Benefits of Bookkeeping Services for Small Business

Small businesses often run on dreams, not on huge investments. The founder may wear many hats — marketer, seller, planner, and even the one who handles cash. Yet, one thing can quietly shape how far that dream may go — bookkeeping. Many owners may not see it first, but good records may change everything. Bookkeeping services for small businesses may sound like something only big firms need. But wait. It may be the one thing that helps a small business breathe easy, make clear plans, and stay free from money worries.

Let’s explore how it can help, why it matters, and what changes it can bring to a small setup.

What Are Bookkeeping Services for Small Business

Bookkeeping services for small business are the daily, weekly, or monthly tasks of recording money in and money out. These may include managing invoices, expenses, receipts, payroll, and tax records. It keeps all money data clean and easy to check when needed.

In Simple Words

It means someone takes care of your books, updates your accounts, and helps you see where your money goes and where it comes from. These services can be done in-house or by a virtual bookkeeper.

Why Bookkeeping Matters So Much

At first, it may not seem important. After all, many small owners think — “I know what’s coming in and out.” But money may slip fast when things are not tracked in the right way.

Bookkeeping can be like a map. It tells you where you stand and where you may head next. Without it, even a good business can lose its way.

Reasons It Matters

- It helps you see real profit, not just cash flow.

- It saves you from surprise bills or missed dues.

- It builds a strong base for future growth.

- It keeps your taxes clean and stress free.

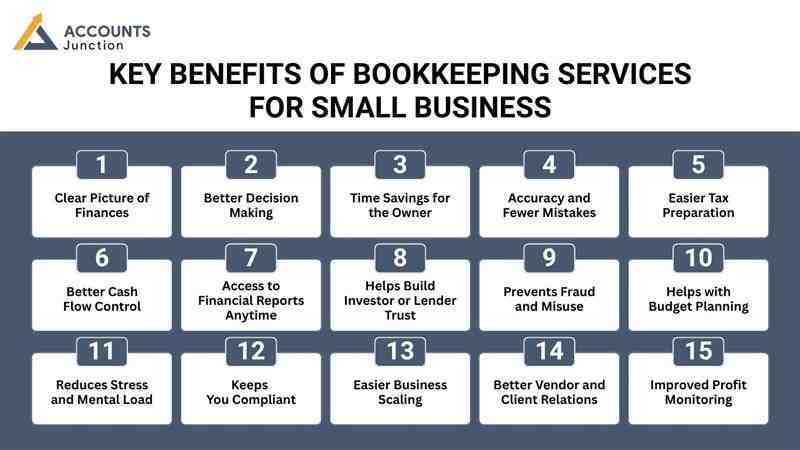

Key Benefits of Bookkeeping Services for Small Business

Now let’s go deeper. What can you really gain when you start using bookkeeping services for small business?

1. Clear Picture of Finances

A small business may grow faster when the owner knows its exact state. Bookkeeping services make sure every transaction is written down.

You may see trends — like when sales rise, when expenses spike, or when cash feels tight. Once you see it on paper, the right choice becomes easier.

2. Better Decision Making

Without data, decisions may rely on guesswork. Bookkeeping brings clean records that help you decide with confidence.

Should you expand now or wait? Can you hire a new hand? Is there enough money for marketing? A well-kept record may show the answer.

3. Time Savings for the Owner

Most small business owners spend long hours managing bills and payments. But with bookkeeping services, this load may shift off your shoulder.

You get your time back — to meet clients, improve products, or rest a bit. The bookkeeper handles the paper maze.

4. Accuracy and Fewer Mistakes

Small errors can cause big losses. Forgetting a bill, entering the wrong amount, or missing tax dates may add up. Bookkeeping services keep your records neat and accurate.

Even a small mismatch may be caught early, saving time and money later.

5. Easier Tax Preparation

Tax season may bring panic for many small owners. But if your books are clean, that fear fades.

Bookkeeping services ensure that every expense, sale, and payment is well recorded. When tax time comes, you or your accountant may glide through the numbers without stress.

6. Better Cash Flow Control

Cash flow is the lifeblood of a small business. One late payment or missed due can upset everything.

With bookkeeping, you may track when money enters and leaves. This gives you time to plan for shortfalls or delays before they turn into real trouble.

7. Access to Financial Reports Anytime

Bookkeeping services for small business often come with simple tools or dashboards. You may check your profit, loss, or cash standing in a click.

These reports may guide you in planning budgets, setting sales goals, and cutting waste.

8. Helps Build Investor or Lender Trust

When you seek a loan or investor, they ask for your books. Clean records show you handle money well. It builds faith and improves your chance to get funds.

A bookkeeper may prepare proper reports that reflect your real value and stability.

9. Prevents Fraud and Misuse

Even in small setups, fraud may happen — sometimes by mistake, sometimes not. Bookkeeping keeps a watch on every transaction.

It adds a layer of check and balance so no payment slips through unnoticed.

10. Helps with Budget Planning

Every plan starts with numbers. Bookkeeping services can help make a monthly or yearly budget based on your past data.

You may set goals for savings, investments, and expenses with more confidence.

11. Reduces Stress and Mental Load

Numbers can pile up in your head if you try to track them alone. With a bookkeeper, that load may fade.

You no longer worry about missing due dates or losing track of payments. It frees your mind for creative work and strategy.

12. Keeps You Compliant

Many small businesses unknowingly break tax or labor laws due to poor records. Bookkeeping ensures that all required papers, receipts, and forms stay updated and safe.

It may help you stay compliant and avoid fines.

13. Easier Business Scaling

When you grow, the need for clean books grows too. With bookkeeping services, you already have the right system in place.

Scaling up, adding branches, or launching new products becomes smooth because your numbers stay in order.

14. Better Vendor and Client Relations

Late payments can hurt relations. Bookkeeping keeps track of dues and credits. You may pay vendors on time and follow up with clients gently for pending bills.

Trust grows when money matters are handled neatly.

15. Improved Profit Monitoring

Some months may look good but not actually bring profit. With accurate books, you see real gains. You may spot which products bring money and which only look shiny but drain funds.

Types of Bookkeeping Services for Small Business

Not every business needs the same setup. Bookkeeping may be done in different ways.

1. In-House Bookkeeping

You hire a bookkeeper who works full-time or part-time in your office. It may be useful if you have many daily transactions.

2. Virtual or Outsourced Bookkeeping

A remote bookkeeper handles your books using cloud tools. This way can save cost and give access to expert help without full-time hiring.

3. Cloud-Based Bookkeeping

Using software like QuickBooks, Xero, or Zoho Books can help track data live. You may view your financial health anytime.

How Bookkeeping Supports Growth

Growth is not just about earning more. It’s about managing better. Bookkeeping gives structure to your growth.

When your books are updated, you can apply for loans, attract investors, plan expansion, or even sell your business one day — all with ease.

Key Growth Support Points

- Shows clear profit margins

- Helps in cost cutting decisions

- Supports future budgeting

- Builds confidence in investors

Signs You May Need Bookkeeping Services Now

If you are unsure whether to get help yet, check these signs:

- You often forget payments or invoices

- You mix personal and business expenses

- You feel lost during tax season

- You spend too much time managing bills

- You have no clear record of profits or losses

If any of these sound like you, it may be time to bring in bookkeeping services for small business.

Choosing the Right Bookkeeping Service

Before hiring, check what you really need. Some bookkeepers only record data, while others help with reports and advice.

Things to Look For

- Experience with small businesses – They understand your size and pace.

- Knowledge of local laws and taxes – Keeps you safe from errors.

- Cloud-based tools – Gives access anytime, anywhere.

- Transparent pricing – No surprise costs.

- Good communication – Keeps you informed at all times.

Cost vs Value

At first glance, hiring a bookkeeper may seem like an expense. But when you add up the time saved, errors avoided, and better decisions made — it often pays back many times over.

You may spend a small monthly fee, yet gain full peace of mind and better control of your money.

Common Mistakes Small Businesses Make Without Bookkeeping

- Mixing personal and business money

- Ignoring small receipts or daily sales

- Forgetting to record online transactions

- Missing payment due dates

- Not reviewing reports regularly

These may look minor but can slowly affect the health of your business.

Bookkeeping services for small business may not feel important or exciting. Yet, they form the silent backbone of a strong company. Clean books may give you the clarity to dream bigger and walk with less worry.

Growth is the foundation objective of every business and that is what every small business deserves. If you want to grow your business by outsourcing bookkeeping, contact Accounts Junction now!

FAQs

1. Why should a small business hire bookkeeping services?

- They can help manage daily records, keep accounts clean, and save time for business growth.

2. Can bookkeeping services help during tax filing?

- Yes, they keep all records updated so tax filing becomes smooth and stress free.

3. How often should a small business update its books?

- Books may be updated weekly or monthly, based on the number of transactions.

4. Are bookkeeping and accounting the same?

- No, bookkeeping records data, while accounting analyzes it for planning and reports.

5. Can a virtual bookkeeper handle all business needs?

- Yes, many small businesses use virtual bookkeepers for full record and report management.

6. How do bookkeeping services improve cash flow?

- They track money in and out, helping you plan ahead and avoid shortfalls.

7. What software do bookkeepers use for small business?

- Tools like QuickBooks, Xero, or Zoho Books are common for real-time tracking.

8. Is it costly to hire a bookkeeper for a small setup?

- It may not be costly, as many services offer flexible plans based on your business size.

9. How can bookkeeping prevent business losses?

- It spots wrong entries, missed payments, or rising costs early before they hurt profit.

10. What reports can a bookkeeper prepare?

- They prepare balance sheets, profit and loss statements, and cash flow reports.

11. Can I manage bookkeeping myself using software?

- You can, but expert bookkeepers ensure accuracy and save you hours of manual work.

12. Do bookkeeping services also handle payroll?

- Many do. They can manage employee pay, taxes, and records together.

13. How does bookkeeping support business growth?

- It gives clear data for planning, budgeting, and scaling your business safely.

14. What happens if bookkeeping is ignored?

- You may face tax issues, wrong reports, and poor financial decisions.

15. Are online bookkeeping services safe?

- Reputed services use secure cloud systems and encryption to protect data.

16. How do bookkeeping services handle receipts and bills?

- They record and store digital copies for easy access during audits or filing.

17. Can I switch from manual to digital bookkeeping anytime?

- Yes, you can move your records to a cloud system with a bookkeeper’s help.

18. Will bookkeeping help me track unpaid invoices?

- Yes, they maintain all client payments and send reminders for pending ones.

19. What size of business needs bookkeeping services most?

- Any business that deals with regular transactions may benefit, no matter the size.

20. Can bookkeeping services help in loan applications?

- Yes, clean books and reports make it easier to apply and get approved for business loans.