How Can CPAs Help Musicians Optimize Their Income and Tax Strategies?

While you are a self-employed musician, you will always want to be more creative in your profession. Despite this, accounting for musicians is important to improve income and make a better tax strategy. Many musicians till now had been ignoring the importance of accounting and other financial aspects of business.

There are many aspects and complexities in the finance, accounting, and tax-related aspects that can be done proficiently by Certified Public Accountants (CPAs) only. To make your task simpler, CPA for musicians can be a better option to deal with the finance, accounting, and tax-related aspects. They can get all the accounting work right and other tax-related aspects.

Why Musicians Need Specialized Accounting

- Musicians do not have a steady income like most workers.

- Their pay can change a lot from month to month.

- Their pay can change a lot from month to month.

- They earn money from many sources, such as:

- Live shows and tours, which can bring big but uneven pay.

- Music royalties and streams, paid when songs are played online.

- Selling items, like shirts, CDs, or other small goods.

- Deals with brands that want to work with them.

- Teaching or classes, such as private lessons or group workshops.

- Each type of income has its own tax rules.

- Royalties are taxed in a different way than live show pay.

- Selling goods may need sales tax in many states.

- Teaching or deals can follow other tax rules too.

- Without help, mistakes can cost money or cause audits.

- Even small errors in reports can lead to fines or fees.

- A CPA for musicians can:

- Track all income correctly, so nothing is missed.

- Handle deductions well, which can lower taxes owed.

- Make tax plans that fit a musician’s life and work.

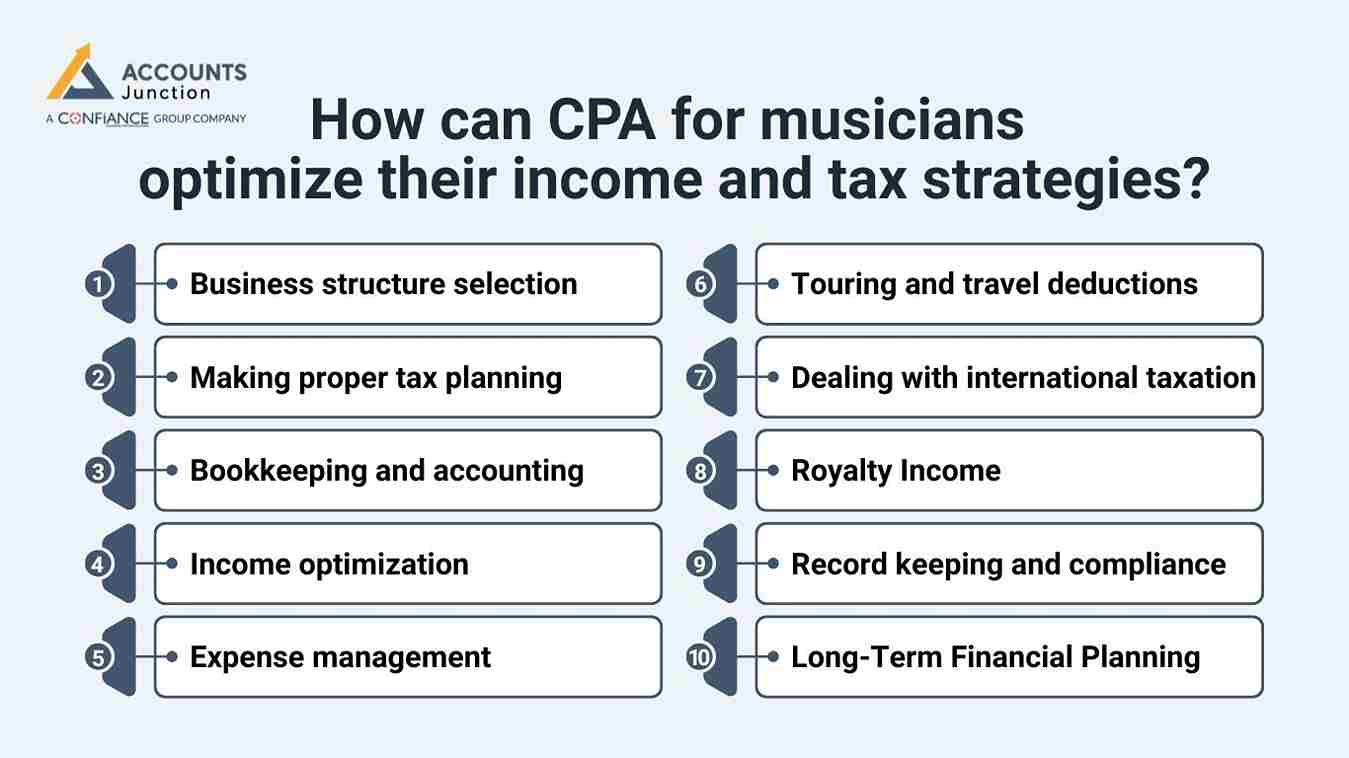

How can CPA for musicians optimize their income and tax strategies?

Here are ways CPA can help in accounting for musicians improve their income and tax strategies:

-

Business structure selection

CPAs can help musicians choose the most appropriate business structure, such as a sole proprietorship, LLC, S-Corporation, or C-Corporation, based on their specific financial situation and long-term goals. The chosen structure can impact tax liability, legal protection, and ease of administration.

-

Making proper tax planning

CPAs can develop tax strategies to minimize a musician's tax liability, such as taking advantage of deductions, credits, and exemptions available to self-employed individuals. They can also help with estimated tax payments to avoid underpayment penalties.

-

Bookkeeping and accounting

Maintaining accurate financial records is crucial. CPAs can help musicians set up an efficient bookkeeping system and provide guidance on tracking income and expenses to ensure that they claim all eligible deductions.

-

Income optimization

CPAs can advise musicians on diversifying their income sources, which might include performance fees, royalties, merchandise sales, and licensing. They can also help with contract negotiation to maximize earnings.

-

Expense management

CPAs can assist musicians in identifying legitimate business expenses and structuring their financial transactions. It will minimize tax obligations while staying within the bounds of tax law.

-

Touring and travel deductions

Musicians often travel for performances. CPAs can guide them on how to properly document and deduct expenses related to touring and travel, including meals, accommodations, and transportation.

-

Dealing with international taxation

For musicians with international income or cross-border activities, CPAs with expertise in international taxation are needed. This can help navigate complex tax issues, such as withholding taxes and tax treaties.

-

Royalty Income

CPAs can assist musicians in managing and reporting royalty income, which can come from songwriting, music publishing, and other creative endeavors.

-

Record keeping and compliance

CPAs can help musicians stay compliant with tax regulations and filing requirements. They can also advise on record-keeping practices to facilitate easier tax preparation.

-

Long-Term Financial Planning

CPAs can work with musicians to develop a comprehensive financial plan that considers short-term and long-term goals. This can involve saving for major expenses.

These are some ways CPA’s can help musicians to optimize their income and tax strategies. You need to outsource this task to an expert CPA who could assist you in achieving these goals.

How Musicians Can Manage Income and Expenses

Musicians can work with their CPA to earn more and pay less tax. Here are some simple ways:

-

Separate Personal and Music Money

Open different bank accounts and credit cards for music money. A CPA for musicians can track these easily and avoid confusion at tax time.

-

Keep Good Records

Save all receipts, bills, and contracts. Many musicians forget this, but proper accounting for musicians helps claim all deductions.

-

Plan for Retirement

Musicians often do not have work retirement plans. A CPA can help set up accounts like SEP IRAs or solo 401(k)s. These also give tax breaks.

-

Deduct Travel and Home Studio Costs

Touring or home studio costs can be deducted. A CPA for musicians can spot what counts, such as:

- Car or travel costs for tours

- Home office or studio costs

- Travel, food, and hotel for music projects

-

Pay Taxes in Parts

Musicians may pay taxes four times a year to avoid fines. A CPA can help estimate payments based on income and prevent surprises.

-

Use Simple Accounting Tools

Software like QuickBooks, Wave, or Xero can link to music platforms. A CPA for musicians can set it up and show how to use it for easy accounting for musicians.

Benefits of Hiring a CPA for Musicians

Working with a CPA who knows the music business gives many benefits:

-

Save Time

Musicians can spend more time making music instead of tracking money.

-

Less Stress

A professional helps with taxes and rules, easing worry.

-

Keep More Money

CPAs find deductions and credits to help musicians keep more income.

-

Better Choices

Clear reports help musicians make smart financial decisions.

-

Audit Help

CPAs can support you if the IRS questions your taxes.

A CPA for musicians helps both now and in the long run, protecting income and growing wealth.

Choosing the Right CPA for Musicians

Not all CPAs know the music world. Here’s how to pick the right one:

-

Music Experience

Find a CPA who has worked with artists or the entertainment field.

-

Know Your Income

They should understand royalties, streaming, merchandise, and gig pay.

-

Clear Talk

A good CPA explains tax rules in easy words.

-

Tech Skills

Familiarity with software and online payments is key.

-

Proactive Help

The best CPAs give advice all year, not just at tax time.

A CPA who knows music can become a trusted partner in managing and growing your money.

Case Study: How a CPA Can Help a Musician

A freelance musician makes money from shows, lessons, and music sales. Before using a CPA for musicians, it was hard to track costs, and too much tax was paid. After hiring a CPA:

- Costs were tracked well, saving money each year.

- Tax payments were made on time, with no fines.

- A separate account was set up, lowering risk.

- Monthly reports helped plan shows and studio work.

Common Mistakes Musicians Make Without a CPA

-

Mixing Personal and Business Finances

Makes deductions and taxes hard to track. It also hides what you earn from music alone.

-

Ignoring Quarterly Taxes

It can lead to fines and surprise bills. Missing dates adds stress and extra interest.

-

Underestimating Deductions

Many costs, like travel or gear, can be claimed. Without a CPA, you may lose money you earned.

-

Late Record-Keeping

Poor notes can cause lost deductions or IRS problems. Clear records also show your profit and loss.

-

Not Planning for Irregular Income

Musicians may not save in high-earn months and run short later. A CPA can help plan funds and cash flow.

Accounts Junction provides outsourced work for accounting services for musicians. We have a team of experts to handle CPA for musicians, which can optimize their income and tax strategies. The CPA here is well-qualified and can advise you to improve your financials. Accounts Junction is a well-known accounting services provider for musicians.

FAQs

1. What is a CPA for musicians?

- A CPA for musicians is an accountant who handles taxes, bookkeeping, and money planning for artists. They know how musicians earn money and the costs they face.

2. Why do musicians need a CPA?

- Musicians earn money from many sources and uneven work, which makes taxes hard. A CPA helps follow rules and claim all deductions.

3. How can a CPA help with music income?

- They track money from shows, royalties, lessons, merchandise, and sponsorships. They also give simple reports to help musicians see all the income.

4. What business structure is best for musicians?

- A CPA can show if a sole proprietorship, LLC, S-Corp, or C-Corp is best. The right choice can cut taxes and keep personal money safe.

5. How does a CPA help with tax planning?

- They make a plan to lower taxes using deductions, credits, and estimated payments. This avoids fines and surprises at tax time.

6. Which music-related expenses can a CPA deduct?

- Costs like tours, travel, home studio, instruments, lessons, and fees can be deducted. A CPA makes sure all costs are counted to cut taxes.

7. How can CPAs help with royalty income?

- They guide reporting and taxes for royalties from songs, publishing, and licensing. They also track all royalty sources to avoid mistakes.

8. Why is separating personal and music finances important?

- It makes tracking easy and avoids mistakes. It also gives a clear view of a musician’s real income and costs.

9. How can a CPA help with irregular musician income?

- They plan cash flow, savings, and tax payments. This helps musicians handle low-income months without stress.

10. Can a CPA help musicians with international gigs?

- Yes, they handle taxes for work in other countries, like withholding and treaties. They help avoid paying taxes twice.

11. How do CPAs support musicians during tax audits?

- They give guidance and prepare papers if the IRS asks questions. A CPA can also talk to tax officers for the musician.

12. What tools do CPAs use for accounting for musicians?

- They use QuickBooks, Wave, or Xero to track money. They also show musicians how to use these tools daily.

13. How can a CPA improve income from music contracts?

- They give advice on deal terms and payment plans to raise earnings. They also check that costs and deductions are handled correctly.

14. Why is record-keeping critical for musicians?

- Good records help claim deductions, track profits, and avoid IRS problems. It also makes tax filing faster and less hard.

15. Can CPAs help with retirement planning for musicians?

- Yes, they set up accounts like SEP IRAs or solo 401(k)s. They also show ways to save more while paying less tax.

16. What mistakes do musicians make without a CPA?

- Mixing personal and music money, skipping quarterly taxes, poor records, and lost deductions. These lead to higher taxes and fines.

17. How does hiring a CPA save time for musicians?

- They do bookkeeping, taxes, and planning, letting musicians focus on music. This also stops mistakes that take hours to fix.

18. What should I look for when choosing a CPA for musicians?

- Look for experience with music income, clear talk, tech skills, and advice all year. They should know tours, royalties, and merchandise.

19. How can a CPA help with touring and travel deductions?

- They make sure travel, hotels, meals, and mileage are tracked and deductible. This saves money and keeps taxes correct.

20. Can a CPA help musicians grow long-term wealth?

- Yes, they plan taxes, boost income, and give money advice. They can also guide saving and investing for the future.