Benefits of Having a Professional Bookkeeper for Your Dental Services

Running a dental clinic means taking care of many minute tasks. One important task is dental bookkeeping. A professional bookkeeper tracks income, expenses, and other key areas of dental bookkeeping to keep things in order. They help with patient payments, insurance claims, and tax season. With a skilled bookkeeper, you can relax knowing your finances are in good hands. In this blog, we will look at some top benefits of dental bookkeeping services for your practice.

Good dental bookkeeping helps prevent errors and keeps your clinic running well. It lets you focus more on patient care and less on finances. Whether it’s managing cash flow, preparing reports, or staying tax compliant, a skilled bookkeeper ensures everything is done right. Let’s see why hiring a dental bookkeeping expert is a smart choice for your clinic.

What is Dental Bookkeeping?

Dental bookkeeping means tracking all financial records for your clinic. It follows payments from patients, costs for tools, and insurance claims. It also covers accounting for dentists, like paying staff and taxes.

Why Is Dental Bookkeeping Important?

1. Keeps Finances Clear

- Dental bookkeeping helps you know how much money comes in and goes out. You can see income from patients and track costs for supplies, rent, and payroll. This keeps your clinic’s finances clear at all times.

2. Helps with Tax and Compliance

- Accurate records make tax filing simple and on time. You avoid fines and meet all legal needs. Clean books also help during audits or reviews.

3. Maintains Steady Cash Flow

- Bookkeeping helps track payments and bills. You can see late dues early and plan for upcoming costs. This keeps your cash flow smooth and stable.

4. Supports Smart Decisions

- Good records give you real data for every choice. You can plan budgets, set prices, and control costs based on facts, not guesses.

5. Builds a Strong Base for Growth

- With clean records, your clinic can grow with ease. You can check profit trends, plan expansion, and gain trust from banks or investors.

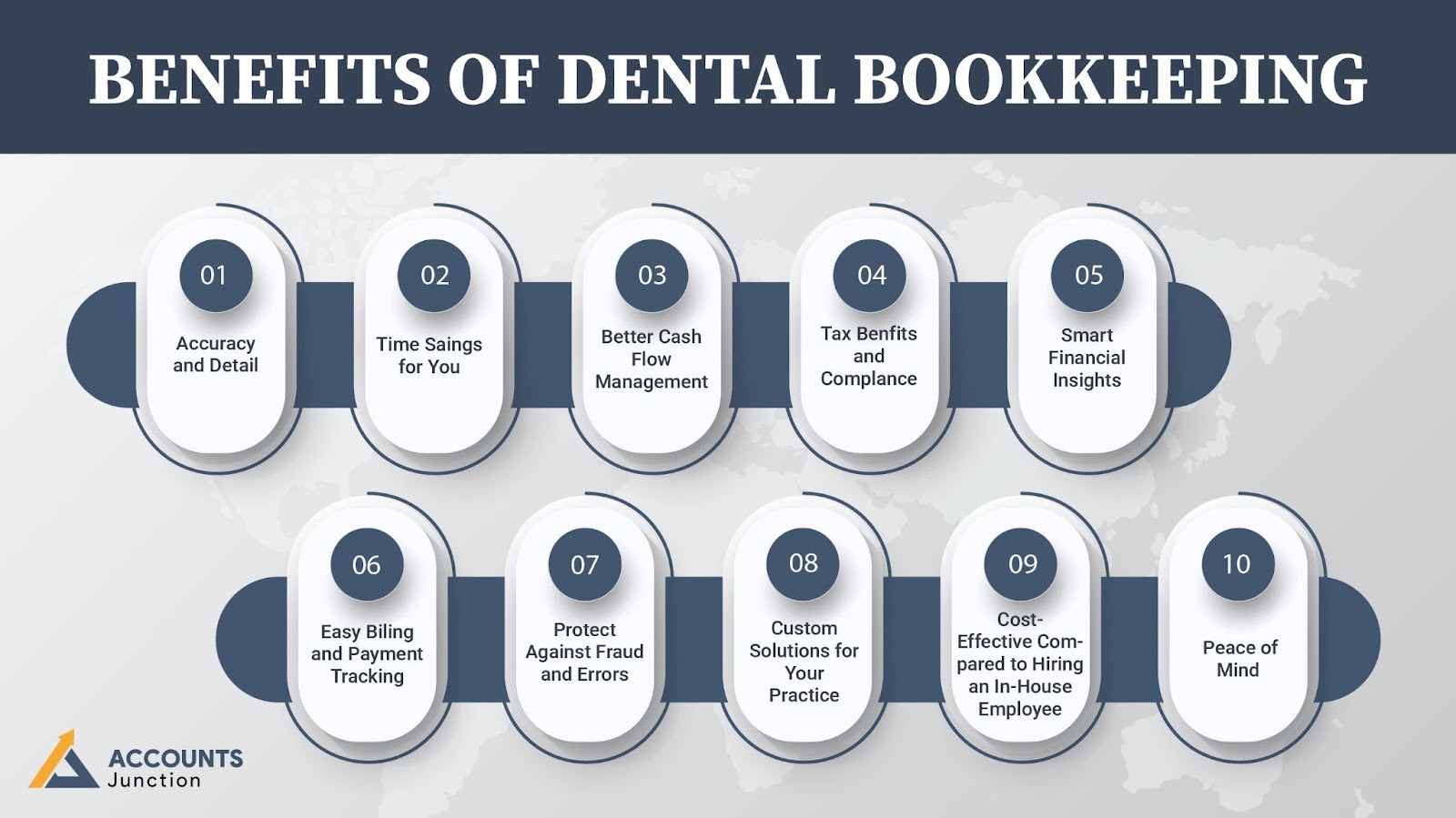

Benefits of Dental Bookkeeping

Here are some benefits of dental bookkeeping services:

1. Accuracy and Detail

- Dental bookkeeping by experts keeps your records accurate.

- Accounting for dentists means checking each payment and expense. This helps catch small details and keeps records clean.

- It lowers the chance of errors. It also helps you file the right tax reports on time.

A professional bookkeeper tracks every dollar in and out of your practice. This ensures there are no mistakes.

2. Time Savings for You

- When you bring in an expert, they take care of your dental bookkeeping. This lets you focus on patient care.

- With a professional in charge, you don’t have to worry about finances. You can grow your business instead.

- Accounting for dentists takes time. Outsourcing it saves you hours on paperwork.

- A professional manages all your financial tasks. This gives you more time to focus on caring for your patients.

3. Better Cash Flow Management

- Dental bookkeeping tracks income and costs for your clinic. This helps keep your cash flow steady.

- A pro can help stop cash flow issues by making sure bills get paid and income is collected.

- With good accounting for dentists, you’ll see how much money comes in and goes out.

Smart dental bookkeeping helps your clinic stay open and pay your team and vendors on time.

4. Tax Benefits and Compliance

- With a professional handling your dental bookkeeping, you make sure your taxes are done right.

- Accounting for dentists means getting ready for tax time, spotting savings, and filing on time.

- Without solid bookkeeping, you could lose out on savings or get hit with fines.

A skilled bookkeeper keeps dental bookkeeping clear, current, and within tax rules.

5. Smart Financial Insights

- Dental bookkeeping provides insights into your practice’s financial performance.

- Pros can help you cut costs and boost your gains.

- With accounting for dentists, you can plan smart for your clinic's growth.

These tips help you spend with care and pick the best path for your practice.

6. Easy Billing and Payment Tracking

- Dental bookkeeping includes tracking patient payments and insurance claims.

- A professional ensures you get paid on time and manages overdue payments properly.

- Accounting for dentists helps streamline your billing process, so you don’t waste time chasing payments.

Keeping an eye on payments and insurance claims helps maintain steady income for your practice.

7. Protect Against Fraud and Errors

- A professional bookkeeper ensures that all transactions are tracked and verified.

- Dental bookkeeping helps catch errors early before they become costly.

- Accounting for dentists also helps protect your practice from fraudulent activities.

By entrusting dental bookkeeping to a bookkeeper, you guarantee the security of your finances.

8. Custom Solutions for Your Practice

- A professional bookkeeper can shape their accounting for dentists to fit your needs.

- As your office grows, your dental bookkeeping needs will shift. A pro can adjust with ease.

- They can guide you with smart money tips to help your practice grow strong.

A custom dental bookkeeping plan helps your office stay on track as things change.

9. Cost-Effective Compared to Hiring an In-House Employee

- Hiring a full-time accountant costs a lot. Outsourcing your dental bookkeeping is a cheaper option.

- Accounting for dentists can be tailored to your needs. You only pay for what you use.

- A professional bookkeeper has the right skills. You don’t need to train an in-house staff member.

Outsourcing dental bookkeeping saves money on pay, training, and extra staff costs.

10. Peace of Mind

- Knowing that professionals are handling your dental bookkeeping allows you to relax.

- You can trust that your financial records stay correct and up-to-date.

- Dental accounting ensures you're prepared for audits, tax filings, and financial reports at all times.

When experts manage your dental bookkeeping, your firm gets a significant advantage. You can rest assured that your finances are in good hands. These were some top benefits of dental bookkeeping services for your practice.

At Accounts Junction, we offer dental bookkeeping services designed for your needs. If you too want to harness the benefits of dental bookkeeping services, contact us now. Start outsourcing your dental bookkeeping to improve your practice’s financial health. This will help you manage finances better and focus more on patient care.

FAQs

1. What is dental bookkeeping?

- Dental bookkeeping is keeping track of all money in your clinic. It includes patient payments, staff pay, supplies, and insurance claims.

2. Why do dentists need bookkeeping?

- It helps keep money clear and correct. You spend less time on papers and more time with patients.

3. How does bookkeeping help cash flow in dental practice?

- It tracks money coming in and going out. You can see late payments or bills due and plan ahead.

4. Can bookkeeping prevent mistakes?

- Yes. Every entry is checked to keep numbers right. This stops errors in payments or reports.

5. How does bookkeeping help with taxes?

- Up-to-date books make tax work simple. You can file on time and avoid fines.

6. Can bookkeeping save time for clinic owners?

- Yes. An expert handles entries, reports, and bills. You get more time to care for patients.

7. Does dental bookkeeping help with billing?

- Yes. It tracks patient payments and insurance claims. You get paid on time and avoid errors.

8. Can dental bookkeeping prevent fraud?

- Yes. Clear records and checks make it easy to spot wrong or fake transactions.

9. How does dental bookkeeping support growth?

- Records show profit and loss trends. You can plan new hires, tools, or services with ease.

10. Is dental bookkeeping cost-effective?

- Yes. Hiring an expert is cheaper than a full-time staff member. You pay for only what you need.

11. Can small clinics use bookkeeping?

- Yes. Even small clinics need clear money records to track payments and bills.

12. How often should books be updated?

- Books should be updated weekly or monthly. This keeps records correct and useful.

13. Can dental bookkeeping help reduce costs?

- Yes. Tracking spending shows waste. You can cut extra costs and save money.

14. Does bookkeeping cover staff pay?

- Yes. It tracks salaries, taxes, and payments. Staff get paid on time with no errors.

15. Can bookkeeping make audits easier?

- Yes. All records are neat and ready. You can show bills and receipts quickly.

16. Is it safe to share clinic data?

- Yes. Trusted services use secure tools. Only allowed people can see your records.

17. Can bookkeeping be done online?

- Yes. Cloud tools let you see your clinic’s money anytime, anywhere.

18. How does bookkeeping help with choices?

- Clear records show profits and spending. You can make smart choices for your clinic.

19. What happens if a clinic skips bookkeeping?

- You may miss bills, lose money, or face tax trouble. Bad records can hurt your clinic.

20. How do I pick the right bookkeeping service?

- Choose a service that knows dental clinics. They should offer simple plans and use secure tools.