Bookkeeping for Amazon sellers via Link My Books

Managing Amazon Seller Bookkeeping is crucial for Amazon sellers. It helps track sales, expenses, and profits. Link My Books makes this process much easier by providing an automated solution for Bookkeeping for Amazon Sellers. In this guide, we will understand Amazon Seller Accounting and how Link My Books can make your life easier.

The Link My Books integration with Xero automatically imports Amazon settlements and creates a clear, easy-to-read invoice in Xero. Sales products over e-commerce platforms create a lot of confusing and complex reports. Bookkeeping via Link My Books helps the seller with bookkeeping for Amazon sellers, making it easier to understand the movement of money in and out of the business.

What is Link My Books?

Link My Books is an Amazon Seller Accounting software that simplifies bookkeeping. It connects to your Amazon seller account to automatically monitor your sales, fees, expenses, and refunds.

Key Features of Link My Books:

- Automatic Data Syncing: Syncs your Amazon sales, refunds, and fees.

- Expense Tracking: Tracks Amazon fees, shipping costs, and returns.

- Financial Reports: Creates clear reports for profit, loss, and tax.

- Integration: Connects with software like Xero and QuickBooks.

What is Amazon Seller Bookkeeping?

Amazon Seller Bookkeeping involves tracking your business's financial transactions. This includes:

- Sales revenue from Amazon

- Amazon fees (e.g., referral fees, FBA fees)

- Shipping costs

- Returns and refunds

Good bookkeeping helps you track money, save time, and grow your business.

Why is Amazon Seller Bookkeeping Important?

Proper bookkeeping helps Amazon sellers in many ways:

- Helps with Taxes

Proper Amazon Seller Accounting makes tax filing easier and more accurate. You avoid late fees and keep tax records in order. - Shows Real Profits

Know exactly what you earn after costs. This helps in making better pricing and product decisions. - Tracks All Expenses

Find out where your money goes and how to cut costs. This can improve your business efficiency. - Supports Business Growth

Make smart decisions based on real numbers. Accurate data helps plan for future expansion. - Improves Cash Flow Management

Monitor your incoming and outgoing funds to prevent cash shortages. This helps you avoid late payments and manage bills. - Makes Inventory Control Easy

Keep an eye on stock levels and avoid over-ordering or stockouts. Better inventory tracking helps reduce storage costs. - Keeps You Audit-Ready

Clean records mean you’re ready if your business is ever audited. It builds trust with investors and authorities.

Benefits of Using Amazon Seller Accounting Software

Manual bookkeeping takes time and can have errors. Using Amazon Seller Accounting Software like Link My Books helps you:

1. Time-Saving

- Amazon Seller Bookkeeping software automates tasks like syncing data, tracking expenses, and generating reports.

2. Minimizing Errors

- Manual bookkeeping can lead to errors. Automated software like Link My Books reduces human errors.

3. Tax Compliance

- By maintaining accurate records, you can ensure you are always ready for tax season and stay compliant with tax laws.

4. Real-Time Financial Insights

- With Link My Books, you get up-to-date financial information, so you can make quick decisions for your business.

5. Easy Integration

- Link My Books easily integrates with popular accounting software like QuickBooks and Xero.

6. VAT and Sales Tax Support

- Perfect for sellers in regions with tax rules. Stay compliant with local tax laws. No worries about penalties.

7. Multi-Platform Sync

- Combine Amazon with eBay, Shopify, and Etsy data. Get a single dashboard for all your stores. It simplifies management.

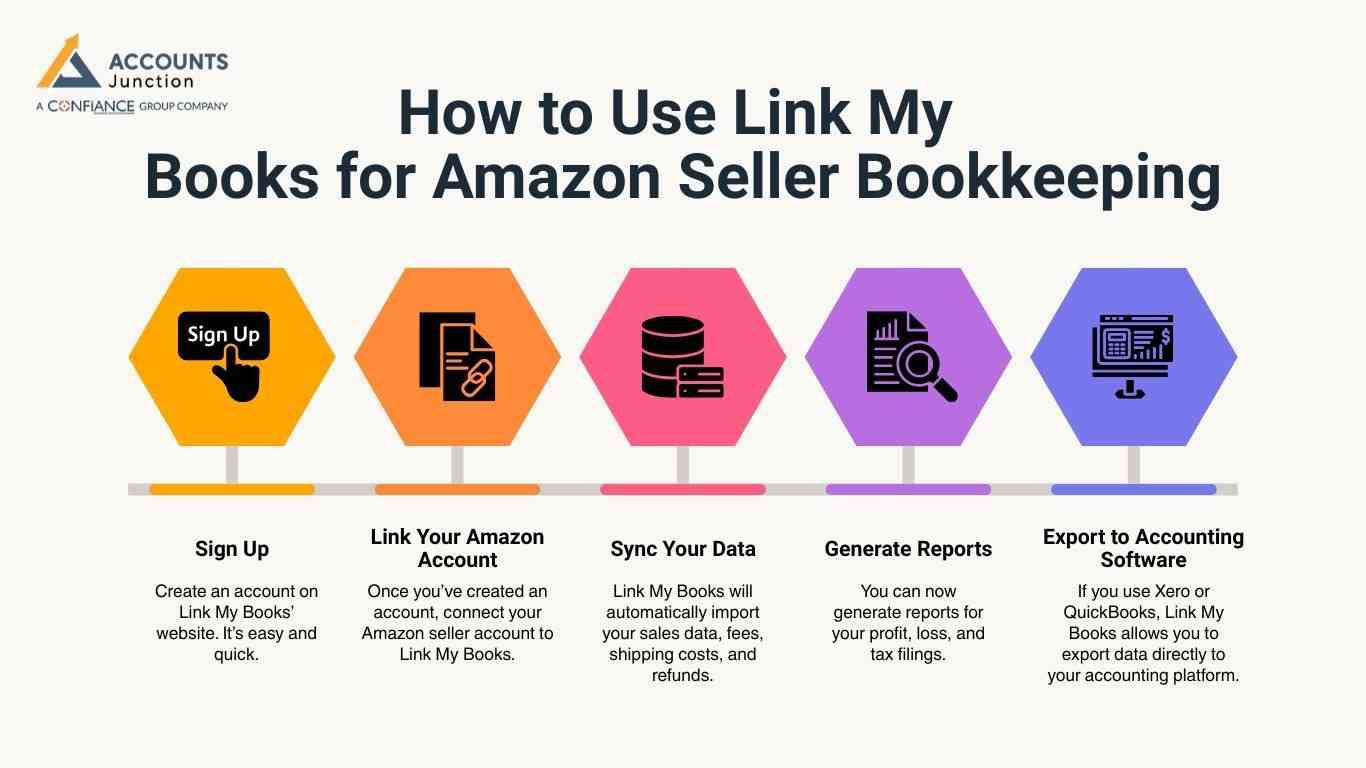

How to Use Link My Books for Amazon Seller Bookkeeping

Here’s how to get started with Link My Books for Bookkeeping for Amazon Sellers

1. Sign Up

- Create an account on Link My Books’ website. It’s easy and quick.

2. Link Your Amazon Account

- Once you’ve created an account, connect your Amazon seller account to Link My Books.

3. Sync Your Data

- Link My Books will automatically import your sales data, fees, shipping costs, and refunds.

4. Generate Reports

- You can now generate reports for your profit, loss, and tax filings.

5. Export to Accounting Software

- If you use Xero or QuickBooks, Link My Books allows you to export data directly to your accounting platform.

Why Choose Link My Books?

Here are a few reasons why Link My Books stands out as a top choice for Amazon Seller Bookkeeping:

1. Easy Setup

- Setting up Link My Books is simple, even for beginners.

2. Accuracy

- It reduces the risk of errors by automating data syncing and calculations.

3. Affordable

- Link My Books is cost-effective, making it accessible for sellers of all sizes.

4. Reliable Customer Support

- If you face any problems, Link My Books provides reliable support to guide you through.

5. Tailored for E-commerce

- Unlike general accounting tools, Link My Books is built specifically for online sellers. It understands Amazon’s unique fee structures, refunds, and payout cycles.

6. Ongoing Updates and Improvements

- Link My Books is constantly updated to match Amazon’s changing systems and tax rules. You always stay compliant and up-to-date without manual effort.

Common Mistakes Amazon Sellers Make in Bookkeeping

Even experienced sellers can stumble when it comes to bookkeeping. Sometimes mistakes may seem small but can grow into major issues.

- Not Recording Every Transaction

Sellers may forget to log refunds, shipping adjustments, or fees. Missing entries can create confusion when filing taxes. - Mixing Personal and Business Expenses

Some sellers may use one bank account for everything. This may make it harder to track real profits or claim deductions. - Ignoring Reports:

Sales and expense reports may pile up without review. Not analyzing them may hide trends or losses that could have been fixed. - Failing to Reconcile Accounts

Bank accounts and Amazon settlements may not always match. Skipping reconciliation may cause inaccuracies. - Relying Only on Memory

Trying to remember numbers may work at first, but it can lead to mistakes and stress during tax season.

By avoiding these errors, sellers may improve accuracy, save time, and make smarter decisions.

How Bookkeeping Impacts Business Decisions

Bookkeeping is not just a task, it may shape the path of your business.

- Pricing Decisions

Clear records may reveal which products make money and which drain resources. You may adjust prices to stay profitable. - Inventory Management

Tracking expenses and sales may show which products sell fast or slow. This can reduce overstock and storage costs. - Cash Flow Forecasting

Knowing exactly what is coming in and going out can help you plan purchases, pay bills on time, and avoid shortages. - Identifying Growth Opportunities

Reports may highlight profitable areas that deserve more investment. You can choose products, ads, or promotions wisely. - Expense Optimization

Bookkeeping may uncover unnecessary costs, like excessive shipping or unclaimed fees. Reducing waste can increase net profit.

When used effectively, bookkeeping may turn numbers into strategies that guide smarter decisions.

Manual Amazon bookkeeping can be challenging. Accounts Junction provides professional services in Bookkeeping for Amazon Sellers using tools like Link My Books. We have certified experts who ensure your financial records are accurate and compliant. Partner with us to manage your Amazon accounting efficiently and focus on growing your business.

Amazon Seller Bookkeeping helps you stay on top of your finances. Link My Books automates your bookkeeping. It tracks sales and expenses and creates reports. Link My Books makes your accounting faster and more accurate. Using Amazon Seller Accounting software saves time, cuts mistakes, and keeps you tax-compliant.

FAQs

1. What is Amazon Seller Bookkeeping?

- It tracks all money flowing in and out of your Amazon business, including sales, fees, refunds, and expenses.

2. Why is bookkeeping important for Amazon sellers?

- It may help track profits, manage expenses, prepare taxes, and keep your business financially healthy.

3. How does Link My Books simplify Amazon bookkeeping?

- It can automate data import, track fees, and generate reports, reducing manual work and errors.

4. Can Link My Books track Amazon FBA fees automatically?

- Yes, it can monitor FBA fees, referral fees, and other Amazon charges for accurate accounting.

5. Does Link My Books help with tax preparation for Amazon sellers?

- Yes, it may organize transactions and create tax-ready reports for faster filing.

6. Can Link My Books integrate with Xero and QuickBooks?

- Yes, it may export Amazon data to popular accounting software for seamless bookkeeping.

7. How can Link My Books improve cash flow management?

- By tracking sales, fees, refunds, and expenses in real time, it may help you avoid cash shortages.

8. Does Link My Books support multi-marketplace sellers?

- Yes, it can combine data from Amazon, eBay, Shopify, and other platforms into one dashboard.

9. How does Link My Books help track inventory costs?

- It may link product sales, shipping fees, and returns to provide a clear picture of inventory expenses.

10. Is it possible to generate profit and loss reports using Link My Books?

- Yes, it may create detailed reports showing profits, costs, and net earnings for better decisions.

11. How often should Amazon sellers sync data with Link My Books?

- Regular syncing, daily or weekly, may keep financial records accurate and up to date.

12. Can Link My Books track refunds and return fees automatically?

- Yes, it may automatically adjust accounts for refunds, returns, and customer reimbursements.

13. How does using Link My Books save time for Amazon sellers?

- It may eliminate manual data entry, automate reports, and reduce reconciliation efforts.

14. Can Link My Books handle Amazon subscription or service fees?

- Yes, it may track recurring Amazon fees alongside other seller expenses.

15. How does Link My Books help prevent bookkeeping errors?

- Automation reduces manual mistakes and ensures accurate syncing of sales, fees, and refunds.

16. Is Link My Books suitable for sellers with multiple Amazon accounts?

- Yes, it may consolidate data from several accounts into a single reporting dashboard.

17. Does Link My Books support international Amazon sellers?

- Yes, it may manage multiple currencies and marketplace-specific fees for global sellers.

18. Can Link My Books generate reports for tax audits?

- Yes, it may create clear and organized reports to stay audit-ready.

19. What makes Link My Books better than manual bookkeeping?

- It may reduce human error, save time, and give sellers a real-time view of finances.

20. How does Accounts Junction enhance Amazon bookkeeping with Link My Books?

- Our certified experts may manage your data, generate tailored reports, and ensure compliance with Amazon accounting standards.