05 Essential Bookkeeping Tips for Small Businesses.

A small business often begins with an idea, not a spreadsheet. Maybe it’s a coffee shop on the corner, a design studio in your living room, or an online store that started as a side plan. The creative part feels easy. But once sales start coming in, numbers follow—and that’s when things get real. Bookkeeping may not be so important at first. Yet, every small business reaches a point where not tracking the details starts to hurt. In this blog, we will share five essential bookkeeping tips for small businesses that can make managing money less confusing and a lot more practical.

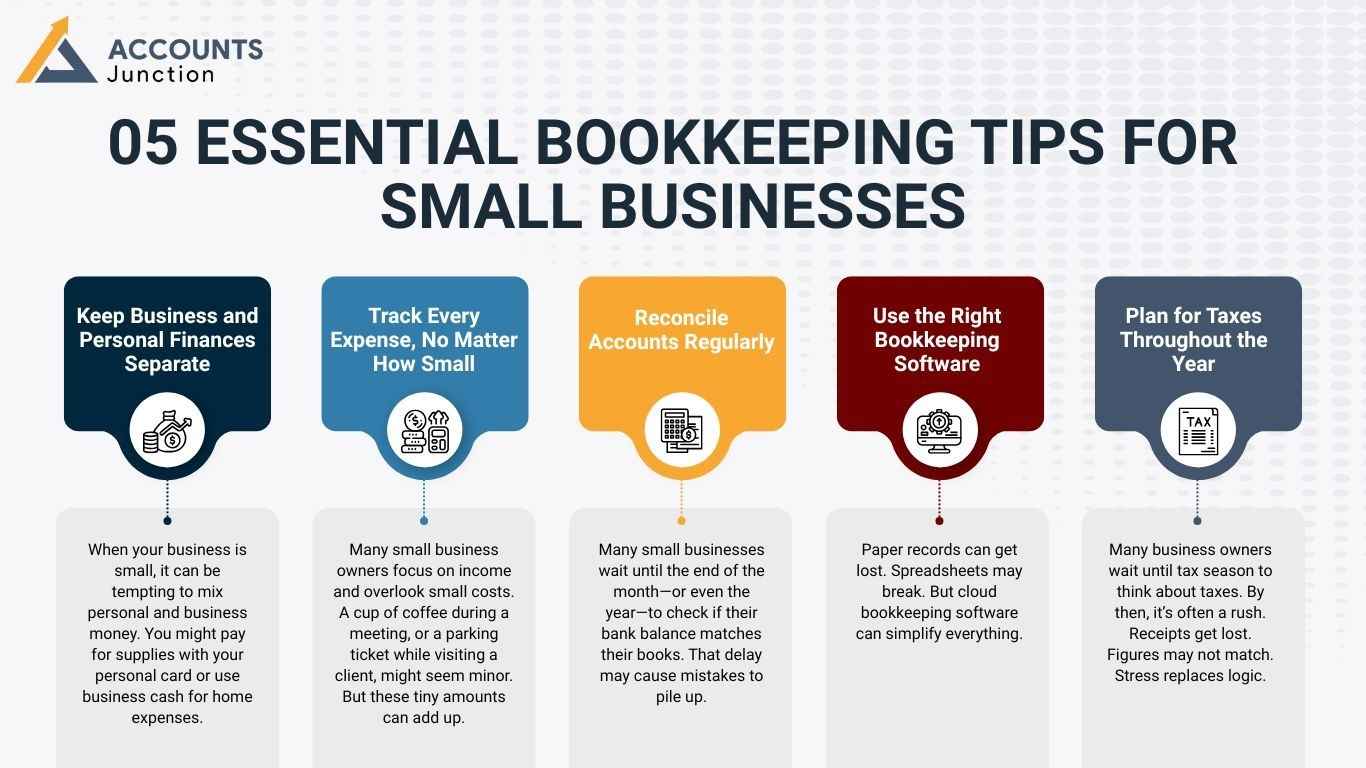

1. Keep Business and Personal Finances Separate

When your business is small, it can be tempting to mix personal and business money. You might pay for supplies with your personal card or use business cash for home expenses. It can feel harmless, yet it creates a mess later.

Why separation matters

Keeping accounts separate may help you see where your money truly goes. It can make tracking expenses simple and keeps your records neat for tax time. If you ever plan to grow or seek funding, clear separation can show professionalism and trust. It is one of the most important bookkeeping tips for small businesses.

How to do it

- Open a business bank account: This single move can make bookkeeping cleaner.

- Use a dedicated card: You may find it easier to monitor purchases.

- Record every transaction: Small entries may look dull, yet they build clarity over time.

Having two different accounts can save hours of sorting and confusion. Your future self will thank you for this discipline.

2. Track Every Expense, No Matter How Small

Many small business owners focus on income and overlook small costs. A cup of coffee during a meeting, or a parking ticket while visiting a client, might seem minor. But these tiny amounts can add up.

Why small expenses matter

Over time, even the smallest expenses can paint a big picture of how your business spends money. Tracking them can help you find areas to save or claim valid deductions later.

Ways to track better

- Use cloud-based tools: Platforms like QuickBooks or Xero may help you capture expenses with photos and notes.

- Save every receipt: Paper or digital, it can all count.

- Review weekly: A five-minute review can stop errors from turning into problems.

Every dollar matters, and so does every detail. Consistent tracking can reveal spending habits that numbers alone may not show.

3. Reconcile Accounts Regularly

Many small businesses wait until the end of the month—or even the year—to check if their bank balance matches their books. That delay may cause mistakes to pile up.

What reconciliation means

Reconciliation is matching your bookkeeping records with your actual bank or credit card statements. If the two don’t match, something is missing or recorded wrong.

How often to do it

Doing this weekly or bi-weekly can make a big difference. It can help you find errors fast and keep your cash flow clear.

Why it helps

- It can prevent fraud or duplicate entries.

- It keeps financial statements clean.

- It saves stress during tax season.

Regular reconciliation may sound dull, yet it can quietly build financial confidence.

4. Use the Right Bookkeeping Software

Paper records can get lost. Spreadsheets may break. But cloud bookkeeping software can simplify everything.

Why software matters

Modern tools can track expenses, send invoices, and even link directly to your bank. It may help you manage your books from anywhere, anytime. It can also reduce manual entry, which lowers the chance of human mistakes.

What to look for

- Ease of use: A simple dashboard can make tasks smooth.

- Automation options: Tools that auto-sync bank data can save time.

- Reports and insights: Some software may show how profits or expenses shift over time.

Popular options

Small businesses often turn to QuickBooks, Xero, or Wave Accounting. These platforms can handle daily bookkeeping tasks, payroll, and financial reports.

Even simple tools can make a huge difference when used consistently.

5. Plan for Taxes Throughout the Year

Many business owners wait until tax season to think about taxes. By then, it’s often a rush. Receipts get lost. Figures may not match. Stress replaces logic.

Why planning early helps

Tax planning doesn’t have to be complex. A little monthly effort can save time, penalties, and money. You can spot deductible expenses early and set aside funds for payments instead of scrambling later.

How to stay prepared

- Keep tax folders: Digital or physical, organize receipts by month or category.

- Know key dates: Deadlines can vary, so it helps to mark them early.

- Consult a professional: A remote accountant or bookkeeper can guide you through updates and help file correctly.

Tax time doesn’t have to bring panic. With steady bookkeeping, you might even look forward to it.

Apart from these, there are several other bookkeeping tips for small businesses in this blog that you can consider.

More Bookkeeping Tips for Small Businesses

Besides the five main ones, there are some other bookkeeping tips for small businesses that can make a difference.

Stay consistent

Bookkeeping is about rhythm. Doing it weekly may prevent numbers from piling up. Small, regular updates can feel lighter than one big monthly cleanup.

Backup your data

Losing data can break your records. Always keep copies—cloud or offline. It may save you from sudden losses or system errors.

Review reports

Look at your profit and loss statement each month. You may notice slow seasons, high expense months, or new trends. That insight can help you plan better.

Outsource when needed

You don’t have to do it all. Remote bookkeepers can handle records while you focus on growth. Outsourcing can bring peace of mind and professional accuracy.

Common Mistakes Small Businesses Make in Bookkeeping

Even with the best intentions, mistakes can creep in. Some of the most common ones include:

- Ignoring small receipts

- Mixing personal and business funds

- Delaying entries until month-end

- Forgetting to reconcile accounts

- Using outdated software or spreadsheets

Avoiding these can help keep your books clear and your mind calm.

How Good Bookkeeping Can Help Your Business Grow

Bookkeeping may seem like record-keeping, but it’s more like a compass. It can show which path brings profit and which one drains cash. With updated records, you can make faster decisions, plan budgets, and forecast growth.

When your books are neat, your focus can shift from counting to creating.

Why You Might Consider a Remote Bookkeeper

Sometimes, even with the right tools, bookkeeping can feel overwhelming. A remote bookkeeper may help you manage your accounts, update entries, and generate reports while you handle operations.

It can also save costs since you don’t need a full-time in-office bookkeeper. Remote bookkeeping may offer flexibility, faster updates, and access to professionals who work across time zones.

The above given bookkeeping tips for small businesses can serve as gentle reminders to keep your finances organized, clear, and ready for growth. Need help with remote bookkeeping? Contact Accounts Junction now and get complete remote bookkeeping services for your business.

FAQs

1. What is bookkeeping for small businesses?

- It’s the process of recording and organizing all your business transactions regularly.

2. Why is bookkeeping important for small businesses?

- It helps track money flow and supports better financial planning.

3. How often should I update my books?

- Weekly updates may keep your data accurate and reduce confusion.

4. Can I do bookkeeping without software?

- Yes, but using software can make the job easier and reduce errors.

5. Is bookkeeping different from accounting?

- Yes, bookkeeping records data while accounting interprets it.

6. How can a small business simplify bookkeeping?

- By using cloud tools, tracking expenses, and keeping records up to date.

7. Do I need a bookkeeper for my small business?

- Not always, but having one can help save time and increase accuracy.

8. What happens if I mix personal and business expenses?

- It can confuse your records and complicate tax filing.

9. How can I choose the best bookkeeping software?

- Look for ease of use, automation, and good support features.

10. What are some free bookkeeping tools?

- Wave and Zoho Books are free or low-cost options for small firms.

11. Can bookkeeping mistakes affect my taxes?

- Yes, wrong entries may cause errors during filing or audits.

12. Why should I reconcile bank statements?

- It ensures your records match your actual balance and helps detect issues.

13. What’s the biggest bookkeeping challenge for small firms?

- Consistency. Many owners forget to record small daily transactions.

14. Can I outsource bookkeeping tasks?

- Yes, remote bookkeeping services can manage your records online.

15. How does bookkeeping help business growth?

- It can reveal spending patterns and guide smarter financial choices.

16. Is paper bookkeeping still used?

- Some do, but digital tools are safer and faster.

17. Should I back up my bookkeeping data?

- Yes, data loss can lead to missing records and stress later.

18. How can I prepare for tax season early?

- Keep receipts organized and update expense records monthly.

19. What reports should I review often?

- Check your profit and loss, cash flow, and expense summaries.