Doctor Bookkeeping and Its Importance

Doctor bookkeeping is the systematic process of recording, classifying, and summarizing the financial transactions of a medical practice. It's more than just tracking income and expenses; it's the foundation upon which sound financial decisions are made. Accurate and up-to-date doctor bookkeeping provides a clear picture of the practice's financial health. It enables doctors to understand profitability, manage cash flow effectively, and make informed decisions about investments and growth. Careful doctor bookkeeping is vital to avoid financial problems, lost chances, and potential legal issues for medical practices.

The Critical Role of Doctor Bookkeeping in Financial Success

- Monitor Financial Performance: Track revenue, expenses, and profitability to identify areas of strength and weakness.

- Manage Cash Flow: Ensure sufficient funds are available to meet operational expenses and plan for future needs.

- Make Informed Decisions: Base strategic decisions on accurate financial data, such as hiring staff, purchasing equipment, or expanding services.

- Comply with Regulations: Maintain accurate records for tax purposes and adhere to healthcare industry regulations.

- Optimize Profitability: Identify cost-saving opportunities and revenue growth areas.

- Enhance Practice Sustainability: Plan long-term financial strategies for the stability and growth of the practice.

How Doctor Bookkeeping Helps Overcome Healthcare Financial Challenges

Healthcare practices face unique financial challenges that make accurate doctor bookkeeping and specialized healthcare accounting expertise essential. Some of the Common issues faced are:

- Complex Billing & Coding: Navigating intricate insurance claims and payment models.

- High Overhead Costs: Managing significant operational expenses.

- Fluctuating Revenue Cycles: Dealing with unpredictable insurance payments.

- Compliance & Regulatory Requirements: Adhering to healthcare-specific laws.

- Evolving Payment Models: Adapting to new revenue recognition methods.

- Managing Accounts Receivable: Tracking outstanding payments for cash flow.

- Tax Planning & Compliance: Handling complex tax laws and ensuring adherence.

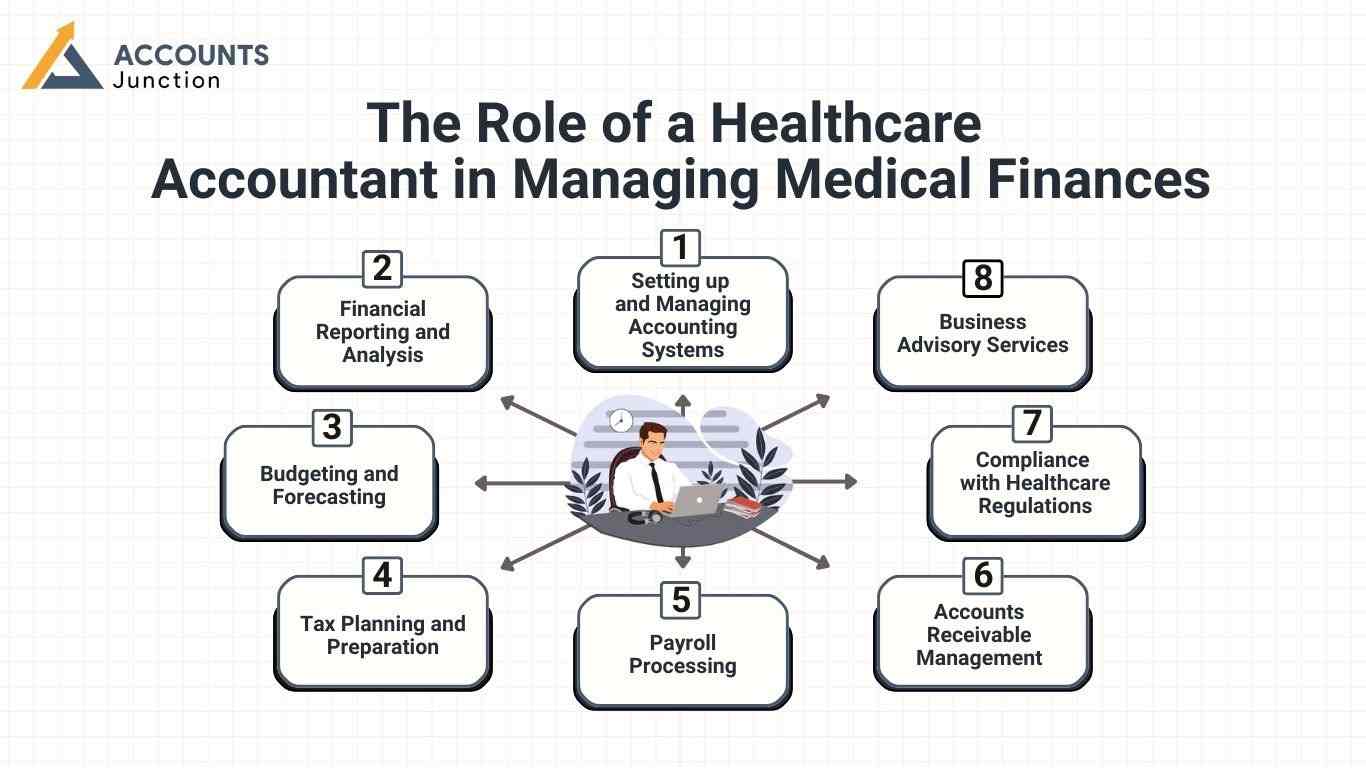

The Role of a Healthcare Accountant in Managing Medical Finances

A healthcare accountant specializes in doctor bookkeeping and the unique financial challenges of medical practices. They bring a deep understanding of the healthcare industry, including billing practices, insurance regulations, and compliance issues. They offer more than just basic bookkeeping. Their expertise includes strategic financial guidance specifically designed for doctors and medical practices.

The role of a healthcare accountant typically includes:

- Setting up and Managing Accounting Systems: Implementing and maintaining efficient bookkeeping systems, often utilizing specialized healthcare accounting software.

- Financial Reporting and Analysis: They prepare regular financial statements like income statements, balance sheets, and cash flow statements. They also analyze this data to provide insights into the practice's performance.

- Budgeting and Forecasting: Developing budgets and financial forecasts to help practices plan for the future and manage resources effectively.

- Tax Planning and Preparation: Advising on tax strategies, preparing tax returns, and ensuring compliance with tax regulations.

- Payroll Processing: Managing payroll for staff, including calculating wages, withholding taxes, and ensuring timely payments.

- Accounts Receivable Management: Implementing strategies to improve collections and reduce outstanding balances.

- Compliance with Healthcare Regulations: Ensuring financial practices comply with relevant healthcare laws and regulations.

- Business Advisory Services: Providing strategic financial advice on issues such as practice valuation, mergers and acquisitions, and expansion planning.

Hire a skilled healthcare accountant. This allows doctors to focus on patient care, knowing their financial well-being is in capable hands.

Common Tax Deductions and Compliance for Doctors

Doctors can take advantage of various tax deductions to reduce their tax liability. However, it's crucial to maintain accurate records and understand the specific requirements for each deduction. Doctors can often deduct expenses such as:

- Business Expenses: Expenses directly related to running the practice, such as rent, utilities, supplies, insurance, and professional development.

- Self-Employment Tax Deduction: Self-employed doctors can deduct part of their self-employment taxes. These taxes include Social Security and Medicare.

- Health Insurance Premiums: Self-employed doctors can often deduct health insurance premiums paid for themselves, their spouses, and dependents.

- Retirement Contributions: Contributions to retirement plans, such as SEP IRAs or Solo 401(k)s, are often tax-deductible.

- Home Office Deduction: Doctors might use part of their home exclusively for their business. If so, they may be able to deduct home office expenses.

- Continuing Medical Education (CME) Expenses: Costs associated with attending CME courses, including registration fees, travel, and lodging, are typically deductible.

- Malpractice Insurance Premiums: Premiums paid for malpractice insurance are deductible business expenses.

Compliance is equally important. Doctors need to follow tax regulations. They must accurately report income and expenses and file tax returns on time to avoid penalties.

Best Software for Doctor Bookkeeping and Medical Accounting

Utilizing specialized healthcare accounting software can significantly streamline doctor bookkeeping and improve efficiency. These software solutions are designed to address the unique needs of medical practices, often including features such as:

- Medical Billing Integration: Seamless integration with medical billing systems to automate revenue tracking and reconciliation.

- HIPAA Compliance Features: Security measures to protect patient financial information.

- Appointment Scheduling Integration: Some software integrates with appointment scheduling systems for better revenue forecasting.

- Electronic Health Records (EHR) Integration: Integration with EHR systems for comprehensive financial and patient data management.

- Customizable Reporting: Ability to generate reports tailored to the specific needs of the practice.

Some popular healthcare accounting software options include:

- QuickBooks Self-Employed: Suitable for solo practitioners.

- Xero: A cloud-based accounting solution often used by small businesses, including medical practices.

- Sage Intacct: A more robust cloud-based solution for larger practices.

- Zoho Books: Another cloud-based option offering various features.

- KashFlow: A simple and user-friendly accounting software.

The best software for a particular practice will depend on its size, complexity, and specific needs. A healthcare accountant can provide guidance on selecting and implementing the most appropriate software.

How Accurate Bookkeeping Can Prevent Financial Pitfalls

Even a small mistake in a doctor's bookkeeping may grow into a significant issue over time. Mismanaged records can cause missed payments, unnecessary fines, or even legal challenges. By keeping consistent and precise financial records, medical practices can reduce the risk of cash flow crises, audit penalties, and unexpected tax bills. This proactive approach may allow doctors to spot problems early and plan for future challenges with confidence.

Key Points:

- Early detection of revenue leaks or overspending

- Avoidance of late tax filing penalties

- Prevention of miscommunication with insurers

- Clear understanding of patient billing cycles

Integrating Technology with Traditional Bookkeeping

While manual bookkeeping has its benefits, technology may make the process faster and more accurate. Cloud-based accounting systems can automate repetitive tasks, reconcile accounts, and generate detailed reports almost instantly. Doctors may still choose to maintain some manual records for security or personal reference, but combining both approaches often creates the best results.

Benefits Include:

- Reduced human errors in financial calculations

- Real-time tracking of income and expenses

- Easy access to financial data from anywhere

- Enhanced collaboration with accountants and staff

Future Trends in Healthcare Accounting

The world of medical finance may evolve rapidly in the coming years. Emerging payment models, AI-assisted accounting, and stricter compliance standards could redefine how doctor bookkeeping is handled. Practices that adapt early may gain a competitive edge by streamlining operations, reducing costs, and making better investment decisions.

Notable Trends:

- AI-driven financial analysis for predictive insights

- Greater integration between EHR and accounting systems

- Increased focus on cybersecurity in financial data

- Personalized financial dashboards for practice management

Accounts Junction knows the financial challenges doctors face. We offer clear and simple healthcare accounting services for medical practices. Our team handles bookkeeping with care, making sure it is accurate and follows all rules. We also give advice to help your practice grow.

You can focus on patients while we manage your finances. We give easy-to-read reports so you can see how your practice is doing.

We help you earn more and spend less by spotting ways to improve your income and cut costs. We also handle taxes, so you pay only what is needed and avoid fines.

Our goal is to give doctors simple, reliable accounting help to reach their financial goals and run their practice with ease.

FAQs

1. What is doctor bookkeeping, and why is it important?

- Doctor bookkeeping tracks all money in and out of a medical office.

- It helps doctors know profits and avoid waste.

2. How can accurate bookkeeping improve a medical practice’s finances?

- It helps doctors see income, control spending, and make smart choices.

- Good records show where money can be saved.

3. What arethe common challenges in doctor bookkeeping?

- Doctors face tricky billing, uneven payments, rules, and high costs.

- Mistakes can cause fines or cash flow problems.

4. Why do doctors need a healthcare accountant?

- A healthcare accountant knows rules, bills, and taxes for doctors.

- They save time and prevent costly errors.

5. Which software is best for doctor's bookkeeping?

- QuickBooks, Xero, Sage, Zoho Books, and KashFlow all work.

- The choice depends on practice size and needs.

6. How does bookkeeping help with tax planning for doctors?

- It shows what costs can be deducted and avoids tax fines.

- Clear records make filing taxes easy and fast.

7. Can bookkeeping increase practice profits?

- Yes, it shows ways to save money and boost earnings.

- It highlights where spending is too high.

8. What reports should doctors check often?

- Income, cash flow, and balance sheet reports track money.

- Checking them helps avoid surprises.

9. How does bookkeeping help with unpaid bills?

- It tracks patient payments and insurance claims.

- Doctors can follow up quickly on late bills.

10. What are common tax deductions for doctors?

- Office rent, insurance, staff pay, and courses are deductible.

- Even small costs add up to savings.

11. How can bookkeeping support budgeting and planning?

- It shows money in and out, so doctors can plan spending.

- It helps set clear goals for growth.

12. Can bookkeeping software work with billing systems?

- Yes, many tools link with billing and patient records.

- This saves time and reduces mistakes.

13. How often should doctors update their books?

- Weekly updates are best, and monthly works for small offices.

- Regular updates keep finances correct.

14. How does bookkeeping help meet healthcare rules?

- It keeps clear records for tax, insurance, and law rules.

- Good records lower the risk of fines.

15. Can accountants help with audits?

- Yes, they check books and fix errors.

- They make audits fast and simple.

16. Is bookkeeping useful for small and big practices?

- Yes, all practices gain from tracking money.

- Even solo doctors see their profits clearly.

17. How does bookkeeping help control costs?

- It shows big expenses and ways to spend less.

- Doctors can make smarter choices with cash.

18. Can bookkeeping guide practice growth?

- Yes, it shows data to hire staff or add services.

- It helps doctors plan wisely for the future.

19. What happens if bookkeeping is poor?

- It can cause money issues, lost deductions, and fines.

- It may also harm the practice’s reputation.

20. How do doctors pick the right accounting software?

- They check practice size, features, and accountant advice.

- Trying a demo can help make the choice.

21. Can bookkeeping track equipment and supply costs?

- Yes, it monitors all office purchases and supply spending.

- This prevents money from being wasted.

22. Does bookkeeping help with insurance claims?

- Yes, it keeps claims clear and speeds up payments.

- Doctors get paid faster and avoid errors.

23. Can good bookkeeping reduce stress for doctors?

- Yes, clear finances let doctors focus on patients.

- It gives peace of mind and less worry.

24. Is bookkeeping needed for new practices?

- Yes, good records stop money problems later.

- It sets a strong base for growth.

25. How can bookkeeping help during tax season?

- It gives clear records, so taxes are easy to file.

- Doctors avoid last-minute stress and mistakes.