Setting Up Effective Bookkeeping Systems for Event Planners.

The event planning business is dynamic and involves a blend of creativity and precision. Managing finances is usually considered as a side issue. Nevertheless, for event organizers, the efficiency of accounting is the basis of any event management company's success. Accounting for event management company involves keeping track of expenses to maximize revenue streams. The implementation of efficient bookkeeping for event planners is a necessity for maintaining the financial health of the business as well as driving growth.

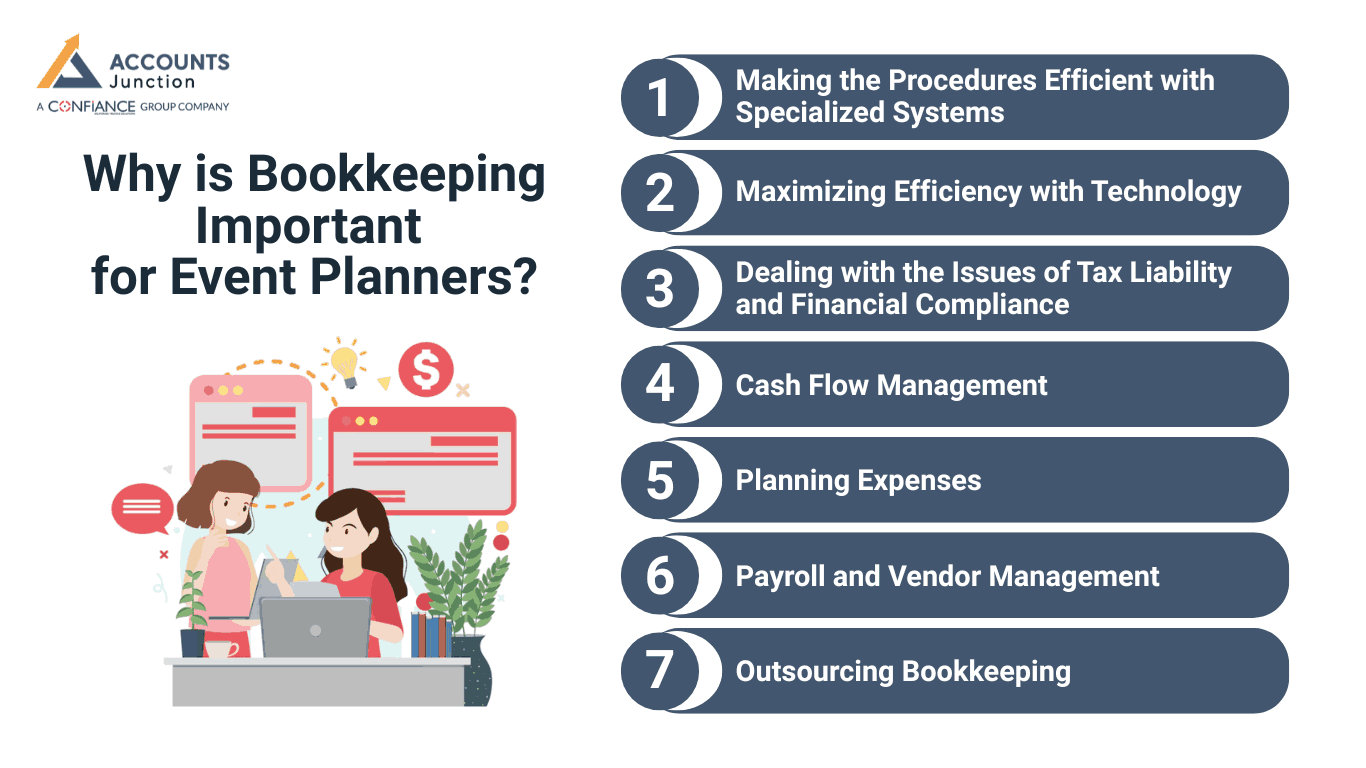

Why is Bookkeeping Important for Event Planners?

Successful accounting for event management company is not just about recording numbers; it's about having a finger on the financial pulse of your event planning business. For event planners, precise accounting indicates cash flow, expense management, and profitability. Through this, they can make well-informed decisions, manage their resources well, and fulfill their financial duties on time. Bookkeeping for event planners is the basics of sustaining growth and success in the event management industry which is very competitive.

Making the Procedures Efficient with Specialized Systems

- The particular needs and requirements of each event management company are different. Hence, it is very important to adapt accounting to the needs of event management company.

- This customization can be realized by installing digital accounting software, creating standardized expense categories and planning for regular financial reporting.

Maximizing Efficiency with Technology

- In the current digital era, technology presents an array of tools and resources that allow event planners to streamline their bookkeeping.

- Accounting software like QuickBooks or Xero eliminates repetitive activities such as invoicing clients, tracking expenses, and bank statements reconciliation.

- These platforms offer real-time financial performance metrics, thereby enabling event planners to be responsive and agile in an ever-evolving industry.

Dealing with the Issues of Tax Liability and Financial Compliance

- Tax liabilities and financial compliance is a critical part of bookkeeping for event planners.

- As businesses that are running within the event management sector, they have to abide various tax laws and regulations.

- Whether it is sales tax or income tax, one has to familiarize himself/herself with these responsibilities in order to avoid penalties and legal problems.

- The right way of keeping financial records and working with qualified accountants who are specialized in accounting for event management company can help the planners in meeting all regulatory requirements while maximizing tax advantages to minimize the liabilities.

Cash Flow Management

- Even with good bookkeeping for event planners, cash flow can feel hard. Planners must track all money each month.

- Income often changes with season or client demand. Knowing slow months avoids stress and last-minute issues.

- Look at past trends to find busy and slow times. This helps plan events and payments safely.

- Forecasting income stops sudden gaps. It allows smooth spending and safe operations for events.

Planning Expenses

- Compare fixed and variable costs with expected income to avoid missed bills. This keeps plans on track.

- Planning ensures obligations are met even in slow months. It also keeps vendors happy and reliable.

- Set aside a small fund to cover delays or cancellations. Proper accounting for an event management company ensures such funds are tracked correctly.

- Agree on payment terms with clients to keep cash flow steady. This also cuts last-minute stress.

- Partial deposits or staged payments help manage money. They give planners extra time to prepare events well.

Payroll and Vendor Management

- Bookkeeping also includes paying staff and suppliers. This ensures everyone is paid on time and fairly.

- Set payroll on a schedule and include taxes and benefits. This keeps the business legal and smooth.

- Pay suppliers on time to build trust and good relationships. Timely payments help future events run well.

- Keep vendor and freelancer contracts handy to avoid disputes. Clear notes on rates and deadlines save time.

- Contract tracking also reduces errors or misunderstandings. It keeps work organized and professional.

- Match invoices with payments to avoid missing or extra bills. Accurate records keep accounts clear and simple.

Outsourcing Bookkeeping

- Busy planners can save time by hiring experts. Professionals know the event business and financial rules.

- Event accountants handle taxes and reports well. This reduces mistakes and keeps the business legal.

- Outsourcing accounting for an event management company lets planners focus on clients and smooth event planning. It also cuts stress and saves time.

- Professionals prevent mistakes that may cost money or slow work. This protects profits and keeps projects on track.

- Many firms use cloud accounting without extra training. Planners can manage money without learning new tools.

- Knowing finances are managed cuts worry and improves focus. Planners can spend more time making events great.

Benefits of Maintaining an Organized Bookkeeping System

A clear bookkeeping system may provide advantages beyond compliance.

-

Financial Transparency

Clear records may help team members understand budgets and allocations.

-

Strategic Growth

Accurate bookkeeping may guide decisions on expanding services or entering new markets.

-

Client Trust

Transparent billing and invoicing may enhance credibility with clients.

-

Preparedness for Challenges

Organized finances may help businesses respond to unexpected issues quickly.

-

Enhanced Profitability

Tracking costs and revenue may highlight areas to improve margins and efficiency.

However, event planner managers must set up a solid bookkeeping for event planners system to remain competitive. Through thorough documentation management, technology utilization and regulation compliance, the planning team can smooth the financial processes and open up the doors to growth and prosperity.

Accounts Junction provides specialized accounting services to event management companies. Our accountants who are well versed in the complex financial terrain of event planning do all the accounting from invoicing to payroll administration. By allocating your bookkeeping to us, the process will be simplified, allowing for more creative time and interaction with clients. We utilize the accountant software that has no need for separate buying or training. We will control the numbers while you concentrate on making the events memorable.

FAQs

1. How can bookkeeping for event planners help track income for multiple events?

- Use sheets or apps to note all cash each week. This keeps all money clear and easy to see.

2. Which software helps manage vendor payments for weddings and parties?

- Pick tools that track pay and send alerts fast. This helps pay vendors on time each week.

3. How to forecast profits for seasonal events effectively?

- Check past cash in and out to guess profit. Plan each season to avoid spending too much.

4. What steps ensure accurate records of catering and venue costs?

- Keep receipts and note all costs as soon as paid. Check records each week to stop mistakes.

5. Can tracking invoices prevent late payments from clients?

- Yes, mark all invoices and send alerts on due dates. This helps clients pay on time each month.

6. How to separate personal and business expenses during event planning?

- Use two accounts and mark each cash clearly. This stops mix-ups and makes tax work much easier.

7. Which tools simplify cash flow tracking for small event businesses?

- Use apps or sheets that show money in and out. Charts help spot trends and avoid cash gaps.

8. How often should expense reports be updated for ongoing projects?

- Check and note costs each week to prevent errors. This keeps reports ready for month-end checks.

9. Can outsourcing accounting for an event management company reduce errors in client billing?

- Yes, experts can spot mistakes and fix them fast. This saves planners time to plan events well.

10. What strategies improve financial visibility for multi-day conferences?

- Note costs each day and add totals at night. This helps see where money goes and save cash.

11. How to categorize staff, marketing, and supply costs for events?

- Use clear labels like staff, ads, tools, and space. This makes reports easy to read and use.

12. What reports highlight top-earning events for better decision-making?

- Profit sheets show which events made the most cash. Charts also help spot trends for future plans.

13. Can monitoring payments improve trust with event clients?

- Yes, mark invoices and send alerts to clients. Clear records also stop mix-ups and build strong trust.

14. How to use past data to plan budgets for future events?

- Check prior costs and cash in to plan budgets. Past numbers help set safe limits on spending.

15. What methods track small miscellaneous expenses without missing details?

- Note all small costs in a sheet or app. Weekly checks prevent surprises when adding total cash.

16. Can digital ledgers replace spreadsheets for tracking event costs?

- Yes, cloud ledgers show cash in real time. They cut mistakes and help teams work together well.

17. How can bookkeeping for event planners make auditing vendor invoices faster before event deadlines?

- Check invoices with contracts and receipts before paying. Spot errors early to avoid extra or missed cash.

18. What are best practices for maintaining secure payment records?

- Keep files in safe folders and back up often. Limit access so no one takes private cash info.

19. How to adjust pricing strategies based on actual profit margins?

- Compare total costs and cash in to set prices. Watch profit closely to avoid too low or high.

20. Which bookkeeping habits reduce stress during tax season for planners?

- Keep notes neat, check each week, and add totals. Early work stops mistakes and makes taxes simple.