Bookkeeping for Startups Tools Tips and Best Practices

Bookkeeping for startups often feels like a moving goal for new founders. Many early teams want clear and simple ways to track money, yet the process seems vague when they start. Some things look easy at first, but more steps appear once the work grows.

For this reason, several founders look for smart plans that help them keep calm during rapid growth. With the right view, the flow of tasks becomes easier, and teams can choose bookkeeping services for startups that help them stay on track.

Challenges of Bookkeeping for Startups and How to Overcome Them

When a new venture begins, the focus often moves to ideas and deals. While this is common, it may cause gaps in record work. Some teams try to track many things in one place, and it adds stress. Others rely on tools that seem enough but end up lost when numbers grow.

When this happens, new teams feel a mix of fear and doubt. A smooth system for bookkeeping for startups may solve these early blocks.

The Role of Clean Records in Early Stages

A clean record base helps teams see where cash moves. Yet many new owners do not know that these steps can save time later. Some tasks feel slow, but they build trust in the flow of money.

When things remain clear, it becomes easy to plan for new steps. This also makes bookkeeping services for startups more productive when they join the process.

Needs of Bookkeeping for Startups

-

Cash Flow Tracking

Cash flow sits at the center of most startup plans. When this flow stays clear, teams can act with more ease. But when records look vague, simple tasks take more time.

In many cases, founders do not see the issue until late. Good cash flow notes guide teams to safer choices, so the process matters a lot in bookkeeping for startups systems.

-

Expense Sorting

The more a startup grows, the more bills appear. Some bills look small, yet they add up and cause strain. As these tasks pile up, teams need clear ways to sort them.

A strong method keeps the list neat and easy to read. This makes bookkeeping services for startups easier to use without stress.

-

Income Notes

Income notes show all money that comes in. These notes show how work moves and how well sales grow. Many times, the lack of income notes leads to wrong plans or missed tasks. Good record flow guides smart growth choices for early teams.

Tools That Support Bookkeeping for Startups

-

Software Tools Many Startups Use

Several tools help build a clear record base, which is key for effective bookkeeping for startups. A few seem known in most new teams.

Some tools offer simple steps, while others bring deep options for detail. When teams use the right tool, the work becomes less tense.

-

Cloud Based Tools

Cloud tools offer fast access from any place. New teams shift roles fast, so this is a big help. Cloud tools let teams add notes, track tasks, and view old data with ease. Many owners feel more calm when cloud tools stay in place.

-

Simple Ledger Tools

Some teams want very basic tools early on. These ledger tools keep the flow lean. When teams want less noise, ledger tools make sense. The idea stays simple: track all in one space with clear notes.

-

Integrated Bank Tools

Some banks offer add ons that link with record tools. This gives fast sync for each deal. More teams like this because it saves time and avoids error. These linked tools often fit well with bookkeeping services for startups offered by firms.

Effective Tips to Improve Bookkeeping for Startups

-

Start With a Clear Plan

Before tasks grow, teams need a plan to maintain strong bookkeeping for startups. A plan shows what to record, when to record, and who must record. Many teams skip this step and then rush to fix errors later. A clear plan helps early stage work move with less stress.

-

Separate Business and Personal Money

Many new owners mix both flows. This makes tasks slow later. A clean split boosts record trust and sets a firm base. Even if the work looks small, this step gives long term ease.

-

Track Each Deal on Time

Late notes cause gaps in the record chain. When things stay on time, each move becomes easy to check. Clarity builds when the team keeps the habit.

-

Use Tools That Fit Growth Pace

No single tool works perfectly for every startup team. Some teams grow quickly and require more advanced tool options. Others move slow and want less detail.

The right tool must match the pace of the team. When tools fit well, bookkeeping for startups feels more smooth.

-

Seek Support When Needed

Record work may look small but takes time. If the team feels lost, seeking help from bookkeeping services for startups may bring peace. Support groups guide teams through steps that look complex at first.

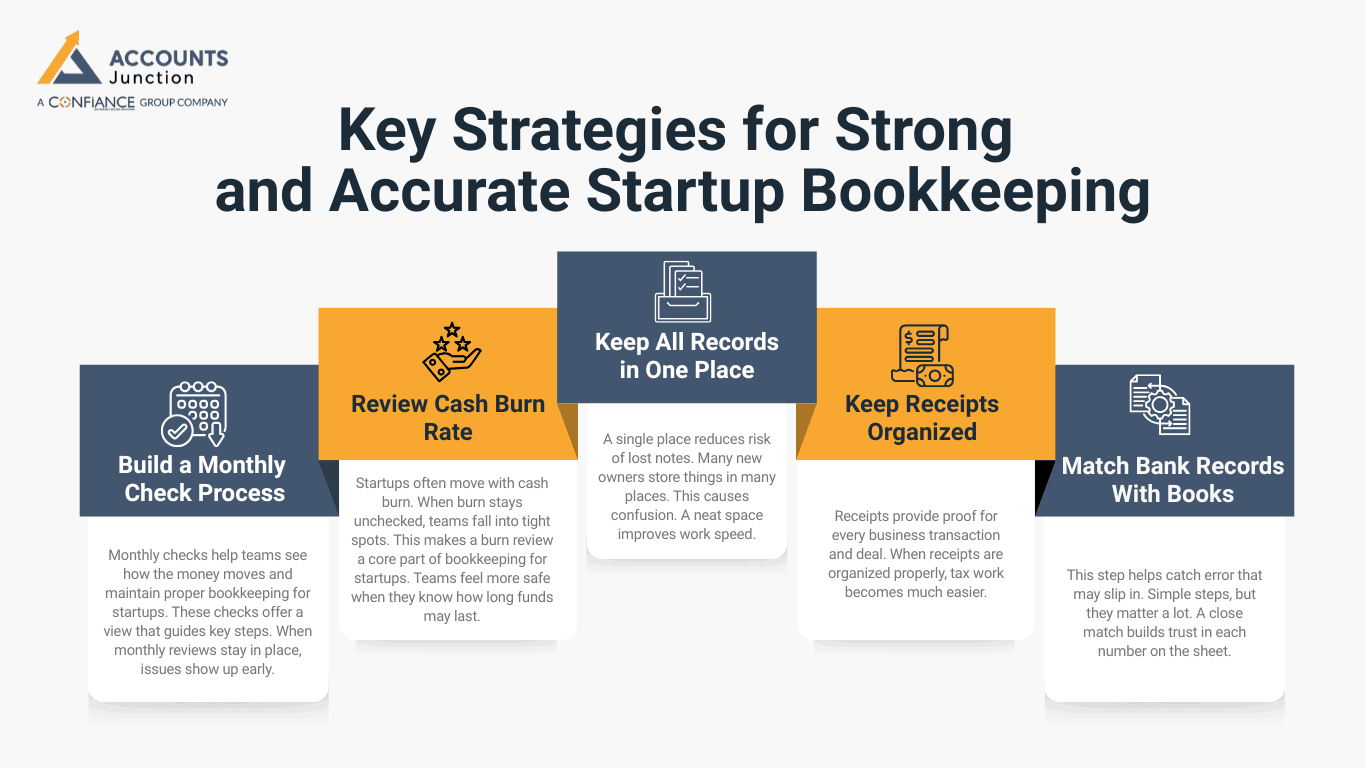

Key Strategies for Strong and Accurate Startup Bookkeeping

-

Build a Monthly Check Process

Monthly checks help teams see how the money moves and maintain proper bookkeeping for startups. These checks offer a view that guides key steps. When monthly reviews stay in place, issues show up early.

-

Review Cash Burn Rate

Startups often move with cash burn. When burn stays unchecked, teams fall into tight spots. This makes a burn review a core part of bookkeeping for startups. Teams feel more safe when they know how long funds may last.

-

Keep All Records in One Place

A single place reduces risk of lost notes. Many new owners store things in many places. This causes confusion. A neat space improves work speed.

-

Keep Receipts Organized

Receipts provide proof for every business transaction and deal. When receipts are organized properly, tax work becomes much easier.

If receipts are lost, stress and confusion quickly increase. Following a simple receipt rule keeps bookkeeping work calm.

-

Match Bank Records With Books

This step helps catch error that may slip in. Simple steps, but they matter a lot. A close match builds trust in each number on the sheet.

Common Mistakes New Founders Make

-

Not Recording Small Deals

Many small deals seem too small to track. Yet they stack up as time moves. When not recorded, the books show the wrong view.

-

Relying Too Much on Memory

Memory fades quickly for early startup owners during busy periods. Many founders assume they will remember all important details.

Often, they fail to recall crucial information on time. Written notes remain clearer and more reliable than mental memory.

-

Mixing Tools Without a Clear Path

More tools do not mean better work. A clear path is vital for smooth bookkeeping for startups. When tools clash, work slows down. A clear tool flow is more helpful for bookkeeping for startups.

-

Using Tools Without Learning Them

Tools help only when teams learn how they work. Some owners skip this step and use only a small part of the tool. This reduces value and creates gaps.

Long Term Value of Bookkeeping for Startups

-

Better Growth Plans

When teams see clear numbers, they plan with more ease. Growth steps become less risky. A clear record path helps owners see what may come next.

-

Investor Trust

Many investors want clear books. Good record work builds trust fast. This helps teams when they seek funds.

-

Smooth Tax Work

Tax processes often feel tense for new startup teams. When records remain clear, managing taxes becomes calm and easier. Accurate notes reduce stress and prevent wasted time or effort.

-

Less Stress During Scale Up

Scaling up requires clear order to manage tasks effectively. Without proper books, the scaling process often becomes very difficult. A strong bookkeeping base gives new teams confidence and calm.

How Bookkeeping Services for Startups Can Help

-

Expert Review

Trained teams bring views that new owners miss. Their work improves the flow of numbers. They guide teams through steps that seem vague.

-

Time Savings

When experts handle tasks, founders save time. More time leads to better focus on core goals.

-

Reduced Risk of Errors

Experts know where errors hide. Their eye helps catch things early. This reduces gaps that harm growth.

-

Support During Big Decisions

Record experts help teams see the full view. A better view leads to safer choices.

Advanced Areas Startups Often Need Help With

-

Budget Plans

A budget adds shape to growth steps. With expert support, these plans look more clear.

-

Forecast Notes

Forecasts help teams guess what may come. When done well, they guide smart moves.

-

Project Cost Records

Project tasks often have hidden costs. Good notes reveal them early.

-

Payroll Records

Payroll grows complex when teams expand. Clean records fix most issues.

Building Strong Habits for Bookkeeping for Startups

-

Daily Check Ins

Small checks each day help keep the work clean.

-

Weekly Briefs

Weekly briefs show how well the plan moves.

-

Monthly Deep Checks

Deep checks once a month keep long term order.

Bookkeeping for startups is not just a task but a vital part of early business strategy. Clear records help founders understand cash flow, track expenses, and make informed decisions. By using the right tools, following simple best practices, and maintaining consistent habits, startups can reduce errors, save time, and plan for sustainable growth. Investing in proper bookkeeping early can prevent costly mistakes later and ensure the team focuses on scaling the business confidently.

At Accounts Junction, we provide reliable bookkeeping services for startups that make managing finances simple and stress-free. Our expert team tracks income, expenses, and cash flow with accuracy, while delivering clear, actionable insights that support confident growth. With proven experience across multiple industries, we help startups choose the right tools, maintain clean records, and stay fully compliant. Ready to gain clarity, save time, and grow with confidence? Connect with Accounts Junction today and take control of your startup finances.

FAQs

1. Why does bookkeeping for startups matter from the first day?

- It gives new teams clear money notes for smart plans. It also keeps the early growth path safe and calm.

2. How do bookkeeping services for startups support new teams?

- They handle record tasks that drain time for founders. They also guide teams with clean notes and clear steps.

3. What tools work best for bookkeeping for startups?

- Simple tools with clear views fit early stage teams. Most new teams want tools that track deals with ease.

4. When should a startup upgrade its record system?

- Teams upgrade when notes feel slow or unclear. A better system helps when deal volume grows fast.

5. How do clean books help a startup raise funds?

- They give investors trust in each money move. Strong records show a team that cares about order.

6. Can bookkeeping services for startups reduce cash flow issues?

- They help track money paths with more care. They also show gaps that lead to cash stress.