CPA Software Solutions for Tax Preparation: What You Should Know

CPA software solutions often shape tax work in a clear way. Many firms use such tools to bring calm flow into tax tasks. Some firms may try new tools, while some firms stay with old tools, yet CPA software solutions still draw broad use. A neat mix of skill and smart work brings gain to teams when they work with CPA software solutions. A small firm may not know such tools well, but most teams still look at CPA software solutions as a clean path to steady tax work. Many small firms also plan to use an online accounting system for small businesses as part of the same work plan, since that tool may link with core tax tasks.

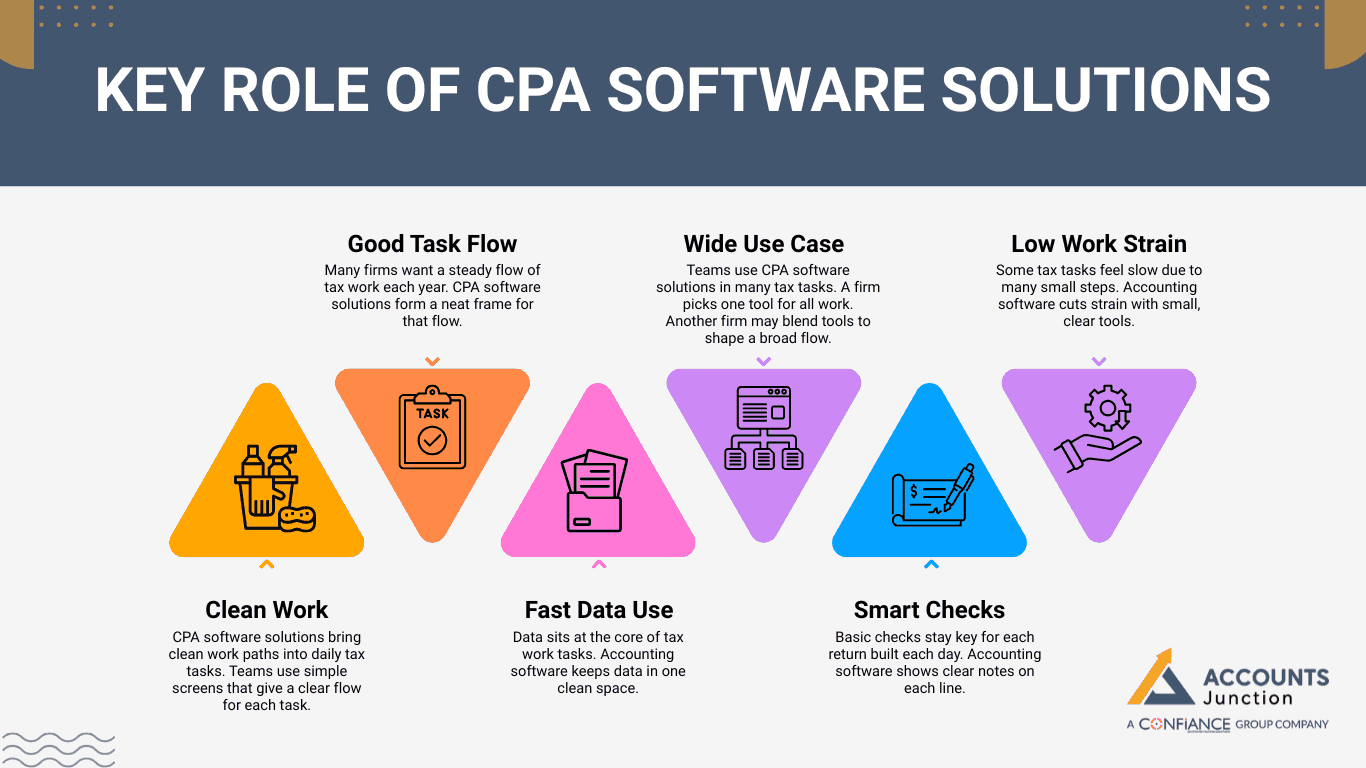

Key Role of CPA Software Solutions

-

Clean Work

CPA software solutions bring clean work paths into daily tax tasks. Teams use simple screens that give a clear flow for each task. Staff gain speed since the tool keeps each step neat. The pace of work shift when the team uses the tool.

-

Good Task Flow

Many firms want a steady flow of tax work each year. CPA software solutions form a neat frame for that flow. Simple steps stay clear, and teams avoid lost time. Work lines stay short since the tool cuts long paths.

-

Fast Data Use

Data sits at the core of tax work tasks. Accounting software keeps data in one clean space. Staff reach data in less time with smooth access. This shapes a calm pace in busy tax weeks.

-

Wide Use Case

Teams use CPA software solutions in many tax tasks. A firm picks one tool for all work. Another firm may blend tools to shape a broad flow. Each path may still gain from a clear and simple tool set.

-

Smart Checks

Basic checks stay key for each return built each day. Accounting software shows clear notes on each line. A staff member may see quick flags for wrong data. This guides a clean fix path in less time.

-

Low Work Strain

Some tax tasks feel slow due to many small steps. Accounting software cuts strain with small, clear tools. Staff use fast clicks that shape calm progress. The low strain may aid in smooth work all year.

Core Parts of CPA Software Solutions

-

Data Form

Many tax tasks start with a clean data form. CPA software solutions keep each form neat and easy to read. Staff may type less since some fields auto-fill. This type of form limit small slips in key lines.

-

Tax Line View

A tax return grows step by step with many lines. Accounting software shows each line in clear view. Staff move through steps with less guesswork. The lines stay clear, which shapes the right pace.

-

File Store

Tax files need calm storage plans that stay safe. Accounting software brings safe storage rooms in one space. Staff reach past files with fast search tools. Teams do not stress about lost files in peak time.

-

Team Link

Team link tools guide work in a neat way. CPA software solutions grant small link tools for each team. Staff share steps in one clean path all day. Work lines then stay tight from start to end.

-

Plan Tools

Plan tasks need simple tools that keep goals clear. CPA software solutions show plan paths for each cycle. Staff check a plan and move in one shared line. Such tools form a calm path for team goals.

-

File Send

Final work phases need smooth send tools for each file. Accounting software uses clear click paths for sends. Firms see quick notes that show file send status. This keeps the full cycle at a calm pace.

Why Firms Look at CPA Software Solutions

-

Work Speed

Firms may want to raise work speed in each tax phase. CPA software solutions shape the rise with smart tools. Staff close more tasks with less slowdown. Work pace may see a new gain in peak tax days.

-

Clear Path

CPA software solutions cut long work loops. A clear path may help a team stay in sync. Each small step stays neat with a clean view. This builds the right work tone across months.

-

Reduce Waste

Teams seek ways to reduce waste in their daily plan. Accounting software helps reduce waste at many points. Steps that once took long hours now take less time. This shapes strong gains in broad tasks.

-

Tight Plan

A tight plan may help staff keep tasks on track. CPA software solutions craft a tight and clean plan. The plan lays out each line in a neat part. This type of plan shapes a calm workflow.

-

Low Slip Rate

Some teams watch slip rates since tax lines can shift. Accounting software keeps slips low through alerts. Staff fix slips with short steps and clear cues. The tool holds slip counts to neat low spans.

-

Good Team Tone

A firm may want a good team tone in tax work. CPA software solutions aid in that tone by clearly defining tasks. Staff see shared steps that show their role in full. This type of tone may bring a strong work mood.

How CPA Software Solutions Fit Small Firms

-

Small Team Gain

Small teams may want tools that guide calm days. Accounting software gives small teams simple screens. Staff may not waste time on long steps or deep menus. This may shape a neat work curve in tax time.

-

Cost Mind

Small firms watch costs and see tool value with care. CPA software solutions may fit cost plans in a smart way. Firms may test low tiers and grow usage over time. This help shape a calm path for tool use.

-

Task Split

Small firm tasks shift among staff each day. Accounting software help split tasks into clear parts. One staff member moves a file to the next with one click. This broad link may guide the team toward a good pace.

-

Data Hold

Data holds key worth in all tax tasks for small teams. CPA software solutions may keep data in a clean base. Staff do not search long for past files or notes. This lead to short and smooth data use.

-

Cross Link

Many small firms use an online accounting system for small businesses. CPA software solutions may link in some ways with that tool. Staff blends both tools in one calm work chain. This may shift the pace of tax tasks in strong ways.

-

Good Start

New staff may learn with ease when the tool is clear. Accounting software helps new staff learn in less time. The neat screens help them grasp each step. This may cut long train lines in peak months.

CPA Software Solutions in Broad Tax Work

-

Prep Tasks

Prep tasks set the tone for each tax cycle each year. CPA software solutions may bring a neat flow to prep work. Staff may move data in small steps that stay clean. The early stage brings strong gains in pace.

-

Check Steps

Check steps need clear screens and a calm pace to work well. Accounting software may highlight lines that need more care. Staff scan key parts with fast-view screens. This may keep the check step short yet firm.

-

Final Build

The final build of a file may take long hours. Accounting software cut that time with clean paths. Staff view each part on one page with fast scrolling. This may shape a smooth end step for each file.

-

Pair Tools

Many firms pair CPA software solutions with file tools. Staff link file tools in a clear and calm flow. This may cut stress in the last step of tax work. Good pairs give firms strong long-term gains.

-

Train Steps

Train steps help teams grow and shift with new trends. CPA software solutions may show clean train guides or cues. Staff may learn new lines in a short time with clear tips. This shapes team skills in a slow but sure curve.

-

Work Notes

Firms may use small work notes to track key points. Accounting software may keep notes in a neat space. Staff may check notes at each step with ease. Notes guide a smooth flow on high-paced days.

How Online Accounting Systems Support Small Businesses

-

Seamless Data Flow

Data sync serves as a key part of the workflow. An online accounting system for small businesses may hold core data. Accounting software may pull that data in a clean stream. This may shape a broad and quick tax line.

-

Close Work Gaps

Work gaps slow tax tasks if data stays split. An online accounting system for a small business can close those gaps. CPA software solutions read each line in one block. This may give a smooth pace in peak work time.

-

Clear Firm View

Firms want broad views of tax and cash lines. An online accounting system for a small business may show neat charts. Accounting software may blend those charts with tax screens. This may shape a clear view across firm tasks.

-

Secure Records

Data safety remains key in all firm tasks. An online accounting system for small businesses may keep safe records. CPA software solutions may store tax files in clean vaults. Firms may trust both tools for this part of the work.

-

Smooth Staff Work

Small staff teams want easy tools that bring calm days. An online accounting system for small businesses may keep tasks light. Accounting software may give staff smooth screens. Team members may see a calm flow in both tools.

-

Efficient Time Use

Time use may shape long-term firm growth in small ways. An online accounting system for small businesses may save time. Accounting software trims waste in tax tasks. The blend may bring a calm pace to long work spans.

CPA Software Solutions and Long-Term Firm Goals

-

Growth Path

Firm growth may need tools that scale with new needs. Accounting software may grow from small use to broad use. Teams may add new parts as staff size grows. This shapes a long and calm growth line.

-

Clear Aim

Firms may seek clear aims for their tax lines. CPA software solutions may form paths that match those aims. Staff see how each tool part fits that aim. This helps firms steer work in the right way.

-

Low Risk

Risk in tax work may rise if steps stay split. Accounting software cuts risk through neat lines. Staff may catch small slips in a short time. This shape broad trust in the full work path.

-

Team Skill

Staff skill may grow as the tool guides key tasks. CPA software solutions may show each step with clear cues. Staff grow skills with daily use and clean screens. Long-term skills shape a strong firm's gain.

-

Data Line

Data lines remain the spine of long tax work. Accounting software keeps data lines in crisp form. Staff may track each line with fast scroll tools. This may build long-term care for firm data needs.

-

End Goals

Firms set end goals for tax tasks each year. Accounting software shows lines that match those goals. Staff may close tasks with clear cues from the tool. This brings firm gains in broad time spans.

Users report that CPA software solutions improve workdays and create calmer workflows during peak seasons. These gains foster trust across busy work environments. Teams note that the tools provide a balanced workspace and enable clear, focused decision-making.

Staff often highlight strong confidence in these solutions, emphasizing their stable design. This stability enhances mood and sharpens focus. Many users note smooth progress during intensive tasks, with the software streamlining each step and supporting efficient task completion.

Accounts Junction provides accounting and bookkeeping services for firms of all sizes. We have certified experts who ensure every record is accurate and clear. Our team maintains smooth and organized financial processes for all clients. Partner with us for reliable and professional accounting and tax services.

FAQs

1. What are CPA software solutions used for?

- They support tax tasks through clean and simple workflows. Users sense easier moves during heavy tax sessions.

2. How can CPA software solutions improve tax preparation?

- These tools show clear screens that guide each tax step. Users feel a steady flow during complex tax work.

3. Why do firms choose an online accounting system for small businesses?

- Small firms trust calm screens that show clean records. These tools offer neat paths that support daily work.

4. Do CPA software solutions make tax reviews easier?

- Users feel reviews turn smoother with clean, guided screens. These tools show key areas with clear visual order.

5. Can CPA software solutions reduce errors during tax tasks?

- Users sense fewer slips when screens show simple cues. These cues direct tasks through clear and stable steps.

6. What features matter most in Accounting software?

- Users value clean layouts with sharp and neat paths. They need calm views that support fast tax checks.

7. How does an online accounting system support small business taxes?

- These tools keep records tidy for smooth tax sessions. Users feel tasks move quickly with a clear daily structure.