Best Bookkeeping Services: How To Choose The Right Provider For You

Running a small business is exciting, but it comes with a lot of responsibilities. One of the most important tasks is keeping track of your finances. This is where bookkeeping services come in. They help you manage your money, stay organized, and make smart decisions. In this blog, we’ll walk you through everything you need to know to choose the best bookkeeping service for your business.

Why Bookkeeping Services Are Crucial for Small Businesses

Small business bookkeeping is an important part of your business’s finances. It records income, expenses, and all money details accurately. Without it, you’d be guessing about how much money you have or owe. For small businesses, this can be significant.

First, good bookkeeping keeps you organized. You'll have a clear understanding of your expenses. This includes payments to suppliers, rent, and equipment purchases. This helps you avoid surprises like running out of cash. Second, it saves you time. Instead of digging through receipts or spreadsheets.

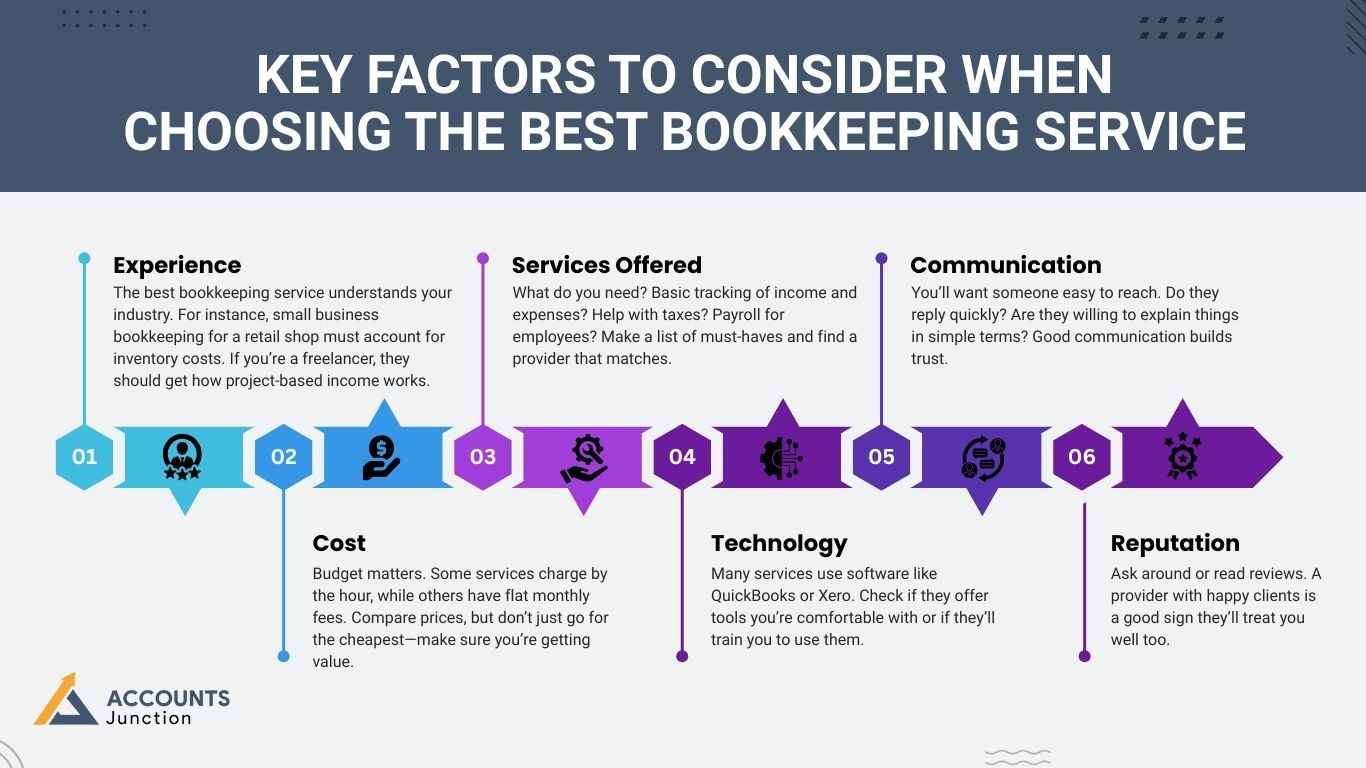

Key Factors to Consider When Choosing the Best Bookkeeping Service

Choosing the best bookkeeping service isn’t one-size-fits-all. You need a provider that fits your small business's bookkeeping needs. Here are some key things to look at:

- Experience: The best bookkeeping service understands your industry. For instance, small business bookkeeping for a retail shop must account for inventory costs. If you’re a freelancer, they should get how project-based income works.

- Cost: Budget matters. Some services charge by the hour, while others have flat monthly fees. Compare prices, but don’t just go for the cheapest—make sure you’re getting value.

- Services Offered: What do you need? Basic tracking of income and expenses? Help with taxes? Payroll for employees? Make a list of must-haves and find a provider that matches.

- Technology: Many services use software like QuickBooks or Xero. Check if they offer tools you’re comfortable with or if they’ll train you to use them.

- Communication: You’ll want someone easy to reach. Do they reply quickly? Are they willing to explain things in simple terms? Good communication builds trust.

- Reputation: Ask around or read reviews. A provider with happy clients is a good sign they’ll treat you well too.

Take your time to weigh these factors. The right choice will feel like a partner, not just a service.

Types of Bookkeeping Services: In-House vs. Outsourced vs. Online

Bookkeeping services come in different styles, and each one has its strengths and weaknesses. Let’s take a closer look at the three main types—in-house, outsourced, and online—so you can figure out what’s best for you.

In-House Bookkeeping

In-house bookkeeping means bringing someone onto your team to handle your finances, either full-time or part-time. This person works right at your business, focusing only on your numbers.

|

Pros |

Cons |

|

Always available for questions |

Expensive (salary + benefits) |

|

Deep understanding of your business |

Hard to find the right person |

|

Full control over their work |

Gaps if they’re sick or leave |

This in-house option works well if you want the best bookkeeping service right on your team, though it costs more.

Outsourced Bookkeeping

Hiring an external company or freelancer to handle your books remotely.

|

Pros |

Cons |

|

Cheaper, pay-as-you-go |

Less face-to-face interaction |

|

Expert skills, no training needed |

Risk of sharing sensitive data |

|

Flexible to your needs |

Slower communication (email/call) |

This is a solid choice if you want flexibility and expertise without the overhead of an employee.

Online Bookkeeping

Online bookkeeping is the modern twist, driven by technology. You use software, and a team—sometimes with help from AI—manages your finances over the internet.

|

Pros |

Cons |

|

Affordable, flat fees |

Feel less personal |

|

Access anywhere, anytime |

Needs reliable internet |

|

Modern tools and real-time data |

Limited help if tech-challenged |

Online bookkeeping can serve as the best bookkeeping service for tech-savvy owners seeking low-cost, anytime access.

How Small Business Bookkeeping Impacts Financial Growth

Bookkeeping is more than just tracking numbers. It's your ticket to growing your small business bookkeeping smarter and stronger.

- Spotting Trends:

- Notice patterns like slow sales in winter or rising supply costs.

- Clear books let you fix issues before they get big.

- Guiding Investments:

- See extra cash for things like marketing or new tools.

- Bookkeeping highlights where your money can work harder.

- Managing Cash Flow:

- Track what’s coming in and going out.

- Avoid surprises so bills get paid on time.

- Building Trust for Expansion:

- Ready to grow? Lenders and investors want clean records.

- Good bookkeeping shows you’re serious and reliable.

In short, bookkeeping turns your finances into a clear path for steady, smart growth.

Tax Accounting for Small Businesses: Ensuring Compliance & Accuracy

Tax accounting for small business bookkeeping keeps you on the right side of the law while saving money.

- Accurate Records:

- Tracks every sale, expense, and deduction.

- No last-minute rush or guesswork at tax time.

- Maximizing Deductions:

- Claims perks like mileage or home office costs.

- Put more cash back in your pocket.

- Staying Compliant:

- Keeps up with changing tax rules and deadlines.

- Avoids costly fines or audits.

- Strategic Planning:

- Some providers team up with accountants.

- Helps lower your tax bill the legal way.

Choosing the best bookkeeping service ensures your taxes are handled smoothly, letting you focus on your business.

Common Mistakes to Avoid When Hiring a Bookkeeping Provider

Hiring the wrong bookkeeping service can cause more problems than it solves. Here are some traps to dodge:

- Ignoring Qualifications: Don’t pick someone just because they’re cheap or friendly. Check their skills and experience—mistakes in your books can be costly.

- Skipping Reviews: If no one’s talking about them, or the feedback’s bad, steer clear. Past clients can tell you what to expect.

- Not Asking Questions: Be clear about what you need. Will they handle payroll? Taxes? Don’t assume—ask upfront.

- Overlooking Tech Skills: If they’re stuck in the past with paper ledgers, you’ll miss out on modern tools that save time.

- Rushing the Decision: Take time to compare options. A hasty choice might leave you with someone unreliable.

Avoid these pitfalls, and you’ll find a provider who’s a perfect fit.

Choosing the best bookkeeping service is key for small business bookkeeping and long-term growth. The right service keeps your finances organized, ensures accurate tax compliance, and supports steady business growth. By considering factors such as experience, pricing, and the range of services offered, you can select a provider that meets your needs. Avoiding common mistakes and evaluating your options carefully will help you make a confident choice. For a reliable and efficient solution, a service like Accounts Junction can simplify your financial management.

If you are looking for a dependable bookkeeping service, Accounts Junction is a strong choice. The firm has built a solid reputation for keeping finances clear, organized, and stress-free for small businesses. Our team is friendly, responsive, and always ready to explain things in simple terms. Clients appreciate the reliability, deadlines are met, mistakes are minimal, and support is available whenever needed. Partnering with Accounts Junction gives you peace of mind. We manage your books accurately and on time, so you can focus fully on growing your business.

FAQs

1. What is bookkeeping for small businesses?

- Bookkeeping is keeping track of all money coming in and going out. It helps you know your business’s finances clearly.

2. Why is bookkeeping important for small businesses?

- It stops money problems, helps with taxes, and makes planning easier.

3. What types of bookkeeping services are available?

- You can hire in-house staff, outsource, or use online bookkeeping services.

4. What is in-house bookkeeping?

- An employee works in your business to handle your books full-time or part-time.

5. What are the benefits of in-house bookkeeping?

- You get fast answers and the bookkeeper knows your business well.

6. What are the drawbacks of in-house bookkeeping?

- It costs more, finding staff is hard, and work stops if they leave.

7. What is outsourced bookkeeping?

- A company or person outside your business manages your books.

8. Why choose outsourced bookkeeping?

- It costs less, is flexible, and gives expert help without hiring staff.

9. What is online bookkeeping?

- Software tracks money online, sometimes with AI help.

10. Who benefits most from online bookkeeping?

- Business owners who like tech and want cheap, easy access to data.

11. How does bookkeeping help with cash flow?

- It tracks money coming in and going out to avoid running out of cash.

12. Can bookkeeping help with taxes?

- Yes, it keeps records right, helps claim deductions, and avoids fines.

13. What services should a small business look for in a provider?

- Track money, manage payroll, do taxes, and make simple reports.

14. How do I check a bookkeeping service’s reputation?

- Look at reviews, ask past clients, and check ratings online.

15. What software do bookkeeping services use?

- Most use QuickBooks, Xero, FreshBooks, or other simple programs.

16. How much does bookkeeping service cost?

- Some charge by hour, some monthly; choose value, not just price.

17. Can a bookkeeping service help me grow my business?

- Yes, it shows where to save, invest, and manage money better.

18. What mistakes should I avoid when hiring a bookkeeper?

- Don’t skip checking skills, reviews, or take a quick decision.

19. How often should I review my bookkeeping?

- Check your books every month to spot problems early.

20. Can bookkeeping services connect to my bank?

- Yes, many link directly to your account for live updates.

21. Is outsourced bookkeeping safe?

- Good services use secure methods to protect your data.

22. Do bookkeeping services handle payroll?

- Yes, they can pay staff, file taxes, and manage benefits.

23. Can bookkeeping services help with tax planning?

- Some work with accountants to lower taxes legally.

24. What is the difference between bookkeeping and accounting?

- Bookkeeping records money, accounting explains it for reports and plans.

25. How do I know if a bookkeeping service is right for me?

- Check their experience, services, cost, software, and how they communicate.