.

Ratios and Comparisons

Financial statements alone are like raw ingredients; they hold potential but need transformation to reveal their true story. This is where ratio analysis comes in. Calculate relevant ratios like the current ratio, debt-to-equity ratio, and return on equity, and track their trends over time. This unlocks hidden patterns and allows you to compare the company's performance to industry benchmarks or its own historical data. Visual aids like charts and graphs can further enhance the impact of your findings.

Trend Analysis and Forecasting

Look at how key numbers change over time to see patterns. Trend study shows possible future results and aids in choices. Use past data to guess future sales, costs, and profits. Showing trends makes your report clear and forward-focused.

Risk Assessment

Check possible risks like high debt, low cash, or few clients. Studying risks helps people make smart choices about money and plans. Showing risks with chances of gain strengthens a financial analysis report.

Benchmarking Against Competitors

Compare the company’s results with similar companies in the field. This shows strong points and weak spots clearly. It helps find advantages or areas needing more work. Charts and tables make comparisons easy to read.

Sensitivity and Scenario Analysis

Test how changes in key numbers affect results. Scenario study in a financial analysis report plans for best, worst, and likely cases. It gives people a clear view of money and risk limits.

Recommendations and Conclusion

Articulate the company's financial strengths and weaknesses, highlighting key trends and their potential implications. Objectivity is key; be mindful of potential biases and ensure your conclusions are well-supported by the data. Finally, consider offering actionable recommendations based on your analysis. Should the company invest in a new venture? Does it need to adjust its financial strategy? Providing valuable insights sets your financial statement analysis report apart as a true decision-making tool.

The financial statement analysis report should be clear, concise, and easy to understand. It should also be objective, presenting the facts without bias. Remember to use professional language and maintain a formal tone throughout the report.

Presentation and Tone of the Financial Analysis Report

Reports must use clear, simple, and professional words. A well-crafted financial statement analysis report improves trust and clarity.

Clear writing helps managers, staff, and auditors see insights. A professional tone builds trust and backs smart choices.

-

Concise Wording

Use short sentences to share information clearly and fast. Skip extra jargon to make reading easy for everyone.

-

Logical Structure

Arrange sections in a natural order for the financial analysis report. Start with the introduction, then the data, analysis, ratios, and end with conclusions in the financial statement analysis report.

-

Neutral Statements

Do not use biased or unsupported claims. Stay objective to keep trust and report value high.

-

Illustrations

Add charts or tables if they make trends easy to see. Visuals help readers grasp data quickly and clearly.

-

Consistency

Keep headings, words, and format the same in all parts. Uniform style boosts clarity and makes the report look professional.

Types of Financial Analysis

A financial analysis report can include many clear types of financial checks. Knowing types helps make a full and true report fast.

-

Horizontal Analysis

Compares data over time to show trends in the financial analysis report. Shows growth or drop in sales, cost, or profit for the financial statement analysis report.

-

Vertical Analysis

Look at each item as a part of the total. Helps compare income or balance sheet items fast.

-

Ratio Analysis

Uses numbers to show how well a firm works. Makes it easy to check periods or different firms.

-

Cash Flow Analysis

Focuses on cash in and cash out each month. Shows if cash flow and work run smoothly and well.

Key Ratios in a Statement Analysis Report

Ratios help check profit, risk, and work well. They show whether a firm grows and stays safe.

Liquidity Ratios

- Current Ratio: Shows if a firm can pay small debts.

- Quick Ratio: Shows cash ready to pay bills fast.

Profit Ratios

- Gross Margin: Shows profit before all firm costs.

- Net Profit Margin: Shows profit left after all costs.

Work Ratios

- Inventory Turnover: Shows how fast stock sells each month.

- Asset Turnover: Shows money made per item or asset.

Debt Ratios

- Debt-to-Equity: Shows debt versus the firm’s own money.

- Interest Coverage: Shows ability to pay interest on debt.

Tools for Report Work

Tools help make financial analysis reports fast and with less work. They cut errors and save time for all staff.

-

Spreadsheet Tools

Excel or Google Sheets are used by most firms. They help make charts, tables, and do sums fast.

-

Accounting Software

QuickBooks, Xero, and Zoho Books make reports with ease. They cut mistakes and give ready sums to use.

-

Data Tools

Tableau or Power BI shows trends in a chart. They make dashboards for a simple check of data.

How to Make Reports Easy to Read

Clear financial analysis reports help readers see key points fast. Good style helps users read and take the right steps.

-

Use Short Titles

Short titles help users find sections fast and clearly.

-

Mark Key Numbers

Bold or color numbers to show trends or risks. This shows profits, cash, or debt in one view.

-

Use Summary Tables

Tables let readers see the main facts at a glance. They give a fast view of firm results and trends.

-

Use Charts

Charts, graphs, or bars show change at a glance. They make checking periods or firms simple.

Benefits of financial analysis reports

Reports give many gains to the firm and investors.

-

Better Decisions

Helps plan cash, cut costs, and grow the firm fast. Shows how moves change profit and cash flow.

-

Help Investors

Gives a clear view of the firm’s health and work. Builds trust and brings loans or more funds.

-

Clear Work

Clear reports help the firm stay open and true. Helps auditors and staff check the firm’s cash and debt.

-

Show Risk Fast

Shows cash, debt, or cost problems early on. Helps fix issues before they grow or cause loss.

Report Check Steps

Check financial analysis reports well before sharing with others.

-

Check Numbers

Match sums with records or tools before use. This stops errors that could mislead staff or users.

-

Check Ratios

Check all number sums for truth before use. Make sure numbers match real firm work and cash.

-

Update Data

Keep report data fresh to see trends and risks. Regular updates help plan and take steps fast.

-

Get Peer Check

Ask another staff member to check the report for errors. Fresh eyes can find faults or points that are not clear.

Common Problems

Even skilled staff members meet issues when making reports.

-

Missing Data

Missing sums lower trust and make the report weak. Always check all sums are there before the report.

-

Hard Numbers

Some ratios are hard for staff to grasp. Explain each in clear words so all can see.

-

Rule Change

Rules for sums may change quickly over time. Update ways to match new rules for firm work.

-

Too Many Numbers

Too much data can make users confused quickly. Focus on key sums to show clear trends fast.

Exploring financial statements can be complex. At Accounts Junction, we understand the value of a well-crafted financial analysis report. Our team of financial experts possesses the experience and expertise to analyze your data with precise detail, providing you with comprehensive and insightful reports that illuminate your path forward. Whether you're a novice seeking guidance or a seasoned professional looking for a second opinion, Accounts Junction stands ready to be your trusted partner in demystifying the financial landscape.

FAQs

1. What is a financial analysis report?

- A financial analysis report shows a company’s finances. It shows profits, costs, cash flow, and trends.

2. How to prepare a financial report?

- Gather income statements, balance sheets, and cash flow. Check trends, ratios, and write findings in order.

3. What are the main sections of a financial analysis report?

- Sections include intro, data, trends, ratios, and end. Each part shows information clearly for easy review.

4. Difference between a financial analysis report and a financial statement analysis report?

- A financial report explains overall data and trends. A financial statement report looks at the main statements only.

5. Why is a financial report important?

- It helps leaders make good choices and track results. It shows strengths, weaknesses, and areas to improve.

6. Which financial statements are included in the report?

- Use the income statement, balance sheet, and cash flow. Extra schedules and notes give more insight and detail.

7. How to analyze financial ratios in a report?

- Work out profit, cash, risk, and growth ratios. Check them over time to see the company's performance.