Benefits of Outsourcing Finance and Accounting Operations for Your Business

Money runs every business. From daily cash flow to long-term plans, each number matters. Handling finance and accounts takes time, focus, and skill. It needs people who can read numbers and know what they mean for the company. Still, many business owners find this work hard to manage alone. Bills, pay, and taxes can build up fast. Even a small error can slow growth. That is why many firms now choose outsourcing. The benefits of outsourcing finance go beyond saving money. It also helps firms save time, gain control, and cut stress. Outsourcing accounting operations lets teams focus on key work.

When experts manage books, reports, and records, accuracy improves. A good partner helps track trends, find early issues, and guide smart choices. It is not only about hiring someone to do math, but it is about building a system that helps growth. Finance and accounting outsourcing means hiring an outside firm to handle money tasks. These tasks may include simple jobs like bookkeeping and payroll, or deep work like reports and data checks. This smart move is not only for cutting costs. It brings skill, tools, and clear records that help firms stay on track and grow strong.

What Does It Mean to Outsource Accounting and Bookkeeping?

Outsourcing accounting and bookkeeping means giving your money work to an outside expert instead of doing it inside your firm. This lets a business use the skills of trained bookkeepers and accountants without the high cost of hiring full-time staff. It also helps the team save time and work better.

When a company outsources, it shares its money records. A trusted service handles key accounting operations, such as tracking costs and preparing reports. They keep books, check bills, and track all costs, showing the benefits of outsourcing finance. The service also prepares reports to show a clear financial status.

Key Accounting and Bookkeeping Services in Outsourcing:

Bookkeeping

- Recording and sorting financial transactions.

- Keeping general ledgers and money records up to date.

Payroll Processing

- Calculating employee pay and deductions. This is part of accounting operations that shows the clear benefits of outsourcing finance.

- Managing tax withholdings and social security contributions.

Financial Reporting

- Making key money reports like balance sheets, profit and loss reports, and cash flow charts.

- Ensuring all reports follow the right rules and standards.

Tax Preparation and Compliance

- Filing tax papers on time and with full accuracy.

- Following all tax laws at the local, state, and national levels.

Accounts Payable and Receivable Management

- Handling bills and payments for vendors.

- Sending customer bills and tracking unpaid dues.

Budgeting and Forecasting

- Helping firms plan for future money goals.

- Giving cash flow plans and budget reports for smart choices.

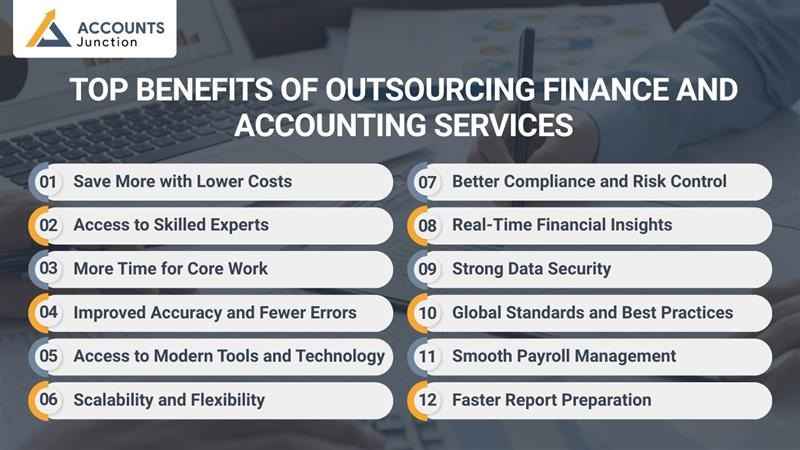

Top Benefits of Outsourcing Finance and Accounting Services

1. Save More with Lower Costs

-

Cut Down on Staffing Costs

This shows the benefits of outsourcing finance instead of hiring costly full-time staff. When you outsource, you pay only for what you need. This can lower monthly costs without losing quality work.

-

No More Extra Office Expenses

Office space, tools, and systems add to your spending. Outsourcing removes the need for desks, computers, and software. You get the same service but without paying for the office setup.

2. Access to Skilled Experts

-

Work with Skilled Experts

Outsourcing lets you hire accountants who know their job well. They use the right tools and keep up with new rules. Your reports stay correct and follow the law.

-

Dependable and Steady Work

A good team checks all your records closely. They make sure your books match every deal. This helps stop late fees and wrong entries.

3. More Time for Core Work

-

Focus on Business Goals

When you outsource, your staff can work on key plans. Instead of spending hours checking numbers, they can grow sales, serve clients, or plan products.

-

No Distraction from Routine Tasks

Finance work takes time and focus. Outsourcing lets you skip daily tasks like data entry, bill checks, and report prep. You get time back to think and act strategically.

4. Improved Accuracy and Fewer Errors

-

Precise Data Recording

Outsourcing experts manage precise accounting operations to reduce errors and improve reports. You can trust that your books reflect true business performance.

-

Better Checks and Reviews

Experts often use multiple reviews before finalizing reports. This extra layer shows the benefits of outsourcing finance, accounting operations and reduces mistakes

5. Access to Modern Tools and Technology

-

Use of Updated Software

Outsourced teams often use top financial software. These tools help with real-time data and fast reporting. You get insights that guide smarter moves.

-

Faster and Smoother Work

Automation tools make tasks faster. You can see live updates, check cash flow, and predict trends without waiting for reports.

6. Scalability and Flexibility

-

Easily Adjust Services

When your business grows, finance needs grow too. Outsourcing lets you add or reduce services anytime. You can expand during busy times and scale down later.

-

Meet Seasonal Demands

Some months need more accounting work, like tax season. An outsourced team can handle an extra load without hiring more staff.

7. Better Compliance and Risk Control

-

Stay in Line with Laws

Rules for tax and finance keep changing. Outsourced experts track new updates and ensure your records meet every standard. This reduces risk and legal issues.

-

Protect Your Business from Errors

A small slip in accounts may lead to penalties. Outsourcing adds extra care and audits that protect you from such costly mistakes.

8. Real-Time Financial Insights

-

Track Performance Anytime

Outsourced teams handle key accounting operations and provide real-time financial insights. You can track cash flow, profits, and costs in real time.

-

Plan Based on Clear Numbers

With updated data, you can plan budgets and projects more smartly. You see what works and where to improve without delay.

9. Strong Data Security

-

Safe and Encrypted Systems

Most outsourcing firms use safe servers and encrypted tools. This keeps your financial data private and secure.

-

Limited Access and Backups

They set clear access rules for staff and back up data often. You can be sure your records are safe.

10. Global Standards and Best Practices

-

Use Proven Methods

Outsourced firms serve clients in many fields. They follow tested steps that keep your accounts correct and reports clear.

-

Learn from Global Norms

They share ideas from other markets. This helps your business stay in line with global rules and improve control.

11. Smooth Payroll Management

-

Timely Salary Processing

Payroll errors can upset your team. Outsourcing ensures timely and correct payments every cycle.

-

Easy Tax and Deduction Handling

Experts handle deductions, benefits, and compliance with tax laws. Your HR team stays free from stress.

12. Faster Report Preparation

-

Quick Financial Reports

With outsourcing, you get monthly and yearly reports faster. This helps in making timely decisions and tracking growth.

-

Ready for Audits Anytime

Outsourced teams keep documents ready for review. This makes audits easy and smooth.

How Outsourcing Finance and Accounting Operations Helps Business Growth

Outsourcing finance and accounting tasks can boost business growth in many ways. It helps firms save time, cut costs, and stay more focused on their goals. With expert help, money matters become clear and easy to handle. You get more time to plan growth and make better choices for your business.

Let’s see how outsourcing supports growth and success.

1. Better Financial Accuracy and Compliance

- Outsourcing ensures your books are correct and up to date. Expert teams record each deal with care and follow tax and law rules. This helps avoid fines and errors. With clear and correct data, owners can make smart and safe choices.

2. Stronger Financial Planning and Analysis

- A skilled provider can study your reports and share useful ideas. They help build plans, track costs, and guess future trends. These insights guide better use of funds and support smart business steps. You get reports that show what works and what needs change.

3. Easy to Scale and Adjust

- Outsourcing gives you freedom to grow. When work goes up or down, you can scale your team fast without hiring more staff. This is a big help for small and growing firms that face busy or slow seasons. You pay only for what you need, when you need it.

4. Better Risk Control

- Trained finance experts can spot and reduce risks early. They help prevent loss, fraud, or cash flow gaps. With their help, your company stays safe and steady. This builds trust and keeps your business on strong ground.

5. Smooth and Simple Operations

- When finance tasks move to a skilled team, your staff can focus on sales, service, and growth. The process becomes fast and neat. Bills, reports, and payroll get done on time. This saves stress and helps your team stay more productive.

The benefits of outsourcing finance and accounting are clear. You save money, gain expert help, and improve control. It fits not just large firms but also small and mid-sized ones. With the right support, you can manage your funds better and plan for growth with ease.

Accounts Junction stands out as a trusted partner in this field. Our team brings skill, care, and modern tools to every project. We work closely with clients, understand each goal, and follow safe and global standards. From handling books to tax tasks, we ensure timely and secure results.

With Accounts Junction, your business can grow with less stress and more focus on what matters most. We make finance simple so you can move forward with clear plans and strong confidence.

FAQs

1. What is finance and accounting outsourcing?

- It means hiring outside experts to handle your money work. They take care of books, pay, taxes, and reports.

2. What are the main benefits of outsourcing finance?

- You save money, cut errors, and get help from skilled people.

3. Can outsourcing help small businesses?

- Yes, small firms can gain expert help without hiring full-time staff.

4. How does outsourcing improve accuracy?

- Experts use smart tools that spot and fix errors early.

5. What tasks can be outsourced?

- You can outsource books, pay, reports, tax work, and plans.

6. Is my data safe when outsourced?

- Yes, good firms use safe systems, backups, and locks for data.

7. Can outsourcing reduce costs?

- Yes, it saves on hiring, space, and tools while keeping good quality.

8. Will outsourcing affect control over accounts?

- No, you still have full access to reports and updates anytime.

9. How fast can reports be prepared?

- Outsourced teams work fast with smart tools and skilled staff.

10. Does outsourcing help with compliance?

- Yes, experts follow laws and make sure reports meet all rules.

11. Can outsourcing support growth?

- Yes, services can grow and change with your business needs.

12. What tools do outsourced teams use?

- They use tools like QuickBooks, Xero, and other cloud apps.

13. How can outsourcing reduce workload?

- It takes daily tasks off your team so they can plan and grow.

14. Is outsourcing suitable for startups?

- Yes, it helps new firms stay on track and save time.

15. Can outsourcing improve payroll accuracy?

- Yes, experts run payroll on time and handle all cuts right.

16. How are outsourced services billed?

- You can pay per task, month, or as per the work scope.

17. Can outsourcing help during audits?

- Yes, it keeps all files ready and neat for review.

18. Do outsourcing teams work remotely?

- Yes, most work online using safe cloud access.

19. How do I choose a good outsourcing partner?

- Pick one with skill, tools, and open talk.

20. Why choose Accounts Junction for outsourcing?

- Accounts Junction offer expert help, smart systems, and full client care.