What Should I Look for When Comparing Different Professional Accounting Services?

Choosing the right professional accounting services may seem hard. Many firms may offer similar work but vary in cost, skills, and tools. Picking the wrong firm may lead to errors or missed deadlines.

Careful checks may save time and avoid problems. Professional accounting services can track money, handle taxes, pay staff, and give clear reports. Firms that fit your needs may make your work easier. Poor choices may cause stress, extra costs, and slow growth.

Businesses may need to look at more than cost. Experience, tools, support, and trust may matter. Good services may also grow with your business and offer clear advice.

Why Comparing Professional Accounting Services is Important

Comparing professional accounting services can help avoid mistakes. Each firm may handle work in different ways. Some focus on bookkeeping only, others add tax and advice. Tools, staff, and methods may differ.

A careful review may improve speed and reduce errors. Firms with the right skills may give timely reports and correct statements. Matching a firm to your needs may help with taxes, pay, and planning.

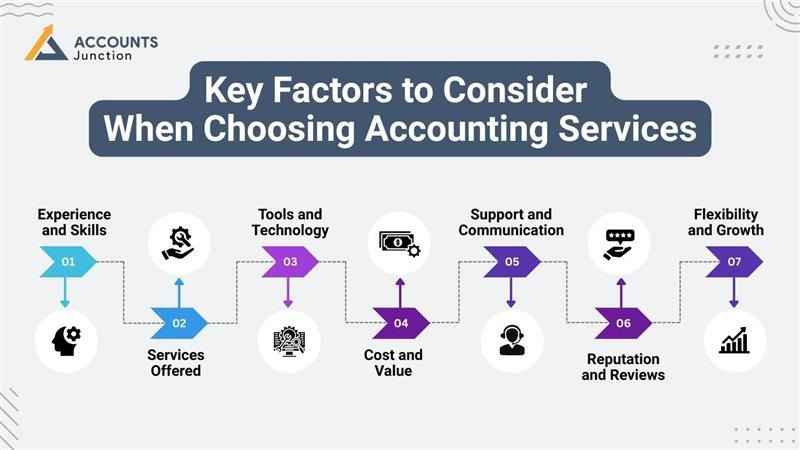

Key Factors to Consider When Choosing Accounting Services

1. Experience and Skills

Industry Knowledge

Firms with experience in your field may provide professional accounting services and know special rules. A firm that works with shops may not fit a factory. Lack of skill may cause errors.

Certifications

CPAs or CAs may show that a firm is trained. Certified staff in professional accounting services may follow rules and check work well.

Team Strength

Junior staff may do simple work. Senior staff handle audits and advice. Ask about the team to know what you get.

2. Services Offered

Basic Work

Bookkeeping, tax, and payroll are core services. Missing these may hurt your business.

Extra Services

Some firms may plan budgets, give advice, or check cash flow. Firms with limited services may need extra help.

Special Work

Some firms may handle audits, fraud checks, or detailed reports. This may suit larger firms or complex work.

3. Tools and Technology

Modern Software

Firms using new software may avoid mistakes. Cloud tools may give live access. Automation can save time.

Data Safety

Financial data is private. Firms may use secure portals, passwords, and encryption. Weak security may cause risks.

System Links

If the firm can link with your shop or sales tools, work may be smoother.

4. Cost and Value

Clear Pricing

Firms may charge fixed fees or hourly rates. Know all costs before you hire.

Value Over Cost

Cheap firms may lack skill. Higher cost may bring better work and full service.

Compare Offers

Ask for proposals. Compare prices, staff, and services. This may help pick the best fit.

5. Support and Communication

Quick Replies

Fast replies may prevent late tax filings or pay errors.

Personal Care

A dedicated accountant may know your business well. Generic service may miss key details.

Ways to Reach

Check if support is via phone, email, or online. Make sure it fits your needs.

6. Reputation and Reviews

Client Feedback

Reviews and testimonials may show reliability and care. Feedback from similar firms is best.

Awards and Recognition

Some firms get awards. These may show trust, but check other factors too.

Word of Mouth

Ask other business owners for tips. Good networks may show strong trust.

7. Flexibility and Growth

Grow With You

Professional accounting services must scale and handle more work as your business grows. Small firms may struggle with more tasks.

Custom Work

Flexible firms may adjust reports or work methods. This may help avoid mistakes.

Checklist for Comparing Professional Accounting Services

- Experience: Check past work and know their industry skills.

A firm with the right skill may cut mistakes and save time. - Certification: Ask if staff has a CPA, CA, or other title.

Certified staff may follow rules and keep work correct. - Services: Make sure the core work and extra work match.

Check if they do books, pay staff, and file taxes. - Tools: Look at software, safety, and system links.

Good tools may cut mistakes and give fast updates. - Price: Compare cost and value before making a choice.

Cheap price may save cash, but may reduce work quality. - Support: Check speed, help, and care from staff.

Fast support may stop late pay or missed filings. - Reputation: Read reviews and ask for client proof.

Past clients may show that the work is good and trusted. - Flexibility: See if the firm can grow with you.

Good firms may handle more work as the business grows.

Tips for Making an Effective Comparison

- Make a Shortlist: Pick 3–5 firms to check closely. A shortlist may help focus on the best options and save time.

- Request Proposals: Compare work, cost, and staff assigned. Proposals may give a clear view of each firm’s offer.

- Check References: Talk to clients or other business owners. References may show real work skills and how the firm acts.

- Check Fit: See if professional accounting services fit your team's style well. A good fit may cut missteps and ease the daily workflow.

- Try Software: Ask for the demo or test access first. Testing may show if the software works fast and is clear.

- Check Staff Skills: Make sure the team has the right skills. Skilled staff may do hard work with few errors.

- Check Reports: Ask for a sample or past work done. Look at reports to see if they are clear and correct.

Considerations for Selecting the Right Firm

- Hidden costs or unclear fees

Hidden fees may make your budget go off track. Ask all costs before you sign any work deal. - No experience in your field

Firms with no skill in your field may fail to work. Pick firms that know your field to avoid mistakes. - Weak data safety

Poor safety may risk your money and private data. Check if the firm uses safe files and strong passwords. - Slow replies or bad support

Late replies may cause missed deadlines or wrong work. Pick firms that act fast and give proper care. - The firm cannot scale as the business grows

Some firms fail when work gets big or hard. Good firms may grow with you and handle more work.

Comparing professional accounting services may save time and reduce risks. Look for experience, skill, good tools, and flexible work. Cost should reflect value and care, not only price. Quick communication and personal attention may give long-term benefits.

At Accounts Junction, we give professional accounting services for all business types. Our certified staff tracks books, pays staff, files taxes, and gives clear reports. Our secure tools may grow with your business. Partner with us to keep your accounts right and stress-free.

FAQs

1. What are professional accounting services?

- These services may include bookkeeping, tax, payroll, and reports.

- They may help businesses track money and stay within rules.

2. Why should I compare professional accounting services?

- Comparison may ensure correct work and fair prices.

- It may help pick a firm that fits business needs.

3. What factors matter when choosing an accounting firm?

- Experience, offered services, cost, tools, and client support may matter.

- Reputation and credentials may also show trust and skill.

4. How can professional accounting services improve business finances?

- They may give correct reports for budgets and tax work.

- Reports may help make clear and smart money choices.

5. Are certifications important for accounting firms?

- Certifications like CPA or CA may show skill and standards.

- They may help ensure rules are followed correctly.

6. How do I assess the quality of accounting services?

- Check reports, timeliness, client feedback, and service methods.

- Tools and personal support may also show work quality.

7. What services do professional accounting services usually provide?

- Bookkeeping, tax filing, payroll, reports, and business advice.

- Some may also give help with budgets and plans.

8. How do pricing models vary for accounting services?

- Some may charge by hour, others may use flat fees.

- Comparing prices may give value without losing quality.

9. Can professional accounting services help with tax compliance?

- Yes, they may ensure taxes are filed correctly and on time.

- They may also cut the risks of mistakes or penalties.

10. How important is technology in accounting services?

- Tools may make reports accurate and keep data safe.

- Firms using the cloud may give real-time access to files.

11. What makes a firm reliable for professional accounting services?

- Experience, client feedback, credentials, and steady reporting matter.

- A strong name may show trust and work quality.

12. How do I compare service levels between accounting firms?

- Look at response time, report accuracy, and tools used.

- Talking to staff may also show how good the support is.

13. Can small businesses benefit from professional accounting services?

- Yes, they may track records, file taxes, and plan budgets.

- Small firms may gain clarity and reduce mistakes.

14. How can accounting services support business growth?

- They may give insights into cash flow, costs, and plans.

- Accurate reports may help plan new moves and growth.

15. Why choose professional accounting services over DIY accounting?

- Experts may reduce errors and follow all legal rules.

- They may save time and offer solutions that scale.

16. How often should I use professional accounting services?

- Businesses may use them each month, every quarter, or as needed.

- Use may depend on reports and tax filing times.

17. Can professional accounting services handle payroll tasks?

- Yes, they may manage wages, taxes, and staff records.

- They may ensure that pay is correct and sent on time.

18. Do professional accounting services help with audits?

- Yes, they may get records ready for audit checks.

- They may also reduce risks of mistakes or fines.

19. How can accounting services save time for businesses?

- Experts may handle reports, taxes, and payroll fast.

- This may let owners focus on daily business work.

20. Can professional accounting services help with cash flow?

- Yes, they may track income, bills, and owed money.

- Reports may help plan spending and keep cash steady.

21. Are professional accounting services suitable for startups?

- Yes, they may guide record keeping, taxes, and finance.

- Startups may avoid errors and stay on track.

22. How do I know if an accounting service is right?

- Check past work, offered services, client reviews, and tools.

- A short trial or call may show fit and skill.